Several local retailers have shown the surprising resilience of the local consumer sector, with recent good results from apparel or discretionary retailers such as Mr Price, and Pepkor, as well as strong post year-end sales from The Foschini Group etc. This seems to bode well for the health of the South African (SA) consumer, with the retail sector’s resilience indicating that South Africans have been able to get themselves back on track surprisingly quickly following 2020’s hard lockdowns and the decimation of jobs caused by the COVID-19 pandemic (and ensuing government-mandated lockdowns).

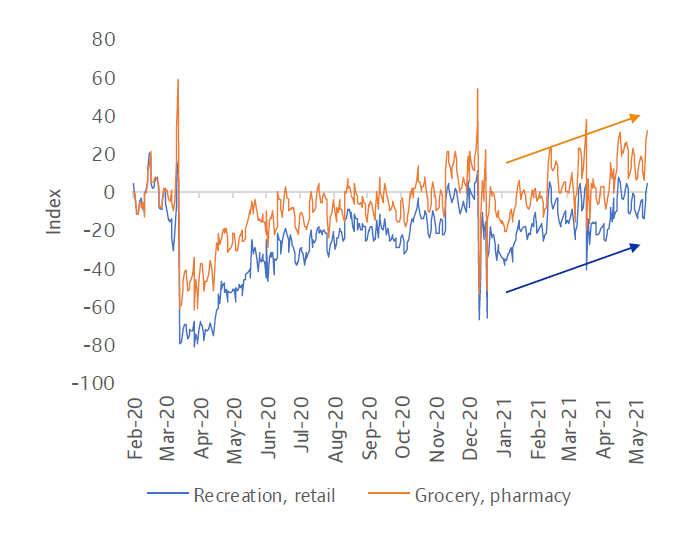

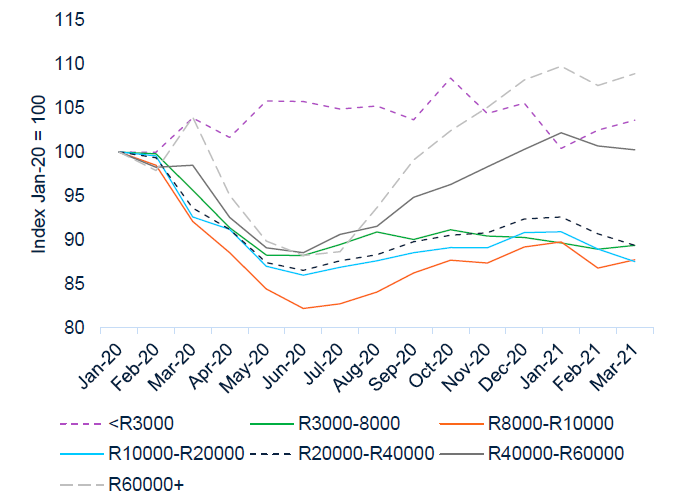

Looking at the general state of the SA consumer (particularly from a retail perspective) a key point to note is that, whilst we are likely to see fairly robust YoY growth in 2021 consumer spending, this spending is also extremely uneven across the wider income spectrum. Furthermore, once the strong (low) base effects from 2020 have played out, YoY growth rates in consumer income and spending should decline quite rapidly. Nevertheless, as things currently stand, the general economic recovery in SA supports a consumer rebound, with electricity consumption also showing a bounce from its March to May 2020 levels (at the height of the lockdowns).

Figure 1: Google data reflect robust consumer mobility

Source: Standard Bank Research

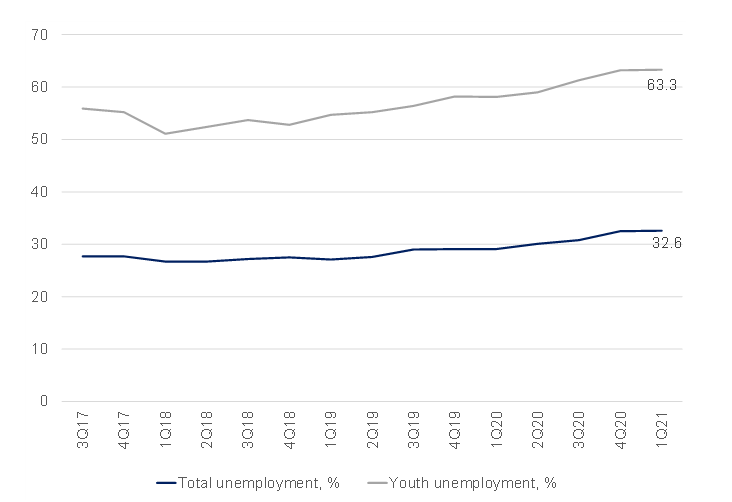

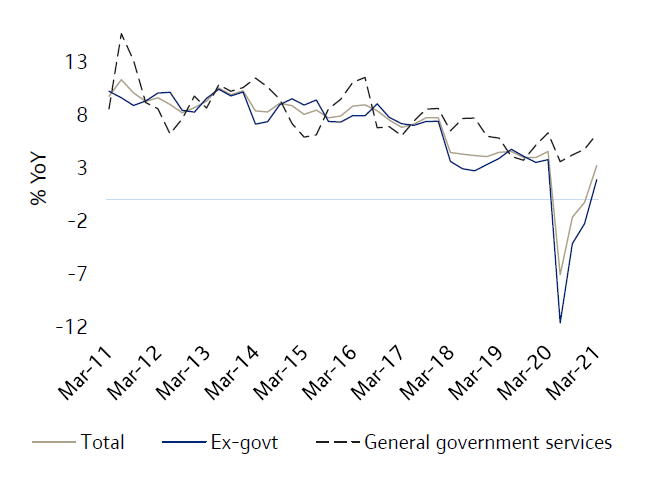

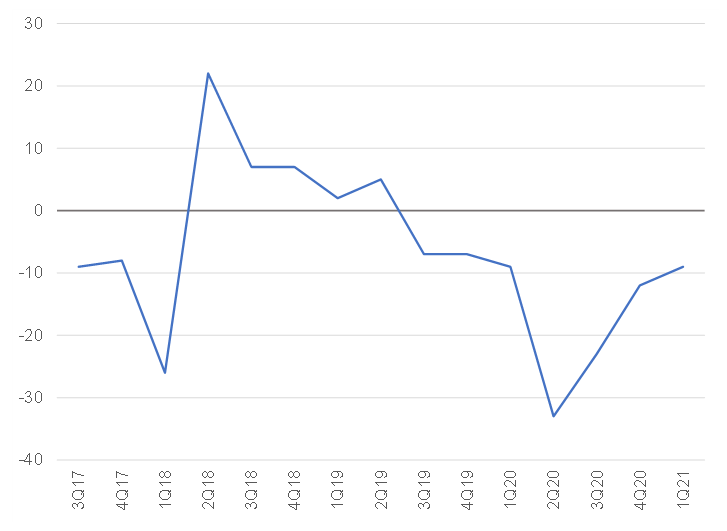

Despite these positive signs, unemployment in SA remains worryingly high (total unemployment now stands at 32.6%), with the latest unemployment data increasing marginally and the number of discouraged work seekers jumping by 6.9%. These employment numbers are symptomatic of SA’s economic challenges and the impact of COVID-19 on the country’s economy. However, on the bright side, according to Standard Bank, by 1Q21 total wages were c. 3% above pre-pandemic levels (see Figure 3).

Figure 2: SA unemployment

Source: Anchor, StatsSA

Figure 3: Total wages are 3% above pre-pandemic levels in 1Q21

Source: Standard Bank Research

Still, the economic recovery remains extremely uneven and job losses are biased towards lower-income groups. A significant portion of the rebound in consumer spending this year is largely expected to be underpinned by the high-income group, with the latest data from credit bureau, Experian indicating that, at least from a disposable income perspective, SA’s most affluent consumer segments continue to be the most affected by macro-economic conditions. This is of course notwithstanding the higher-income base that this consumer group has as a relative buffer. From a socio-economic perspective, the lower-income groups naturally continue to face the greatest hardships.

Experian’s SA Consumer Default Index (CDI) deteriorated from 4.02 in December 2020 to 4.33 in March 2021, as people struggled to keep up with their payments related to the increased economic activity, following the easing of strict lockdowns towards the latter part of 2020. Experian CDI is designed to measure rolling default behaviour among SA consumers with home loan, vehicle loan, personal loan, and credit card accounts. The CDI tracks the marginal default rate as it measures the sum of first-time (accounts that have never) defaulted balances as a percentage of the total sum of balances outstanding.

To better illustrate this, we highlight that the CDI looks at what Experian refers to as the six macro financial affluence segmentation (FAS) sectors in analysing its data:

- Luxury living (2.5% of the credit active population): Affluent individuals representing the upper crust of SA society, with the financial freedom to afford expensive homes and cars.

- Aspirational achievers (9.3% of the credit active population): These are young and middle-aged professionals, with the resources to afford a high level of living, while also furthering their careers, buying property, and establishing families.

- Stable spenders (7.2% of the credit active population): Young adults that rely on financial products to assist in making ends meet or to afford specific necessities such as clothing, school fees, or seasonal luxuries.

- Money conscious majority (40.0% of SA’s credit active population): These are older citizens that are conscious of where and how they spend their money, and they often seek out financial products to cover their basic needs or for unforeseen expenses.

- Laboured living (24.6% of the credit active population): A financially limited segment as salaries are below national tax thresholds. They spend their money on basic living necessities such as food and shelter.

- Yearning youth (16.4% of the credit active population): These are very young citizens that are new to the workforce and includes a mix of labourers and possibly working students earning low salaries and that are limited to spending on non-essential goods.

As has been the case over the past three quarters, FAS groups 1 and 2 continue to exhibit the most significant deterioration (CDI YoY % change), largely because of their high exposure to secured credit.

Figure 4: Job losses are biased towards low-income groups …

Source: Standard Bank Research. Standard Bank employment proxy by monthly income band.

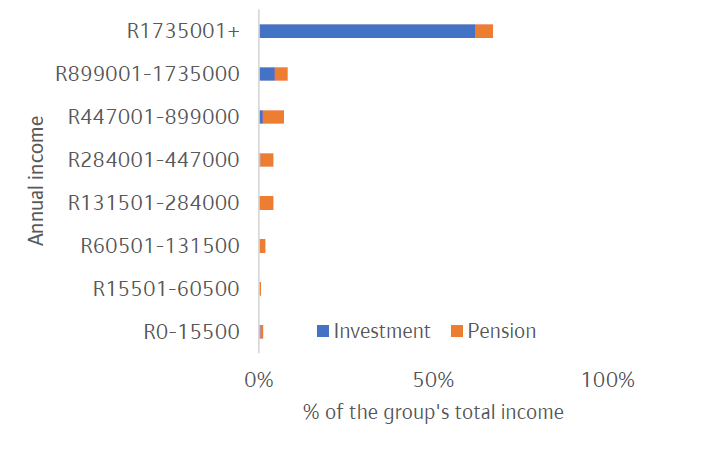

Even when looking at the high-income groups, we note that they are “not quite there yet” in terms of investment income terms of employment.

Figure 5: Investment income is quite important for high-income groups

Sources: SARB, IMF, Treasury, Stats SA, Bloomberg, Standard Bank Research

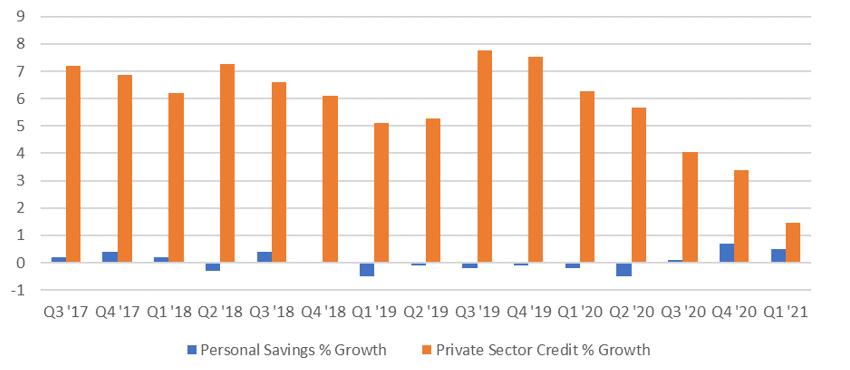

Whilst debt growth supports consumer spending power, the current rise in household bank credit is largely owing to growing mortgages (courtesy of SA’s current low interest rate environment). Interestingly, after declining by five points in 1Q21, the RMB/BER Business Confidence Index (BCI) jumped 15 points to 50 in 2Q21. This means that the number of respondents satisfied with prevailing business conditions now equal those that are unsatisfied – an outcome we have not seen in years. While the improvement in sentiment is no doubt encouraging, uncertainties remain. Various risks such as the fast-spreading third wave of COVID-19 infections, the danger of additional lockdown restrictions being imposed, Eskom’s electricity grid that looks increasingly unstable, and the looming threat of industrial action could easily still knock confidence in the period ahead. Notable too is the fact that the rebound in the BCI thus far has mainly been driven by consumer-sensitive sectors, while confidence in sectors linked to the supply-side of the economy remains distinctly lower.

Figure 6: SA RMB/BER consumer confidence

Source: Anchor, BER

What then is the trajectory of SA’s wage/income growth?

This is not an easy question to answer. A lot will depend on the outcome of government’s wage negotiations with public sector unions. However, it is important to bear in mind the decline in government grant transfers (i.e., the end of its COVID-19 relief-of-distress grants and the Unemployment Insurance Fund’s [UIF] temporary employee relief scheme [TERS]), that have previously been supporting the low-income groups. But at the end of the day, SA remains a nation of spenders and not savers and we do not expect that to change anytime soon. Whilst on average there has been an increase in amounts saved over the years, this growth is largely attributed to the wealthier individuals who are better positioned to continue growing their money through savings and investments – even during times of economic downturn. The number of middle-income South Africans who enter the world of savings has, however, slowed. Without access to disposable income, necessities trump savings contributions. Interestingly, in comparison to many of our peers in the Southern African Development Community (SADC countries include Angola, Botswana, Congo [DR], Lesotho, Malawi, Mauritius, Mozambique, Namibia, Seychelles, Swaziland, Tanzania, Zambia, and Zimbabwe), sub-Saharan Africa, and BRICS countries (Brazil, Russia, India, and China), SA does not have positive savings rates.

The question is, what makes SA so different? It largely boils down to the fact that it is so easy to get credit extension in SA, thus it has not allowed people to build a culture of saving. In many other countries if you want to buy something you save for it. South Africans do not like to do that, instead thinking in terms of the availability of credit, and often South Africans do not even consider the interest rate/s they are paying. Worryingly, most people do not understand how much they pay in fees and interest, given that these amounts are often not that transparent. In our view, this all means that, on average, South Africans will continue spending, whether they have the funds available or not.

Figure 7: SA consumer saving vs credit

Source: Anchor, SARB, StatsSA