The South African Reserve Bank (SARB) cut the repo rate by a further 0.50% on Thursday (21 May), bringing the total 2020 interest rate cuts to date to 2.75%. From an investment perspective, this means that those investors earning a 7.00% return on their 32-day notice accounts in January have seen their income plummet to 4.25% on that same investment today. Globally, investors are recalibrating their expectations of yields and real returns as interest rates push towards, or even below, zero. South Africans are forced to pay a risk premium to compensate for the perilous state of our nation’s finances. This risk premium is, for now, keeping interest rates positive and generating some returns for investors. In this note, we update our assessment of the outlook for bonds and income funds within Anchor.

It is worth noting that, while the SARB left the door open for further interest rate cuts this year, and SA’s economic malaise will likely be even worse than the SARB predicts, we believe further rate cuts are unlikely. Our view is that rates will remain at current levels for longer than the market is anticipating – perhaps for two- to three- years. In the near term, we think that inflation will likely trough in the coming months and that recovering oil prices, Eskom tariffs and some inflation as a result of supply disruptions will see the inflation rate normalise to between 3% and 4%. While this might allow for a small interest rate cut in the coming months, we remain sceptical that the SARB will actually follow through on this.

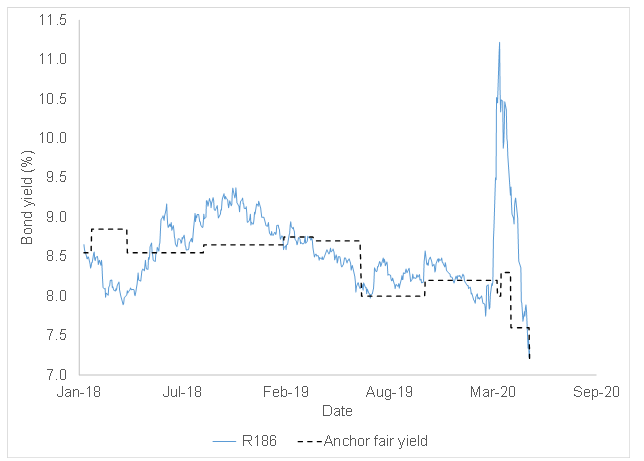

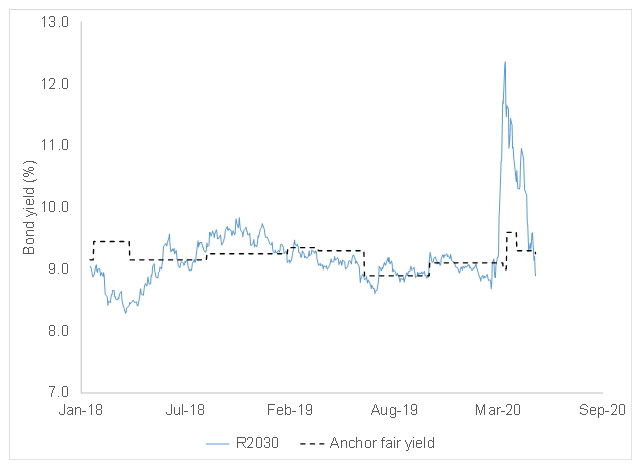

Our assessment is that this latest interest rate cut does little for longer-term bonds that are more concerned about the looming fiscal chasm than short-term interest rates. We have therefore reduced our target yield for the R2030 from 9.30% to 9.25% in response to the latest cut. We think that this bond is now a little on the expensive side and we would not be surprised to see its yield pushing higher again. In contrast, we expect that the R186 should see its target yield decline from 7.60% to 7.20%. This reflects the fact that this bond is one of the best alternatives to cash, especially where investors are taking relatively little duration risk yet earning significantly more than cash and floating rate notes. We expect that this bond yield (currently 7.45%) will drift lower over the coming days. Our various outlooks are set out in Figure 1 and 2 below.

Figure 1: Anchor SA bond yield monitoring – R186

Source: Thomson Reuters, Anchor

Figure 2: Anchor SA bond yield monitoring – R2030 bond

Source: Thomson Reuters, Anchor

Implications for the Anchor BCI Bond Fund

This portfolio invests in longer-term bonds and targets a higher interest yield. These longer-term bonds are not particularly impacted by the interest rate cut and, therefore, we expect that this portfolio will be able to maintain its yield of around 10%. In the near term, we think that the portfolio has run very hard and that the longer-dated bonds are a little on the expensive side. In the longer term, locking in a 10% yield today is probably more appealing than many other domestic asset classes. Investors have to be aware that, historically, this portfolio has been less risky than equities, but certainly is much more volatile than cash. We reiterate our view that, for clients looking to lock-in yields for periods of 3 years and longer and are willing to accept some volatility in their capital values, this portfolio is an attractive option.

We also repeat our view that this portfolio is not suited to short-term investments.

Implications for the Anchor BCI Flexible Income Portfolio.

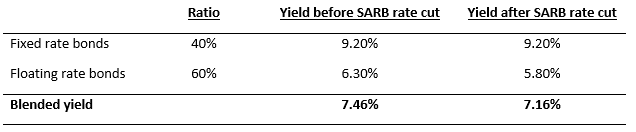

Broadly speaking, this portfolio is comprised of floating rate bonds, that give great stability of capital values but will see their interest rates change with the rate cut, and fixed-rate bonds, that have not really seen their interest rates move.

The approximate portfolio construction is set out below:

Figure 3: Approximate portfolio construction of the Anchor BCI Flexible Income Portfolio

Source: Anchor

As a result of the most-recent rate cut, we expect that the portfolio yield on the Flexible Income Fund will, in time, drift lower towards 7.15% and investors are advised to recalibrate their expectations. We have seen a spectacular May to date, with the portfolio generating returns of 2.04% over the first 21 days of the month. The capital recovery that we had been predicting has indeed happened. We think that there is a further 0.50% to 1.00% of recovery available in this portfolio, however, we must accept that this will play out over a longer time frame.

In considering the options for low-risk investments, we highlight that bank deposits are now likely to yield around 4.00%, while money market fund returns are likely to gravitate towards 4.60%. On a relative basis, the Anchor BCI Flexible Income Fund has thus seen its attractiveness increase when compared to the alternatives for earning income, without taking material risks to investors’ capital value. We therefore think that this will continue to garner support as investors seek to generate what income they can in the current economic environment.