Retail trends in SA and around the globe have been interesting since a slew of unexpected events hit the world, altering consumer behavioural patterns and ultimately impacting retail trends. The onset of COVID-19 and its ripple effect on the global economy and retailers has been far-reaching. COVID-19 has impacted every fibre of human society, and one would think the world has lived through an event of biblical proportions. Globalisation and the world’s interconnectedness have meant that we have all felt the highs and lows of living through the pandemic. This article focuses on SA retail trends since the onset of COVID-19.

SA before COVID-19

First, it is important to highlight that a big underlying driver for the retail market is a country’s macroeconomic environment. Thus, it is essential to provide the context of SA’s macroeconomic environment before the arrival of the pandemic. This will help readers understand the country’s retail trends holistically – not only in a historical and current context but also in future implications.

SA’s macroeconomic environment before COVID-19 was already quite challenging compared to the mid-2000s when the country’s economic prosperity was relatively good. SA grew GDP at a healthy pace, peaking in 2006 at 5.6% YoY. The years 2008 to 2018 were characterised by poor governance and low levels of GDP growth. Furthermore, SA unemployment increased and remains alarmingly high, even in a post-COVID-19 world. A key issue with SA’s economy is that it has one of the highest Gini coefficients in the world. The Gini coefficient is based on the comparison of cumulative proportions of the population vs cumulative proportions of income, and it ranges between 0 (perfect equality) and 1 (perfect inequality), which means that SA is an unequal country in which high-income earners pocket the largest percentage of the nation’s income. As a result, high inequality presents serious risks for the country in the medium- to long-term, and the current administration’s reform mandate has been to address this high inequality. However, COVID-19 and Russia’s war on Ukraine have dealt a massive blow to the local economy, and economic reform has been slow. This means that the macroeconomic climate SA so desperately needs to create jobs and improve the living conditions of its populace is likely to be delayed, with the economy slow to recover.

The COVID-19 impact on retail sales

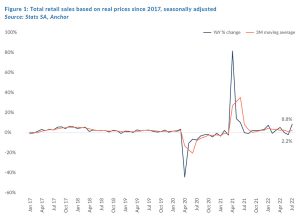

Looking at total retail sales trends over the past five years (Figure 1), we see that the initial negative impact on overall SA retail sales is very apparent after March 2020, when COVID-19 first arrived on our shores. Since March 2020, several other events have further impacted retail sales performance, albeit slightly less than COVID-19. The two events that directly or indirectly affected the SA retail environment were the July 2021 civil unrest locally and Russia’s invasion of Ukraine in February this year.

Below we highlight some interesting takeaways from Figure 1.

- Relative to the pre-pandemic era and despite a challenging economic climate in the years preceding COVID-19, retail sales have been a lot more volatile post-pandemic vs pre-pandemic.

- Although the economy has recovered to a certain extent, the volatility in retail sales growth has been driven by the impact of several lockdown restrictions due to various COVID-19-waves, base effects and the July 2021 civil unrest locally.

- Russia’s invasion of Ukraine has indirectly impacted SA’s retail market. The subsequent sanctions on Russian seaborne crude oil and petroleum products have been a catalyst for the brent crude oil price, which has driven fuel prices higher. This has seen inflation soar and driven most global central banks to hike rates as inflation remains stubbornly high in many countries, including SA. Furthermore, Ukraine and Russia play a significant role in exporting essential grains, and some soft commodity prices have increased as a result, pushing soft commodity prices higher, which in turn have negatively impacted food inflation, driving it higher.

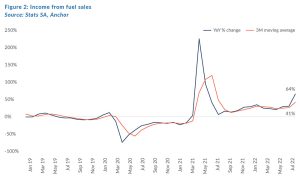

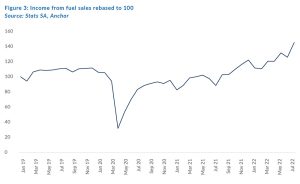

Figure 2 below demonstrates the effect COVID-19 had on fuel as brent crude oil prices plummeted on the back of dwindling demand when COVID-19 and the ensuing lockdowns swept the globe. As the world recovered and demand returned, we can see the impact of fuel prices in SA as brent crude oil prices increased after Russia invaded Ukraine.

Diving deeper into sectoral retail trends

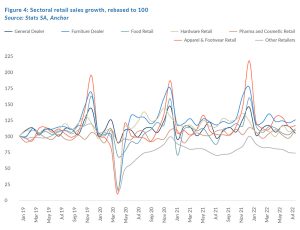

In Figure 4, we rebase various retail sectors’ sales performance from January 2019 until July 2022. The data below are based on constant prices and are not adjusted for seasonality.

- Figure 4 shows that spending in discretionary retail segments typically increases during the festive season. The apparel and footwear sector experienced heightened sales in December 2021, followed by furniture and food retail.

- We can also see the severe impact of COVID-19 on all retail sectors after March 2020.

- The impact of the July civil unrest is most pronounced within the food, general dealer and apparel categories.

Following the onset of COVID-19, some retail segments have performed differently compared with the pre-COVID era, spurred by unexpected consumer behavioural patterns. Although the local economy was negatively affected by COVID-19, pockets of the economy that were insulated from job and income losses influenced retail trends in interesting ways during the height of the pandemic.

As lockdown restrictions were put in place locally, remote work became a convenience for most SA corporates due to the lockdown restrictions, particularly in the services sector. This went on to influence behavioural patterns amongst consumers. Despite the severe job losses resulting from COVID-19, SA’s working population, particularly the mid-to-upper Living Standards Measure (LSM) demographic, had relatively good disposable income. Low petroleum prices, working-from-home (little to no commuting expenses), and the low-interest rate environment meant that consumers could pursue their DIY projects and divert spending that was provisioned for travel, entertainment and fuel towards special DIY projects and more discretionary purchases. However, since lockdown restrictions have been lifted, the economy has started to recover, and spending patterns have also normalised. As a result, 2022 has seen retail growth exposed to the home improvement, and DIY sectors decline, given these categories’ higher base effects in 2020 and 2021.

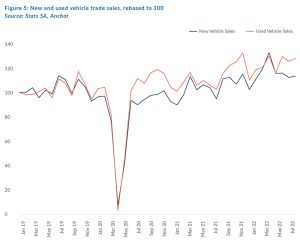

Furthermore, COVID-19 also affected the seaborne market, which resulted in major supply-chain disruptions driven by shipping delays, a shortage of shipping containers and increased port congestion. The motor retail segment is one discretionary retail segment that has performed well locally, benefitting partly from the automotive microchip shortages in the world, which has dislocated the supply of motor vehicles globally. Due to low supply and high demand for these vehicles, new and used vehicle prices have also increased significantly.

COVID-19 SA government interventions

COVID-19 SA government interventions

The SA retail market has also benefitted from some of the government’s COVID-19 economic interventions. The two key interventions highlighted below continue to positively affect or benefit the retail market, particularly the apparel and food retail sectors.

- The R350 unemployment grant; and

- The Presidential Employment Stimulus (PES) employs youth as temporary teacher assistants and pays them a stipend of c. R3,500/month. The programme aims to limit high unemployment rates amongst the youth.

Without these interventions, we might not have witnessed some of the strong retail growth rates that several of SA’s apparel and food retailers experienced during the pandemic. Additionally, a few JSE-listed companies’ management teams have linked retail weakness in May and June to the temporary cessation of unemployment grants. This demonstrates the positive effects of these interventions on the local economy. As SA continues to recover to pre-pandemic levels, these government interventions may be revoked as they have been used as temporary interventions to cushion the economy from the adverse effects of COVID-19. If they are revoked, SA may witness pedestrian retail growth numbers once everything fully normalises. Recall that SA’s economic reform plan is being implemented at a snail’s pace, and loadshedding has become a bottleneck in the country’s economic recovery. Although most SA corporates have become resilient to a tough economic environment, the fundamental drivers of our underlying economy have not fully recovered, and SA’s strong retail sales growth numbers in some sub-sectors of the retail market are currently laced with a high inflationary component as opposed to volume growth.

Near-term uncertainty remains

To conclude, for the SA retail market to flourish further, the country needs a healthy macroeconomic environment as the world continues to normalise. However, as SA and other major economies pursue contractionary monetary policy, geopolitical risks remain elevated, and the near-term outlook for the local and global retail market remains opaque.