Wednesday’s (19 February) unexpected, last-minute postponement of the Budget caught many by surprise. Despite this, the rand has remained relatively stable, moving from R18.45/US$1 on the morning of 20 February to approximately R18.52/US$1 later that day. Similarly, exchange rates against the euro and the British pound have seen minimal fluctuations.

Markets appear to have adopted a “wait-and-see” approach, evaluating the potential consequences of the delay and the broader political dynamics at play. At the heart of the dispute within the Government of National Unity (GNU) over the 2025 Budget is the proposed two-percentage-point VAT increase. This hike is intended to fund additional spending on social grants, public sector wages, and infrastructure while still allowing debt to peak in FY25/FY26, albeit at a slightly higher level. However, the proposal has faced resistance from some GNU coalition partners and possibly certain ANC members, raising concerns about whether the Budget will secure enough support to pass through Parliament, given the ANC’s reliance on its coalition allies.

The bond market has reacted mildly to the delay, with around 5 bps weakness. We do not expect rating agencies to respond significantly to this, with S&P having already upgraded South Africa’s (SA) credit outlook to positive in November 2024, citing political stability following the National and Provincial Elections (NPEs) and the formation of the GNU. The JSE has also seen a modest decline of 0.5%, with international markets more focused on the US, where the Republican Budget plan will be unveiled on 20 February.

This budget postponement is unprecedented in SA’s democratic era, mainly because the ANC now requires opposition support to pass the Budget. Statements from GNU partners indicate that the disagreement centres on the VAT hike – it appears that National Treasury (NT) did not provide adequate time for the Cabinet to deliberate on the Budget’s more contentious elements, underestimating how the GNU has reshaped political dynamics in SA. This raises questions about Deputy Finance Minister Ashor Sarupen’s (a DA minister) level of involvement in the process and whether NT sufficiently anticipated these challenges. Over the coming days, clarity should emerge on whether the proposed VAT hike truly blindsided the DA or if it leveraged the delay to assert its influence within the GNU—both possibilities could be true.

In the interest of transparency, the initial press embargo on the budget has been lifted, providing us with more details about the budget. The 2025 Budget further included above-inflation increases to social grants, an expansion of the list of essential food items that are VAT zero-rated, and no changes to the fuel levy—all aimed at mitigating the impact of the VAT hike on low-income households. Additionally, the budget strongly emphasised infrastructure investment through direct fiscal allocations and the budget facility for infrastructure, which leverages additional funding sources. This focus is intended to drive economic growth and job creation. The Budget Review further outlines ongoing reforms to support infrastructure development, including an expanded role and increased allocations for the budget facility for infrastructure, streamlined regulations for public-private partnerships (PPPs), and reforms in municipal electricity, water, and waste management services.

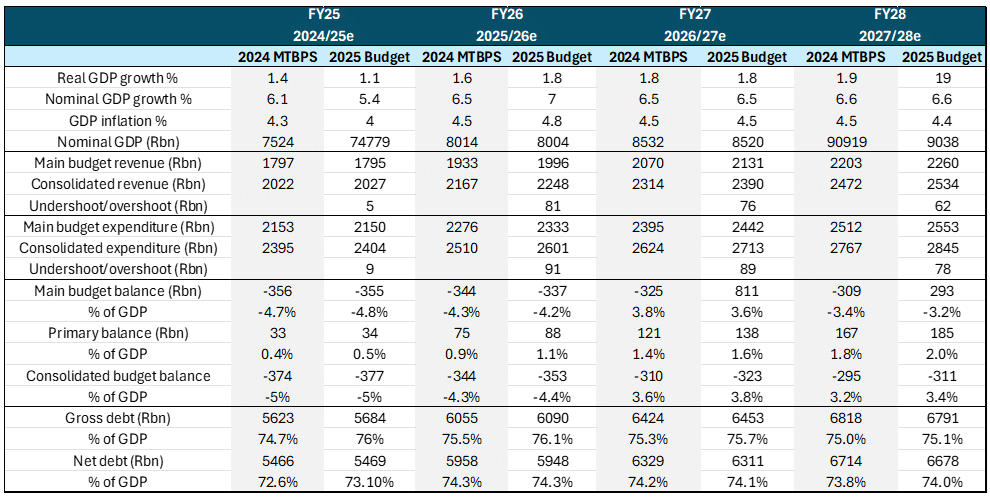

Figure 1: Summary of fiscal forecasts from the proposed 2025 Budget

Source: National Treasury, Anchor

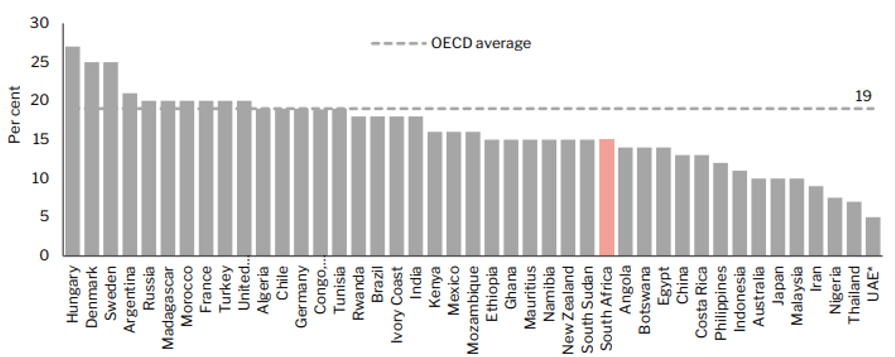

Figure 2: VAT comparison across the OECD*

Source: Nedbank

*Organization for Economic Co-operation and Development.

VAT was selected as the primary funding mechanism for increased spending pressures because NT considered it the least harmful tax increase in terms of economic growth. Preliminary estimates suggest that a 2-percentage-point VAT hike could have generated between R40bn and R60bn in additional revenue. SA’s VAT system currently zero-rates 21 essential food items to make them more affordable for lower-income households. To mitigate the impact of the proposed VAT increase, the government has suggested expanding this list while boosting infrastructure investment to create jobs, address economic bottlenecks, and improve government service delivery. However, despite these measures, the VAT hike would likely have weighed on household consumption and added to inflationary pressures, potentially delaying interest rate cuts by the South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC).

Unlike the last VAT increase in 2018, which was well-communicated and phased in, this proposal appears to have been introduced with little warning. This lack of transparency runs counter to SARB’s ongoing efforts to manage inflation expectations and shield the most vulnerable from rising prices through interest rate policy. In fact, SARB Governor Lesetja Kganyago has even suggested lowering the inflation target from 4.5%—the midpoint of the current 3% to 6% range—further underscoring the disconnect between fiscal and monetary policy. By opting for a VAT hike, NT has chosen one of the more regressive fiscal measures, placing it at odds with SARB’s mandate to protect purchasing power.

Nonetheless, while the postponement of the Budget has caused uncertainty, it is preferable to an outright cancellation. Globally, political disputes over budgets have had significant consequences. In France, efforts to cut the budget deficit led to the removal of the prime minister, while Kenya faced widespread protests, delays in International Monetary Fund (IMF) funding, and the eventual abandonment of proposed tax hikes. Although markets dislike uncertainty, the delay may signal a growing level of accountability within SA’s political system. This is democracy and coalition politics in action—messy, but ultimately a sign that smaller parties now hold real influence. While this may cause short-term instability, it could also push the government toward greater transparency and more inclusive decision-making, potentially paving the way for much-needed economic and structural reforms.