We are all familiar with the idea that as interest rates go up, bond prices go down. On Wednesday (19 May), South Africa’s (SA’s) April annual consumer price index (CPI) inflation came in at a much higher 4.4% (vs a 3.2% print in March) and thus we expect the SA Reserve Bank (SARB) to hold rates at current levels when the SARB’s monetary policy committee (MPC) concludes its meeting on Thursday (20 May). Notwithstanding the aforementioned, we think that the most likely move by the MPC will be to raise rates at some point in the near future, with Anchor’s base case being that the first interest rate hike will be towards the end of this year, or in 1Q22.

Against this backdrop of rising interest rates locally, we are currently seeing pension funds rotate into bonds (the Anchor BCI Bond Fund will likely benefit from this over the next two weeks). We have also seen foreign investors comment that their favourite trade, in the non-equity emerging market (EM) space, is to buy SA government bonds (followed by Mexican interest rate products). In addition, we have been receiving several queries of late as to why this is occurring in a rising interest rate environment.

Much like in the case of equities, it is no good knowing that interest rates are going to rise. Investors also need to consider what is already priced in. An advantage which fixed income has is that, if we apply a bit of mathematics to the Forward Rate Agreement (FRA) curve, it gives us a good indication of what is already priced in. Currently, we calculate that the market is pricing in two interest rate hikes of 0.25% each in 2021, with a further four interest rate hikes of 0.25% each next year. This gives us a total interest rate hike of 1.5% by the end of 2022.

Assuming that the global environment, the local economy, and domestic politics continue their current trajectory then, if we have less than six interest rate hikes by the end of 2022, bonds will be offering capital gains. Conversely, more than six rate hikes will result in capital losses.

The SA economy is still languishing after years of mismanagement. No established economist is expecting a prolonged surge in our economic growth rates and the recovery from the various crises is expected to be softer than for many developed nations. This means that domestic inflation will likely lag the rest of the world and that once the reopening effects have played out, we expect inflation to average c. 4%. In summary, this is not the type of economy where the SARB will be in a position to aggressively hike rates. Therefore, we expect that the number of rate hikes will be less than the six which the market is pricing in and that capital gains may be on offer from bonds.

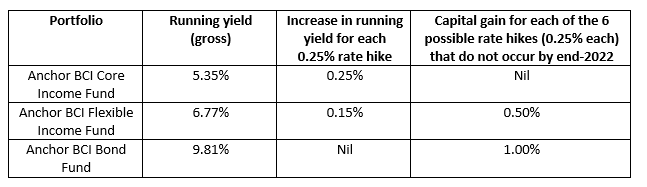

Anchor offers three different fixed income portfolios domestically, with each one of these behaving differently in the event of rate hikes (see our estimates in Figure 1 below). Bear in mind that several factors (both global and domestic) could impact the price of bonds at any point in time. We note that, for the purposes of Figure 1, we are trying to isolate the impact of any future interest rate hikes.

Figure 1: Anchor’s three local fixed income portfolios and their respective behaviour in the event of rate hikes

Source: Anchor

From Figure 1 above, we highlight that pension fund investors are looking to lock into their 9.81% yield, while also taking an exposure that interest rates will not rise six times over the next 18 months. It only takes slightly fewer than six rate hikes for bonds to average over 10% for the next two years, which foreign investors should find appealing. We also note that foreign flows into SA bonds have turned positive once again.

Still, while the current lower-yield environment locally has made fixed income less attractive, we are starting to see increasing interest in the SA market, both domestically and globally, as capital gains appear to be on the table.