On Tuesday (8 December), Statistics SA announced that South Africa’s (SA’s) 3Q20 gross domestic product (GDP) bounced by 13.5% QoQ (66.1% QoQ annualised), off a low base (economic output having dropped by 16.6% QoQ in the previous quarter, 2Q20, as SA dealt with the fallout of the COVID-19 induced lockdowns). The bounce beat aggregate expectations for a 54.4% QoQ annualised expansion in 3Q20, leaving economic output c. 6% below the 3Q19 level – significantly better than forecasts of a 7.8% YoY decline. The economic expansion ended four quarters of shrinking economic activity – SA’s longest recession in 28 years.

Manufacturing industry, trade, and mining were the biggest drivers of 3Q20 growth. The manufacturing industry rose at an annualised rate of 210.2%, driven by increases in the production of basic iron and steel non-ferrous metal products, metal products and machinery, petroleum, chemical products, transport, and food and beverages. Mining and quarrying jumped 288.3%, with the industry recovering in 3Q20 largely due to easing global and local lockdown restrictions. Higher production was mainly due to increased activities in the production of platinum group metals (PGMs), iron ore, gold, manganese ore, and diamonds.

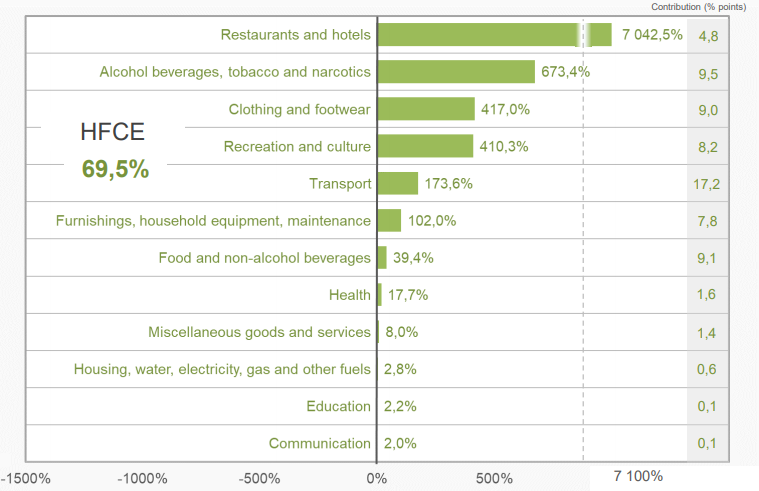

Household’s spending was also a key contributor to the GDP rebound (up c. 70% QoQ annualised), as easing lockdown restrictions allowed consumers to begin spending at restaurants and hotels as well as purchase alcoholic beverages and tobacco.

Figure 1: Household final consumption expenditure, QoQ growth (seasonally adjusted and annualised)

Source: Stats SA

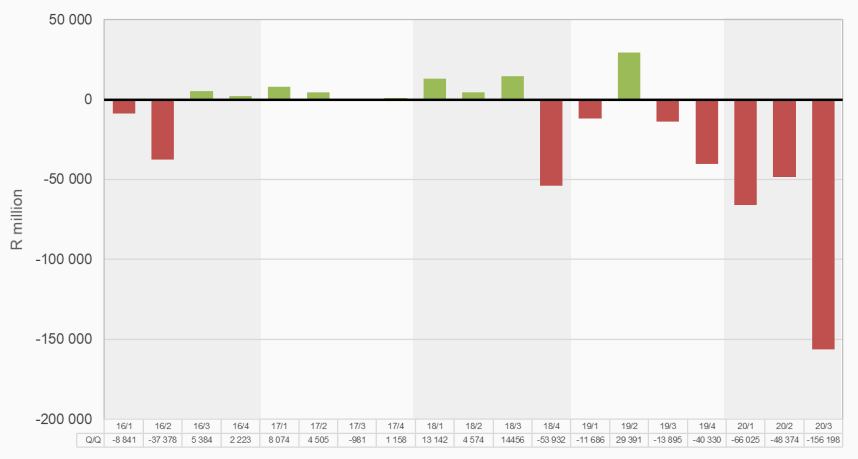

Also noteworthy was a R156bn drawdown in 3Q20 inventories, with companies having been in destocking mode for seven of the past eight quarters, which bodes well for future economic activity as companies start to restock.

Figure 2: Change in inventories

Source: Stats SA

Large industry drawdowns were reported for the mining and trade industries in 3Q20

It is worth remembering that it was only midway through 3Q20 that SA moved to alert level 2 (17 August), so only half of the quarter benefitted from the reopening of restaurants, bars, guest houses, and gyms, also the resumption of interprovincial travel and the sale of alcohol and cigarettes, while it was only the last 12 days of the quarter that benefitted from the incremental activity allowed under lockdown level 1 (the further relaxing of alcohol sales, a shorter curfew, and larger numbers allowed at gatherings). Assuming no increases in lockdown restrictions for the last few weeks of the year, 4Q20 will be the first full quarter with limited lockdown restrictions, which should help drive economic growth to its pre-COVID-19 levels and beyond.