On Tuesday (24 August), Statistics South Africa (Stats SA) released the Quarterly Labour Force Survey (QFLS) for 2Q21, which showed that SA’s unemployment rate has risen to 34.4% – the highest on a global list of 82 countries monitored by Bloomberg. SA’s 2Q21 unemployment rate was in line with expectations, albeit at another record high (it was also the highest level since the QLFS started in 2008). More concerning to us is that the expanded definition of unemployment (i.e., which includes discouraged work-seekers and is thus more reflective of the true level of unemployment in SA) increased by 1.2 percentage points to 44.4% in 2Q21 vs 1Q21. The number of people who were not economically active for reasons other than discouragement, declined by 4.5% QoQ resulting in a net decrease of 386,000 in the not economically active population.

Formal sector employment, accounting for 68.3% of total employment, recorded a loss of 375,000 jobs during the quarter. However, employment in the informal sector, private households, and agriculture rose. According to Stats SA, QoQ, some industries created jobs while others lost jobs, resulting in a net decline of 54,000 in total employment. Looking at some sectors, we highlight the following:

- The finance industry lost 278,000 jobs.

- Community and social services lost 166,000 jobs.

- Manufacturing lost 83,000 jobs.

- Agriculture added 69,000 jobs.

- Construction jobs increased by 143,000.

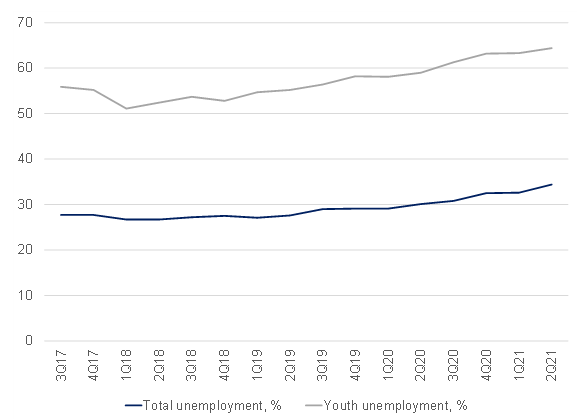

Youth unemployment now sits at 64.4% (Figure 1), indicative of the current social unrest and pointing to longer-term, structural issues in the SA economy. All in all, these numbers are indicative of an economy still greatly impacted by the COVID-19 pandemic and the resulting lockdowns of 2020, with many capable workers still inactive.

Figure 1: Total unemployment vs youth unemployment, %

Source: Anchor, StatsSA

Looking ahead, unemployment data are likely to deteriorate in 3Q21 due to the tighter restrictions amid a third wave of the pandemic and the social unrest experienced in parts of the country in July. Overall, rising joblessness will increase pressure on the government to extend current relief measures that would complicate efforts to stabilise public finances – an issue of which National Treasury is keenly aware.