On Tuesday (8 September), Statistics SA announced that South Africa’s (SA’s) gross domestic product (GDP) dropped by 16.4% QoQ seasonally adjusted, or 17.1% YoY, pushing the country deeper into a recession. This was SA’s fourth consecutive quarterly GDP decline, but the data reflect the months of April, May, and June – the worst period of the COVID-19-induced lockdown, which started on 26 March in SA (1Q20 is basically pre-lockdown).

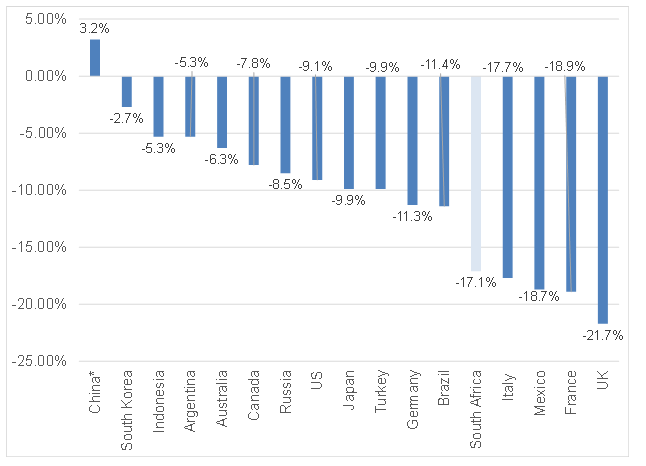

SA is not alone in having to deal with the ravages of COVID-19 on its economy. COVID-19 is a truly global crisis and the impact of the pandemic-induced lockdowns on economies around the world were severe. In Figure 1 below, we highlight the impact on various global economies during the same period.

Figure 1: Global real GDP 2Q20 performance, YoY % change

Source: Anchor, Bloomberg.

*China’s lockdown period was from 23 January–8 April 2020 so it impacted 1Q20 GDP data for the most part.

We note that the headline-grabbing number of SA’s GDP plummeting by 51%, which so many publications have highlighted in reporting on the numbers is misleading as it is annualising the quarterly number (i.e. if we contracted at that pace for four quarters our economy would shrink by 51% – probably a bit aggressive extrapolating that kind of correction!). Still, the actual numbers were pretty dire, albeit without the same shock value and only slightly worse than consensus expectations of a 16.0% YoY drop.

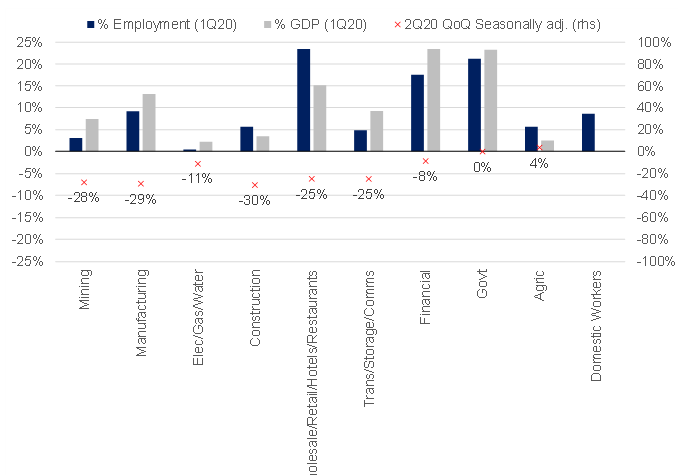

Looking at the data through to a sectoral level, we have created the chart in Figure 2 below to highlight how significant each of the sectors are in terms of their respective contribution to SA’s economic output and employment (based on 1Q20 data).

Figure 2: SA sectoral contribution to total GDP and employment

Source: Anchor, Bloomberg

Probably the most concerning in terms of employment are:

- Manufacturing, which accounts for c. 13% of SA employment and economic output was down 29% QoQ seasonally adjusted in 2Q20. However, we highlight that the good news here is that the recent manufacturing purchasing managers index (PMI) print of 57.1 is also the highest it has been since early 2007, so it would appear that the sector has bounced back well.

- Trade (wholesale and retail) as well as hotels and restaurants, which together are responsible for 23% of employment (and 15% of GDP), recorded a 25% QoQ seasonally adjusted drop in output in 2Q20 and it is critical that this sector gets back on track from an employment (and economic output) perspective.

On the positive side, the financial sector, which constitutes 18% of SA employment (and 23% of GDP) saw its output drop “only” 8% QoQ seasonally adjusted in 2Q20.

Government, SA’s second-biggest sector in terms of employment (21%) and making up 23% of economic output, saw its contribution to the economy decline by only 0.2% QoQ seasonally adjusted in 2Q20.