The quote often attributed to Russian revolutionary and politician Vladimir Lenin – “There are decades where nothing happens; and there are weeks where decades happen” – seemed particularly apt for financial markets in January. Global equities experienced heightened volatility during the month, and while not all market moves can be attributed to political developments, the frequency and scale of policy-related headlines materially amplified market turbulence in January. Despite this, most major global equity markets delivered solid monthly gains, with the MSCI World Index rising by 2.3% MoM.

January’s elevated volatility coincided with a rapid succession of policy announcements and geopolitical developments from US President Donald Trump’s administration. Trump adopted an increasingly confrontational tone on trade and foreign policy, contributing to sharp, headline-driven market moves. On 20 January, US equity markets suffered one of their weakest sessions since late-2025 after Trump threatened steep tariffs on European allies in his bid to acquire Greenland, initially suggesting the US might take Greenland “the hard way” if a deal is not made (he later backtracked).

Beyond trade policy, markets were confronted with a broad range of destabilising headlines. Intensified ICE raids saw civil unrest and two deaths in Minnesota, while Trump again threatened Canada with tariffs if it signs trade deals with China. The administration also sidelined the UN by establishing a “Gaza Peace Board”, formally withdrew from the World Health Organization, launched a criminal investigation into US Federal Reserve (Fed) Chair Jerome Powell, expanded the US military presence in the Middle East and carried out the extrajudicial capture of Venezuela’s president. Collectively, these developments heightened uncertainty around US foreign policy, institutional independence, and global stability.

Against a backdrop of elevated equity valuations, investors reassessed the sustainability of US growth and the inflationary implications associated with the Trump regime’s on-again, off-again tariffs. Trump’s behaviour on the global stage (his Davos address was widely perceived as erratic, reinforcing concerns around policy unpredictability and contributing to short-term risk aversion) has also raised red flags, although he did abandon his tariff threats against Europe, easing trade war concerns, and ruled out the use of military force to acquire Greenland. US markets rallied following the news as investors’ risk appetite returned to equities. In a classic flight-to-safety, out of the US dollar (US Dollar Index -1.4% MoM), gold and precious metals prices surged to record highs. Gold prices had been soaring to new highs, partly driven by fears that Trump would choose a Fed chair to replace Powell, who would cave to his demands to cut rates, leading to a declining US dollar and rising inflation (buying gold is a hedge to protect against those events). However, precious metals prices retreated sharply toward month-end after reports suggested that Trump would nominate Kevin Warsh, viewed by markets as a comparatively orthodox and credible candidate, as the next Fed chair.

Despite the volatile month, the three major US indices ended January higher. The S&P 500 (which passed the 7,000 level for the first time on 28 January before retreating) rose 1.4% MoM while the Nasdaq advanced by 0.9%. The Dow ended 1.7% higher – its ninth straight monthly gain and its longest winning streak since 2018.

In US economic data, December headline inflation came in at 2.7% (in line with November’s print), while core inflation, which strips out the volatile food and energy prices, rose 2.6% YoY (slightly below consensus forecasts). Released in January, November’s core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, printed at 2.8% YoY, up from October’s 2.7%. Retail sales rose 0.6% in November, an increase from October’s downwardly revised 0.1% decline. As expected, the Fed did not cut rates at its meeting on 28 January.

European equity markets had a strong start to the year, ending January on a high note with the Euro Stoxx 50 Index climbing 2.8% MoM, its seventh consecutive monthly advance driven by robust corporate earnings and positive economic data, despite ongoing geopolitical risks. France’s CAC, however, was down 0.3% MoM, while Germany’s DAX advanced by 0.2% MoM. On the data front, the eurozone’s annual inflation rate was 1.9% in December, down from 2.1% in November, while the euro area GDP grew by 1.3% YoY in 4Q25, exceeding market expectations of a 1.2% growth print.

UK equity markets also had a positive January, with the FTSE 100 Index climbing above the 10,000 points level for the first time on 5 January and ending the month 2.9% higher (it reached a best level of 10,238.94 on 15 January). UK December inflation rose 3.4% YoY, up from November’s 3.2% print. Core inflation increased by 3.2%, unchanged from November and in line with expectations.

In China, despite markets dropping on Friday (30 January) following a sharp decline in the gold price, which sparked a broad-based selloff, the Shanghai benchmark gained 3.8%, its best monthly gain since August, while Hong Kong’s Hang Seng rose by 6.9% MoM. January’s official manufacturing PMI dropped to 49.3 vs December’s 50.1. Non-manufacturing PMI, which includes services and construction, fell to 49.4 (its lowest level since December 2022) from 50.2 in December. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei ended January 5.9% higher, closing at a record high above 54,000 on 14 January. Gains were driven by a weaker yen, expected corporate reforms, and potential fiscal stimulus, though the market also experienced some volatility later in the month. The country’s December headline inflation slowed sharply to 2.1% vs November’s 2.9% YoY.

Among commodities, Brent crude ended the month 16.2% higher at US$70.69/bbl, with Trump’s unpredictable foreign policy agenda raising geopolitical tensions, although these gains are likely to be capped by a looming oversupply. Despite the tumble on Friday, gold had an impressive January, gaining 13.3% MoM. Other triggers providing support to safe-haven assets included the weaker US dollar, worries about Fed independence and renewed trade jitters. Platinum group metals (PGMs) had a solid month (although it ended abruptly with Friday’s losses): platinum rose 6.5% MoM, palladium was up 5.7%, and rhodium soared by 20.4% MoM.

The JSE recorded an eleventh consecutive monthly advance in January, with the FTSE JSE All Share Index (ALSI) rising by 3.6% as ongoing gains in precious metals prices boosted the local bourse. The rand had a strong month, firming by 2.6% MoM to trade at c. R15.70/US$1 level on 29 January before giving up some of its gains and ending the month at R16.15/US$1. Rand strength was driven primarily by broad-based US dollar weakness, supported by surging commodity prices and, to a lesser extent, improving investor sentiment towards South Africa (SA) Inc. Commodity-linked shares continued to drive the JSE (Resi-10 +13.2% MoM), followed by financial shares (Fini-15 +2.9% MoM), especially the banking counters. The SA Listed Property Index was up 1.0% MoM. However, industrials (Indi-25 -4.1% YoY) had a lacklustre month.

In domestic economic data, SA December headline consumer inflation increased modestly to 3.6% YoY from 3.5% in November, while core inflation printed at 3.3% YoY, up from November’s 3.2%, undershooting market expectations and reflecting a broadly contained inflation environment. The key takeaway from this slightly below expectations inflation print is that most analysts expect this to be peak inflation and that we anticipate marginally lower prints for the time being. Against this backdrop, and in line with expectations, the South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) opted to maintain rates at 6.75% at its January meeting.

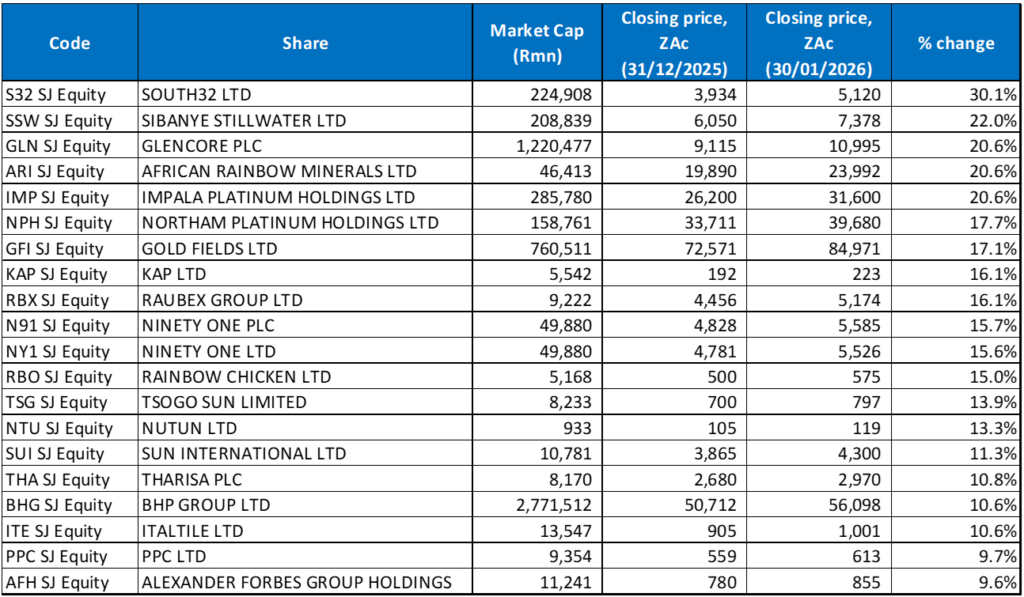

Figure 1: The 20 best-performing shares in January 2026, MoM % change

Source: Bloomberg, Anchor

At a stock level, January’s gains were overwhelmingly driven by commodity-linked shares, particularly precious metals and diversified miners, with nine out of the twenty best-performing shares coming from the sector. On 26 January, gold surged past the US$5,000 level, briefly touching US$5,500, while silver and platinum prices saw similar gains. Along with factors mentioned in our introduction, central banks’ buying of gold has been a key factor in pushing up its price, as well as increasing gold demand from individuals buying jewellery, and from investors in China, the world’s biggest buyer of gold.

South32 Ltd (+30.1%) was January’s best-performing counter, with the share price hitting a 12-month high after a trading update released last month showed a solid half-year performance. The globally diversified mining and metals company (which has interests in copper, zinc, silver, aluminium, manganese, and nickel) recorded share price gains as production from its Australian manganese division returned to normal levels. This has allowed South32 to maintain its full-year guidance across its commodities. Overall, manganese production soared 58% YoY in the December 2025 half-year. Its Australian manganese operations were put on hold in early 2025 after severe storms made it challenging to repair key infrastructure, which had been damaged by a cyclone in 2024. However, its latest trading update shows production levels normalising, with output at the Australian manganese division up 26% YoY, while SA manganese rose 4% YoY as it completed planned maintenance. Stronger metal prices also drove share price gains.

Sibanye Stillwater was in second place with a 22.0% MoM gain. The miner’s share price surged 303.9% in 2025, powered by the dramatic recovery in PGM prices and strong gold prices, as well as the company’s improving financial metrics. Last week, CEO Richard Stewart laid out a fresh capital allocation framework aimed at cutting costs and slashing debt in half over the next few years as precious metal prices bolster its balance sheet. In his first major presentation since taking the helm from Neal Froneman, Stewart told shareholders that his “back-to-basics” strategy will target paying off debt and investing in the existing portfolio rather than inorganic growth. Earlier in January, the Group had announced that it would embark on a phased implementation approach for its Finnish lithium project after costs surged 17% to EUR783mn due to regulatory changes and expanded project scope. The mine and refinery are expected to help Europe reduce its reliance on China for the vital battery metal for electric vehicles.

In third place, Glencore Plc rose by 20.6% (as did African Rainbow Minerals [ARM], and Impala Platinum [Implats]), driven by a combination of surging commodity prices (particularly copper, gold, and silver) and active takeover interest from Rio Tinto, announced in January. The potential merger, which could create the world’s largest mining company, has sparked investor optimism. CEO Gary Nagle also recently said that a string of reserve upgrades in South America at the end of 2025 gave Glencore a much-needed tailwind. Nagle noted in the Group’s full-year production report that its recent exploration efforts had yielded “notable increases” at its mines in Peru, Chile, Argentina and the US. The boost to Glencore’s portfolio could help in the company’s drive to lift its annual copper output back above 1mn tonnes p.a. after it fell for a fourth straight year and is now more than 40% below 2018 levels.

Meanwhile, ARM shares also experienced a surge, driven by strong earnings forecasts, a strategic focus on copper and anticipated increases in mine production and operational optimisation. Implats gained operational momentum to post respectable production numbers for the six months ended December. Group production was 1.79mn oz, just below 1% better YoY. The platinum miner said it was on track to meet production, cost and spending guidance for the year to end-June 2026 after a stable performance in 1H26. Soaring PGM prices saw sales revenues increase c. 40% YoY at R33,250 per 6E ounce sold, compared with R23,831 a year ago. In 1H26, capital spending is expected to have declined to c. R2.9bn from R3.9bn in 1H25, as processing projects at Zimplats near completion. The miner is targeting between 3.4mn and 3.6mn oz of refined and saleable production in FY26. Output rose 1% YoY in 1H26 at 1.8mn oz, thanks to a stable performance across its operations.

Implats was followed by Northam Platinum (Northam), Gold Fields, and KAP Ltd with MoM gains of 17.7%, 17.1%, and 16.1%. Northam’s share price has experienced significant upward momentum, driven by a combination of strong production performance and improving market sentiment towards PGM prices. Record production and soaring gold prices have buoyed the Gold Fields share price, which was up 193.7% in 2025. Gold Fields has delivered higher production and earnings as well as strong dividends and strategic growth progress, driven by strong performance from key mines across its portfolio. Diversified industrials Group, KAP Ltd’s share price gains have been driven by a combination of a turnaround strategy, completed capital investments, and market optimism regarding its financial outlook despite previously challenging conditions. KAP is focusing on reducing net debt and improving its cash flow efficiency.

Infrastructure development and construction materials supply Group, Raubex and asset manager Ninety One Plc rounded out the ten best-performing shares with MoM gains of 16.1% and 15.7%, respectively. In January, Ninety One Plc’s 3Q26 trading update showed total assets under management of GBP159.8bn (+5.1% QoQ). Last week, Ninety One and Sanlam said that the creation of a long-term active asset management relationship between SA’s largest money manager, Ninety One, and Sanlam Life Insurance is a step closer to being fulfilled as the local component of the transaction is expected to be completed on 2 February (the UK component was completed in June). The local transaction involves, among other things, Ninety One’s acquisition of all the shares in Sanlam Investment Management and the creation of an initial 15-year strategic relationship between Ninety One and the Sanlam Group.

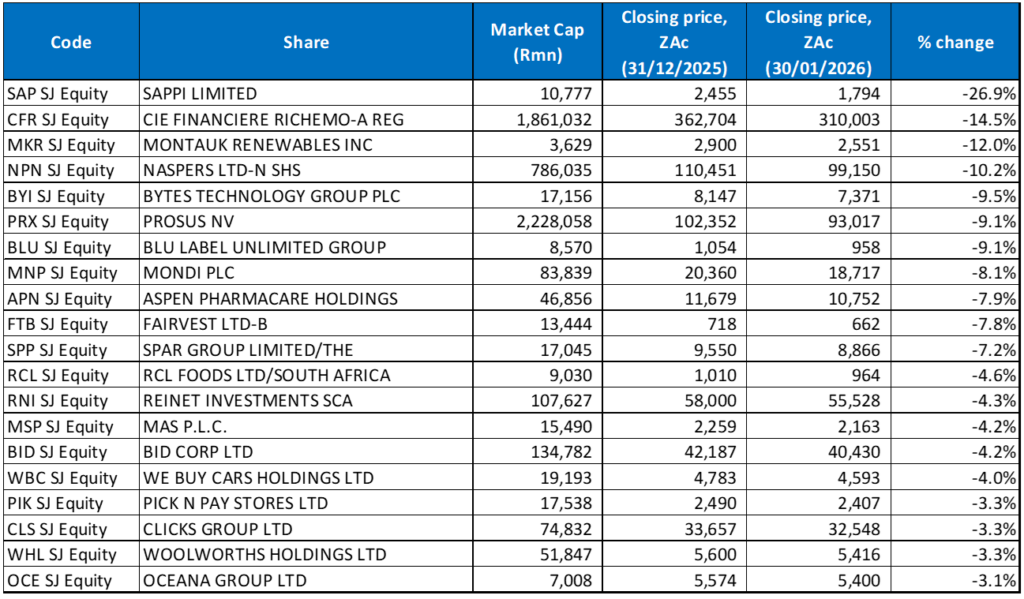

Figure 2: The 20 worst-performing shares in January 2026, MoM % change

Source: Bloomberg, Anchor

Major industrial counters on the JSE faced downward pressure in January as a stronger rand weighed on rand-hedge counters, while others continued to face weak domestic consumer demand and high borrowing costs. A combination of geopolitical risk, portfolio rebalancing, and a sharp market-wide sell-off on 30 January also weighed on these shares.

Sappi Ltd was January’s worst-performing share with a 26.9% MoM decline. The company has been under pressure as its financial performance has deteriorated, with losses and margin pressure reflecting weaker global demand for its products and an oversupply in European paper markets. Rising debt and leverage, the suspension of dividend payments (and freezing of non-essential capital expenditure), and credit rating downgrades further weighed on sentiment. In FY25, the company reported a US$177mn loss (vs a FY24 profit of US$33mn), and management warned that 1Q26 adjusted EBITDA would likely be lower than in 4Q25.

Sappi was followed by Richemont in second place with a 14.5% MoM decline. The luxury goods company reported 3Q26 sales of EUR6,399mn, up 4% YoY. The performance was driven by the jewellery maison (accounting for c. 75% of sales) and a recovery in its Specialist watchmakers segment, while the Americas remained its primary revenue driver. Nevertheless, the share price fell by c. 10% in the days following the release, initially due to valuation but also related to the prospect of US tariffs on Europe over Greenland. Rising precious metals prices also present a headwind, as gold is estimated to comprise 30%–50% of its cost of goods sold, and a 50% increase in the gold price could impact margins by 5%–7%, although Richemont has been pushing pricing to mitigate this.

Montauk Renewables, which specialises in the management, recovery and conversion of biogas into renewable natural gas (RNG), was 2025’s worst performer (-65.1% YoY), and its fortunes did not change in January as it declined by a further 12.0%. The company had a tough 2025, navigating a challenging market environment as Renewable Identification Number (RIN) pricing pressures significantly impacted its financial performance. Montauk’s 3Q25 results, released in November, showed revenue decreasing 31% YoY to US$45.3mn, while net income stood at US$5.2mn (US$0.04/share), a 69.5% YoY drop. The decline in profitability was primarily attributed to lower RIN pricing (-31.4% YoY).

Naspers N, Bytes Technology and Prosus were down 10.2%, 9.5%, and 9.1% MoM. After a strong run in 2025 (Prosus was up 37% and Naspers -N- rose 33%), both faced some share price weakness in January as investors reacted to shifting sentiment in global tech markets, as broader market caution around tech has led to price pressures and consolidation, outweighing fundamentals.

Rounding out January’s ten worst-performing shares are Blu Label Unlimited, Mondi Plc, Aspen Pharmacare, and Fairvest Ltd -B-, which recorded MoM losses of 9.1%, 8.1%, 7.9%, and 7.8%, respectively. Mondi’s decline has largely been driven by continued negative sentiment following its disappointing trading update in October, which flagged company-specific challenges heading into 2026. Added to that, the packaging industry continues to suffer from weak demand, with consumption impacted by slow economic growth.

Local pharma Group, Aspen Pharmacare Holdings, came under pressure again in January on the back of ongoing financial and operational concerns, as investors worry about weak revenue growth and muted earnings prospects. Aspen’s share price had jumped by over 20% on 29 December after it said it is selling its entire Asia-Pacific operations outside of China to Australia’s BGH Capital for c. R26.5bn in a deal that hands Aspen a premium valuation for assets it was not planning to sell. The sale is subject to regulatory and shareholder approval and includes its operations in Australia, New Zealand, Hong Kong, Malaysia, Taiwan and the Philippines.