A comfortable retirement, that elusive chapter of life that often feels like a distant dream, is within your grasp. Retirement can be a financially challenging time if not effectively managed. However, for the prudent investor, who manages their financial affairs with purpose and recognises the power of compounding, it is not as daunting a task as it may seem. Financial decisions made with your retirement in mind are vital in attaining a stress-free retirement.

As South Africans, we live in an era where financial security during retirement is a primary concern that should not be taken lightly, particularly if you are still young or have recently started working. According to a recent Sanlam report entitled Finances through the life stages: How is SA doing?, only 6%-8% of South Africans can retire comfortably, only 36% have a retirement fund, and just 7% feel prepared to retire.

In SA, where financial stability in one’s golden years takes centre stage, retirement funds stand as pillars of assurance. They are designed to provide a structured approach to accumulating funds throughout one’s working life, ensuring a consistent income stream post-retirement. Retirement funds also play a pivotal role in safeguarding the financial well-being of individuals during their retirement years.

The concept of retirement planning has evolved favourably for retirees over the past few years to equip people with a multitude of ideas to plan their retirement effectively.

One solution involves integrating a tax-free savings account (TFSA) into traditional retirement funds to optimise your retirement income through a sequential drawdown approach.

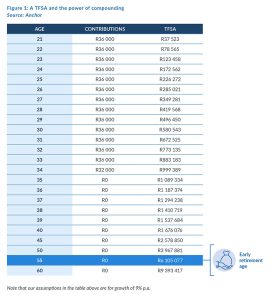

Individuals are allowed a maximum contribution of R36,000 p.a., whether owning one or multiple TFSAs and a R500,000 lifetime limit. Any growth within a TFSA is tax-free, whether it be interest, dividends, or capital gains. As with all correctly managed investment programmes, the magic of a TFSA is in the power of compounding. By starting to contribute earlier rather than later, you allow yourself the advantage of compounded growth over a more extended period. As per the table in Figure 1 below, assuming contributions start at age 21, once you reach age 55, your contributions would have compounded to roughly R6mn.

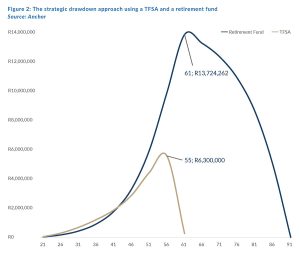

Utilising your TFSA to meet your immediate needs during early retirement ensures tax-free access to funds and grows your retirement funds. As the balance of your TFSA slowly depletes, you transition to drawing income from your retirement funds – this combination strategy optimises tax efficiency, minimises the immediate impact on your retirement funds and maximises your long-term financial well-being by compounding the growth in your larger retirement funding base.

Note our assumptions for the above are as follows: A growth rate of 9%, TFSA contributions from age 21, retirement fund contributions from age 21, R1,500 p.p. escalating at 5% for ten years, after that 8% for the remainder of the period until retirement at age 55, retirement from the TFSA at age 55, retirement from the retirement fund at age 61, and a drawdown of R110,000/month from age 55.

Figure 2 demonstrates the potential for exponential growth within a retirement fund, particularly when strategically leveraging the early utilisation of a TFSA as a source of retirement income instead of drawing down from a traditional retirement fund.

Opting to delay your retirement from a retirement annuity (RA) or any other retirement fund by a minimum of 5 to 7 years could allow your retirement savings to double in value, allowing you to purchase a larger living annuity when retiring and commencing withdrawals. A more substantial living annuity value would allow you to select a lower drawdown rate, e.g., 2.5%-8%, effectively extending the ‘lifespan’ of your living annuity. This significantly boosts the ability to provide sustained financial support throughout your retirement. It is essential also to note that once you elect to retire and draw income from your retirement funds, the tax will automatically be deducted, and you will receive the after-tax income value at every income period.

There are a few other key points to consider. First, the above information should not motivate anyone to invest in a TFSA rather than a pension fund. It should, however, encourage South Africans to invest in a TFSA over and above their retirement funds, thus creating a larger nest egg for retirement.

Second, starting with small contributions holds significance. Every contribution has value, and the impact of compounding remains substantial. Do not delay contributing until you can commit to R36,000 p.a.; even small beginnings yield significant results.

Third, the Figure 1 table data are relevant regardless of the starting age chosen to open a TFSA. For example, by opening a TFSA for your children at birth, the later potential commitments of tertiary studies, buying a vehicle, or even a house can be cushioned when navigating your retirement.

Lastly, while living annuity drawdowns can only be adjusted annually on the anniversary date, the flexibility of varying the value and frequency of drawdowns from a TFSA provides a well-suited solution. This adaptability proves advantageous during the first few years of retirement, accommodating changing income requirements and unforeseen expenses.

In the grand tale of life, retirement is your final act, your well-deserved standing ovation. By making the right choices early in life, you are penning a script that ends with applause – your applause, even when your earnings potentially take a pause. Embrace the tools at hand and pave the ultimate path to financial freedom. After all, comfort in retirement is not a privilege but a mark of a well-lived life (and money wisely invested!).