The October Effect, a psychological phenomenon where investors anticipate equity markets to decline in October, was disproven. Despite its reputation as a month of volatility and crisis, October 2025 delivered solid gains for global equities (MSCI World +2.0% MoM/+20.2% YTD), albeit with its characteristic volatility as the month saw wild swings in equity markets. US markets, in particular, extended their strong 2025 run, buoyed by better-than-expected 3Q25 earnings from US corporates and continued optimism around artificial-intelligence-driven growth. Investor sentiment was further lifted by hopes of additional US Federal Reserve (Fed) rate cuts—which did materialise late in the month—and an easing of US-China tariff tensions. Meanwhile, concerns around the ongoing US government shutdown, stretched valuations, and geopolitical risks had limited market impact. On 29 October, the Fed, under political pressure from President Donald Trump, lowered its benchmark rate by 25 bps. Although the Fed had previously indicated the likelihood of another cut in December, Chair Jerome Powell struck a more cautious tone, noting that “a further reduction of the policy rate in December is not a foregone conclusion—far from it.”

Elsewhere, Trump’s meeting with Chinese President Xi Jinping ended in a partial stand-down on key issues. The US reduced tariffs on some Chinese goods entering the country, with Trump saying that China will also buy “massive” amounts of soybeans and other US farm products. At the same time, Beijing agreed to suspend export controls on rare earths (essential for modern technology and used in everything from electric vehicles [EVs] to smartphones). However, just as one trade spat ended, a new one emerged with Canada (the US’s top export partner).

Among the major US indices, the S&P 500 closed at a record 6,890.89 on 30 October, before ending the month at 6,840.20 – a 2.3% MoM gain (+17.5% YTD). The Dow also reached new record levels before ending October at 47,562.87 (+2.5% MoM/+11.8% YTD). The Nasdaq jumped 4.8% MoM (+22.9% YTD) – its seventh consecutive positive month. In economic data, US September headline inflation, as measured by the Consumer Price Index (CPI), picked up, rising to 3.0% vs August’s 2.9% print. Core CPI, excluding food and energy, also rose by 3.0% vs August’s 2.9%. The CPI reading is the only official economic data allowed to be released during the government shutdown, which has now gone on for over 30 days.

European stocks edged higher last month as investors looked to earnings reports for clues on business activity and confidence in the region. France’s CAC closed 2.9% higher (+10.0% YTD), Germany’s DAX advanced by 0.3% MoM (+20.3% YTD). In economic data, October eurozone inflation came in at 2.1% vs September’s 2.2% print. Core inflation was unchanged at 2.4% but came in above expectations. Preliminary eurozone growth data showed the economy had grown by a higher-than-expected 0.2% in 3Q25. At its October meeting, the ECB again left rates unchanged.

UK equity markets delivered good gains, with the FTSE 100 advancing to new highs, lifted by oil stocks and positive results from blue-chip firms. The index hit a peak of 9,760.06 on 30 October and ended the month 3.9% higher (+18.9% YTD). UK September inflation was unchanged, marking the third consecutive month that the rate has printed at 3.8% YoY. Core inflation rose 3.5% – down from 3.6% in August.

China’s equity markets closed mixed as optimism over trade progress with the US was offset by a lack of new government policy stimulus measures and weak economic data. Still, investor sentiment seemed to remain positive with expectations of further upside on the back of structural reforms by the government. The Shanghai Composite ended the month 1.9% stronger (+18.0% YTD), while Hong Kong’s Hang Seng Index dropped by 3.5% MoM (+29.1% YTD). China’s GDP grew 4.8% YoY in 3Q25, a slowdown from the 5.2% print in 2Q25. Fixed-asset investment, which includes real estate, unexpectedly fell by 0.5% in the first nine months of 2025. Resilience in exports (+8.3% YoY) helped to avoid a sharper slowdown. The October official manufacturing PMI contracted more than expected, printing at 49.0 vs September’s 49.8. The non-manufacturing PMI, which includes services and construction, ticked up at 50.1 in October from 50.0 in the prior month. The 50-point mark separates expansion from contraction.

Japan’s equity markets rallied with the benchmark Nikkei hitting record highs in October, closing 16.6% higher MoM (+31.4% YTD), highlighting investor optimism over the election of the new Prime Minister Sanae Takaichi, who is expected to consider a new economic stimulus package and increase defence spending. Takaichi is Japan’s first female prime minister and the fourth prime minister to hold the office since Shinzo Abe stepped down in 2020. Economic data showed industrial production rose 2.2% MoM in September, beating market expectations and rebounding from a 1.5% drop in August. September headline inflation climbed to 2.9% YoY vs August’s 2.7% print, marking the 42nd straight month that inflation has run above the Bank of Japan’s (BoJ) 2% target. So-called “core-core” inflation, excluding the prices of fresh food and energy, decreased to 3.0% from August’s 3.3% print. At its October meeting, the BoJ left rates unchanged.

Among commodities, Brent crude (-2.9% MoM/-12.8% YTD) ended the month lower at c. US$65/bbl. The gold price (+3.7% MoM) recorded its biggest drop (-5%) in c. five years on 21 October as it retreated from an all-time high of US$4,381/oz reached on 20 October, before rebounding. The yellow metal has soared 52.5% YTD, buoyed by geopolitical and economic uncertainty as well as buying from central banks around the world. Among platinum group metals (PGMs), platinum slipped 0.1% MoM but remains up 73.5% YTD, while palladium (+14.1% MoM/+57.6% YTD) and rhodium (+15.1% MoM/+79.2% YTD) recorded good gains. Iron ore rose 4.0% MoM (+7.1% YTD) as China’s imports recorded another robust month in October, following September’s record arrivals. After a weak start to 2025, iron ore imports have picked up pace in the past four months, all recording official arrivals exceeding 100mn tonnes.

The JSE recorded its eighth consecutive monthly advance with the FTSE JSE All Share Index (ALSI) up 1.2% MoM (+29.9% YTD), while the Capped SWIX ended 1.8% higher (+33.4% YTD). Financial counters were the outperformers in October with the Fini-15 jumping by 7.3% MoM (+10.2% YTD). It was followed by listed property (+6.3% MoM/+15.5% YTD) and industrials (Indi-25 +1.5% MoM/+21.6% YTD). In stark contrast to the past few months, commodity-linked shares were the underperformers (Resi-10 -5.4% MoM/+104.8% YTD) – the first monthly decline since February. This amid renewed volatility and some profit-taking in commodity-linked shares as the gold price came under pressure earlier in October and platinum retreated. The rand weakened by 0.4% MoM (+8.0% YTD) against a stronger US dollar. In domestic economic data, September headline inflation advanced slightly to 3.4% YoY, from 3.3% in August, while core inflation rose to 3.2% YoY vs August’s 3.1% print.

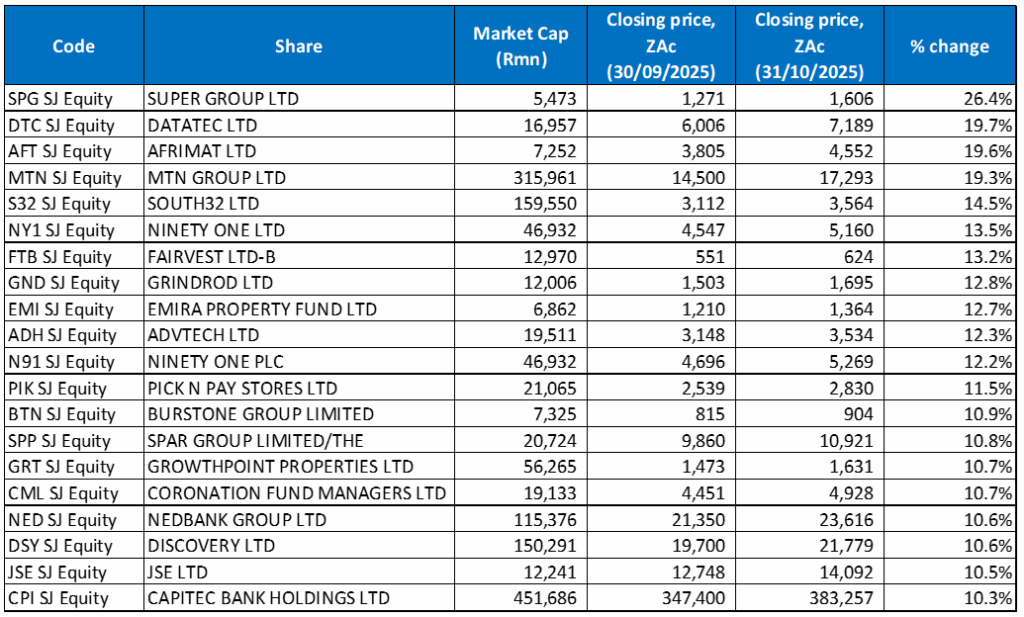

Figure 1: October 2025’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

In a marked difference to the familiar theme this year (precious metals miners driving returns on the JSE), October saw SA Inc. and property shares staging a comeback, with only two mining stocks featured among the top-20 best-performing shares. Logistics and mobility company Super Group was last month’s top performer, surging 26.4% MoM, albeit from a low base. The strong rebound has likely been driven, in part, by improved sentiment and signs that the company is turning a corner. In April, Super Group unlocked R7.47bn in capital by disposing of its 53.6% interest in SG Fleet Group. It used part of the proceeds to reduce its debt and paid a special dividend of R16.30/share in June. The restructuring has strengthened its balance sheet and sharpened focus on its logistics and mobility operations in Africa, Europe, and the UK.

JSE- and US-listed information and communications technology (ICT) Group, Datatec (+19.7% MoM), was October’s second-best-performing share on the back of robust demand for its technology solutions, particularly for cybersecurity and AI-related infrastructure. Datatec also reported a strong 1H financial performance last month, with the Group recording a 2.9% YoY increase in revenue to US$1.83bn for the six months ended August, while headline EPS soared 109.5% YoY. It declared a dividend of R1.75/share, up 133.3% YoY.

Mid-tier mining and materials Group, Afrimat, took third place with a 19.6% MoM gain, buoyed by the release of strong interim results. The results reflected a successful turnaround in its newly integrated Lafarge cement assets, a significant increase in HEPS (+92.3% YoY to ZAc101.9), and improved iron ore and cement sales. Group revenue rose 29.9% YoY to R5.3bn while operating profit was up 29.8% YoY to R379.8mn. Afrimat’s fly ash business also reported robust volume and profitability growth, with July 2025 marking the highest production month since its acquisition.

MTN Group’s share price jumped by 19.3% MoM on the back of a strong operational turnaround in its Nigerian operations, driven by improved macroeconomic conditions and strategic execution. MTN Nigeria reported a robust 3Q25 performance, delivering strong revenue growth as momentum accelerated with double-digit gains across all its key revenue segments. For the nine months to end-September, profit after tax improved to NGN750.2bn (c. US$519mn) after a loss of NGN514.9bn a year ago. Total subscribers increased 11% YoY to 85.4mn, while active data users rose 12.8% YoY to 51.1mn.

In a trading update, South32 (+14.5% MoM) said its Australian manganese unit had executed its operational recovery plan and ramped up export shipments as planned, resulting in a near doubling of its output between 31 July and 30 September. Robust commodity prices (particularly for copper, silver, and aluminium) and positive sentiment around its strategic investments also helped to boost the share price.

South32 was followed by Ninety One Ltd, Fairvest Ltd -B-, and freight and logistics Group Grindrod with MoM gains of 13.5%, 13.2%, and 12.8%, respectively. Ninety One said recently that its 2Q26 assets under management (AuM) jumped to GBP152.1bn. Last month, it said it would open offices in the Middle East to take advantage of growth in the region’s markets – a move viewed positively by investors. In October, property Group Fairvest announced the purchase of two KwaZulu-Natal shopping malls for a total of R674mn as it continues its strategy of investing in retail assets that service previously underserved communities. Fairvest has also made a R486mn investment in Onepath Investments (OPI), which owns digital infrastructure leased to a fibre network operator focused on SA townships. The company raised R976mn in an accelerated book build in August, which it said would be used for these acquisitions and investments. Grindrod said last month that it would appoint former Transnet rail executive and terminals head, Kwazi Mabaso, as its new CEO.

Rounding out October’s best-performing shares were Emira Property Fund (Emira; +12.7% MoM) and private education Group ADvTECH (+12.3% MoM). Emira Property said in October that it had boosted its stake in SA Corporate Real Estate to 8.7%, a move aimed at acquiring undervalued assets and strengthening its income stream. The fund’s international diversification strategy, which includes investments in US and Polish properties, and strong underlying performance, has contributed to the positive market sentiment towards the counter. ADvTECH’s robust 1H25 results, released in late August, showed a 16% YoY increase in normalised EPS and a 10% rise in Group revenue, while the company continued to experience strong enrollment growth, pushing its total student numbers past 100,000 for the first time. ADvTECH’s ongoing expansion in Africa and the sustained market demand for quality education have contributed to the positive market sentiment towards the share.

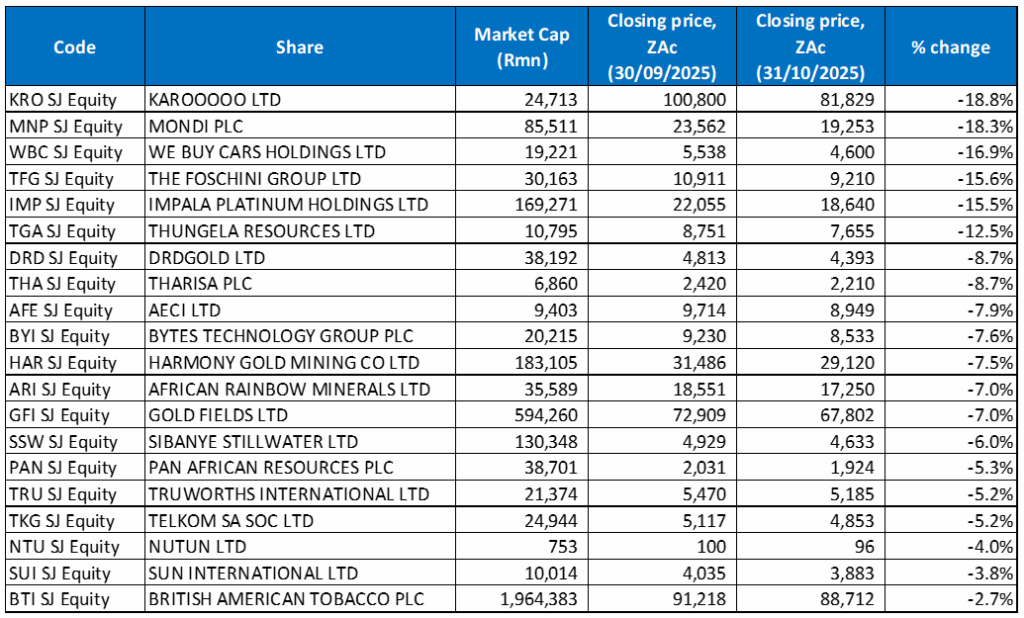

Figure 2: October 2025’s 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Karooooo, which owns 100% of Cartrack and 74.8% of Karooooo Logistics, was October’s worst performer, declining 18.8% MoM. The company released disappointing 2Q25/1H26 results in October, with adjusted EPS for the six months ended August rising by 16% YoY to R16.83 – the rate of increase was slower than revenue growth. For the six months, Cartrack subscribers grew by 15% YoY – also a slower rate of growth, with net new subscribers of 154,753 vs 165,078 in 1H24. Its subscription revenue was up 19% YoY to R2.32bn. Still, despite strong subscription revenue growth, the company maintained its existing FY26 guidance, which weighed on the share price.

Mondi Plc, which is listed on the JSE and London Stock Exchange (LSE), was October’s second-worst-performing share with an 18.3% MoM drop. The share price fell by a whopping 16.7% on 6 October after the company reported softer markets and extended maintenance shutdowns for 3Q25. Mondi also warned of weak demand and falling paper prices, with CEO Andrew King saying, “Trading conditions in the third quarter were challenging, with softer volumes and declining prices across most pulp and paper grades,”. Underlying core profit came in at EUR223mn, lower than 2Q25’s EUR274mn, with Mondi citing weak volumes, particularly in its fine paper and corrugated segments, and declining selling prices as the reasons behind the drop. Mondi also lowered its EBITDA contribution expectations from major projects in 2025, from an estimated EUR60mn to c. EUR30mn.

Mondi Plc was followed by We Buy Cars Holdings, which fell 16.9% MoM. A disappointing trading update last week, implying a deceleration in earnings growth, saw the share price plummet 13.5% on the day. While the company said it was set to report an increase in headline earnings of over 100%, with core headline earnings rising by between 12% and 17% YoY, due to the issuance of 83mn new shares during its pre-listing capital raise, core HEPS was only expected to rise by between 0.8% and 6% YoY. In addition, while the first half of its financial year was strong, the second half was “somewhat subdued” and “softer than expected.” At the same time, stricter credit conditions have resulted in its finance approval rate dropping, indicating tighter consumer credit, which has negatively impacted the used car market. The entry of more affordable, new Chinese car brands into the SA market has also been eating into the used car market, putting pressure on sales.

The Foschini Group (-15.6%) share price fell sharply after it said in a trading update that HEPS for the six months to 30 September are expected to drop by 20% to 25% YoY due to subdued consumer spending and pressured margins. The retailer’s performance was impacted by challenges across all its major markets, with its TFG Africa segment experiencing winter clearance sales that led to a 90-bp margin contraction. The TFG Australia segment faced a decline in earnings before interest and tax (EBIT) due to higher expenses, including costs from new stores and inflationary pressures.

Foschini was followed by Impala Platinum (Implats), Thungela Resources and DRDGold, with MoM declines of 15.5%, 12.5%, and 8.7%, respectively. In its 1Q26 production report, Impala revealed a 5% YoY decline in Group 6E production volumes, with the company citing lower grades, recoveries, and timing of maintenance as reasons for the dip. This seemed to overshadow otherwise positive sales data and reaffirmed guidance, leading to a negative market reaction and a share price decline. Long-term concerns about PGM demand likely also weighed on the share price.

Thermal coal prices have remained significantly lower than the record highs of 2022 due to well-supplied markets and global economic uncertainty. This price pressure was the main driver behind Thungela’s disappointing financial performance in 1H25, which saw an 80% YoY drop in HEPS and a 12% decline in revenue. DRDGold’s share price likely dropped primarily due to profit-taking and general market volatility (after reaching a 23-year high earlier in the month), coupled with a slight decrease in operational cash and a lower-than-expected production report for the first quarter of its 2026 financial year.

Tharisa Plc (-8.7% MoM), AECI (-7.9% MoM) and Bytes Technology Group (-7.6% MoM) rounded out October’s worst-performing shares. AECI came under pressure following the surprise resignation of its CEO, Holger Riemensperger. The company has appointed AECI Chemicals executive VP Dean Murray as the Group’s interim CEO, with effect from 15 October. Finally, Bytes Technology Group’s share price slumped after it reported a 7% YoY drop in operating profit as it navigated changes to Microsoft partner incentives and adjusted to a new sales structure. Bytes, which is listed locally and on the LSE, said its HEPS fell 5.1% YoY in the six months to 31 August to ZAc12.03 from ZAc12.67 at the same time last year.