So far, SA seems to have threaded a needle that few investors would have wagered heavily on ahead of the 2024 National and Provincial Elections (NPEs). Investment markets have reacted predictably to developments since the election in what can be summed up as a “Ramaphoria 2.0” trade – those shares geared to the local economy have rallied strongly, while rand-hedge shares have underperformed. In this article, we set out to see what we can learn from the performance of JSE-listed financial and industrial shares in the years following Cyril Ramaphosa’s appointment as president of the ANC and his subsequent inauguration as president of SA following the ANC’s recall of ex-president Jacob Zuma. Was tactically positioning in those shares which were likely to be the biggest beneficiaries of Ramaphoria a successful long-term investment?

The rivers of ink spilt by investment commentators on the implications of SA’s NPEs held on 29 May left one in little doubt that they were likely to be the most pivotal since 1994. At the possible risk of oversimplification, the majority view of these commentators immediately ahead of the NPE was that the ANC was likely to lose its majority. Still, by securing c. 45% of the vote, it would likely manage to cobble together a coalition of small (inconsequential?) parties to maintain the status quo – a sort of “better the devil you know” scenario. The feared alternative, albeit less likely, was that a greater loss of support for the ANC could force it into a coalition with either the EFF or the M.K. party. It is interesting to ask yourself, had you correctly predicted an outcome in which the ANC secured just 40.2% of the vote and M.K. would significantly exceed expectations at 14.6%, how would you have positioned your investments? Most likely, your odds on an investor-unfriendly future ahead for SA would have risen considerably vs the consensus! Even with the NPEs result known, the course ahead was far from obvious.

So far, it is safe to say that those rivers of commentators’ ink were all spent in vain. That SA’s political parties would agree relatively quickly on establishing a market-friendly government of national unity (GNU) is a welcome outcome. Much remains to be seen as to how things turn out. Coalitions globally do not have a great record in government, and SA’s performance at a municipal level is hardly grounds for optimism either. Despite securing a meaningful share of the vote, whether the radical parties will meekly accept what looks like political marginalisation remains to be seen. However, these are questions for another day, and this is not intended to be yet another article opining on SA politics!

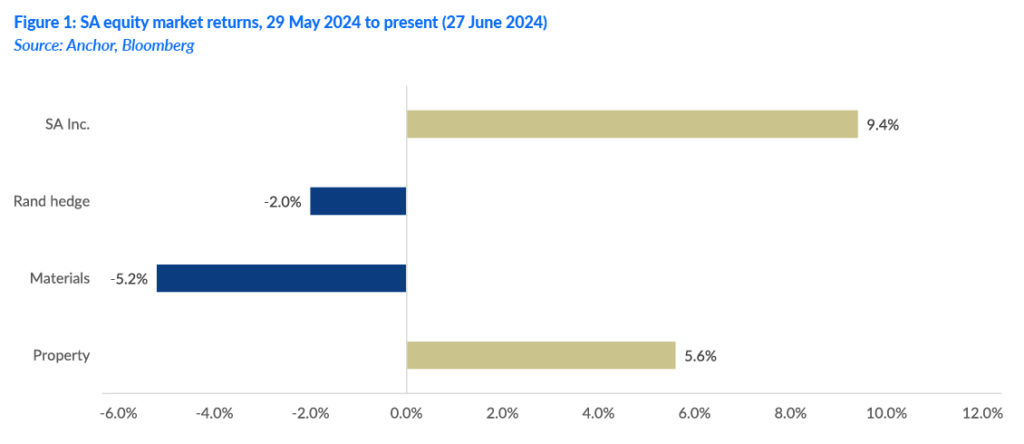

Since the election, a better-than-feared outcome from an investor’s perspective has driven a strong rally by shares most geared to the local economy. With the rand having appreciated 3.0% vs the US dollar in the same period (to 28 June 2024), rand-hedge shares have struggled. Mining shares’ performance is linked chiefly to the changing fortunes of commodity prices, and while the rand has been a slight headwind, SA’s politics are unlikely to have been much of an influence. So far, so predictable – we are seeing Ramahporia 2.0 unfolding before our eyes!

Tactically, as long as the better-than-feared newsflow continues, there are many reasons to support the case for the pattern of relative performance to continue: (1) still depressed valuations of SA Inc. shares relative to their histories, (2) very underweight positioning in domestic shares relative to benchmarks by institutional investors, (3) reduced incidence of loadshedding offering the prospect of a sharp rebound in earnings for a wide range of SA-orientated companies, to mention a few. A possible pitfall with tactical trading linked to themes like an election result is that it can lead investors to disregard individual companies’ fundamentals as they seek out those businesses expected to be most sensitive to the particular theme of the moment.

In this case, it is better-than-expected news; thus, the tendency is to seek out the most out-of-favour/lowly rated sectors and shares. To those investors who successfully positioned themselves for Ramaphoria 2.0 in good time – well done! It is now important to see what lessons we can learn from how Ramaphoria 1.0 turned out over the longer term. Below, we look at the performance of SA equities from Ramaphosa’s appointment as ANC president (December 2017) until the end of 2023 – a period of six years.

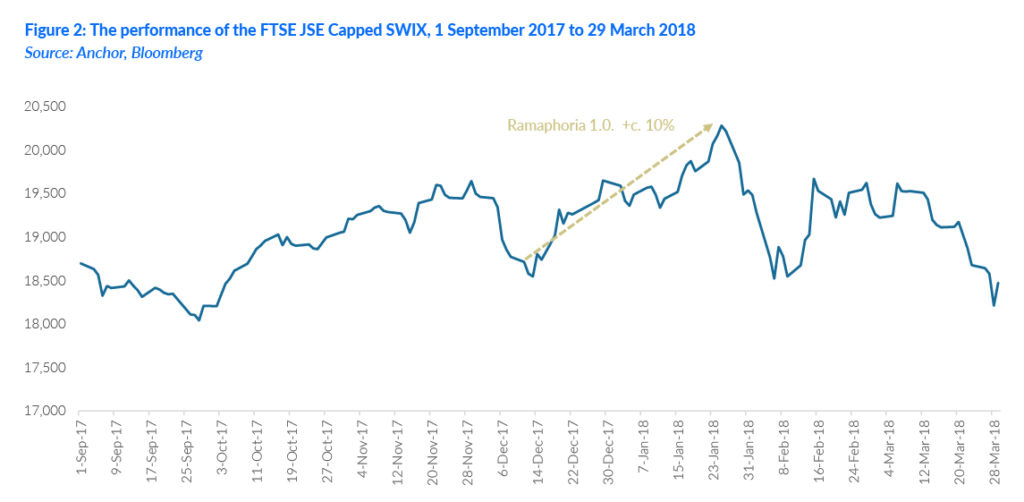

The first point to note is that Ramaphoria 1.0 did not last very long. In fact, by the time Ramaphosa was inaugurated as SA president in mid-February 2018, it was all but over! The lesson here is that investors should dance close to the door – the time that SA equities can swim against the tide of global investment sentiment might be shorter than you think.

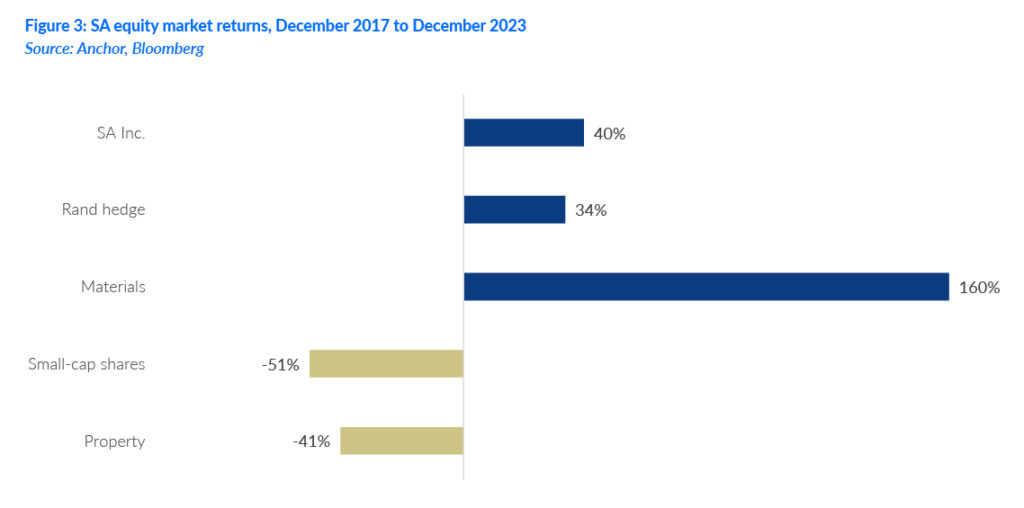

Those familiar with SA equities will likely be all too aware of the paltry returns the JSE has delivered over the last few years. Over the past six-year period of our study, the FTSE JSE Capped SWIX delivered a price return of just 14.5% – rather disappointing considering that 10% of that came in the first month of Ramaphoria 1.0! Admittedly, with dividends reinvested, the total return over this period improved to 46%, better, but equating to a pre-tax compound annual growth rate (CAGR) of just 7%, hardly likely to have set your hair on fire. Disaggregating the performance of the local equity market below, it is evident that infatuation with Ramaphoria 1.0 would likely have caused investors to miss the one thing that did work relatively well – the favourable commodity cycle driving miners. Interestingly, despite the rand depreciating by 40% against the US dollar over this period, rand hedge shares in aggregate did not provide a particularly good place for investors to hide, albeit more for company-specific reasons (a big de-rating in British American Tobacco and China’s crackdown on its technology sector severely impacting Naspers’s key investment, Tencent, for example).

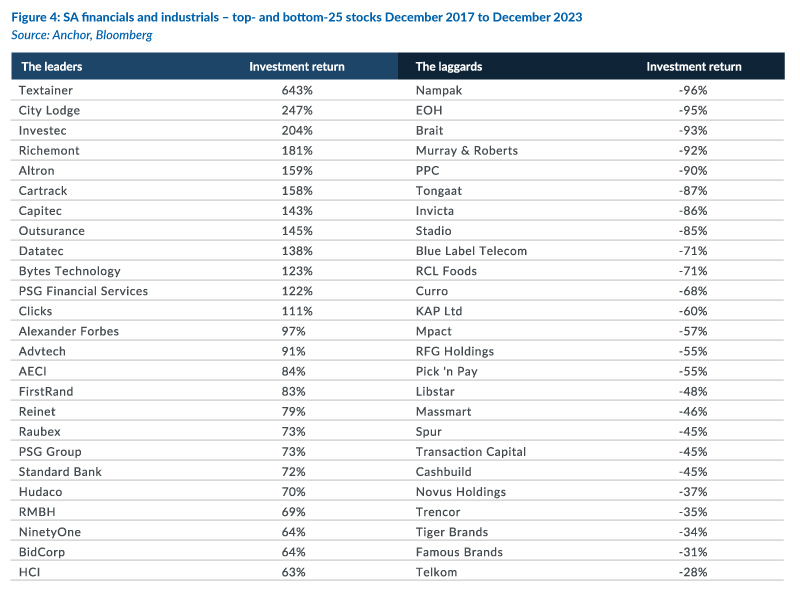

In the table (Figure 4) below, we have drilled down to a stock-level view to see how things might have turned out for investors who leaned heavily into the Ramaphoria 1.0 trade and held on. Admittedly, at a stock level, it becomes apparent that the SA stock market is full of idiosyncratic investment cases, which tends to muddy the picture that emerges. At the risk of being accused of torturing the numbers until they confess to what we want, we decided to exclude stocks linked to the commodity cycle (a performance driven by factors largely unrelated to our study) and SA-listed property shares (a speculative bubble of sorts popped as past financial engineering was revealed – again not relevant to our study).

For us, the picture that emerges from the above scorecard is that quality wins over the longer term. Highly rated shares (BidCorp, Clicks, Capitec, and Richemont, for example) would have unlikely been among investors’ choices for those stocks expected to benefit most from a recovery in the SA market. However, their capital allocation acumen and ability to compound growth steadily over time won out. Among the laggards, there is no doubt several company-specific corporate disasters (EOH, Tongaat, and Transaction Capital) come to mind. However, looking beyond that, many of the laggards were in troubled sectors or were the competitive underdogs (think Tiger Brands vs AVI; Pick n Pay vs Shoprite). These are interesting options for investing in an expected positive shift in sentiment towards SA equities, but ultimately, they let investors down.

In conclusion, if those reforms that the brief Ramaphoria 1.0 rally had anticipated materialised, things may have turned out very differently for SA Inc. shares. Once again, there is reason for optimism, and a welcome rally in SA Inc. shares has already begun to reflect that. We hope this time will be different, with expectations matched by delivery. However, the key lesson we draw from Ramaphoria 1.0 is that, while fundamentals can be suspended for a short while, quality is worth paying up for because it ultimately rises to the top. Date the lowly rated out-of-favour corners of the SA market with Ramaphoria 2.0 in mind, but do not marry it!