Prosus released strong FY21 results on 21 June, with core headline earnings jumping 44% YoY to USc299/share – in line with recent guidance. However, the fact that this is a NAV play means that this, in itself, is not likely to be market moving. Still, we do think it was a very solid operating result from the ex-Tencent part of the business and below we highlight some main points from these results.

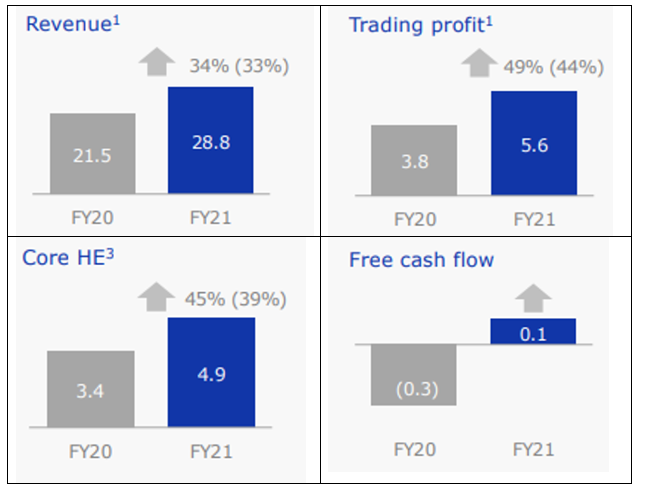

Figure 1: Prosus FY21 result highlights

Source: Prosus

Focusing specifically on the Ecommerce division (the non-Tencent part of the Group), revenue grew by 54% YoY, while trading losses shrunk by 46% YoY to US$429mn (from US$782mn), despite the Online Classifieds and Payments & Fintech verticals both experiencing a challenging 1H21 due to COVID lockdowns. Pleasingly, Prosus reported stronger revenue and profit growth than Tencent, showing promising progress in scaling the rest of its investment portfolio. Although we think Prosus will likely need to sustain this record for several reporting periods to build confidence among investors (free to choose whether to invest directly in Tencent or via Prosus), that it is more than just a proxy for Tencent, this was a good start.

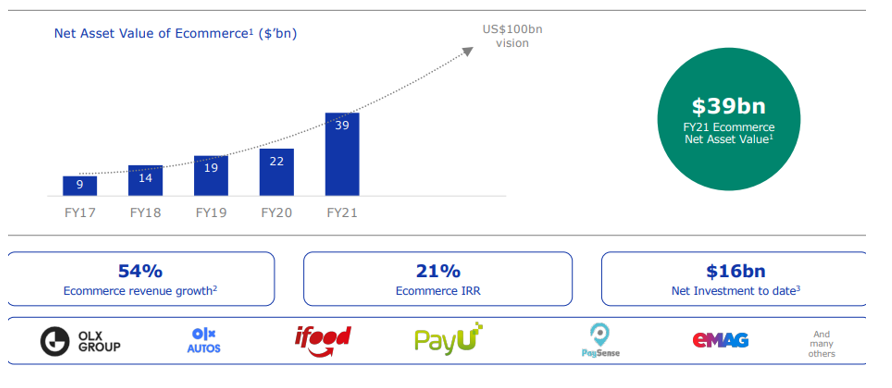

No doubt a shift in emphasis, which we are likely to see continue in future presentations, considerably more attention was focused on the value which management believes it has created through its investment activities in the E-commerce division and, for the first time, it has disclosed the progression of value for these assets.

Figure 2: Progression of value of the Ecommerce portfolio

Source: Prosus

To give some context to the above value, the Tencent stake is currently worth c. US$210bn. While this obviously continues to cast a long shadow over the rest of Prosus’ investment portfolio, with the latter now approaching 20% of the Group’s NAV (if you believe management’s valuation, of course!), it is certainly conceivable that the investment case for Prosus will begin to decouple from Tencent to some extent.

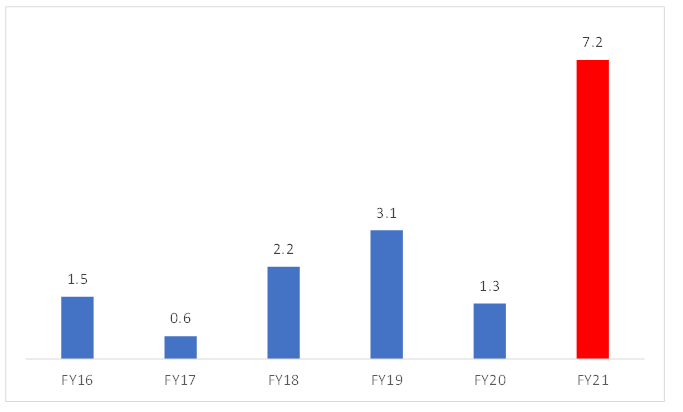

Another notable aspect of the FY21 results was the amount that Prosus invested in its portfolio. At US$7.2bn, Figure 3 below shows the degree to which this dwarfs prior years’ investments.

Figure 3: Annual investment (US$bn)

Source: Prosus

A large chunk of the spend in FY21 was in the Edtech space. Historically reported as part of its “Ventures” portfolio, Edtech will in future be disclosed as a separate segment within the E-commerce division, alongside Online Classifieds, Food Delivery and Payment & Fintech.

Outlook

Looking ahead, Prosus sounds confident in how its investments are positioned, with the company saying that it remains a long-term investor in Tencent and “remains committed to taking the right actions to unlock value for all shareholders, as well as addressing the discount to NAV”.

Conclusion

Operationally, this is a solid set of results at an aggregate level. Unfortunately, it is all about the corporate action and discount to NAV right now and we did not see anything new on that front. While we doubt that investors will pay too much attention to the operational trends in the short term. However, we do think it is worth keeping the progress Prosus is making in mind – it is obviously a long road, but it looks like a very credible performance to us, and it is hard to believe that if the Group can sustain it, investors will not eventually start to recognise this.