Pick ’n Pay reported 1H21 results on 20 October, with Group sales growth of 2.6% YoY. This was negatively impacted by the various lockdown measures (especially the ban on liquor and tobacco) as well as weak operating conditions in the company’s African regions, dominated by Zimbabwe and Zambia. For South Africa (SA), Pick ’n Pay reported YoY sales growth of 3.4%, with like-for-like (LfL) growth of 1.7% – inflation came in at 3.4% implying a volume decline of c. 1.7% YoY. Space growth stood at c. 1.7%.

The Group’s gross margin was 19.6% in 1H21 vs 19.8% in 1H20. In our view, this is an impressive achievement especially when considering that clothing and liquor tend to be higher-margin products. Trading profit (excluding the impact of the once-off voluntary severance programme [VSP]) was down 17% YoY, with the trading margin down to 2.2% vs 2.7% in 1H20. The company paid out the FY20 deferred dividend (of R1.73/share) and declared an interim dividend of R0.18/share for the half-year. This was a real show of confidence from management in the robustness of the results and the company’s balance sheet. Cash generation was very strong in the period, with cash from operations of R1.3bn.

The positives

- The company provided more clarity on how it has been able to improve its gross profit (GP) margin. According to Pick ’n Pay, 0.3% of the GP margin improvement was generated by further efficiency gains and optimisation in the distribution of the Pick ’n Pay brand. A further 0.3% improvement was achieved by consolidating the distribution function for the Boxer brand from 45% to 50%. Management are extremely confident that they will be able to eliminate another R1bn in costs through further efficiency gains over the next two years. The CEO even mentioned that the R1bn in savings is only an initial target. The inefficiencies in Pick ’n Pay have long been a central reason as to why it has a far lower trading margin relative to, for example, Shoprite. Although we do not believe that the company will ever achieve Shoprite’s lofty trading margin (which is one of the highest in global retail), these savings will go a long way towards reducing the gap between the two retailers. To put these savings in context, for FY20 Pick ’n Pay reported profit before tax of R3.18bn, which means that, should the company achieve its goal, these savings can lead to profit before tax growth of 15% p.a. for the next two reporting periods.

- Pick ’n Pay Clothing has been performing very strongly and this segment gained market share in the key categories of women and children’s wear. Clothing retailers tend to have significantly higher GP margins than food retailers. As clothing becomes a greater contributor to Group revenue this should lead to structurally higher GP margins for Pick ’n Pay.

- Pick ’n Pay has also launched a mobile virtual network operator (MVNO) that will be linked to its SmartShopper loyalty card. This should mean that its value-added services contribution improves and will also be a good draw card to bring more foot traffic to its stores.

- During the period, Pick ’n Pay acquired the online grocery business, Bottles for an undisclosed sum. We believe that this should help the company fight the onslaught of Checkers’ 60Sixty app.

The negatives:

- Pick ’n Pay lost market share in its core food business. Its SA numbers were lower than its peer group have reported thus far. CEO, Richard Brasher acknowledged that the company lost market share, but he highlighted that the business recorded a strong performance last year (in 1H20), and that Pick ’n Pay currently still has a higher market share in its food business than it had in 2018. Nevertheless, we believe it is critical that Pick ’n Pay reverses this trend quickly.

- Brasher again reiterated that he will be stepping down in the next two years. The COVID-19 outbreak has made the search for his successor difficult. Brasher has done a brilliant job in turning Pick ’n Pay’s fortunes around and we are not aware of any clear strong internal candidates. The company has also indicated that the appointment will likely again come from outside the business.

- Although Pick ’n Pay is very confident that it will be able to take out further costs, it did highlight that efficiency gains from centralising distribution across the Group has probably run its course.

Valuation

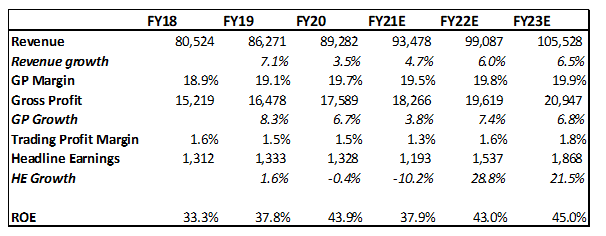

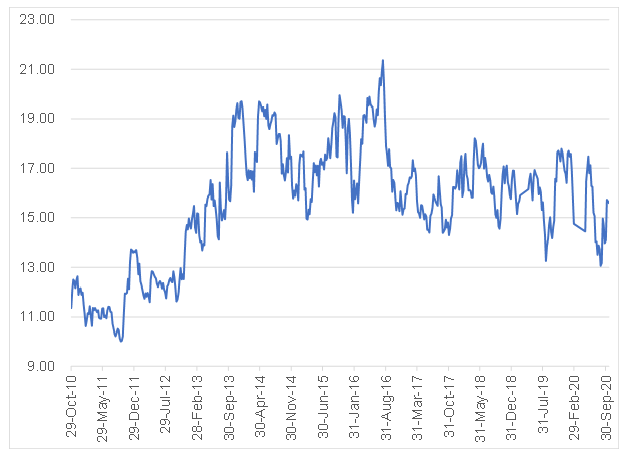

The Pick ’n Pay share price has rallied since its trading update on 7 October, which guided these results relatively well. We will not rush to buy at these levels, as we believe we may be presented with better opportunities in future. As can be seen from our forecasts in Figure 1 below, we believe that Pick ’n Pay will recover quickly from the COVID-19 pandemic and that its ROE and headline earnings growth trajectories are very attractive. Although Pick ’n Pay’s valuation is not very cheap (see Figure 2 which provides a good indication of the historic 24-month forward PE), we nevertheless view the valuation as fair in the current environment.

Figure 1: Pick ’n Pay forecasts, Rmn unless otherwise indicated

Source: Anchor

Figure 2: BEst P/E ratio (blended 24 months)

Source: Anchor, Bloomberg

Conclusion

Pick ’n Pay posted a commendable performance in a very difficult operating environment. To us the positives of these results far outweighed the negatives, and we believe that the company is likely to show an improvement in ROE from FY22 onwards. This is due to management’s strong conviction that they will be able to improve the GP margin even further through greater centralisation, a favourable shift in product mix (predominantly clothing), and lower operating costs following a further round of voluntary severance packages. Although we are optimistic on the company’s fortunes going forward, the share price has run hard and we will not be rushing to buy the share at current levels. Nevertheless, we believe that it is a share to keep an eye on and we will use any share price weakness to accumulate.