Pepkor Holdings reported FY20 results on 23 November, which once again highlighted the momentum that the South African (SA) value retailers are experiencing at present.

The highlights

For the highlights listed below, we have referenced Pepkor’s pre-IFRS16 numbers as these are more comparable to those of FY19.

- Diluted HEPS from continuing operations were down 21% YoY.

- For us, the most impressive number from these results was the 3.6% YoY revenue growth.

- This, after Pepkor lost just under one month of trading during its FY20.

- Pepkor’s strong revenue performance can be attributed to a robust showing from its financial technology (FinTech) service business, Flash, a competitor to Blue Label Telecoms, selling airtime, electricity, vouchers, and other services through terminals at spaza shops across the country. Flash grew its revenue by 25.7% YoY and FinTech in general recorded a revenue increase of 20.4% YoY.

- Pep and Ackermans were also very resilient, growing revenue by 2.6% YoY.

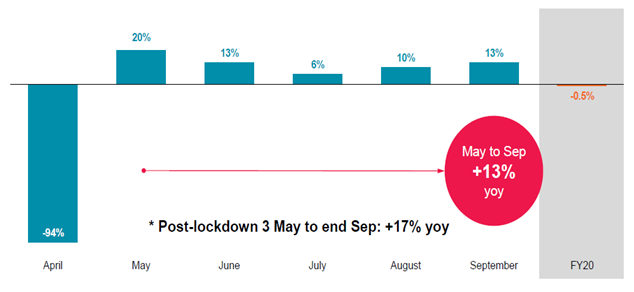

Figure 1: Pep and Ackermans, LfL YoY sales growth

Source: Pepkor

Figure 2: Flash Group overview

Source: Pepkor

- Pepkor’s gross profit (GP) margin declined from 36.4% to 35.3%.

- This can be attributed to a greater revenue contribution from FinTech.

- FinTech has a lower GP margin than traditional clothing retailing, but it also has a far superior cash conversion cycle.

- Impressively, markdowns were kept at a similar level to 2019.

- Net debt halved from R14bn to R7.1bn.

- This was due to improved stock levels (it will be interesting to see whether this can be maintained, we suspect not).

- R1.9bn was raised in an accelerated bookbuild.

- No dividend was declared.

The positives

- The sales momentum for the Group’s important divisions (Clothing and FinTech) was very strong in the period following the lockdown and management have indicated that this momentum has continued into the Group’s new financial year (FY21).

- The Pepkor balance sheet is in far better shape than it has been since its listing. Net debt has been significantly reduced and the repayment profile has been pushed out to help alleviate any concern that a second COVID-19 wave may hamper its ability to repay debt.

- This should allow management to focus more on the Group’s operations and potential expansion.

The negatives

- We highlight that there is not too much to complain about in these results and operationally the business has made progress on most fronts.

- The balance sheet remains encumbered by intangible assets, which continues to depress the return metrics for the company.

Valuation

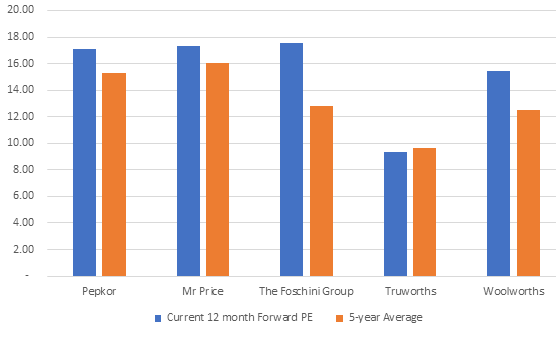

Figure 3: Bloomberg consensus valuation summary

Source: Anchor, Bloomberg

- We believe that Pepkor is trading at a fair value relative to its history. We also highlight that the market is currently willing to pay a premium for value retailers (the acquisition of JET by Foschini, for example, has helped Foschini increase its value offering) and given recent sales trends this is understandable.

- Considering Pepkor’s current valuation metrics, balance sheet, and expected earnings growth going forward, we continue to prefer Mr Price and The Foschini Group in the local retailer space.

Conclusion

Pepkor reported results from continuing operations, which were slightly ahead of our expectations. Most of its divisions also traded robustly in the months following the hard lockdown and these divisions gained good market share. Management came across as being confident in their ability to consolidate these gains in FY21 with further store expansion (Pepkor also continues to exceed expectations on this) and low prices. Pepkor’s Flash business (a competitor to Blue Label) is growing remarkably fast. While this will have a negative impact on the Group’s GP margins, it will also assist Pepkor with cash generation (assuming its contracts with the mobile operators are similar to that of Blue Label). We continue to prefer the value retailers in the current difficult economic environment and, in our view, there are a few better value retailers in the SA market than Pepkor. As such, we maintain our preference for Mr Price and The Foschini Group among the local retailers.