There are two main types of employee retirement funds – pension funds and provident funds. Historically there has been a difference in the tax treatment of the two, with provident fund contributions not being tax deductible in the hands of employees. This has meant that employers made the contributions to the fund and not the employees themselves. Currently, with most employees’ remuneration being calculated on a cost-to-company (CTC) basis, there is no real difference to employees as the contribution is just part of their overall salary package.

The one significant difference between provident and pension funds – provident fund members have the option to take 100% of their fund value in cash at retirement. However, members of pension funds are limited to a maximum of one-third in cash at retirement (the remaining two-thirds is used to purchase an income). This enhanced optionality of provident funds has made them the more popular choice by far when setting up employee retirement funds.

RETIREMENT REFORM

The SA government has proposed changes to the industry to encourage retirement fund members to save towards retirement and to actually retire with adequate savings. These reforms harmonise the treatment of the various retirement funds including pension, provident, and preservation funds as well as retirement annuities (RAs). However, the real impact will be felt by provident fund members. The proposed changes encompass three main areas:

- Retirement;

- fund transfers; and

- emigration.

Further detail on each of the above is included below.

RETIREMENT

From 1 March 2021 all contributions made to a retirement fund (including to a provident fund), will allow a maximum withdrawal of one-third in cash at retirement. The balance will be used to purchase an annuity (regular income) in the same way that existing pension fund members do now.

The fact that members have vested rights in a retirement fund means:

Any fund member over the age of 55 on 1 March 2021 will still be able to access the full invested amount in cash (including all contributions made to the fund and the future growth in the fund itself).

Fund members below the age of 55 on 1 March 2021 will have vested rights on the investments made up to that point (and the growth of these investments). However, all future contributions will be subject to the new limits, with a maximum of one-third in cash at retirement.

FUND TRANSFERS

Fund members of any age will retain vested rights on all transfers to another approved fund. Future contributions (after 1 March 2021) are, however, not given vested right benefits. Nevertheless, a special concession has been made for members aged 55 years and older – all future contributions made (plus growth) will also gain vested rights benefits and can be withdrawn in full at retirement.

It should also be noted that, if a provident fund member, aged 55 or older, transfers to a new employer fund after 1 March 2021, then the new contributions and growth will be classified as non-vested benefits and subject to the new annuitisation rules (a maximum of one-third in cash at retirement).

EMIGRATION

Up until 1 March 2021, preservation funds and RAs allowed for a full lump sum withdrawal on “formal emigration” from SA or the cessation of a work visa. Now, instead of emigration, members must remain a non-tax resident for 3 years or longer to access their RA/preservation fund prior to retirement. The requirement to emigrate has been removed entirely which is good news to many; but may introduce a three-year waiting period for members to access these retirement savings.

It is important to highlight that giving up your SA tax residency creates a deemed disposal for capital gains tax (CGT) on all your assets (except fixed property). This can be an unexpected and sizeable tax bill, and it is therefore highly recommended that you consult your tax practitioner before starting this process.

WHAT ABOUT THE TAX PAYABLE ON EXITING RETIREMENT FUNDS?

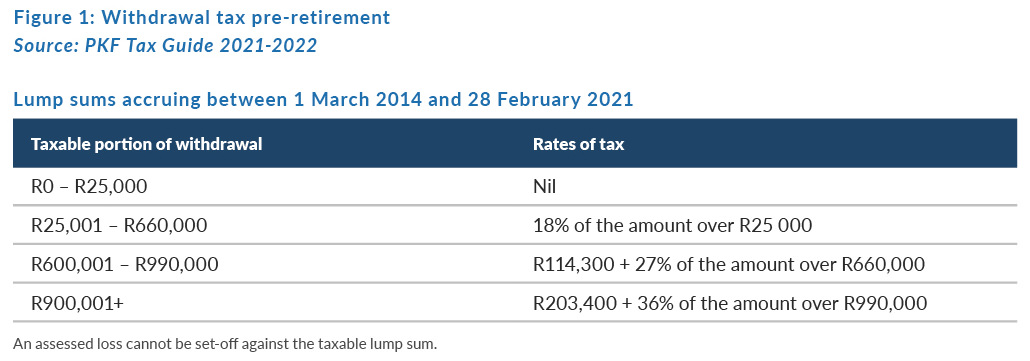

The changes in legislation only affect what is possible, but do not provide any guidance as to what funds members should actually do when contemplating a pre-retirement withdrawal from retirement funds. One important consideration is the tax that would be payable on early exit. Pre-retirement withdrawals are taxed according to the withdrawal tax table in Figure 1 below.

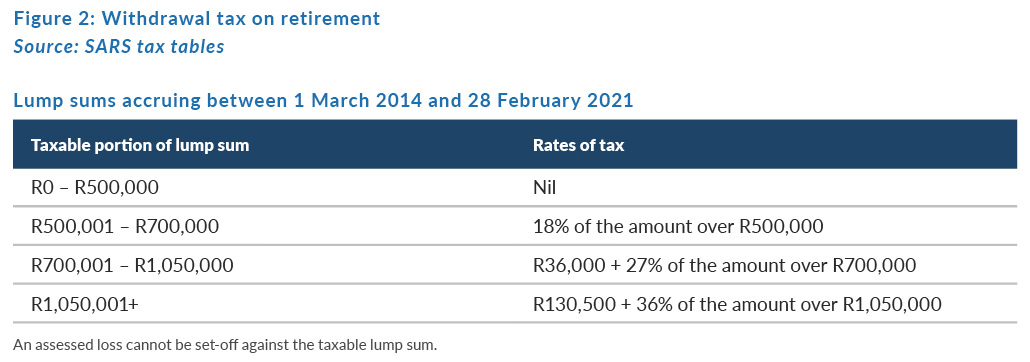

The withdrawal tax table above is less favourable than the below tax table (Figure 2), which shows taxation rates at retirement.

On retirement, up to R500,000 can be taken per lifetime in cash (tax-free) vs pre-retirement withdrawal cash lump sums that allow only R25,000 tax-free in cash. We note that the tax tables are cumulative during a taxpayer’s lifetime, which means that any withdrawals made pre-retirement will effectively increase the tax on retirement lump sums taken at a later stage.

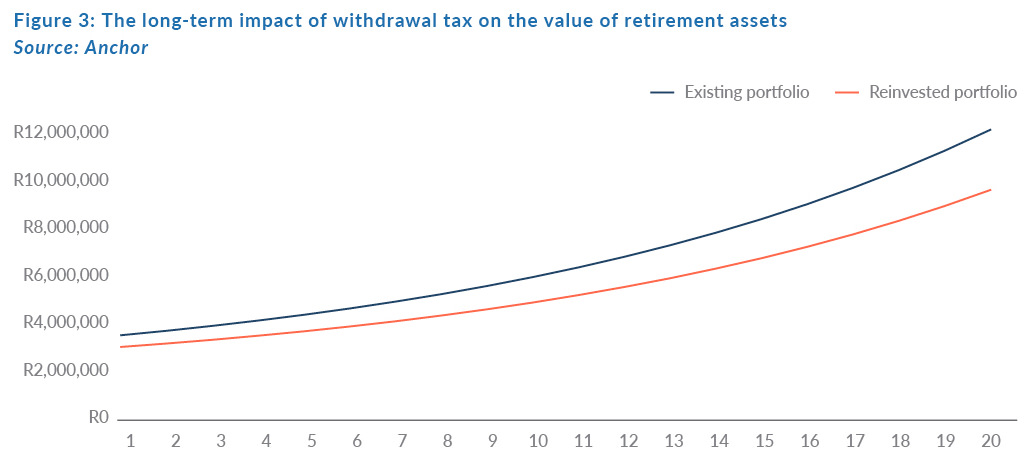

There is also a general principal worth remembering – tax deferred is tax saved. If you are paying tax now to access your retirement funds, then it leaves less assets to keep growing for you. Figure 3 below illustrates the effect of withdrawal tax on retirement assets and how this affects the long-term growth.

As an illustrative example, Figure 3 assumes that R2mn is invested in a provident preservation fund. The preservation fund member is 45 years old (below retirement age), when a 100% withdrawal is made in order to invest the money directly offshore. The real cost of the move is felt most acutely down the line – let us assume the same investment returns are achieved over the next 10 years by the preservation fund and the offshore investment. In this case, the preservation fund would have been worth over R1mn more than the offshore investment (by not paying the withdrawal tax now). In other words, the offshore investment has to beat the local preservation fund return by 3.5% p.a. just to come out even in 10 years’ time.

An argument can be made that you could do better by investing 100% offshore now, but there is a real cost to making the move, and therefore a real need to achieve better returns to make the withdrawal worthwhile from an investment return perspective.

WHAT ABOUT REGULATION 28 RESTRICTIONS ON RETIREMENT FUNDS?

Regulation 28 guidelines remain in force on retirement funds. This restricts investment exposure inside all retirement funds (the offshore investment exposure is limited to 30%, for example). These restrictions have led to many retiring from pension funds etc. earlier than necessary in order access investments which are not subject to these investment restrictions (i.e., living annuities). As we have already noted, “retirement” tax is less than “withdrawal” tax (refer to Figure 1 and 2 above), but there is also income tax to consider – living annuities must pay fund members an income of between 2.5% and 17.5% of the fund value per year. This is fully taxable as income in the member’s hands.

Usually, this tax is not overly onerous for retirees who have lower income, but if members are still working, or there are other sources of income (like rental income, for example) this can rapidly increase the rate of tax payable for members in living annuities.

IN SUMMARY

The retirement landscape is constantly shifting and keeping an eye on these changes is essential for retirees, emigrants, and savers in general. Seeking competent advice is highly recommended in this area and may require input from your tax practitioner in addition to your investment advisor.

Disclaimer: The contents of this article is for information purposes only and the accuracy, completeness, timeliness, or correct sequencing of any of the information contained herein cannot be guaranteed and should thus not be construed as investment advice. Readers should thus only act thereon after having consulted their financial advisor.