Historically October has been famous for stock market crashes (1929, 1987 and the 2008 global financial crisis), but this past month saw most major global markets, with the notable exception of China, enjoy a solid rally (MSCI World 7.2% MoM/-19.7% YTD) and make a significant comeback from the rout of the past two months. This was despite runaway inflation, geopolitical headlines (Russia’s ongoing war on Ukraine and increasing tension with the West), Europe’s energy crisis, more hawkish comments from the US Federal Reserve (Fed), COVID-19 cases in China climbing once again and the outcome of the 20th National Congress of the Communist Party of China (CCP), impacting sentiment.

On US markets, the US blue-chip S&P 500 rose 8.0% (-18.8% YTD) in October, while the tech-heavy Nasdaq gained 3.9% MoM (-29.8% YTD), and the Dow soared 14.0% (-9.9% YTD) – its best month since 1976. Around one-third of S&P 500 companies have reported 3Q22 earnings, and in aggregate, earnings have declined by c. 1.4% YoY in 3Q22, attesting to the impact of inflation on margins. Still, earnings are c. 1.32% ahead of expectations.

In US economic data, we saw another negative surprise for US inflation as September consumer price index (CPI) data came in worse than expected. Consensus economist forecasts were anticipating headline CPI to decrease from 8.3% YoY in August to 8.1% YoY in September, but instead, headline CPI came in at 8.2% YoY. Core CPI, which excludes the erratic food and energy component, also came in higher than expected at 6.6% YoY in September vs August’s 6.3% print and consensus forecasts of 6.5% YoY. MoM, September headline CPI rose by 0.4% vs August’s increase of 0.1%, while core CPI remained flat at 0.6% MoM. The Fed’s preferred inflation gauge, core personal consumption expenditure (PCE), which strips out the volatile food and energy categories, climbed 0.5% MoM and 5.1% YoY in September vs August’s 4.9% print. US consumer spending, accounting for more than two-thirds of US economic activity, slowed to 1.4% in 3Q22 vs 2Q22’s 2.0% pace. Finally, annualised gross domestic product (GDP) grew 2.6% QoQ in 3Q22, marking its first increase in 2022 and compared to a 0.6% drop in 2Q22.

In Germany, the DAX ended the month 9.4% higher (-16.6% YTD), while France’s CAC Index closed October 8.8% in the green (-12.4% YTD). The European Central Bank (ECB) announced another hefty 75-bpt rate hike at its October meeting, while in economic data, eurozone headline inflation reached another record high of 10.7% YoY in October vs September’s 9.9% print. This is as high energy prices (+41.9% YoY) continued to drive inflation, followed by food prices (+13.1% YoY). Core inflation, excluding the food and energy categories, rose 4.8% YoY vs September’s 4.3% YoY. The region’s biggest economy, Germany, saw its October inflation rate unexpectedly jump to 11.6% YoY, exceeding all forecasts, while France’s inflation rate soared 7.1% YoY vs 6.2% in September. In the Netherlands, October inflation slowed to 16.8% YoY vs September’s 17.1% YoY. Euro area GDP growth data showed a 0.2% rise in October.

The UK’s blue-chip FTSE-100 Index closed October 2.9% higher (-3.9% YTD). On the political front, Rishi Sunak became Britain’s third prime minister in two months on 25 October, hopefully bringing some relief to the ongoing political turmoil in that country. UK September inflation jumped back to a 40-year high after easing in August as rising food and energy costs drove inflation to 10.1% vs August’s 9.9% YoY print.

China bulls saw a stock rout as Xi Jinping consolidated power, tightening his grip on the government. The outcome of the CCP conference, where new leaders were selected for the next five years, disappointed as China leapt towards a more authoritarian regime. It came as no surprise that Xi Jinping was re-elected, having made amendments to term limit rules in the lead-up to the conference, but the big surprise was how aggressively he moved to force moderates out of the existing top leadership structures, packing the new leadership team with loyalists who appear to be strongly aligned with his ideologies. The conference defined Xi Jinping as the “core of the party”, cementing his ideas as the party’s guiding principles. Chinese shares did not respond well to the outcome, and on the first trading day after the conference, many large foreign-listed Chinese shares dropped in their teens. The trajectory of Chinese politics is leaving investors uneasy about how much of a priority they are for China’s political leadership.

On markets, Chinese equities extended losses as a resurgence in COVID-19 infections opened the way for further lockdowns, and disappointing economic data worsened the country’s outlook. All these events conspired to pull Hong Kong’s Hang Seng Index down 14.7% MoM (-37.2% YTD) to its lowest level since early 2009, while the Shanghai Composite Index closed 4.3% lower MoM (-20.5% YTD). On the economic data front, investors digested mixed (and delayed) 3Q22 data from China, which continue to show the country’s zero-COVID policies impacting growth. Although 3Q22 GDP came in at 3.9% YoY – above consensus expectations of a 3.3% YoY rise, it was still much lower than the third-quarter reading in previous years. China’s official manufacturing purchasing managers index (PMI) disappointed, falling to 49.2 in October from 50.1 in September. The official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, fell to 48.7 in October vs September’s 50.6 print (the 50-point mark separates expansion from contraction).

In Japan, Prime Minister Fumio Kishida announced a JPY71.6trn (c. US$490bn) stimulus package to bolster growth and ease the impact of rising prices. At the same time, last week, the Bank of Japan (BOJ) maintained its negative rate policy – an outlier vs global peers undertaking substantial rate hikes. The BoJ also revised its projections for Japan’s core consumer inflation to reach 2.9% in the current fiscal year vs its previous forecast of 2.3%. The benchmark Nikkei gained 6.4% MoM in October (-4.2% YTD).

Among commodity prices, Brent crude oil saw a turnaround after declining for three consecutive months, gaining 7.8% (+21.9% YTD) in October. However, the oil price fell into month-end following disappointing factory activity data out of China and concerns that the country’s COVID-19 curbs could curtail oil demand. Iron ore (-14.2% MoM/-28.1% YTD) dropped below US$80/tonne in October over the outlook for steel consumption in China, ending the month at around the US$80/tonne level. The gold price recorded its seventh consecutive MoM decline (-1.6% MoM/-10.7% YTD) on the back of a strong US dollar and fears of further monetary policy tightening from a hawkish Fed. The platinum price rose 7.7% MoM (-3.9% YTD), while the price of palladium fell 14.8% MoM (-3.1% YTD).

The JSE followed major developed markets higher, with South Africa’s (SA’s) FTSE JSE All Share Index closing October up 4.6% (-9.5% YTD), while the FTSE JSE Capped SWIX advanced by 5.3% MoM (-2.0% YTD). Financial counters took the lead and were the star performers this past month, with the Fini-15 jumping 12.7% MoM (+5.0% YTD), while the SA Listed Property Index was a close second with a 9.4% MoM gain (-12.4% YTD). The resources sector also put in a solid performance, with the Resi-10 gaining 3.9% MoM (-11.8% YTD). The Indi-25 recorded a 1.6% MoM gain but is still down 17.6% YTD. Highlighting the best-performing shares on the JSE by market cap, Anheuser-Busch InBev, the second-largest company on the exchange, was up 11.7% MoM. Other large-cap counters that posted impressive gains included Standard Bank (+19.2% MoM), Anglo American Platinum (Amplats; +13.4% MoM), British American Tobacco (+11.5% MoM), and Glencore (+11.4% MoM). The rand continued to retreat against a strong US dollar, weakening a further 1.5% MoM against the greenback (-13.1% YTD). Eskom loadshedding continued in October, further compromising SA’s already weak economy.

In terms of local economic data, annual September headline inflation, as measured by the consumer price index (CPI), slowed for a second month, coming in at 7.5% vs August’s 7.6% print. The major drivers of the lower CPI print were food and non-alcoholic beverages, housing and utilities, transport, and miscellaneous goods and services. Nonetheless, the increase in core inflation (which excludes the volatile categories of food and energy costs and rose to 4.7% YoY from 4.4% previously) reflects the continued generalised rise in prices across other sectors of the economy surveyed by Stats SA.

Finance Minister Enoch Godongwana delivered a hopeful medium-term budget policy statement (MTBPS) on 26 October, painting a positive story, with only part of the latest revenue windfall allocated to increased expenditure, followed by a clear indication from the National Treasury (NT) that for any permanent additions to expenditure, there would need to be an equivalent permanent increase in revenue (or a cut in existing expenditure). However, NT did acknowledge that significant risks remain on the horizon, particularly amid growing concerns about downside global and local growth risks.

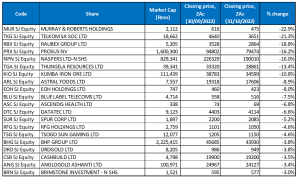

Figure 1: October 2022’s 20 best-performing shares, % change

Source: Bloomberg, Anchor

Pulp and paper producer Sappi was October’s best-performing share – up 28.7% MoM. Sappi’s share price recorded a c. 8% one-day gain on 10 October after the company upgraded its 4Q22 guidance, saying that it expected earnings would be higher than those achieved in 3Q22. Sappi noted that during the fourth quarter, market conditions were stronger than initially expected and European energy prices, principally gas, were lower than anticipated. Sappi’s European operations account for c. 45% of total Group sales, and Sappi has a high reliance on gas at its plants. The announcement was a turnaround from the company’s cautionary guidance in early August when it warned that it was “anticipating another strong performance in the fourth quarter…” but “… with Ebitda below the record levels achieved in the third quarter” owing to rising energy costs in Europe.

Investec Plc and Investec Ltd were the second-and-third best-performing shares, recording MoM gains of 27.5% and 26.1%, respectively. Last month, Investec announced plans to buy back shares as part of its “capital optimisation strategy”. In a stock exchange filing, Investec said that it had appointed JPMorgan Equities SA to purchase shares on the JSE and London Stock Exchange and other trading platforms in the UK on which the company is listed. The share buyback programme, which will be limited to a maximum market value of R1.2bn, started on 3 October and is expected to end on or before 17 November 2022.

Investec was followed by Capitec Bank (+22.4% MoM), Standard Bank (+19.2% MoM) and Harmony Gold (+19.1% MoM). In September, Capitec’s share price tumbled c. 24% MoM after the market took a dim view of the company’s interim dividend, and Capitec’s CEO highlighted concerns about global and domestic economic uncertainty. However, last month saw a turnaround in its share price. Early last month, Capitec said it had been granted a license to conduct a life insurance business in SA and is planning to start underwriting its own life and funeral insurance products soon. Meanwhile, Standard Bank’s share price rallied after it reported a 42% jump in attributable earnings for 9M22 (to 30 September). Standard Bank said that higher average loan and advance balances and higher average interest rates supported the double-digit net income growth for the period under review compared to the same period in 2021. It added that ongoing market volatility was driving client trading activity, supporting continued strong trading revenue growth.

Harmony was followed by local diversified industrial Group Kap Industrial Holdings, gaming, casino, and hotel Group Sun International and property Group MAS Plc, with gains of 18.5%, 18.2% and 15.6% MoM, respectively. In October, Sun International announced a major extension of its Sun Vacation Club at Sun City, which is expected to cost c. R850mn and will take place over the next five years. According to Sun International CEO Anthony Leeming, the Sun Vacation complex had performed well after COVID-19 restrictions were lifted, with more people opting for self-catering accommodation and timeshare. He added that weekend leisure demand in Sun City is high but said that the trend would not poach business from its other existing hotels because they cater for different markets and budgets.

Fortress REIT Ltd -A- shares rounded out October’s best-performing counters with a 15.4% MoM gain. In October, Fortress shareholders tabled a proposal to amend the company’s memorandum of incorporation (MOI) to allow for a split dividend (between A and B shares) over the next two financial years. If the required 75% shareholder approval is received, Fortress could retain its real estate investment trust (REIT) status, and hence both classes of shareholders would receive a distribution.

Figure 2: October 2022’s worst-performing shares, % change

Source: Bloomberg, Anchor

Engineering and mining contracting company Murray & Roberts was the worst-performing share on the JSE for a second month running in October – declining by a further 22.9% MoM. The company’s share price slumped c. 37% on 17 October after it said that several of its projects were progressing slower than planned, thus affecting margin and working capital requirements. It also forecasts a loss in the six months to end-December. According to the company, “Margin deterioration has recently been recorded at the Traveler project in the US, and the Waitsia project in Australia, both of which will be close to completion by the end of FY23”. It added that it has a reasonable degree of certainty that the margin deterioration will see its results for the six months ending 31 December, at least 100% down YoY.

Telkom (-21.3% MoM) was in second place, plunging c. 23% on 19 October after the company said that MTN had “terminated discussions” on a possible takeover deal. According to Telkom’s statement, talks broke down due to Telkom’s inability to guarantee that it would not entertain any offers from other parties. MTN expressed interest in acquiring Telkom in July. The deal would have seen MTN move past Vodacom to become SA’s largest mobile operator.

Another construction company, Raubex, was October’s third worst performer, with a MoM share price drop of 18.8%. In a trading statement for the six months ended 31 August 2022, released in October, Raubex said that it expected its EPS and headline EPS to be between 10.0% and 20.0% higher compared with an EPS of 140.60c and HEPS of 137.00c recorded in the previous corresponding period.

Prosus, now relegated to the fourth largest JSE-listed company, declined by 16.2% MoM, with Naspers (-16.0% MoM) closely following as the rout in Chinese markets resulted in the pair being weighed down by their c. 28% stake in Tencent, which lost 22.0% MoM. The outcome of the CCP conference saw investor fears reemerge that continuing strict policies and laws would hamper the future growth of China’s tech giants. This after Chinese President Xi Jinping began his third term as leader, packing the new leadership team with loyalists, which meant it was unlikely that the measures already enacted to curb the growth of the tech companies would be reversed.

The price of export coal dropped c. 24% MoM, weighing on major coal exporter (and an outperformer this year), Thungela Resources, which saw its share price fall 13.4% in October, while mining company Kumba Iron Ore was down 10.8% MoM. In its 3Q22 production and sales report, Kumba said that its total production decreased by 8% to 10mn tonnes. Relative to 2Q22, production increased by 5%, driven by a 22% improvement at Kolomela. Export sales of 10mn tonnes were flat YoY and 2% lower relative to 2Q22 as rail constraints kept finished stock levels down at the Saldanha Port. For FY22, the company expects total sales in the range of 36 and 37mn tonnes.

Poultry products producer Astral Foods (-8.9% MoM) plummeted 14.3% on 27 October after the company warned that high feed input costs would negatively impact its half-year profit. In its FY22 trading statement, Astral said it expects its HEPS to be between R26.77 and R27.99 compared to the R12.28 posted in the prior year’s corresponding period. Like many other food producers, Astral is grappling with the fallout from Russia’s war on Ukraine, which has sent international grain prices soaring. Feed costs (mainly maize and soya) account for c. 70% of the cost of producing a broiler. Astral said in the trading update that its “… broiler operations are not able to fully recover record high feed input costs through the selling price of poultry,”.

Tech company EOH Holdings (-8.0% MoM) and Blue Label Telecoms (-7.5% MoM) rounded out October’s worst-performing shares. In its FY22 results, released last month, EOH said that its revenue declined 6.8% YoY to R6.03bn, while its diluted loss per share stood at ZAc99 compared with ZAc181 reported in FY21. Last week, EOH also announced that it plans a rights issue to raise up to R500mn as it moves to deal with the high levels of legacy debt on its balance sheet. At the same time, the company said it would raise an additional R100mn in an empowerment deal with strategic partner Lebashe Investment Group. However, despite a turnaround in its operational performance, news of the rights offer weighed on the share price.

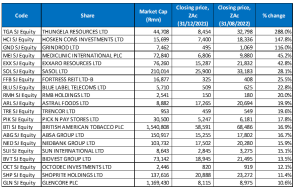

Figure 3: Top-20 October 2022, YTD

Source: Anchor, Bloomberg

Fourteen out of October’s top-20 YTD best-performing shares also featured among the top-20 performers for the year to end September, with Sappi (+24.1% YTD), Standard Bank (+22.6% YTD), Sun International (+16.3% YTD), Pick n Pay Stores/Omnia Holdings (both up 12.5% YTD), and Bidvest (+12.2% YTD) replacing RMB, Datatec, Astral Foods, Blue Label, Emira Properties and Octodec.

Coal miner Thungela Resources (+241.1% YTD) was the top-performing share for the ninth consecutive month despite its share price being down 13.4% in October. Thungela’s share price has been buoyed this year by soaring coal prices, reaching record highs following Russia’s invasion of Ukraine. The resultant sanctions on Russia, a major European gas supplier, have seen increased gas-to-coal switching. Thungela’s YTD total return (which includes the dividend) now stands at 337.6%.

BHP Group (+188% YTD) bumped Hosken Consolidated Investments (HCI;+143.2% YTD) from second place into the third spot. HCI was again followed by logistics company Grindrod Ltd (+109.3% YTD), which moved to the fourth spot as its share price gained 14.2% MoM in October. In its trading update for the nine months ended 30 September 2022, Grindrod Ltd revealed that Maputo Port volumes were up 23.0% YoY, capitalising on the additional slab and berthing capacity. Moreover, its dry bulk terminal volumes were up 47.0% YoY. In the logistics segment, the locomotive deployment rate in its rail business improved to 63.0% compared to the 32.0% recorded in the prior period.

Healthcare Group Mediclinic International was the fifth best-performing share YTD – its share price advanced by 6.1% in October. It is now up 53.4% YTD amid a takeover offer by a consortium led by Remgro’s Johann Rupert. Remgro, already Mediclinic’s majority shareholder with a 44.6% stake, is partnering with MSC Mediterranean Shipping Company SA to pay GBp504/share for the shares in Mediclinic it does not already own.

Mediclinic was followed by Exxaro Resources, Glencore, and ABSA Group with YTD gains of 33.8%, 31.3% and 30.9%, respectively. Diversified miner Glencore (+11.4% MoM) released its 3Q22 production update in October, which showed that its own-sourced copper production declined by 14.0% YoY to 770,500 tonnes, while own-sourced zinc production decreased by 18.0% YoY to 699,600 tonnes. However, own-sourced nickel production increased by 15.0% YoY to 81,600 tonnes, attributable ferrochrome production advanced by 4.0% YoY, and coal production rose by 7.0% YoY to 81.90mn tonnes.

Rounding out the YTD 10 best-performing shares were Fortress REIT -B- shares (discussed earlier) and Trencor, with YTD gains of 30.2% and 29.6%, respectively.

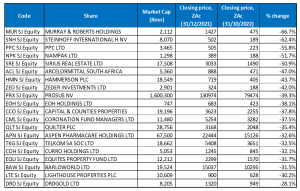

Figure 4: Bottom-20 October 2022, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, 16 of the 20 shares for the year to end-October were also among the 20 worst-performers for the year to end-September. Zeder Investments (-42.0% YTD), Prosus NV (-39.3% YTD), Telkom (-32.5% YTD), and DRD Gold (-28.1% YTD) were the newcomers last month, replacing Harmony, City Lodge, Famous Brands and MTN.

After taking the worst-performer spot for six consecutive months, Steinhoff (-62.4% YTD) was bumped into the second spot, and Murray & Roberts (discussed earlier; -66.7% YTD) claimed the worst-performer position. PPC (-55.8% YTD) remained in the third position after its share price retreated by a further 2.2% in October.

Despite its impressive performance for October, Nampak (discussed earlier; -51.7% YTD) remained among the YTD worst-performing shares. It was followed by Sirius Real Estate, ArcelorMittal SA, and Hammerson Plc, which recorded YTD declines of 50.9%, 47.0% and 43.7%, respectively.

Investment holding company Zeder Investments, Prosus (discussed earlier), and EOH (discussed earlier) rounded out the ten worst-performing shares with YTD losses of 42.0%, 39.3%, and 38.1%. In its 1H23 results, released last month, Zeder Investments revealed that its investment income fell to R22.0mn from R69.0mn posted in the previous year, while it recorded a diluted loss per share of ZAc15.1 vs EPS of ZAc25.5 reported in 1H22.