Netcare reported interim results to 31 March 2021 (1H21) on 24 May, with Group revenue rising 24% YoY to R10.08bn, while adjusted headline EPS came in at ZAc27.3 (-61.9% YoY). Netcare said that the second COVID-19 wave had negatively impacted its results for the period under review. Profit before tax jumped 165.2% vs 2H20 but decreased by 60.9% YoY to R542mn. Until the pandemic hit, Netcare was a large returner of cash to shareholders via dividends and share buybacks but it did not declare an interim dividend and at the results presentation, CEO Dr. Richard Friedland said Netcare will “only resume dividend payments once the operating environment stabilises.” Still, we anticipate that, at some point over the medium term, the company will once again pay out the majority of its free cash flow to shareholders and thus, at the right price, it can make for a good cash return story.

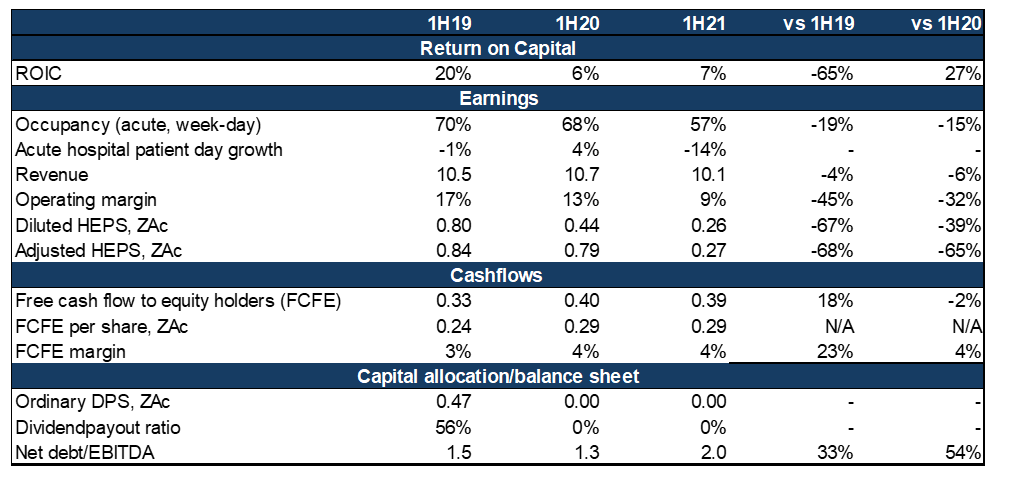

Figure 1: Netcare 1H21 results overview, in Rbn unless otherwise indicated

Source: Anchor, Company data

Some salient points from these results include:

- Netcare said that it will finish vaccinating its workforce in the next two weeks.

- Elective surgeries had to be suspended in December 2020 until February 2021, due to the second wave of the pandemic and the tighter lockdown restrictions imposed by government.

- The occupancy and the patient-day growth rate was lower vs 1H20 and well-below pre-pandemic (1H19) levels.

- Margins continued to decline.

- Earnings were lower vs 1H20 and pre-pandemic (1H19) levels.

- Leverage was manageable with net debt/EBITDA at 2.0x (which we view as being decent, especially when considering the drop in EBITDA).

- Netcare guided that EBITDA margins will improve, assuming that there is no major third wave of the pandemic.

- For April 2021, acute patient days were up 62% YoY but down 8% vs March 2021.

- May 2021 occupancy is currently trending at c. 57%, which is similar to the 1H21 average.

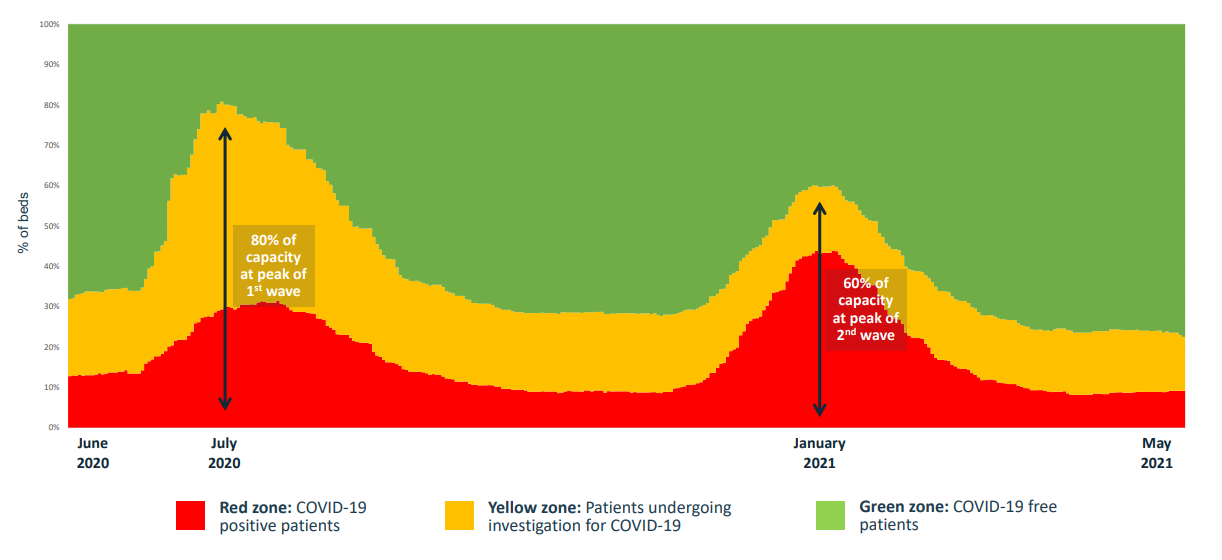

- Figure 2 below shows how the majority of beds had to be dedicated to COVID-19 positive patients at the peak of the second wave.

Figure 2: Netcare – the percentage of beds dedicated to COVID-19 patients, June 2020 to May 2021

Source: Netcare

Conclusion

The share currently looks cheap vs normalised (e.g., FY19) earnings and cash flows and it is currently trading at 8.5x 2019 adjusted HEPS and a 7.6% dividend yield on 2019’s dividend. However, despite this apparent cheapness, we are cautious about Netcare’s growth outlook in a normalised environment. Netcare also estimates that c. R80mn of additional COVID-19 operating costs will be permanent (a 0.4% impact on margins), while we expect revenue growth in normalised times to be tepid due to muted growth in South Africa’s insured population and pricing pressure from the major medical insurers.

We value the share at c. R13.70/share by applying an 11x multiple to an estimate of normalised free cash flow (R2.2bn) to get a R24bn enterprise value (EV) and subtracting the R6bn net debt to get R18bn in equity value or around R13.70/share (we note that the share closed at R15.00 on 26 May). We do not believe that there is currently substantial downside to the share, but we would also not be buyers due to the headwinds Netcare currently faces (as we discussed above).