On Tuesday (21 January) evening, Naspers announced an accelerated bookbuild offering in which it will issue and place 22mn shares of its international internet subsidiary, Prosus (1.4% of the shares outstanding [Naspers held 73.8% of Prosus before]). An accelerated bookbuild is done by offering shares in equity markets to raise capital, usually when a company needs financing. The placement will be done at a 4.75% discount to Prosus’ closing price on Tuesday, raising c. $1.7bn. The announcement says that proceeds will be repatriated to SA and will be returned to Naspers shareholders in the form of a share buyback.

Below, we highlight our thoughts on this announcement:

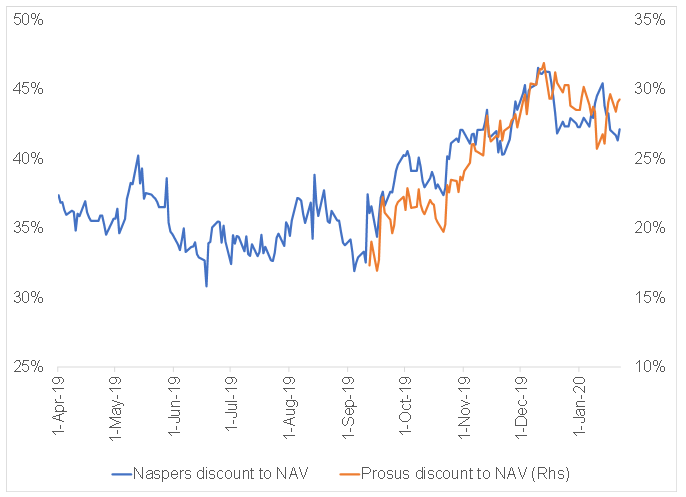

- Regarding the current discounts to NAV for Naspers and Prosus, we calculate it to be 42% and 28%, respectively (see Figure 1).

Figure 1: Naspers and Prosus discounts to NAV

Source: Bloomberg, Anchor

- We note that probably more relevant in the context of an intended share buyback of Naspers shares, funded by the sale of Prosus shares is what has happened to the gap in discounts between the two shares. As can be seen in Figure 1, when Prosus listed in September 2019, the gap in discounts was about 18%. Although the discounts on both have widened since, Prosus has underperformed Naspers and currently the gap is c. 12%. The fact that Naspers has placed the Prosus shares at a discount, means that the gap is effectively even smaller and will narrow even more assuming the market reacts to the signal and closes the discount on Naspers (which seems likely in our view).

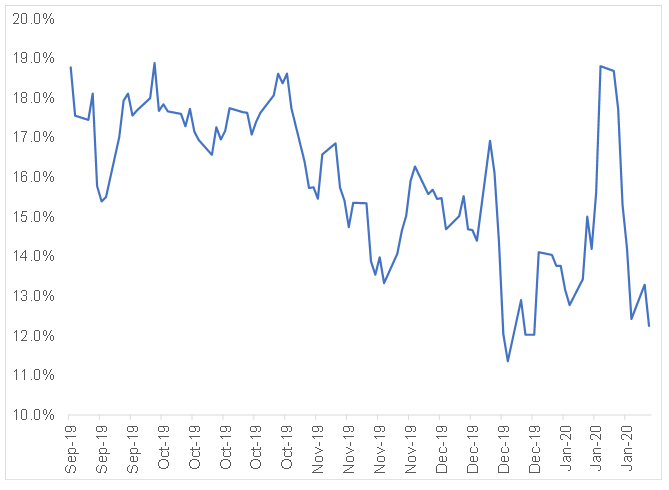

Figure 2: The gap between the Naspers discount and Prosus discount to NAV

Source: Bloomberg, Anchor

- We are a bit surprised that Naspers has done it this way. We would have thought it would have made a lot more sense to do this quietly in the background and then announce it once done. It is possible though that Naspers has decided, following the recent strong run in Tencent, that this is a good time to lock in the cash, after which it will buyback Naspers shares opportunistically.

- The fact that the discount gap has closed considerably since Prosus listed is a further factor that is making us scratch our heads a bit on timing. We suppose hindsight is a perfect science, but Figure 2, which shows the gap between the discounts, suggests to us that this is not a particularly good time for Naspers to be doing this trade, unless of course it expects the gap to continue to narrow.

- As mentioned previously, Naspers management was far more vocal about taking further action to narrow the discount in the medium term. Having resisted calls to do buybacks up to this point, this is a big change for it. It is also clear that the optionality on closure of the discount resides in Naspers rather than in Prosus. We believe that this development is likely to put a ceiling on the Naspers discount.

- One issue which Naspers also mentions is that this bookbuild will improve the free float and liquidity in Prosus. This may be the case but the relative underperformance of Prosus to date would hardly cause one to conclude that there has been a scarcity of Prosus shares relative to demand! Knowing that Naspers is a seller of Prosus is probably not great for the direction of its discount. It would certainly help if a new source of demand was to materialise. Prosus’ inclusion in the Euro Stoxx 50 Index is the next event that we are aware of which could be meaningful for passive demand. This ordinarily takes place in September, but it could happen sooner if there is corporate action that leads to the disappearance of one of the current Euro Stoxx 50 members in the interim.