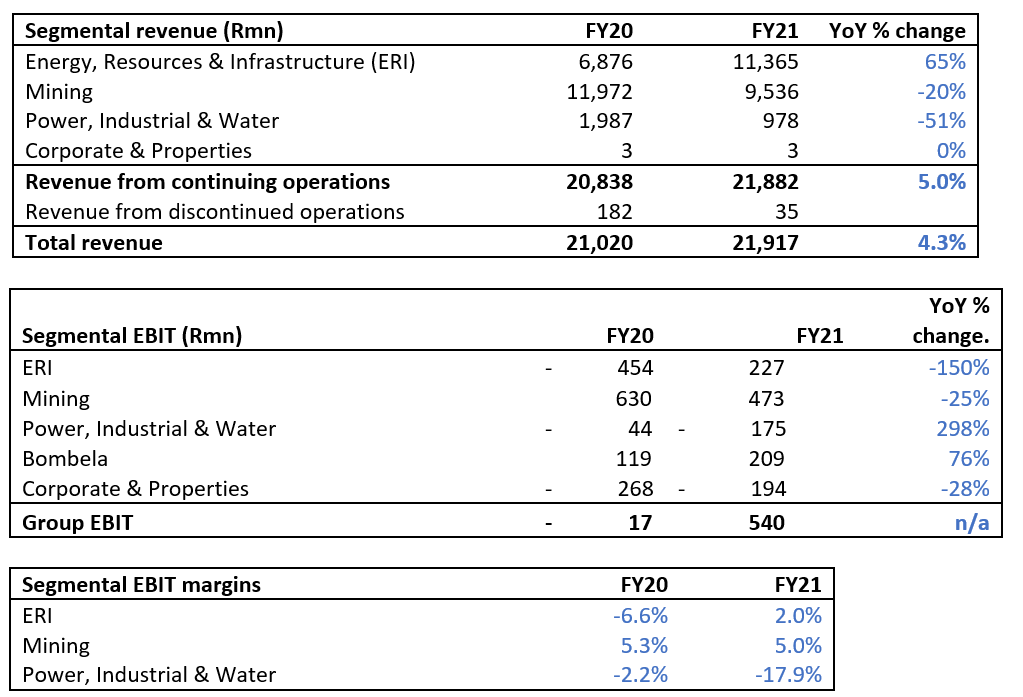

Murray & Roberts (MUR) reported FY21 results on Thursday (2 September), which were mostly in line with consensus expectations and are reflective of a recovery from the depths of the 2020 COVID-19 pandemic as the Group’s operations returned to profitability. Revenue from continuing operations increased to R21.9bn (vs FY20’s R20.8bn), of which 81% was generated outside of South Africa (SA). MUR also posted a strong improvement in earnings before interest and tax (EBIT) from continuing operations of R540mn (FY20: a R17mn loss). Diluted continuing HEPS came in at ZAc16 vs a ZAc88/share loss in FY20. The company also reported a strong order book of R60.7bn (FY20: R54.2bn), with the project pipeline including near orders of R11.1bn and category 1 opportunities of R84.1bn (of which c. R30bn is being negotiated on a sole-tender basis). No dividend was declared as the company said that it is focused on project ramp-up and preserving cash.

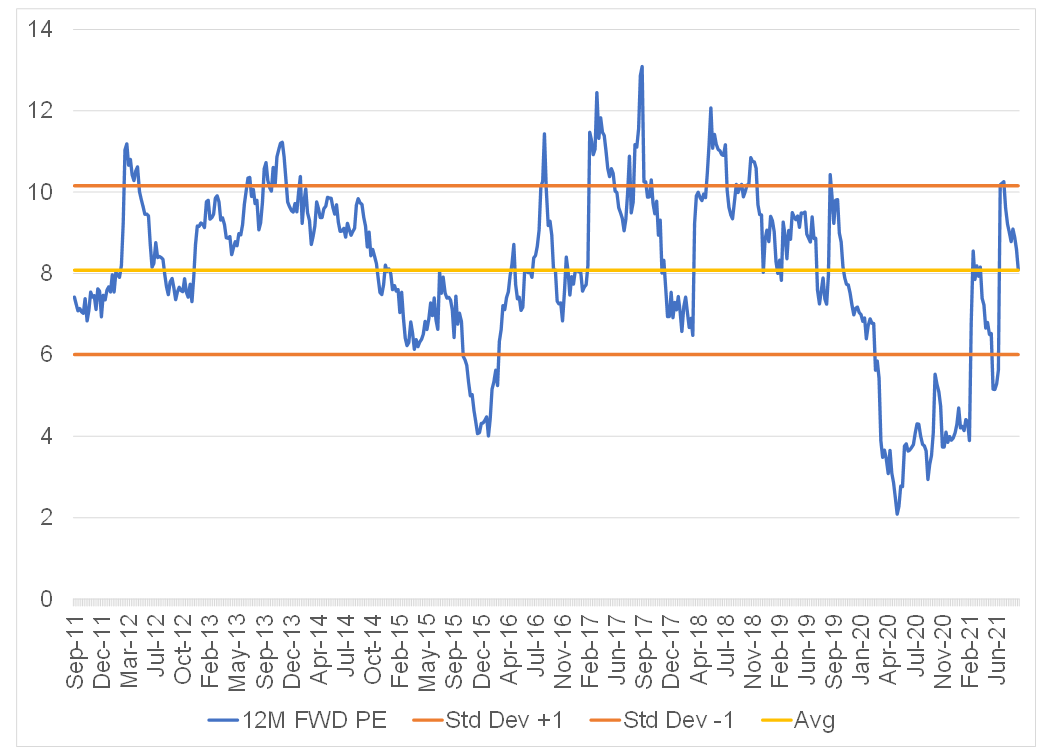

Figure 1: Bloomberg 12M FWD PE is in line with the historical average

Source: Anchor, Bloomberg

Figure 2: MUR five-year share price history, R

Source: Anchor, Bloomberg

Figure 3: MUR segmental performance snapshot

Source: Anchor Bloomberg

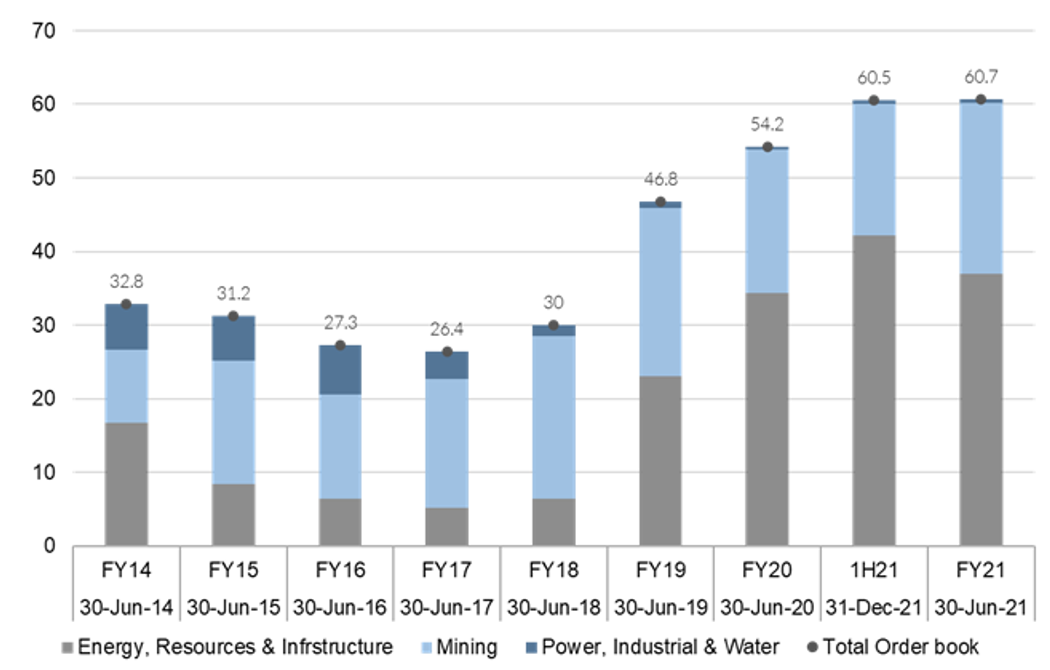

Order book history

Following a record order book at its 1H21 results, the order book increased marginally from R60.5bn to R60.7bn.

Figure 4: MUR order book history, Rbn

Source: Company reports, Anchor

MUR announced a record order book at its 1H21 results and it also had an investor day in June, we were of the view (at that time) that the share was fairly valued and that the news of the record order book had already been priced in. We expect earnings of R1.48/share in FY22E (vs consensus expectations of R1.84/share) using conservative EBIT margin assumptions and revenue growth that is reflective of the order book growth. However, we believe that MUR’s earnings growth for FY22E and FY23E is very sensitive to its Energy, Resources & Infrastructure (ERI) segment’s EBIT margin (management is targeting an EBIT margin of 3%-4% for this segment). The ERI division’s order book has some complex projects, and we are cautious against the risk of loss-making projects possibly eroding ERI’s margins. Barring the possibility of loss-making projects, we expect meaningful earnings growth for the next three years given the strong order book.

In our view, there is upside to MUR’s current share price and the share could rerate as the company posts solid FY22 earnings growth, driven by improved margins in ERI and the strong order book. Overall, we recommend buying the share as a cyclical play, but we caution investors that the share could be range-bound in the near term as news of the record order book is now priced in. Given the trust deficit the market has with regards to construction companies, we expect a positive catalyst when MUR releases positive 1H22E results or a positive trading statement for its FY22E results.

Outlook

Management is optimistic that it will achieve strong earnings growth for the next 3 years, driven by improving operating conditions within its core operations and the strong order book. The Mining and ERI business segments are the key drivers of a solid operational performance within MUR.