Mr Price released its 1H21 results on Thursday, 26 November and also announced the acquisition of local retailer, Power Fashion, which currently has 170 stores around South Africa (SA). We note that the deal is still subject to approval by the competition authorities, but management are very confident that the acquisition will be concluded by April 2021. Mr Price’s 1H21 results showed that revenue was down 14.8% YoY to R9.2bn, while half-year profit dropped c. 25% YoY. The period covered an extremely difficult operating environment for Mr Price, during which the full impact of the pandemic and ensuing lockdowns was felt. The retailer said that consumers’ appetite for credit was low, and consumers prefer paying cash. Online sales jumped 71.5% YoY, accounting for 2.6% of total Group sales. The share price rose by 8.4% on Thursday, the day the results were released and the acquisition was announced.

The highlights

- Mr Price’s diluted 1H21 HEPS was down 25% YoY.

- The Group resumed dividend payments, but at a reduced payout ratio of 63%.

- Group sales declined by 14.8% in the half-year with:

- Apparel sales down 18% YoY; and

- Home sales 8% lower YoY.

- The gross profit (GP) margin improved by 200 bpts to 42%, albeit off a low base. This was achieved by fewer and lower markdowns through improved inventory management.

- The Group announced the acquisition of value discount retailer, Power Fashion for c. R1.6bn.

- Power Fashion has in the past bought excess stock from Mr Price.

- Power Fashion generated revenue of c. R1.6bn (7% of Mr Price Group’s revenue) over the past 12 months.

- According to management, the acquisition will be earnings accretive from day-one.

- Mr Price’s cash balance was up 35% from the previous reporting period (FY20).

- Mr Price now has R6.2bn in cash on its balance sheet.

- This equates to c. 14% of Mr Price’s current market cap.

- Mr Price is launching three new categories and entering some very lucrative, and high foot-traffic, segments, namely mrpBaby, mrpSchoolgear, and mrp&co (a novelty and gifting store that will compete with Cotton On’s Typo stores).

The positive

- We believe that the Power Fashion acquisition can provide Mr Price with some exciting growth opportunities over the next few years.

- Power Fashion’s product range competes directly with the price points and value of Pep.

- Power Fashion currently trades from 170 stores, while Pep, for example, has 2,384 stores. Mr Price management believe that they can grow the Power Fashion store footprint to a maximum of 1,800 locations across SA and eSwatini.

- Power Fashion will also allow Mr Price to segment its offering better, with Power Fashion being the true value retailer and Mr Price focusing more on fast value fashion at slightly higher price points.

- Mr Price continues to grow its online sales significantly.

- Online now contributes more than any flagship store to Mr Price’s overall sales at 2.6% of total sales.

- Online sales grew by 71.5% post the hard lockdown (the period from May to the half-year end at 26 September 2020).

- Mr Price’s click-and-collect online delivery service to its stores is proving very popular and can be operated at a higher margin than the delivery-to-customers option.

- Share buybacks

- The Group announced a further share buyback programme and management indicated that they are happy to return excess cash to shareholders in future.

- Sales momentum

- Management said that, post the half-year end, sales momentum accelerated and the Group’s sales for the first six weeks of 2H21 grew by >10%.

- Growth on Black Friday will be more challenging this year due to the high base in 2019.

The negative

- Government grants.

- Management are cautious on what impact government’s COVID-19 support measures had on its sales momentum.

- They are worried that sales will slow once these support measures are pulled by government.

- Credit book

- Although collection has improved since FY20, management did indicate that they were starting to see some stress in Mr Price’s credit book and the company has thus increased provisions from 7.5% (1H20) to 15.2% (1H21)

- We note that Mr Price is one of the SA retailers that is the least exposed to a slowdown in credit sales.

Valuation

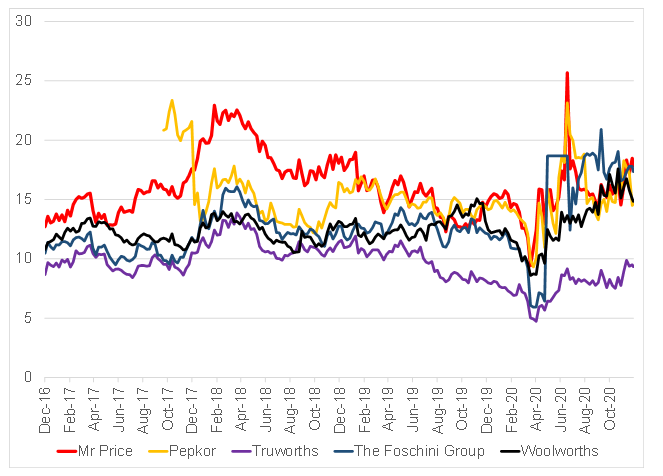

- Mr Price is currently trading at its median one-year forward PE ratio of c.18x.

- However, we believe that, given the significant cash holding and future growth potential of the business due to the Power Fashion acquisition, Mr Price still presents value.

Figure 1: Mr Price vs the peer group BEst P/E ratio (blended 24 months)

Source: Anchor, Bloomberg

Conclusion

This was a strong set of results from Mr Price especially given the circumstances. The 200-bpt improvement in the GP margin is very impressive, in our view. Over the past few years, Mr Price’s GP margin has been quite volatile, and management have made the GP margin a key focus area and we will be monitoring this closely going forward. The Group’s acquisition of Power Fashion can provide real future space growth for the company, which should help accelerate its earnings recovery going forward. However, for us, the most impressive achievement in this set of numbers was the cash generation. Mr Price now has a cash pile of R6.4bn (accounting for c. 14% of its market cap) and this provides the management team with attractive future optionality, including further acquisitions, share buybacks, enhanced dividends, etc. Given the above, we maintain our view that Mr Price is our preferred SA retailer and we would continue to recommend buying the share.