The US and most global equity markets continued to regain their footing in June (MSCI World +4.3% MoM/+9.8% YTD/+11.6% in 2Q25), recording a strong recovery as markets rebounded from earlier-in-the-month volatility driven by tariff uncertainties and geopolitical tensions (Israel-Iran conflict, Russia’s ongoing assault on Ukraine, the Israel/Gaza war). Equity markets reacted positively to trade policy developments, including a temporary pause in tariff escalations and a US-China trade truce, which sparked optimism despite risks such as tariffs and inflation remaining front of mind. Still, overall, US and global equities have, for the most part, posted an impressive comeback following their steep declines in April, after US President Donald Trump initially announced sweeping tariffs.

US equity markets experienced a strong recovery, with the S&P 500 climbing 5.0% in June (+5.5% YTD/+10.6% in 2Q25), while the Dow rose 4.3% MoM (+3.6% YTD/+5.0% in 2Q25), and the tech-heavy Nasdaq surged by 6.6% MoM (+5.5% YTD/+17.7% in 2Q25).

In economic data, US May headline inflation, as measured by the Consumer Price Index (CPI), rose less than expected, coming in at 2.4% YoY vs April’s 2.3%. Core CPI, excluding food and energy, was unchanged at 2.8% YoY. May’s core personal consumption expenditure (PCE), excluding food and energy, the US Federal Reserve’s (Fed) preferred inflation gauge, rose by a higher-than-expected 2.7% YoY, up from May’s revised 2.6%. In its third and final 1Q25 GDP estimate, the Commerce Department said that the US economy shrank at a 0.5% annual pace in 1Q25 as Trump’s trade wars disrupted business. That is worse than the 0.2% decline reported in its second estimate. At its 18 June meeting, the Fed kept rates unchanged but raised its forecast for inflation and lowered its outlook for economic growth in 2025. Fed Chair Jerome Powell noted that increases in tariffs are likely to boost prices, adding that the effects on inflation could be more persistent.

European equity markets recorded a mixed performance, with gains in some indices tempered by volatility from trade tensions, geopolitical risks, mixed economic data and sector-specific challenges. In addition, uncertainty surrounding the Trump administration’s tariff moves ahead of the previously announced 9 July deadline saw a cautious mood prevail. Germany’s DAX declined 0.4% MoM (+20.1% YTD/+7.9% in 2Q25), while France’s CAC closed 1.1% lower (+3.9% YTD/-1.6% in 2Q25). Eurozone headline inflation came in at 1.9% YoY vs April’s 2.2% print – dipping below the European Central Bank’s (ECB) 2.0% target for the first time since September 2024. Meanwhile, core inflation eased to 2.3%, the lowest since January 2022.

In the UK, the FTSE 100 was unchanged MoM in June (+7.2% YTD/+2.1% in 2Q25). May UK inflation slowed to 3.4% (in line with expectations) from 3.5% in April, while core inflation increased by 3.5% in May, down from April’s 3.8%.

In China, optimism was driven by Beijing’s stimulus efforts, including monetary easing and fiscal policies aimed at boosting domestic demand and stabilising the property market. Hong Kong’s Hang Seng rose 3.4% (+20.0% YTD/+4.1% in 2Q25), fuelled by a tech-driven rally and investor optimism around companies like DeepSeek, while the Shanghai Composite was up 2.9% (+2.8% YTD/+3.3% in 2Q25). China’s official June manufacturing PMI improved slightly to 49.7 vs May’s 49.5 but remained below the 50-mark separating expansion from contraction. However, the non-manufacturing PMI, which includes services and construction, rose to 50.5 from 50.3 in the prior month.

Japan’s benchmark Nikkei ended May 6.6% higher (+1.5% YTD/+13.7% in 2Q25) despite ongoing concerns over the adverse impact of US tariffs on the country’s economy. Japan’s May core inflation accelerated for a third straight month, printing at 3.7% YoY vs April’s 3.5%, topping market forecasts and reinforcing expectations that the Bank of Japan (BoJ) may further tighten monetary policy to address persistent inflationary pressures.

Among commodities, gold advanced by only 0.4% MoM (+25.9% YTD/+5.7% in 2Q25) while among the platinum group metals (PGMs), platinum surged 28.5% MoM (+49.8% YTD/+36.2% in 2Q25), buoyed by a sharp rise in Chinese imports, the prospect of a third annual supply deficit and renewed investor interest in the metal, which is used in catalytic converters. Palladium was up 13.6% MoM (+21.3% YTD/+11.7% in 2Q25), and rhodium rose 0.5% MoM (+19.7% YTD/-3.9% in 2Q25). Brent crude (+5.8% MoM/-9.4% YTD/-9.5% in 2Q25) recorded gains following a 12-day war that started with Israel targeting Iran’s nuclear facilities on 13 June, which pushed up oil prices. Crude surged above US$80/bbl after the US bombed Iran’s nuclear facilities and then slumped to c. US$67/bbl following Trump’s announcement of an Iran-Israel ceasefire.

In South Africa (SA), the JSE recorded solid gains in June. The FTSE JSE All Share Index rose 2.2% (+14.7% YTD/+8.8% in 2Q25), while the Capped SWIX also ended the month 2.2% higher (+16.1% YTD/+9.7% in 2Q25), with advances being led by mining sector shares. The materials sector was the star performer (Resi-10 +4.8% MoM/+44.9% YTD/+9.5% in 2Q25), primarily due to a soaring platinum price, as gold’s gains were muted. Resources were followed by industrials (Indi-25 +2.2% MoM/+15.5% YTD/+11.4% in 2Q25) and financials (Fini-15 +0.8% MoM/+3.1% YTD/+5.0% in 2Q25). The Listed Property Index was the laggard, declining by 1.4% MoM (+2.6% YTD/+6.6% in 2Q25). The rand strengthened by 1.6% MoM against the US dollar (+6.4% YTD/+3.3% in 2Q25).

In domestic economic data, May headline inflation held steady at 2.8% YoY, unchanged from April, with core inflation also unchanged at 3.0% YoY in May. The SA economy managed to just stay afloat in 1Q25 as GDP rose by a meagre 0.1% QoQ on a seasonally adjusted basis, following a revised 0.4% increase in 4Q24.

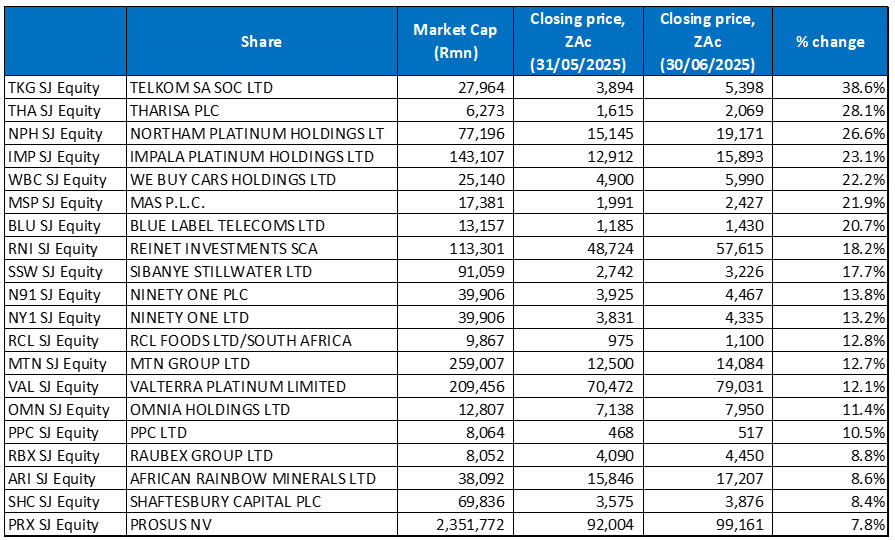

Figure 1: June 2025’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Telkom SA SOC Ltd was June’s best-performing share, recording an impressive 38.6% MoM gain as investors cheered news of the company’s robust FY25 results and the announcement of a resumption in dividend payments (after a four-year suspension). Group revenue rose 3.3% YoY to R43.88bn due to strong growth in its mobile service revenue (+10.2% YoY) and fibre-related data revenue (+10% YoY). Profit surged to R7.5bn vs R1.9bn in the same period a year ago. Headline earnings per share (HEPS) jumped 44.8% YoY to ZAc544.5, while HEPS from continuing operations soared 62.3% YoY to ZAc467.5. The company declared a final dividend of ZAc163.05/share along with a special dividend of ZAc97.82/share, taking the total dividend to ZAc260.87/share.

A soaring platinum price (+28.5% MoM – to the highest levels in four years) has sparked a bull run on SA PGMs, with several platinum counters among the top performers in June. Telkom was followed by Tharisa Plc (+28.1% MoM), Northam Platinum (+26.6% MoM), and Impala Platinum (Implats; +23.1% MoM). It is hoped that this turnaround in the platinum price will boost PGM companies’ earnings, particularly after the industry undertook restructuring in 2024 to cut costs. A sustained platinum price rally is also expected to offer a lifeline to SA’s platinum industry at a time when miners are contending with increasing electricity costs and logistical issues, thus allowing the industry to stave off further production cuts this year. A supply deficit and rising demand are driving the higher platinum price, especially from China’s jewellery sector. The bullish momentum aligns with expectations of another annual supply deficit in 2025, with the World Platinum Investment Council (WPIC) projecting a supply deficit of c. 1mn ounces this year, driven by strong demand and constrained output. Moreover, the WPIC’s two to five-year forecasts indicate that deficits are expected to occur every year until 2029. Platinum is primarily used in catalytic converters for vehicles. Its 49.8% price increase YTD (to close at US$1359.42/oz on 30 June) has outpaced gold’s 25.9% jump.

We Buy Cars Holdings Ltd’s share price surged by 22.2% MoM on the back of robust demand for used vehicles, strategic expansion plans (it is expanding its operations with a new East London outlet described as a “supermarket” style facility designed to accommodate 300 vehicles) and strong interim results for the six months ended 31 March 2025, with core headline earnings increasing by 26.4% YoY.

We Buy Cars was followed by MAS Plc, Blue Label Telecoms and Reinet Investments with MoM gains of 21.9%, 20.7%, and 18.2%. Blue Label has been buoyed by a combination of company-specific developments, including the announcement that it plans to list its subsidiary Cell C (which has only recently been restored to a sustainable profitability path), on the JSE, its desire to restructure Blue Label’s investments and unlock value for its shareholders, a strong FY24 financial performance and bullish market sentiment. Investor group Reinet’s share price jumped c. 11% on 30 June (extending its 27 June rally), after it confirmed that it was in discussions over the potential sale of its indirect 49.5% interest in the UK-based insurance company, Pension Insurance Corporation.

Sibanye Stillwater (+17.7% MoM) and Ninety One Plc (+13.8% MoM) rounded out June’s top 10 performers. Sibanye’s gains have been driven by a combination of market-wide PGM and gold price dynamics (the soaring platinum price discussed earlier and a gold price that is up 25.9% YTD), company-specific developments, including a strong financial and operational performance and positive investor sentiment. Last month, Sibanye also said it would approve the restart of its R5bn Burnstone gold project in Mpumalanga. Meanwhile, Ninety One was among June’s biggest gainers as shares in the asset management Group rose to a more than seven-month high after it reported steady annual growth despite challenging market conditions. Ninety One posted a 4% YoY increase in assets under management (AUM) to GBP130.8bn (c. R3.16trn), for the year to end-March, with the company saying that the increase in AUM was due to the positive market and foreign exchange effect of GBP9.7bn, which outweighed net outflows. Adjusted operating profit was 1% lower YoY at GBP187.9mn, and HEPS were down 7% YoY to GBp17.2. However, founder and CEO Hendrik du Toit said the company had regained positive flow momentum in the second half of the year under review. Ninety One saw net outflows of GBP4.9bn for the year but said that this represented a “substantial improvement” on the prior year’s net outflows of GBP9.4bn.

Figure 2: June 2025’s 20 worst-performing shares, MoM % change

Source: Anchor, Bloomberg

Industrial, chemical and logistics Group KAP (-19.0% MoM) was June’s worst-performing share. This follows the company’s warning in early June that it expects lower FY25 earnings amid challenging trading conditions. KAP said that its FY25 HEPS is expected to decrease by over 30% YoY, when compared to HEPS of ZAc45.3 in FY24. In updated guidance on the company’s operational performance for the 11 months (to 31 May 2025) of FY25, KAP said trading conditions have remained challenging, with sentiment further dampened by the uncertainty created by the delay in the approval of the national budget, the resultant instability of SA’s Government of National Unity (GNU) and the potential adverse impact of US tariffs. In addition, KAP said that April was a particularly weak month due to the limited trading days. Taking the above into consideration, the Group expects to deliver modest revenue growth, a reduction in EBITDA, a decline in operating profit and meaningfully lower earnings during the period.

KAP was followed by Afrimat with a MoM share price decline of 15.5%, with Sappi (-13.8% MoM) in third place. In May, Afrimat reported a sharp drop in its HEPS to ZAc72.3 for the year to end-February from ZAc567.3c in the previous year, while its operating profit fell by nearly 60% YoY. The decline in earnings was due to falling iron ore prices and the underperformance of SA’s export rail lines. Declining iron ore prices have continued to weigh on Afrimat, and in June, the steelmaking ingredient’s price dropped by a further 3.7% MoM (-7.2% YTD/-7.2% in 2Q25). Iron ore prices are down primarily due to a combination of slowing steel demand in China, particularly in the property sector, and increased global iron ore supply.

Sappi was followed by Karooooo Ltd, Woolworths Holdings and Oceana Group with MoM declines of 12.0%, 11.7% and 11.4% respectively. Karooooo’s decline was triggered by founder Zak Calisto announcing plans to sell 1.5mn of his shares at a discounted US$50/share, which raised concerns about insider confidence and increased share supply. On 11 June, the day before the announcement, the closing share price of Karooooo was US$59.53 on the Nasdaq and R1049.99 on the JSE, meaning the shares were sold well below the trading price. Meanwhile, Oceana Group reported mixed interim results last month with a 2.9% YoY increase in revenue to R5.2bn, driven by higher sales volumes in canned foods and wild-caught seafood. However, lower fish oil and fish meal prices and increased net interest expenses negatively impacted profit, with operating profit down 33.5% YoY and profit after tax falling by 43.7% YoY. Headline earnings for the six months to the end of March were down c. 44% YoY.

DRDGold, real estate investment trust (REIT), Burstone Group, Equites Property Fund and Hosken Consolidated Investments (HCI) rounded out June’s worst-performing shares with MoM declines of 11.1%, 10.5%, 9.3% and 8.8%, respectively. Burstone (formerly Investec Property Fund) released disappointing FY25 results at the end of May, which showed that its revenue dropped to US$2.01bn from US$2.05bn posted in FY24, while it also reported a diluted loss per share of ZAc281.16 compared to EPS of ZAc28.90 recorded in the prior year. Investment holding company HCI reported an uptick in its annual HEPS, primarily driven by the Group’s property and hotels businesses, while its media and broadcasting division recorded a decline. In addition, its oil and gas business remains under pressure, with IOG and African Energy Corp incurring a loss of R262mn (albeit an improvement on the R483mn loss in the prior year). HCI posted a 3% YoY rise in FY25 HEPS to ZAc1,499.5, while its revenue increased by 1% YoY to R13.43bn.

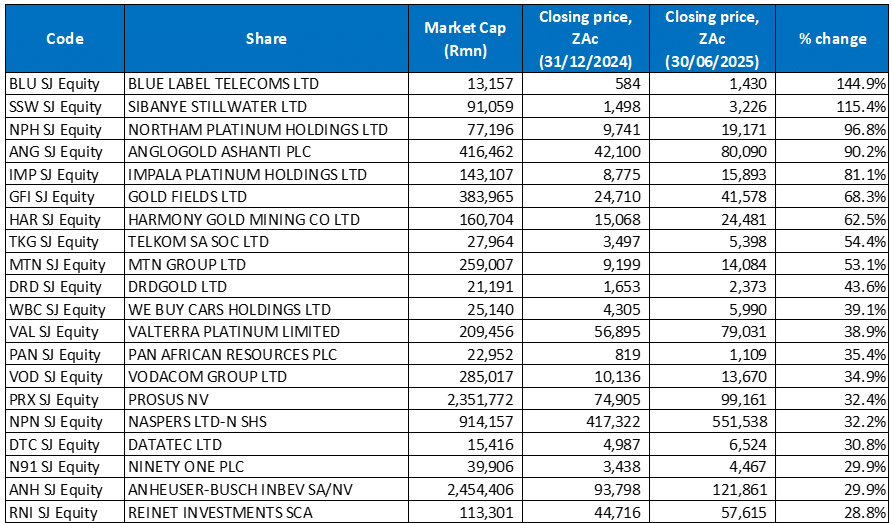

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

The YTD best-performing shares to end June overlapped with those to the end of May as gold miners, whose prices have soared this year despite the gold price’s lacklustre performance in June, continued to feature prominently among the YTD top performers. Sixteen of the year to end May’s 20 best performers were also among the best performing shares for the year to end June, with only four new shares entering the fray – Telkom SA, We Buy Cars, Ninety One Plc, and Reinet.

Blue Label Telecoms (discussed earlier) continued its strong run in June and remained in the top spot YTD with a gain of 144.9%. It was again followed by Sibanye Stillwater (+115.4% YTD, discussed earlier). Sibanye’s improving financial metrics have positioned it as a strong performer in the mining sector, hinting at potential benefits for investors, with some market commentators attributing its share price upswing to Sibanye’s strategic operations and expansion plans, which have aroused investors’ interest.

AngloGold Ashanti (+90.2% YTD) was bumped from third position to fourth by Northam (+96.8% YTD), which gained 26.6% in June on the back of the soaring platinum price. AngloGold was followed by Implats, Gold Fields, and Harmony Gold, with YTD advances of 81.1%, 68.3%, and 62.5%, respectively. Gold Fields gained 2.6% in June while Harmony’s share price came under pressure last month, resulting in the share declining by 4.3% MoM.

Telkom SA (discussed earlier; +54.4% YTD), mobile operators MTN Group (+53.1% YTD), and DRDGold (+43.6% YTD) rounded out the ten best-performing shares to end June.

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

There was also a significant overlap between the year to end-May’s worst-performing shares and the worst-performers to the end of June (YTD), with eighteen shares unchanged and two new entrants to the grouping – HCI and Oceana.

Montauk Renewables (-51.5%) remained the worst performer YTD for a fourth consecutive month, despite the share price recording a 6.5% MoM increase in June. Montauk was again followed by Nutun (formerly Transaction Capital; -44.3% YTD) in second place, with Sappi (-39.6% YTD) replacing Cashbuild in third spot. Nutun is undergoing a two-year restructuring and declined by a further 2.9% in June, following its May share price drop of 24.3%. The company underwent a comprehensive reorganisation in 2024 and now trades as a global specialist business process outsourcing (BPO) operator and provider of collection and debt acquisition services in SA. In May, Nutun reported interim results to the end of March 2025, which showed a revenue decline of 4% YoY to R1.48bn due to a reduced non-performing loans portfolio (NPL) acquisitions in 2024 and 1H25 and the impact on consumer payment behaviour of the adverse SA economic environment. However, Nutun’s headline loss per share improved to ZAc17.2 from a loss of ZAc231.2 in the same period of 2024. The company has suspended its dividend payments until the restructuring has been completed.

Sappi was followed by Afrimat (-38.1% YTD), thermal coal producer and exporter Thungela Resources (-36.6% YTD), KAP Ltd (discussed earlier; -33.2% YTD), Truworths (-31.1% YTD), and Curro Holdings (-31.0% YTD). Thungela’s share price has been under pressure due to lower-than-expected energy demand in Europe and Asia, which has led to lower thermal coal demand and prices. Since 2023, China and India have bought less thermal coal, weighing on Thungela’s revenues. Challenges with Transnet Freight Rail’s performance, which is a key constraint in Thungela’s ability to export coal, have also weighed on its share price.

Finally, Italtile (-29.3% YTD) and Aspen Pharmacare (-27.5% YTD) rounded out the ten worst-performing shares YTD. Aspen’s share price has declined due to a combination of factors, including a disappointing financial performance, a “material contractual dispute” impacting its manufacturing and technology agreement, and concerns about potential losses from its investment in mRNA technology.