Despite trade tensions continuing to weigh, most major global equity markets recorded good gains in August (MSCI World +2.6% MoM/+14.1% YTD), supported by strong US corporate earnings, improving risk sentiment and investors ramping up bets that the US Federal Reserve (Fed) will cut rates in September. This follows remarks made by Fed Chair Jerome Powell speaking at an annual central banking forum in Jackson Hole, where Powell said that the US job market is on such shaky ground that the Fed may soon need to cut rates to support the economy (the Fed has kept rates unchanged for eight straight months). Elsewhere, the US slapped a 50% tariff on Indian imports late last month—triggering renewed market volatility across Asia. At the same time, banking sector concerns in the UK (especially around taxation) helped pull back sentiment in European markets.

Still, notwithstanding the late-month pullback into the US Labor Day long weekend, the S&P 500 closed 28 August at 6,501.86 — its first time above the 6,500 mark, before ending the month at 6,460.26 – up 1.9% MoM and 9.8% YTD. The Dow also set a record on the day, closing at 45,636.90, before ending August at 45,544.88 (+3.2% MoM/+7.1% YTD). The Nasdaq rose by 1.6% MoM (+11.1% YTD) – its fifth consecutive positive month. Gains were driven by renewed optimism around the artificial intelligence (AI) trade as better-than-expected quarterly earnings from Nvidia (accounting for c. 8% of the S&P) helped boost investor confidence in the sector.

In US economic data, July headline inflation, as measured by the Consumer Price Index (CPI), held steady at 2.7% YoY – unchanged from June. Core CPI, excluding food and energy, climbed 3.1% vs June’s 2.9% YoY print. July’s core personal consumption expenditure (PCE), excluding food and energy, the US Fed’s preferred inflation gauge, accelerated to 2.9% YoY (the highest level since February) vs June’s 2.8% print. The Commerce Department said last week that 2Q25 GDP grew at an annualised 3.3% – this was better than initial estimates of 3.0% growth. The print was boosted by consumer spending (+1.6% vs an initial +1.4% estimate) and a drop in 2Q25 imports (-29.8% QoQ, due to new tariffs).

European markets have performed well this year, but the last week of August proved especially challenging as political turmoil inside the EU, headlined by the 8 September no-confidence vote in France on the government’s plans to cut public spending, and the impacts of trade policy on the bloc, brought potential pitfalls to the fore. Germany’s DAX retreated by 0.7% MoM (+20.1% YTD), while France’s CAC closed 0.9% lower (+4.4% YTD). July eurozone headline inflation printed at 2.0% – unchanged from June and in line with the European Central Bank’s (ECB) 2.0% target. Core inflation was also unchanged at 2.3%.

In the UK, late August turbulence cast a shadow on equity markets. The FTSE 100 advanced slightly (+0.6% MoM/+12.4% YTD), hitting a record closing high of 9,321.40 on 22 August, before UK bank stocks dropped sharply last week amid fears of a new tax on their profits, weighing on the FTSE’s performance. UK July inflation hit another higher-than-expected level – increasing 3.8% YoY (the highest since January 2024) after reaching 3.6% in June. Core inflation rose 3.8% YoY vs 3.7% in June.

In China, equities had a stellar August with Chinese markets buoyed by increasing efforts from the government to promote local chip production, while continued softness in the economy ramped up investor hopes that Beijing will dole out even more stimulus measures. The Shanghai Composite Index jumped 8.0% in August (+15.1% YTD), while Hong Kong’s Hang Seng rose by 1.2% (+25.0% YTD). China’s July retail sales were weak, decreasing from 4.8% in June to 3.7% in July, continuing a disappointing trend, with no sustained recovery in Chinese consumer spending (before the COVID-19 pandemic, China’s retail sales were growing at a rate of 8% to 10% p.a.). The core issue remains extremely depressed consumer sentiment (directly linked to the poor performance of the country’s housing market over the past few years), which plummeted in 2022 and has shown no signs of a meaningful rebound. China’s official manufacturing PMI shrank for a fifth month in August to 49.4 vs July’s 49.3, remaining below the 50-mark separating expansion from contraction. The non-manufacturing PMI, which includes services and construction, expanded to 50.3 from 50.1 in the prior month.

Japan’s benchmark Nikkei ended August 4.0% higher (+7.1% YTD). July headline inflation declined to 3.1% YoY vs June’s 3.3% print – its lowest level since November 2024. Still, it marked the 40th straight month that inflation has run above the Bank of Japan’s 2% target. The so-called “core-core” inflation rate, excluding the prices of fresh food and energy, held steady at 3.4%. Japanese industrial production shrank more than expected in July, while retail sales data also disappointed.

Among commodities, Brent crude (-6.1% MoM/-8.7% YTD), which posted gains in a July rally, fell back, ending the month at c. US$68.12/bbl. However, gold surged 4.8% higher MoM (+31.4% YTD) after dipping early in August, the yellow metal rebounded sharply amid weak US jobs data, dovish central bank signals and a weaker US dollar. Among the platinum group metals (PGMs), platinum gained 6.1% MoM (+51.1% YTD), while palladium (-7.9% MoM/+21.0% YTD) and rhodium (-2.1% MoM/55.2% YTD) ended August lower. Iron ore prices rose c. 2.9% MoM (+3.3% YTD), supported by expected cuts to steel production and potential government support for China’s struggling property market – a key driver of steel demand.

The FTSE JSE All Share Index (ALSI) recorded its sixth consecutive monthly advance in August, up 3.4% MoM (+21.1% YTD), while the Capped SWIX ended 3.5% higher (+22.9% YTD). Advances were led by a concentrated rally in commodity-linked shares (Resi-10 +11.6% MoM/+70.0% YTD) as precious metals miners were again among the most significant contributors to the JSE’s gains in August, buoyed by rising gold and platinum prices. At the same time, the broader market was constrained by an underperformance in domestically focused shares (SA Inc. stocks). Listed Property (+2.8% MoM/+10.1% YTD) delivered strong contributions, while industrials (Indi-25 +1.2% MoM/+18.2% YTD) and financials (Fini-15 +1.0% MoM/+5.7% YTD) recorded gains but lagged in comparison. The rand firmed by 3.1% MoM against a weaker US dollar (+6.3% YTD).

In domestic economic data, July headline inflation edged higher to 3.5% YoY, from 3.0% in June, marking its highest print since September 2024. MoM, inflation ticked up to 0.9% from 0.3% in June, primarily driven by food costs, municipal tariff adjustments, and higher fuel prices. July core inflation advanced slightly to 3.0% YoY vs June’s 2.9% print.

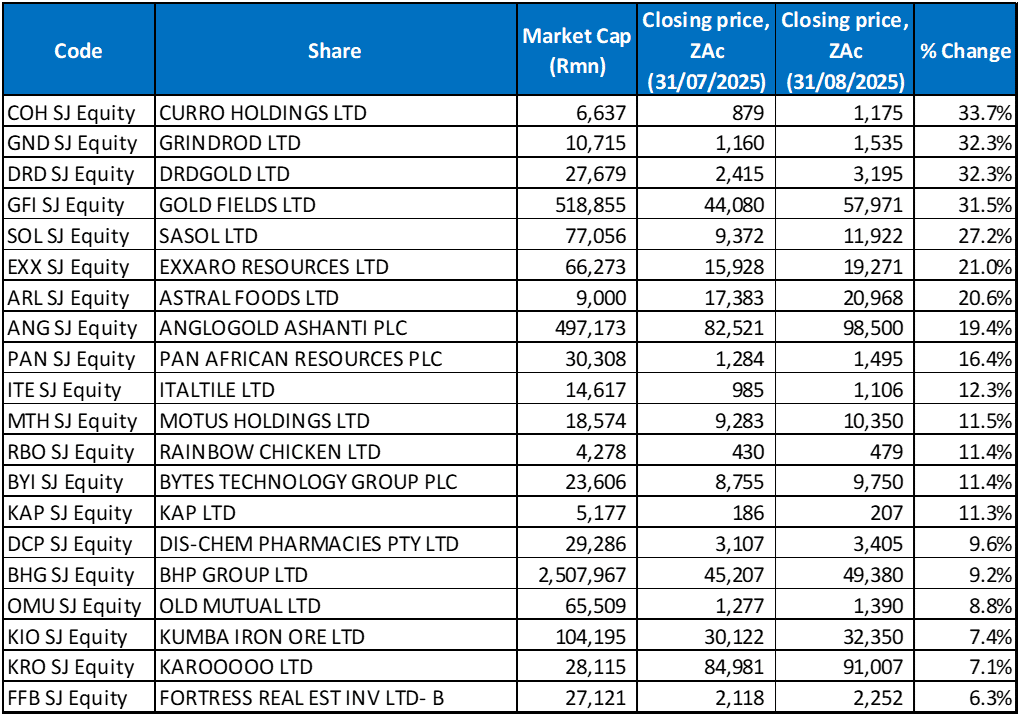

Figure 1: August 2025’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

The best-performing share in August was the education Group, Curro (+33.7% MoM), following a R7.2bn buyout offer for the company from the charitable foundation set up by PSG Group founder, Jannie Mouton. The aim is to delist Curro and convert it into a non-profit organisation to expand access to quality education.

Logistics giant Grindrod and gold miner DRDGold followed – both were up 32.3% MoM. After Grindrod announced on 22 August that it would reward shareholders with a special dividend on the back of a boost to earnings from recent asset sales, its share price rocketed, reaching the highest level in c. nine months and closing 10.9% higher on the day. Grindrod reported a R903mn cash injection from the sale of non-core assets in 1H25, resulting in a 23% YoY jump in its headline earnings to R592mn, or ZAc88.7/share. This saw it declare a special dividend of ZAc32.3/share in addition to an interim payout of ZAc23/share. Meanwhile, DRDGold reported results for the year ended 30 June, showing that despite a drop in gold production, its revenue rose to R7.9bn and net income reached R2.2 bn. The stronger sales and profit growth led the gold miner to announce a final cash dividend of ZAc40/share for the year. The earnings boost was primarily driven by a c. 31% increase in the rand price of gold.

DRDGold was followed by another gold miner, Gold Fields (+31.5% MoM), which declared a dividend of R7/share for 1H25 vs a dividend of R3/share declared in 1H24, as its net profit increased to US$1.03bn from US$389mn for the prior comparable period. The Group’s strong performance was attributed to a solid operational performance, coupled with a higher gold price.

In its results for the year ended 30 June 2025, Sasol (+27.2% MoM) reported that its turnover decreased by 9.5% YoY to R249.1bn, while its headline EPS rose 93% YoY to R35.13. Sasol’s share price surged the most in more than four years on the day of the results release (25 August) after the energy and chemical company slashed impairments and outlined progress on management’s turnaround plan for the business. The share is now up 43.2% YTD as investors continue to warm to the Group following its capital markets day in May, which outlined a refreshed strategy to get Sasol back on a growth path and ultimately pay dividends again.

Exxaro, Astral Foods and AngloGold Ashanti with MoM gains of 21.0%, 20.6% and 19.4%. Exxaro’s share price shot up after the mining and renewable energy Group declared its 45th consecutive dividend of R8.43/share (+6% YoY) for 1H25 and following the acquisition of manganese assets for up to R14bn. The Group reported a 13% YoY HEPS increase to R17.24, while revenue rose 8% YoY to R20.6bn. Gold miner, AngloGold, recorded an improved performance in its 2Q25 results released last month, driven by greater gold production, strong gold prices and “disciplined” cost management. Revenue from product sales rose to US$2.45bn from US$1.38bn posted in 2Q24, while diluted EPS stood at USc132, compared with USc60 recorded in 2Q24.

Pan African Resources (+16.4% MoM) and Italtile (+12.3% MoM) rounded out August’s ten best-performing shares. Tile retailer Italtile’s share price firmed after it declared a special dividend payout despite its profit remaining flat for the year to end-June. The Group declared a special dividend of ZAc98/share on the back of strong cash generation and cash reserves in excess of operational requirements. For the year, HEPS rose 2% YoY to ZAc125.1 as system-wide turnover retreated by 2% YoY amid a weaker performance at its manufacturing and supply chain unit. However, its retail segment edged up 1%, while Italtile’s Online stores and the East African operations also stood out as bright spots. The company warned that weak SA economic growth, cheap imports and tariffs in neighbouring markets would keep pressure on its margins. Italtile said that it planned to intensify cost control and efficiency while reviewing its non-core assets.

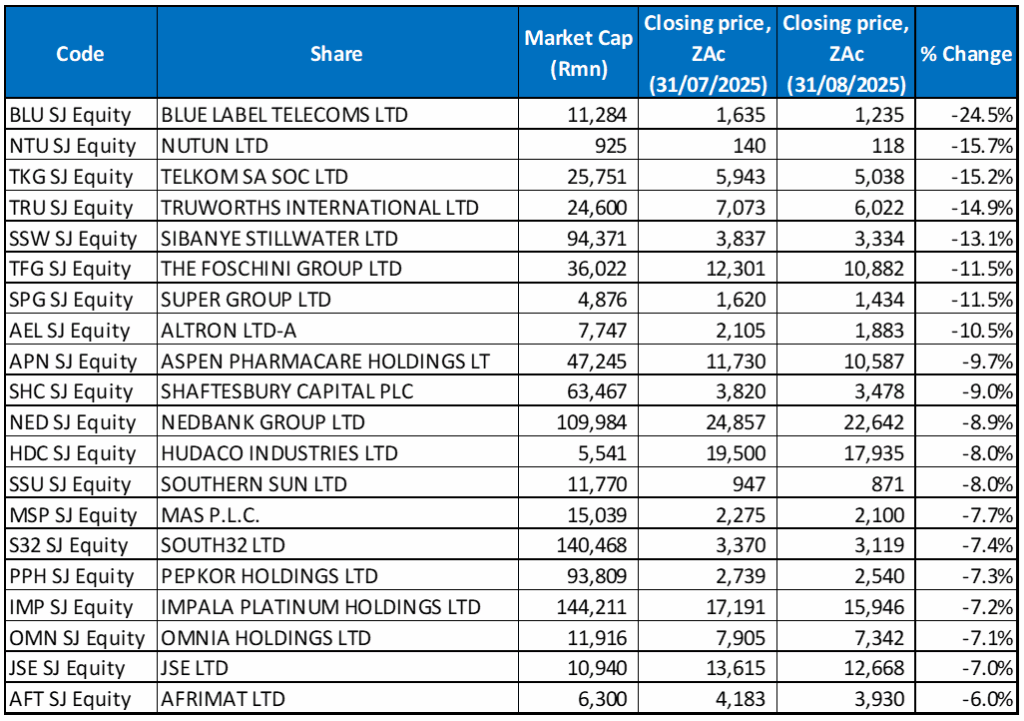

Figure 2: August 2025’s 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

After a good run this year, Blue Label Telecoms was August’s worst-performing share with a MoM share price decline of 24.5%. Last week, the share price plummeted over 20% on the day after it released its FY25 results. Core HEPS rose to ZAc461.63 from ZAc76.08 a year ago, while gross profit advanced by 2% YoY to R3.38bn. Blue Label reported a 264% increase in net profit after tax to R2.48bn, crediting Cell C for its positive contributions to earnings. However, despite the significant earnings growth, Blue Label’s revenue declined by 4% YoY to R14.05bn for the period under review. The company said that only the gross profit earned on “PINless top-ups”, prepaid electricity, ticketing and universal vouchers is recognised as revenue. If this is adjusted, its effective revenue growth was c. 7% YoY, resulting in a total revenue print of R96bn, compared to R89.3bn in the prior year. The company’s board also elected not to declare a dividend.

Blue Label was followed by Nutun Ltd and Telkom SA with MoM declines of 15.7% and 15.2%, respectively. Shares in Telkom fell after the Group’s 1Q25 trading update on 5 August showed that its IT services subsidiary, BCX, disappointed (BCX revenue fell 8.3% YoY). Overall, this dragged down an otherwise strong quarterly performance as Telkom reported an overall robust 1Q25 financial performance by focusing more on its mobile data and fibre-based services, where revenue grew by 9.6% and 11.3% YoY, respectively, and disposing of non-core assets. In 2024, Telkom sold its masts and towers business, Swiftnet, for R6.6bn – a cash injection that continues to benefit its balance sheet, with R4.75bn worth of debt being settled since the previous year-end.

Clothing retailer, Truworths and gold and PGM miner Sibanye Stillwater posted MoM declines of 14.9% and 13.1%, respectively. Truworths delivered disappointing results in August with HEPS for its financial year to 30 June falling 8% YoY to ZAc752.1, while Group trading profit decreased by 31.4% to R2.9bn. Revenue increased by 2.7% YoY to R22bn, with growth impacted negatively by Truworths Africa, the Group’s biggest business, which reported a 0.4% decline in sales (to R14.5bn). Sibanye Stillwater’s share price gave up some of its sharp 12-month gains after the miner reported impairments for its US platinum operations and on its Keliber lithium project, and despite forecasting a 19-times increase in HEPS. Sibanye said 1H25 HEPS was expected to be between ZAc180 and ZAc200, representing an increase of more than 100% compared with the ZAc10 reported in 1H24. The impairment of non-financial assets at its US PGM operations was a consequence of the One Big Beautiful Bill Act (OBBBA) signed into US law on 4 July 4. The OBBBA amended the treatment of credits for critical minerals, previously assumed to be evergreen. Under the amended terms, the credits will be phased out in equal annual increments from 2031 to 2034, after which they will be terminated.

The Foschini Group (-11.5% MoM) also delivered a disappointing trading update, which showed that Group sales increased by 11.5% YoY to R14.40bn, with online sales advancing by 45.5% and now contributing 14.5% of the total retail sales, following the acquisition of White Stuff. Meanwhile, TFG Africa online sales grew by 40.2%, driven by the company’s Bash platform. However, Foschini said that June sales in its TFG Africa segment had flattened, following the first eight weeks of the 2026 financial year, which had recorded strong sales.

Super Group, Altron Ltd -A-, and Aspen Pharmacare recorded MoM declines of 11.5%, 10.5% and 9.7%, respectively. Altron’s share price dropped c. 10% on 28 August following a voluntary trading update that showed a flat revenue and EBITDA performance for the six months to the end of August 2025. The company said that a more challenging operating environment with tight IT budgets was to blame. Pharmaceuticals Group, Aspen, fell after warning it would report an annual loss because of impairments of R4.1bn and increased restructuring costs. The company said that the retrospective implementation of global minimum tax legislation in SA, coupled with the Mauritian government’s announcement of a qualified domestic minimum top-up tax of 15%, effective FY25, had impacted its Commercial Pharmaceuticals brand valuations and Group effective tax rates.

Rounding out the ten worst-performing shares was property developer, Shaftesbury Capital, with a MoM decline of 9.0%.

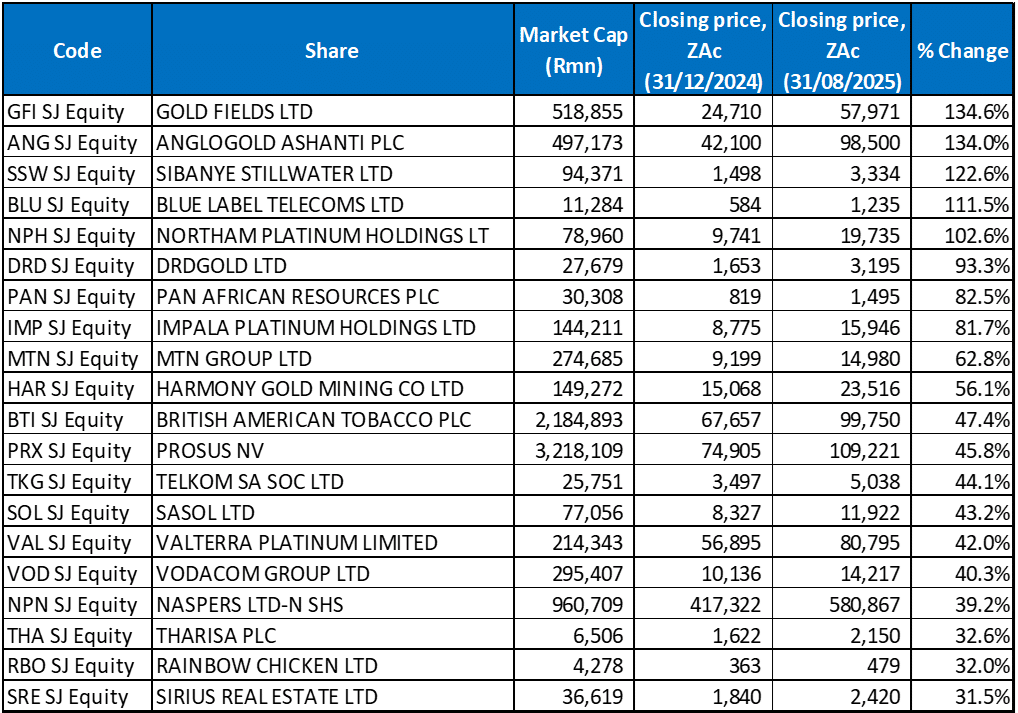

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

Mining stocks and record gold and platinum prices—spurred by safe-haven demand amid global policy uncertainty and a weaker US dollar—continued to power the JSE’s YTD rally. The result is that half of the top-performing shares for the year to end August have again come from the resources sector. There is also a major overlap with those to the end of July as gold (and platinum) miners, whose share prices have soared this year, continued to feature prominently among the YTD best performers. Eighteen of the year to end July’s best performers were also among the best performing shares for the year to end August, with only two new entrants in the rankings – Sasol and Rainbow Chicken.

Gold miners bumped Blue Label Telecoms (discussed earlier) from the top spot as its share price dropped by 24.5% MoM in August, moving it from number one to the fourth best performer YTD. Gold Fields took the best-performing share YTD position with an impressive 134.6% gain, after its share price soared by 31.5% last month. It was followed closely by AngloGold Ashanti (+134.0% YTD), which reported improved second-quarter results, supported by higher gold prices and increased sales volumes, with Sibanye Stillwater (+122.6% YTD) in third place. Sibanye’s 2025 surge, powered by improving financial metrics, has positioned it as a strong performer in the mining sector, with some market commentators attributing its share price rise to the miner being undervalued. Unfortunately, the share came under pressure in August, declining 13.1% MoM despite boasting a 19-fold increase in 1H25 earnings and narrowing its losses to US$211mn, from US$372mn in 1H24.

Northam was in fifth place with a YTD gain of 102.6%. Its share price fell by 5.9% in August after the platinum miner reported a 14.4% YoY drop in FY25 profit, as mining costs surged, despite record sales volumes. HEPS came in at R3.81, compared with R4.45 in FY24.

Northam was followed by DRDGold (discussed earlier), Pan African Resources and Impala Platinum (Implats) with YTD gains of 93.3%, 82.5%, and 81.7%. Last month, Implats reported a weaker operational performance in FY25 as its headline earnings plunged by 70% YoY to R732mn as lower sales volumes and muted rand PGM prices weighed on its profitability. Revenue was down 1% at R85.5bn after a 3% slip in PGM output to 3.55mn ounces. Implats delivered gross profit of R2.4bn, down 55.3%. Still, despite the plunge in earnings, Implats surprised investors with its first dividend payout in c. two years, signalling the board’s confidence in its prospects amid a resurgence in PGM prices.

Mobile operator MTN Group (+62.8% YTD) and Harmony Gold (+56.1% YTD) rounded out the ten best-performing shares for the year to end August. MTN declined by 2.3% last month after the telecoms Group said it had been approached, through its external US counsel, regarding a US Department of Justice (DoJ) grand jury investigation relating to MTN Group, its former subsidiary in Afghanistan and Irancell. Harmony’s share price came under pressure in late August as the company warned of significantly rising operational costs, including higher electricity and labour expenses, despite record-high gold prices and a substantial profit for Harmony.

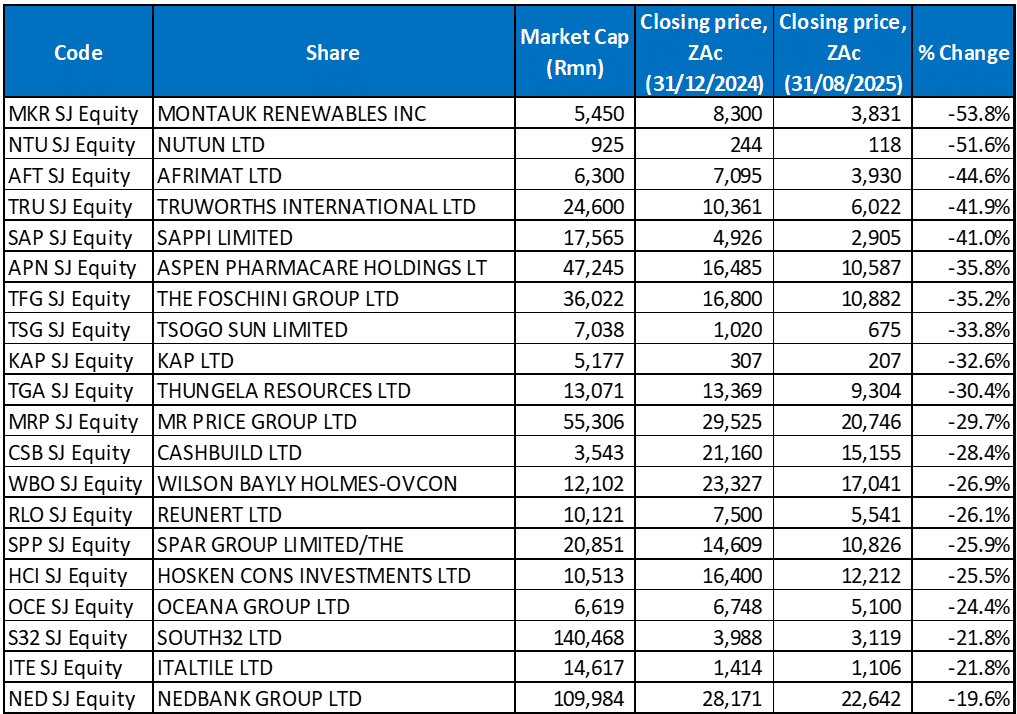

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

The worst-performing shares for the year ending August (YTD) showed a significant overlap with those to the end of July, with eighteen stocks unchanged and only two new additions – South32 Ltd and Nedbank. Renewable energy company Montauk Renewables (-53.8%) remained the worst performer YTD for a sixth consecutive month, followed by Nutun (formerly Transaction Capital; -51.6% YTD) with Afrimat (-44.6% YTD) in third place. Montauk shares slid 3.9% last month after the company posted its 2Q25 results, which showed widening losses as higher costs and impairments offset modest revenue growth. Montauk’s loss per share stood at US$0.038, which further deteriorated from a US$0.005 loss in 2Q24. Nutun continued to drift lower amid restructuring and disposals, while Afrimat was down 6.1% MoM in August after it said in its latest business update that structural constraints continued to weigh on its customer base. Afrimat added that it remains focused on eliminating losses in its cement division and unlocking value through targeted expansion. The company said that while 1Q25 was weak, there were signs of improvement in 2Q25, including in sales volumes and significant progress made on the integration of the Lafarge business.

Afrimat was followed by Truworths (discussed earlier; -41.9% YTD), Sappi (-41.0% YTD) and Aspen (discussed earlier; -35.8% YTD). Sappi released 3Q25 results last month, reporting a US$33mn loss after a US$20mn loss was recorded in 2Q25. Adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) came in at US$390mn for the first nine months, down 15% YoY. As Trump’s trade wars put pressure on its profitability, Sappi posted a net debt position of US$1.95bn at the end of June, up 45% from the previous first three quarters. Due to the weaker results and its growing debt burden, Sappi announced that no FY25 dividend would be declared. Its CEO attributed the jump in Sappi’s debt levels to weaker profitability, a softer US dollar and investment in its Somerset Mill in the US.

Retailer Foschini (discussed earlier), Tsogo Sun, chemical and logistics Group Kap Ltd, and thermal coal producer and exporter Thungela Resources rounded out the year to end August’s worst-performing shares with losses of 35.2%, 33.8%, 32.6%, and 30.4%, respectively. Last week, Kap reported disappointing FY25 results, with revenue rising by 2% YoY to R29.6bn, while operating profit fell 14% YoY to R1.9bn. HEPS plummeted 47% YoY to ZAc24.1. Despite solid operational execution and share buybacks, Thungela’s share price came under pressure again after it reported a sharp drop in first-half earnings as weaker coal prices and rising costs squeezed margins. Revenue fell 12% YoY to R14.8bn, driven by weaker export coal prices in SA and Australia, and pressure from a softer rand against the US dollar. Thungela said operating pressures were aggravated by higher production costs, particularly at the Ensham mine in Australia, where difficult mining conditions and inclement weather drove export costs up 25% and reduced its first-half output by 16%. Thungela still declared an interim dividend and announced a new share buyback programme.