US markets had a difficult start to a historically challenging month for equities, retreating in the first week of September but rebounding as buy-the-dip interest supported the market, and upside momentum acted as a catalyst driving US equities higher. While US markets seemed shaky after the release of August core (excluding food and energy) inflation, which remained above the US Federal Reserve’s (Fed) 2.0% target at 3.2% YoY, positive momentum continued following the Fed’s 50-bp rate cut. Signs of resilience in US economic data reinforced expectations that the economy would enjoy a soft landing and that the Fed would cut rates to secure such an outcome. Besides Fed rate cut optimism, the belief that global growth prospects will improve as the European Central Bank (ECB) and the People’s Bank of China (PBoC) move towards more accommodative monetary policies also buoyed markets (MSCI World +1.9% MoM/+19.3% YTD/+6.5% 3Q24). China’s announcement on 23 September of some of the boldest stimulus measures in years to boost its economy and revive growth saw global markets rally. According to China’s official Xinhua News Agency, President Xi Jinping’s Politburo meeting on 26 September concluded with a pledge to support fiscal spending, stabilise the real estate sector, and strive to achieve China’s annual economic goals.

Historically, September has been the worst month of the year for equities, but this past month broke with that tradition. In the US, the three major indices ended the month in the green, reaching new record highs and becoming the first positive September for all three indices since 2019. The Dow rose by 1.8% MoM (+12.3% YTD; +8.2% 3Q24), while the S&P 500 ended the month 2.0% higher (+20.8% YTD/+5.5% 3Q24), and the tech-heavy Nasdaq advanced by 2.7% MoM (+21.2% YTD/+2.6% 3Q24).

On the economic data front, US August inflation continued to slow, falling for a fourth consecutive month, with headline inflation, as measured by the Consumer Price Index (CPI), at 2.5% YoY vs July’s 2.9% print. However, core CPI, excluding the erratic food and energy components, i.e., prices for other items, remained sticky, climbing 3.2% YoY (unchanged from July). MoM, July headline and core inflation rose by 0.2% and 0.3%, respectively. August US retail sales surprised on the upside, rising 0.1% MoM (expectations were for a 0.2% decline) vs July’s upwardly revised surge of 1.1%. YoY, retail sales increased by 2.1% vs July’s 2.7% rise. The core personal consumption expenditures (PCE) price index, excluding food and energy, a key Fed inflation gauge, advanced by a lower-than-expected 2.7% in August vs July’s 2.6% YoY print. MoM, core PCE was up a modest 0.1%.

Major European equity markets ended higher in September as China’s stimulus measures carried over to European equities. MoM, Germany’s DAX was up 2.2% (+15.4% YTD/+6.0% 3Q24), while France’s CAC ticked up slightly (+0.1% MoM/+1.2% YTD/+2.1% 3Q24). In economic data, August eurozone headline inflation dropped to 2.2% YoY (the lowest level since July 2021) from 2.6% in July, while core inflation, excluding energy, food, alcohol, and tobacco prices, eased to 2.8% from July’s 2.9% print. In Germany, August inflation fell to 2.2% YoY (the lowest since March 2021) vs July’s 2.7%, while France’s harmonised August inflation dropped sharply to 2.2% YoY from July’s 2.7% print. At its September policy meeting, the ECB lowered its key lending rate (by 25 bps) to 3.5% – its second cut in this easing cycle, which started in June.

The UK stock market, however, ended the month in the red, with the blue-chip FTSE-100 down 1.7% in September (+6.5% YTD/+0.9% 3Q24). UK inflation was unchanged from July, coming in at 2.2% YoY in August – slightly above the Bank of England’s (BoE) 2.0% target rate. August services inflation, a component closely watched by the BoE given its reflection of domestically generated price rises, increased to 5.6% YoY from 5.2% in July. Core inflation also increased at 3.6% YoY, up from July’s 3.3% print. After delivering its first interest rate cut in four years on 1 August, the BoE held rates steady at 5% during its September meeting.

In Asia, China unveiled its biggest economic stimulus package since the COVID-19 pandemic in September in its latest attempt at reviving the economy, which has been in a slump caused by a shaky property market, deflationary pressures, and depressed investor confidence. It includes US$325bn-plus in stimulus measures, primarily via monetary vs fiscal channels and will make it easier to invest in real estate, reduce some home deposits, and cut rates. While markets had expected some of the announced measures, the highly publicised rollout seemed to indicate Chinese authorities are taking warnings seriously that the country risks missing its c. 5% growth target this year. The announcement provided a strong tailwind for risk assets. However, market commentators doubt whether it will be enough to break long-term deflationary pressure and the entrenched real estate crisis in China. Either way, it was an adrenalin shot for equity markets in the last week of September, with the Shanghai Composite ending the month 17.4% higher (+12.2% YTD/+12.4% 3Q24) – its first gain in five months and its best MoM performance since 2015. Hong Kong’s Hang Seng rose 17.5% MoM (+24.0% YTD/+19.3% 3Q24). Chinese markets will be closed for the country’s Golden Week holiday from 1 October.

China’s August retail sales (+2.1% YoY) and industrial production (+4.5% YoY) advanced slower than expected. August inflation rose for a seventh consecutive month (+0.6% YoY), but the rise was below forecasts and well below the 3% rate targeted by the PBoC. September Manufacturing PMI came in at 49.8, higher than August’s 49.1 and better than the Reuters consensus expectation of 49.5 but still the fifth consecutive month below 50. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, came in at 50 in September, decelerating from 50.3 in August. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei ended September 1.9% in the red (+13.3% YTD/-4.2% 3Q24) following mixed economic data and as equities dropped on the back of expectations that the country’s incoming prime minister, Shigeru Ishiba, would pursue policies keeping the yen strong — which would weigh on Japanese exporters. In economic data, August headline CPI stood at 3.0% (a 10-month high) vs July’s 2.8%, amid a sustained pick-up in consumption on the back of higher wages. Core-core inflation (excluding fresh food and energy prices and considered by the Bank of Japan [BoJ] when formulating monetary policy) printed at 2.0% YoY vs 1.9% in July. At its September meeting, the BoJ kept its benchmark interest rate steady at c. 0.25% — the highest rate since 2008.

On the commodities front, oil prices fell for a third month in September, with the price of Brent crude declining by 8.9% (-6.8% YTD/-16.9% 3Q24) as high supply levels seemed to offset the escalating conflict in the Middle East. While oil declined, most commodities rallied following the announcement of wide-ranging stimulus measures in China. Gold continued its uptrend (+5.2% MoM/+27.7% YTD/+3.2% 3Q24 [its biggest quarterly gain since 2016]), posting fresh highs (it closed September at US$2,634.58/oz). Among platinum group metals (PGMs), the platinum price gained 5.6% MoM (-1.4% YTD/-1.0% 3Q24), palladium rose 3.5% MoM (-8.8% YTD/+2.7% 3Q24), and rhodium was up 1.1% MoM (+7.3% YTD/+2.2% 3Q24). In a rapid rise from below US$90/tonne in early September, iron ore posted robust gains of 5.2% MoM (-24.3% YTD/-2.1% 3Q24) buoyed by China’s stimulus announcement. China is the largest iron ore market.

In South Africa (SA), the FTSE JSE All Share Index breached the 87,000 level last month before retreating to close at 86,548 on 30 September – up 3.3% MoM (+12.6% YTD/+8.6% 3Q24). Improved global investor sentiment following China’s announcement of new stimulus measures, easing monetary policies from the Fed and the South African Reserve Bank (SARB), optimism around SA’s Government of National Unity (GNU), and no loadshedding for c. six months were among the factors that boosted the local bourse. The Capped SWIX was up 4.0% MoM (+15.9% YTD/+9.6% 3Q24). Industrial counters, as measured by the Indi-25, outperformed, rising by 4.8% MoM (+15.5% YTD/+10.7% 3Q24), followed closely by the SA Listed Property Index, which was up 4.7% MoM (+25.7% YTD/+18.3% 3Q24) as property shares continued to outperform. A turnaround in the prices of several commodities saw the Resi-10 recoup some of its August losses with a 3.1% MoM gain (+0.5% YTD/-2.1% 3Q24). The Fini-15 rose by 1.4% MoM (+18.8% YTD/+12.5% 3Q24).

Highlighting the September share price performances of the largest JSE-listed shares by market cap, BHP Group, the biggest share on the exchange, jumped 9.9% MoM as iron ore prices rose on China’s stimulus announcements. BHP was down 2.9% in August after it reported muted FY24 earnings growth and cut its dividend. Meanwhile, the second and third-biggest shares on the bourse – Anheuser-Busch InBev (AB InBev) and Prosus were up 5.2% and 14.3% MoM, respectively. The rand has strengthened to c. R17.23/US$1 (a 20-month high) over the past few weeks, with the biggest driver being the inevitability of domestic and global rate cuts, ending September 3.2% stronger vs the greenback (+6.3% YTD/+5.4% 3Q24).

In local economic data, August headline inflation eased further to 4.4% YoY from 4.6% in July, marking the lowest headline inflation rate since April 2021. The easing of price pressures appears widespread, with a notable slowdown in energy prices (down from 12.1% YoY in July to 11.5%). However, inflationary pressures persist in certain areas, as witnessed by the slight uptick in food, alcoholic beverages, and tobacco products. Core inflation (excluding food, fuel, and electricity) moderated to 4.1% YoY in August vs July’s 4.3% print. This was the lowest core inflation level since May 2022. Against this backdrop of decelerating inflation, the SARB’s Monetary Policy Committee (MPC) decided to lower the repo rate by 25 bps to 8% p.a. SA consumer confidence hit a five-year high last month, with the FNB/BER Consumer Confidence Index (CCI) rising from -10 to -5 index points in 3Q24 – its second consecutive five-point increase. This rise, while still below the long-term average of zero since 1994, is the highest confidence level recorded since 1H19. On the GDP front, SA’s economy started the year with a whimper, recording a revised 0.0% QoQ growth rate in 1Q24. However, in 2Q24, the economy strengthened by 0.4% QoQ. The finance, manufacturing, trade, and electricity, gas & water supply industries drove most of the economy’s production or (supply) side momentum. On the expenditure (demand) side, household consumption, government consumption, and a build-up in inventories contributed favourably to growth.

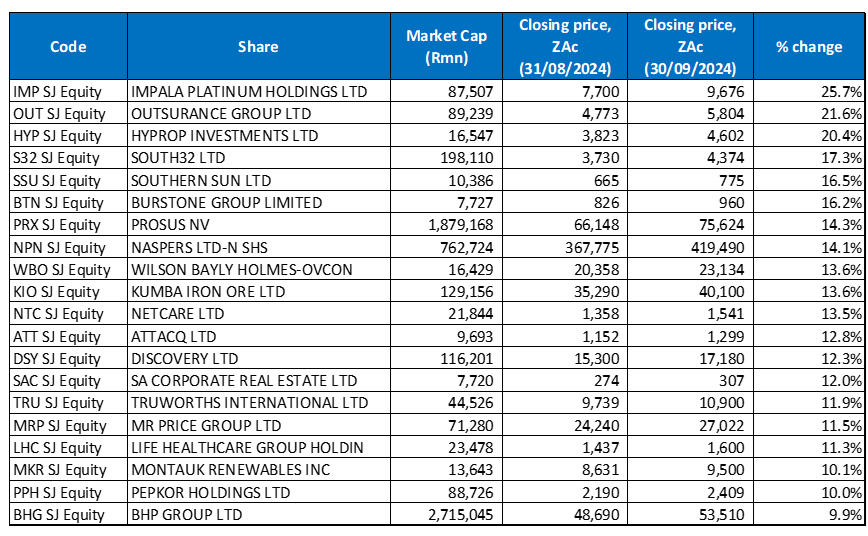

Figure 1: September 2024 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

China is the largest consumer of SA commodities, so mining counters have benefitted from improved sentiment following Beijing’s recently announced stimulus measures. These companies and other China-exposed names, such as Naspers and Prosus, featured prominently among September’s best-performing equities. Property counters were also among the winners, continuing their recent outperformance as interest rate cuts locally and abroad boosted sentiment (property companies are more sensitive than other sectors to interest rates).

Impala Platinum (Implats) was September’s best-performing share, jumping 25.7% MoM, albeit from an oversold position (the share price was down 17.4% in August). Higher PGM prices, especially the platinum price ending September 5.6% higher, seemed to spur the gain. According to the World Platinum Investment Council (WPIC), platinum is forecast to move into a wider supply deficit this year. In its 2Q24 report, the WPIC said platinum demand would exceed supply by an expected 1.03mn ounces in 2024. The Implats CEO recently ruled out the development of new PGM mines in SA, noting the long-term outlook for demand in electric vehicles (EVs) has reduced the desire to develop assets in this sector. PGMs, used mostly for internal combustion engines, have come under pressure due to the popularity of battery-operated EVs. Implats, which recently reported an annual loss after taking R20bn in write-down charges, completed its restructuring last month, resulting in c. 4,000 workers losing their jobs.

The insurer, OUTsurance Group, was September’s second-best performing share, with a 21.6% MoM gain. The share price surged 8.2% on 17 September after it reported a strong FY24 performance. OUTsurance recorded a rise in insurance revenue of 18.9% YoY to R31.91bn, while its normalised EPS jumped 10.2% YoY to ZAc230.6. It also lifted its ordinary dividend by 29% YoY and declared a special dividend of ZAc40/share.

Hyprop Investments (+20.4% MoM), in third place, reported FY24 results, which showed that revenue rose to R4.74bn from R4.37bn posted in FY23, while its diluted EPS decreased by 36.5% YoY to ZAc273.4. Hyprop also reported distributable income of R1.41bn in the year to the end of June, or ZAc370.4/share. Although this was 8.6% lower than in FY23, it was better than the guidance Hyprop provided when it released its FY23 results, which was for the measure to be 10%-15% lower YoY due to higher interest costs. The real estate investment trust (REIT) also saw a strong operational performance from its SA and Eastern Europe portfolios, contributing to the distributable income per share being ahead of previous guidance.

Diversified mining and metals group South32 (+17.3% MoM), which has seen its share price bolstered by China’s wide-ranging stimulus measures, said last month it had been awarded a US$166mn (c. R2.9bn) grant from the US Department of Energy. This is to develop a commercial-scale manganese production facility at its Hermosa project in Arizona. The South32 CEO said that the grant recognised the potential of Hermosa’s manganese deposits to “supply battery-grade manganese to the emerging North American market”.

In a 1H24 trading update, hotels and resorts company Southern Sun (+16.5% MoM) said that its trading volumes have improved marginally for the first five months of its financial year ending 31 March 2025. It said that Group occupancy was 57.1% vs 55.9% recorded in the prior year. The average room rate increased by 1.7% for the five months to end-August compared to the previous period. Southern Sun’s share price also hit an all-time high of ZAc800 on 27 September.

Another REIT, Burstone Group’s share price was up 16.2% MoM. In a pre-close 1H25 trading update released last week, Burstone highlighted that it had made significant progress in executing its stated strategy, with many of these initiatives expected to start delivering results in 2H25 and beyond. With c. R38bn gross asset value under management, Burstone has c. R4.7bn third-party assets under management of which c. 65% is offshore (across western Europe and Australia). It has advanced its fund and asset management strategy by partnering with Blackstone for the Pan-European Logistics portfolio. In Australia, its Irongate joint venture is driving asset growth, while negotiations for a local platform are ongoing. Burstone expects to deliver 1H25 results in line with previous full-year guidance of distributable income per share (DIPS) between ZAc49.02 and ZAc50.04 vs 1H24’s ZAc51.07/share.

Prosus NV, Naspers Ltd -N-, and Wilson Bayly Holmes Ovcon (WBHO) were up 14.3%, 14.1%, and 13.6% MoM, respectively. Positive sentiment regarding China’s latest stimulus measures saw Prosus and Naspers’ share prices soar. Much of the rally was driven by their largest investment, Chinese tech giant Tencent – its share price has gained c. 11% since the stimulus announcement. Naspers is Tencent’s largest shareholder through its Amsterdam- and JSE-listed subsidiary Prosus. Meanwhile, WBHO reported a 16% YoY increase in its FY24 revenue to R27.5bn, with operating profit up 27% YoY to R1.4bn and HEPS from continuing operations jumping by 18.7% YoY. SA accounts for 69% of WBHO’s revenue, the UK 20%, and the rest of Africa 11%.

Kumba Iron Ore’s (+13.6% MoM) share price rose in line with the positive market sentiment that has greeted China’s announcement of stimulus measures, which are also expected to increase demand for iron ore (China is the world’s top consumer of the steel-making ingredient). Iron ore prices have surged on improved market sentiment as policymakers moved more aggressively to shore up China’s economy, with the spot iron ore price reaching c. US$110.10/tonne at month-end, from below US$90/tonne earlier in September.

Figure 2: September 2024 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Aspen Pharmacare was September’s worst-performing share, with the pharmaceutical Group’s share price dropping by 18.7% MoM. Aspen’s share price plummeted c. 13% on the day it released its FY24 results after its performance fell short of its own 1H24 guidance, which it provided in March. At that stage, Aspen said it expected to deliver mid-single-digit growth in normalised earnings before interest, tax, depreciation and amortisation (EBITDA) for the full year. However, it reported only a 1% YoY increase to R11.26bn, compared to R11.1bn in FY23. Revenue rose 10% YoY to R44.7bn, compared to R40.7bn in the previous year, while headline EPS fell 3% YoY to ZAc1,356.6. According to the Aspen CEO, the company’s performance was negatively impacted by higher acquisition-related transaction costs and higher-than-expected price decreases in China due to the government’s move to volume-based procurement.

Aspen was followed by Sasol, which was down 15.6% in September after retreating by 6.6% in August following the release of disappointing FY24 results. Sasol reported a turnover of R275.11bn, lower than the R289.70bn posted in FY23. It also recorded a diluted loss per share of R69.94, compared to EPS of R13.02 reported in the prior year. The results were negatively impacted by challenging operating conditions, including depressed chemical prices and constrained margins, which were somewhat offset by a stronger rand/oil price, improved refining margins, and higher sales volumes.

AngloGold Ashanti (-13.2% MoM) was last month’s third worst-performing share. Its share price dropped 5.7% on 10 September after the company announced board approval for the acquisition of UK-listed gold miner Centamin in a US$2.50bn stock and cash deal (Centamin shareholders get 0.06983 new AngloGold shares and US$0.125 in cash for each share they own).

Super Group, RCL Foods Ltd, and Tharisa Plc followed AngloGold with MoM declines of 12.9%, 11.6%, and 8.8%. Logistics and mobility solutions provider Super Group’s FY24 results disappointed, with revenue advancing by 4.6% YoY to R64.9bn, as it benefitted from a weaker rand and acquisitions in the UK and locally. However, headline EPS fell 25.9% YoY. EBITDA retreated by 1.4% YoY to R8.45bn, and operating profit declined 5.6% YoY to R3.79bn, mainly due to weaker performances in its European supply chain and UK dealerships businesses. Over the past few years, local food producers have had to navigate increasing food price inflation, high soft commodity prices, and loadshedding expenses, which have escalated manufacturing costs. In its FY24 results, food producer RCL reported a 31% YoY rise in headline earnings from continuing operations despite softer consumer demand. RCL Group revenue from continuing operations rose 6.8% YoY to R26bn, mainly due to higher sales pricing in response to sustained high input costs, while headline EPS from continuing operations was up 31.0% YoY to ZAc121.6. The unbundling and separate listing of Rainbow Chicken is now complete, and RCL has resumed paying dividends, with the board approving a gross cash dividend of ZAc35/share.

Industrial conglomerate Barloworld was down 7.8% MoM after it said last month that it had told US authorities of possible export control violations entailing the sale of certain goods to its Russian subsidiary, which it is probing. Barloworld has submitted an initial notification of voluntary self-disclosure to the US Commerce Department’s Bureau of Industry and Security regarding the possible violations.

Rounding out September’s ten worst-performing shares were Telkom SA, Thungela Resources and paper and packaging company Mondi Plc, with MoM declines of 6.8%, 5.6%, and 5.2%, respectively. After soaring c. 20% in August, there seemed to be some profit-taking in Telkom as the share price retreated again in September. Last month, the telcos Group said it had received approval from the Competition Commission for the R6.75bn sale of its masts and towers business housed in Swiftnet. Telkom announced earlier this year that it would sell its masts and towers business to a consortium comprising an infrastructure fund managed by a subsidiary of Actis LLP and an infrastructure vehicle 100%-owned by Royal Bafokeng Holdings.

Figure 3: Top-20 best-performing shares, YTD

Source: Bloomberg, Anchor

The YTD best-performing shares featured thirteen of the year-to-end August’s best performers, with seven shares entering the top-20 in September – Hyprop Investments, Southern Sun, Fortress Real Estate -B-, Attacq, JSE Ltd, OUTsurance Group, Blue Label Telecoms, and Prosus.

Construction and infrastructure development company Raubex was in the top spot for a second consecutive month, gaining 89.5% YTD. The share price recorded a 6.7% MoM rise in September after Raubex said its first-half earnings were expected to rise sharply as its construction materials, roads and earthworks, and infrastructure divisions delivered a “more than satisfactory performance”. In a 1H24 trading update, Raubex revealed that it expects headline EPS to be as much as 45.0% to 55.0% higher YoY than the ZAc189.8 recorded in 1H23.

Another construction firm, WBHO (+77.9% YTD; discussed earlier), was in second place, followed by mid-tier gold producer Pan African Resources’ (+77.8% YTD) in third spot. Pan African Resources’ share price has soared this year, partly due to an improvement in the gold price (+27.7% YTD) and the prospect of increased production. The company has guided to a 21% YoY increase in gold production in the current financial year – equal to 215,000 and 225,000 ounces. It would exceed its 2022 production record of just above 200,000 oz if achieved. Last month, it was reported that Pan African Resources will be included in the influential GDX Index for the first time after New York fund manager Van Eck took a 5.9% stake in it.

It was followed by Mr Price Group, Altron, and software company Karooooo Ltd, which posted YTD gains of 72.3%, 68.8%, and 51.5%, respectively. Karooooo was up 4.0% MoM after reporting 1Q25 results, which showed revenue rose to R1.08bn from R1.00bn posted in 1Q24, while its diluted EPS increased 40.9% YoY to R7.17.

Karooooo was followed by Capitec Bank, Harmony Gold, Hyprop (discussed earlier), and Southern Sun (discussed earlier), with YTD share price increases of 50.2%, 49.0%, 47.9%, and 47.6%, respectively. In its 1H25 trading statement, released in early September, Capitec (+4.1% MoM) revealed that it expects headline EPS to be 35.0% to 37.0% higher YoY than the ZAc4,072.0 recorded in 1H24.

In its FY24 results, released last month, Harmony reported revenue of R61.4bn—higher than the R49.3bn posted in FY23—while headline EPS surged 132% YoY to ZAc1,852. Operating free cash flow reached a record of R12.7bn, up 111% YoY. Record prices and excellent grades drove the blockbuster results. Still, the gold miner’s share price sank following the release of the results as it maintained a conservative dividend policy in the face of major capital expenditure (capex) plans. Harmony also announced the retirement of its CEO, Peter Steenkamp, at the end of this year.

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

There was some overlap between the year to end-August’s worst-performing shares and the worst-performers to the end of September (YTD), with fifteen shares remaining and five new entrants to the grouping – Super Group, Telkom SA, Hosken Consolidated Investments (HCI), Ninety One Plc, and AECI.

Montauk remained the worst-performing share YTD, down 44.8%, despite its share price recording a 10.1% MoM gain in September. Montauk was followed by Sasol (-37.4% YTD), with Anglo American Platinum (Amplats) remaining in the third spot, with a 35.6% YTD drop. Amplats, the world’s largest primary PGMs producer, dropped out of the JSE Top 40 Index on 25 September (replaced by Pepkor), reflecting the YTD decline in its share price as PGM miners fall out of favour. The Amplats share price closed at R620.37 on 30 September, down from its peak of R2,675.38 in 2022.

Steel manufacturer Kumba (-34.8% YTD) has been under pressure for a while, although it saw some relief in September, rising by 13.6% MoM following China’s rollout of stimulus measures. Still, for most of this year, low iron ore prices have slowed growth across the construction sector, while tariffs on goods from China have weighed on Kumba’s recovery prospects. In addition, it has been facing operational constraints locally due to inefficiencies at Transnet.

Kumba was followed by Thungela Resources, Sibanye Stillwater, and Northam Platinum, with YTD losses of 28.6%, 28.3%, and 22.4%. Coal miner Thungela, in its 1H24 results (for the six months ended 30 June 2024), reported revenue of R16.75bn, up from R14.36bn posted in 1H23. However, headline EPS dropped by 58% YoY to ZAc952 as a poor rail performance and a reversal of the record coal prices of 2022 and early 2023 continued to weigh on its financial performance. Thungela slashed its interim dividend by 80%, paying out R2/share, compared with R10/share in the previous comparative period.

In its 1H24 results, released last month, Sibanye said that revenue dropped to R55.2bn from R60.6bn posted in 1H23 while it reported a diluted loss per share of ZAc264.0, compared with EPS of ZAc262.0 recorded in the previous year. Northam reported FY24 results in August, which showed that its revenue declined 22.2% YoY to R30.8bn, while headline EPS fell 81.6% YoY to R4.45, compared with R24.15 recorded in FY23. This was mainly due to lower prices despite higher sales volumes and increased revenue from chrome sales. The Northam CEO noted that the local platinum mining industry has entered a phase of irreversible decline as producers struggle with low prices and demand suffers from the rise of battery-operated EVs. While their share prices recovered somewhat in September (rising by 3.6% and 3.4% MoM, respectively) following China’s stimulus announcement, these gains have not moved them out of the YTD worst performers list.

MTN Group, Super Group (discussed earlier), and Bytes Technology Group rounded out the ten worst-performing shares with YTD declines of 20.5%, 18.8%, and 17.1%, respectively. MTN reported 1H24 results in August, with revenue at R90.84bn (-19.8% YoY) and a diluted loss per share of ZAc409 vs EPS of ZAc225 reported in 1H23 due to other African currency devaluations, and the weak macro-economic environment. However, MTN said that its underlying performance remained strong, with growth seen when reporting on a constant currency basis. According to the Group CEO, strong operational momentum was maintained, and the business’s resilience was reflected in its ecosystem’s growth, with data traffic and fintech volumes up by 35.7% and 18.0% YoY, respectively.