With the notable exception of the world’s second-biggest economy, China, most global equity markets closed 2023 in the green (MSCI World +4.9% MoM/+11.5% in 4Q23/+24.4% for 2023). Despite geopolitics (the wars in Gaza and Ukraine) casting a shadow over global markets, stocks rallied into year-end, with bonds reversing the heavy losses from earlier in the year as US inflation fell and recession fears eased, replaced by a growing belief that US policymakers would achieve an economic soft landing. At its last meeting for 2023, the US Federal Reserve (Fed) opted to hold rates steady and signalled an end to its rate-hiking cycle (US rates are now at a 22-year high). Forecasts released alongside the Fed’s announcement indicated that most members of the Fed’s Federal Open Market Committee ([FOMC], which sets rates) had pencilled in three rate cuts for 2024.

In US economic data, November headline inflation, as measured by the Consumer Price Index (CPI), rose 3.1% YoY – in line with market expectations. November core CPI, excluding the erratic food and energy components, was unchanged at 4.0% YoY. MoM, headline inflation increased by 0.1% while core inflation rose by 0.3%. November US retail sales rebounded, rising by 0.3% MoM vs October’s revised 0.2% MoM decline. YoY, retail sales accelerated to 4.1% in November vs October’s 2.5% print. November core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, slowed to 3.2% YoY (in line with expectations) compared to 3.5% YoY in October, edging closer to the Fed’s goal. MoM, November core PCE rose by 0.1% vs 0.2% in October.

After posting three consecutive months of losses, US markets reversed course in November and December, rallying into year-end and recording impressive gains for 2023. The Dow rose by 4.8% MoM (+12.5% in 4Q23/+13.7% in 2023), while the tech-heavy Nasdaq Composite and the blue-chip S&P 500 indices rose by 5.5% (+13.6% in 4Q23/+43.4% in 2023) and 4.4% MoM (+11.2% in 4Q23/+24.2% in 2023), respectively. The Nasdaq’s 43.4% YoY jump was led by the Magnificent Seven stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Despite the slow pace of the European economy, which ended the year oscillating close to a recession, major European markets recorded solid gains for 2023, bouncing back from a torrid 2022. Germany’s DAX gained 3.3% MoM (+8.9% in 4Q23/+20.3% in 2023), while France’s CAC Index closed December 3.2% higher (+5.7% in 4Q23/+16.5% in 2023). In economic data, November euro area inflation declined to 2.4% vs 2.9% YoY in October. Germany’s November inflation slowed for a fifth consecutive month, falling to its lowest level since June 2021 as energy product and food prices dropped, coming in at 3.2% YoY vs October’s 3.8% print. The core inflation rate declined to 3.8% YoY vs 4.3% in October. France’s November inflation also continued to cool, falling to 3.5% YoY, compared to October’s 4.0% YoY print, on the back of a slowdown in energy prices, services and manufactured goods.

The UK’s blue-chip FTSE-100 advanced by 3.7% in December and is up 3.8% in 2023 (+1.6% in 4Q23). December UK inflation rose at its slowest pace in c. 18 months, falling to 4.3% vs October’s 4.6% YoY print.

China’s equity markets were the outliers in 2023, underperforming US equity markets by a considerable margin in a year that can best be described as highly disappointing for China bulls. Investor concerns around the country’s economic recovery continued to weigh on sentiment, while a government crackdown on excess borrowing by property developers has resulted in a housing market slump. MoM, Hong Kong’s Hang Seng Index was unchanged in December (-4.3% in 4Q23/-13.8% in 2023), while the Shanghai Composite Index was down 1.8% MoM (-4.4% in 4Q23/-3.7% in 2023). China’s official December Manufacturing Purchasing Managers Index (PMI) slipped further into contraction territory (for a third consecutive month), coming in at 49.0 vs November’s 49.4 print. The index has declined in eight of the past nine months, only increasing in September. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, advanced to 50.4 in December vs 50.2 in November. The 50-point mark separates expansion from contraction.

Although Japan’s benchmark Nikkei ended December 0.1% lower, the index is up 5.0% in 4Q23 and 28.2% for 2023. Japan’s November core CPI (excluding the volatile fresh food category but including energy costs) slowed sharply to 2.5% YoY vs October’s 2.9% print.

Among commodities, Brent crude was down for a third consecutive month (-7.0% MoM) and ended 2023 down 10.3% (-19.2% in 4Q23). The spot gold price ended last month 1.3% higher (+11.6% in 4Q23/+13.1% in 2023). The platinum price rose by 6.7% MoM (+9.3% in 4Q23/-7.7% in 2023), while palladium jumped by 9.0% MoM (-11.9% in 4Q23/-38.6% in 2023).

South Africa’s (SA’s) FTSE JSE All Share Index advanced by 1.8% in December (+6.2% in 4Q23/+5.3% in 2023), while the FTSE JSE Capped SWIX rose 2.9% MoM (+8% in 2023). Property counters were among the best performers on the JSE in December, with the SA Listed Property Index up an impressive 9.3% MoM (+12.5% in 4Q23/+2.5% in 2023). The Fini-15 gained 5.3% MoM (+10.8% in 4Q23/+15.1% in 2023), while the Indi-25 rose by 0.2% MoM (+5.5% in 4Q23/+14.8% in 2023). The Resi-10 was the laggard in December, declining by 1.3% MoM (-0.04 in 4Q23/-18.7% in 2023), despite good performances from the gold counters. Highlighting the monthly performances of the biggest shares on the JSE by market cap, the largest company on the exchange, BHP Group, soared 10.2% MoM, while the second-biggest share, Anheuser-Busch InBev, rose 1.6% MoM. Prosus and Naspers were down 10.6% and 9.9% MoM, respectively, dragged lower by their biggest holding, Tencent, after Beijing released draft guidelines to curb excessive gaming. Other large-cap counters such as Richemont and Glencore soared by 9.2% and 4.7% MoM, while British American Tobacco (BAT) and Anglo American Plc were down 10.0% and 7.5%, respectively. The rand strengthened by 2.6% against the greenback in December (+3.0% in 4Q23/-7.8% in 2023).

In local economic data, November headline CPI surprised on the upside, cooling to 5.5% (its first contraction since July) vs 5.9% YoY in October. The decline was mainly due to a monthly decrease of 5.5% in the fuel price index, which drove the annual rate for fuel lower to 1.8% in November from 11.2% in October. This, in turn, led to a drop in the yearly transport rate, which decreased to 4.3% from 7.4%. Core inflation (which strips out the more volatile price categories of food and energy costs) increased slightly to 4.5%, from 4.4% in October, which is notably still at the midpoint of the South African Reserve Bank’s (SARB) target range. Seasonally adjusted October SA retail sales (released in December) declined by 2.5%, weighed down by loadshedding. This was after registering its first expansion for 2023 in September when it increased by an upwardly revised 1.0% YoY.

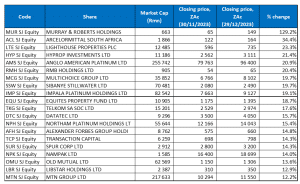

Figure 1: December 2023 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Engineering and construction firm Murray & Roberts (MUR) was December’s best-performing share, with the share price soaring by 129.2% MoM, albeit from a very low base. The share price was buoyed after MUR said in early December that “meaningful progress” was being made to reduce its debt with a consortium of SA banks, that it had significantly lowered overhead costs, and that it would continue to focus on operational efficiencies and liquidity management. MUR also noted that its Cementation Canada business had recently secured a renewed banking facility with a Canadian bank that would allow it to pay CAD40mn (c. R557mn) in dividends to MUR over the six months to June 2024, thereby assisting MUR in further reducing its SA debt to R350mn over the period. The market welcomed the news, and on 8 December (the day of the announcement), MUR’s share price jumped by 13.6%. For 2023, unfortunately, the share was down 49.5%.

MUR was followed by ArcelorMittal SA (AMSA) in the second spot, with a MoM gain of 34.4%. However, YoY, the share is down 65.4%. Lighthouse Properties (+23.3% MoM) rounded out the top three performers for December. Last month, it was announced that Resilient REIT and Lighthouse have jointly acquired Salera Centro, a regional shopping centre in Castellon de la Plana in Spain, for EUR171mn. Resilient and Lighthouse will each contribute EUR85.5mn, excluding transaction costs, and in terms of the JSE listings requirements, the acquisition is a category two transaction and does not require shareholder approval.

Lighthouse was followed by Hyprop Investments, Anglo American Platinum (Amplats), RMB Holdings (RMH) and Multichoice with MoM gains of 21.4%, 20.9%, 20.4% and 19.7%. RMH’s share price was up 8.6% on 13 December after the company declared a special dividend of ZAc23.5/share. RMH has returned R327mn to its shareholders in special dividends after settling a loan dispute with the property developer Atterbury, in which RMH has a strategic interest. RMH has set itself a five-year period during which it will monetise its remaining property assets following the unbundling of its stakes in FirstRand, Outsurance, Momentum Metropolitan and Discovery to shareholders.

Sibanye Stillwater (+19.7% MoM), Impala Platinum (Implats; +19.1% MoM), and Equites Property Fund (+18.7% MoM) rounded out December’s best-performing shares. Last month, Sibanye Stillwater (+19.7% MoM) warned it could increase its cost-cutting exercise if commodity prices deteriorate further. Sibanye is among SA’s largest private sector employers, with c. 81,000 employees across its operations, and this scenario raises the potential risks of further job losses across the Group’s SA PGM business.

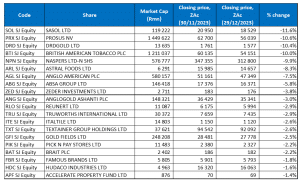

Figure 2: December 2023 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Sasol (-11.6% MoM) was December’s worst-performing share, declining by 11.6% MoM on the back of a lower oil price (down 7.0% MoM). Prosus followed Sasol with a 10.6% MoM decline. On 22 December, Prosus and Naspers (-9.9% MoM) recorded significant share price drops (down c. 13% and 14%, respectively, on the day), as their largest investment, Tencent, shed c. 15% of its value after China’s regulators unveiled new measures to curb spending on online games. China had previously clamped down on the gaming sector in 2021, including restricting hours and the ages of players allowed to play. MoM, Tencent, in which Prosus has a c. 25% stake, was down 10.4%. DRDGold rounded out the three worst-performing shares with a MoM share price decline of 10.4%.

BAT and Astral Foods’ share prices were down 10.0% and 8.3% MoM, respectively. BAT’s share price slumped by c. 7% on 6 December after the company said it would take a hit of c. EUR25bn (c. R598bn) as it writes down the value of some US cigarette brands. According to BAT, macroeconomic pressures in the Group’s US market impacted its cigarette business. For FY23, BAT’s Group revenue growth is now expected towards the lower end of its 3%–5% target range. It also expects low single-digit growth in revenue and adjusted profit from operations in 2024.

On 8 December, Anglo American (Anglo; -7.5% MoM) lost R93bn in market value as its share price sank 13% in its biggest one-day drop since the 2009 global financial crisis. This was after Anglo announced plans to cut overall production by c. 4% in 2024 and a further 3% in 2025. The company said it is also targeting a US$1.8bn reduction in capital expenditure between now and 2026 to soften the blow of weaker commodity prices. The big production cuts will come in PGMs and copper, expected to be 13% and at least 21% lower YoY in 2024. The production cuts announced by Anglo are part of a US$500mn (R9.5bn) cost-paring exercise.

Last month, ABSA (-5.8% MoM) warned in a voluntary trading update that its credit losses will remain high in its next annual results as customers continue to grapple with elevated interest rates. The announcement saw its share price close 6.3% lower on 8 December, its biggest drop in almost nine months as consumers and businesses feel the impact of higher inflation, poor economic growth and the SARB hiking rates by 475 bps since November 2021. Zeder Investments (-3.8% MoM) and AngloGold Ashanti (-3.0% MoM) rounded out December’s worst-performing shares.

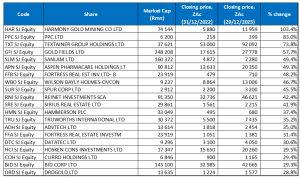

Figure 3: The 20 best-performing shares of 2023

Source: Anchor, Bloomberg

Nineteen out of November’s top-20 YTD best-performing shares again featured among the top-20 best performers for the year to the end of December. Following a good performance last month, Datatec (+15.7% MoM) was the only new entrant, bumping PSG Financial Services from the list. In December, Datatec said it had acquired an additional 40% shareholding in UK-based digital and technology consultancy Mason Advisory, taking its interest in the business to 80%.

November’s winner, Harmony, remained in the top spot with a 2023 gain of 103.4%. It was followed by cement maker PPC Ltd (+83.0% YoY) in second place, bumping Textainer (+73.8% YoY) from the number-two spot to number three.

Gold Fields remained in fourth position with a 2023 gain of 57.7%, followed by Sanlam (+49.4% YoY) and Aspen Pharmacare (+49.3% YoY). Aspen (+9.9% in December) announced last month that it had concluded agreements to acquire Sandoz (China) Pharmaceuticals and its product portfolio for up to EUR92.6mn (c. R1.89bn) and that it would dispose of four anaesthetic products on sale in Europe. Aspen CEO Stephen Saad said that the acquisition was an attractive opportunity for the pharma Group to take a major step “in our objective to increase our presence in China. Sandoz’s portfolio, pipeline, well-established infrastructure, and experienced team will expand Aspen’s footprint and capabilities in the world’s second-largest pharmaceutical market and strengthen our foundation for growth in China.”

Aspen was followed by Fortress Real Estate Investments Ltd -B- shares (+48.2% YoY) and Wilson Bayly Holmes Ovcon (WBHO; +46.7% YoY) in eighth place.

Spur Corp Ltd and Reinet Investments rounded out 2023’s top-10 performers with YoY gains of 45.5% and 42.4%, respectively.

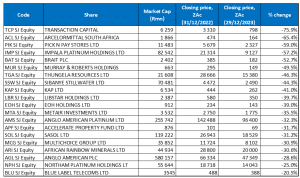

Figure 4: The 20 worst-performing shares of 2023

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, seventeen of the twenty shares for the year to the end of December were unchanged from the twenty worst-performers to the end of November. A robust performance from the JSE-listed property sector (the SA Listed Property Index rose by 9.3% MoM in December) saw Equites Property Fund (+18.7% MoM), Growthpoint Properties (+10.2% MoM), and Resilient REIT (+10.7% MoM) drop out of the bottom 20, with Sasol (-11.6% MoM), Anglo American (-7.5% MoM) and Blue Label Telecoms (+3.5% MoM) taking their spots.

Despite its share price gaining a further 14.3% last month after soaring in November, investment holding company Transaction Capital remained the worst-performing share of 2023, with a 75.9% YoY drop. On 5 December, the company released its financial results for the year ended 30 September 2023. The Group said that SA Taxi alone recorded a headline loss from continuing operations of R3.7bn for the year – an increase from the R2.1bn loss reported in 1H23. According to the Group, the loss was driven primarily by a R1.1bn increase in repossessed vehicle stock write-downs as further material changes were made to SA Taxi in 2H23. The company said that the operational restructuring of SA Taxi is expected to be completed by March 2024 and will focus on stabilising the business by cutting costs and repositioning it in the pre-owned minibus taxi market.

MUR’s sterling performance in December saw it move to the sixth spot on the worst performers list, with AMSA (-65.4% YoY) taking MUR’s previous position in second place, while retailer Pick n Pay (-59.0% YTD) moved into the third spot after losing a further 2.2% in December.

Impala Platinum (Implats), Brait, MUR and Thungela Resources followed with YoY declines of 57.2%, 52.7%, 49.5% and 46.3%. Platinum counters have been in a rout this past year as PGM prices have plummeted, and China’s economic growth has remained sluggish, resulting in lower demand from the world’s second-largest economy.

Sibanye Stillwater (-44.3%), KAP Ltd (-41.0%), and Libstar Holdings (-39.7%) rounded out the ten worst-performing shares of 2023.