Despite continuing restrictions caused by the pandemic and inflation worries, most major global stock markets ended 2021 with gains for the third year running as the MSCI World Index surged 21.8% in US dollar terms. This came as easy monetary policy, the deluge of fiscal stimulus, and vaccine rollouts combined to propel the global economic recovery from the COVID-19 pandemic. 2021 started on a bullish note with vaccine rollouts and government stimulus packages with ongoing monetary policy support from the world’s largest central banks helping push global financial markets higher. However, towards year-end, the prospect of central banks removing these financial market support measures, and rapidly increasing cases of the more infectious Omicron variant, threatened to derail investors’ fortunes. This resulted in choppy markets coming under pressure towards mid-November, before ending the month on a decidedly risk-off tone after US inflation came in ahead of expectations, and fears around Omicron saw US shares drop sharply on Black Friday (26 November). Fortunately, most major global stock markets managed to pull through December’s heightened volatility, which failed to derail the rally.

The US proved resilient despite COVID-19 related challenges, with companies reporting robust earnings growth notwithstanding supply chain issues and global shortages. The blue-chip S&P 500 gauge climbed 4.4% MoM in December (its best December in over 10 years) to close the year 26.9% higher. The S&P 500’s surge was led by a c. 50% jump in energy counters as oil prices soared. Still, The Financial Times (FT) reports that the top six contributors to the S&P 500’s performance were all big tech names, led by Microsoft and Apple, now the two largest companies in the world by market cap, which rose by 51% and c. 34% YoY, respectively. The Dow Jones ended 2021 up 18.7% (+5.4% MoM), while the tech-heavy Nasdaq gained 21.4% YoY (not quite the mind-blowing 43.6% it gained in 2020 but still an impressive jump for the year) and advanced by 0.7% MoM

At its mid-December meeting, the US Federal Reserve (Fed) moved into inflation-fighting mode, with the Fed now expected to raise rates three times this year. It also outlined plans to double the pace at which it withdraws its COVID-19 induced US$120bn/month bond-buying programme. In terms of US economic data, November inflation surged by 6.8% YoY – the fastest rate since 1982. Excluding food and energy prices, core CPI rose 4.9% YoY – the sharpest rise since mid-1991.

The UK’s blue-chip FTSE 100 recorded one of its best yearly performances in c. two decades in 2021 – ending 14.3% higher YoY. MoM, the index was up by 4.6% in December. The BBC reported that the UK economy grew at a slower pace than initially expected in 3Q21, with revised data from the Office of National Statistics (ONS) showing that the quarter grew 1.1% – down from an initial estimate of 1.3%. The ONS said that weaker consumer spending and the impact of energy firms going out of business resulted in the lower GDP print. According to the ONS, the UK’s economic recovery to pre-pandemic levels remains below that of other large economies such as the US, France, and Germany.

In Europe’s largest economy, Germany, the DAX ended 2021 with a 15.8% YoY gain (+5.2% MoM) – its best year since 2019, while the eurozone’s second-biggest economy, France’s CAC Index soared 28.9% MoM (+6.4% MoM).

In contrast to the robust gains recorded across developed markets (DMs), Hong Kong’s Hang Seng Index was down 0.3% MoM and fell 14.1% YoY, weighed down by China’s regulatory crackdown which targeted the tech and education sectors. A slowing manufacturing sector, debt crises in the country’s property market, and carbon emissions-related curbs also weighed on sentiment. Nevertheless, the Shanghai Composite Index rose 4.8% YoY and gained 2.1% MoM. In terms of economic data, China’s official manufacturing purchasing managers index (PMI) rose to 50.3 in December, a minor acceleration from November’s 50.1 print. China’s official composite PMI, which includes both manufacturing and services activity, stood at 52.2 in December – unchanged from November. The 50-point mark separates expansion from contraction. Elsewhere, Japan’s benchmark Nikkei closed the year 4.9% higher and rose by 3.5% MoM in December.

2021 was a volatile year for commodities, with energy prices rising faster than other commodities, driven by increased demand as the global economy reopened and fuelling inflation. Supply chain bottlenecks resulted in worldwide shortages, sending commodity prices higher amidst increased demand and a lack of supply. The Brent crude oil price, which peaked at US$86.70/bbl in October 2021, ended the year 50.2% (+10.2% MoM) higher. This was its biggest gain since 2016, on the back of a strong rebound in crude demand following a dismal 2020. Natural gas and coal prices also soared amid increased demand for power generation from major economies such as China (which suffered power cuts in the second half of last year). Meanwhile, precious metals were 2021’s underperformers due, in part, to investors opting for assets that perform well in a rising interest rate environment and which bear yield. Thus, as major global central banks start to tighten liquidity, gold is underperforming as real yields increase. After retreating in November, the gold price rose 3.1% in December although YoY the yellow metal lost 3.6%. Platinum and palladium gained 3.2% and 9.4% MoM, respectively, but declined by 9.6% and 22.2% YoY. After reaching a peak in May, the iron ore price tumbled in the second half of the year on the back of strict output curbs in China. However, the price leapt again (+19.3%) in December but is still down 26.3% for the year.

Following a 4.5% gain in November, South Africa’s (SA’s) FTSE JSE All Share Index rose a further 4.6% in December, with the index ending 2021 with an impressive 24.1% gain. Financials, property, commodity, and platinum group metals (PGMs) counters were the outperformers in December with the Fini-15 rising 8.9% MoM (+22.7% YoY), the SA Listed Property Index up 6.0% MoM (+25.6% YoY), and the Resi-10 advancing 5.5% MoM (+23.3% YoY). The Indi-25 gained 2.5% MoM (+22.5% YoY). Looking at the best December performers by market capitalisation, large-cap commodities companies outperformed, with Impala Platinum jumping 11.2%, Anglo American Platinum (Amplats) soaring 9.6%, and BHP Group rocketing 8.6%. British American Tobacco leapt 10.3% and Capitec bounced 11.9% MoM. The local unit closed the month marginally weaker (-0.4% MoM) against the greenback amid the stronger dollar and uncertainty around the Omicron variant. On a YoY basis, the rand has lost 8.5% of its value vs the US dollar.

In local economic data, November annual headline inflation, as measured by the consumer price index (CPI), accelerated to its highest level since March 2017, coming in at 5.5% YoY vs 5% in October. Stats SA said the transport category continued to be the major factor behind inflation, recording an annual increase of 15% in November. SA’s November trade surplus widened to R35.83bn vs a revised R2.68bn in October. After recording four consecutive quarters of growth, SA real gross domestic product (GDP) slumped 1.5% QoQ in 3Q21, eroding some of the economic gains the country has made since the severe impact of COVID-19 in 2Q20. SA’s economy was dealt a blow by what was essentially the twin pressures of tighter COVID-19 lockdown restrictions and the July civil unrest, which were further exacerbated by renewed loadshedding and the Transnet cyberattack that disrupted operations at key SA ports.

On the pandemic front, the country appeared to have passed the peak of the fourth wave (Omicron) of infections. As at 31 December, Department of Health data show that 27.95mn vaccines have been administered to date (vs 25.6mn as at 30 November), while the total number of confirmed COVID-19 cases since the start of the pandemic stood at 3.17mn vs 2.97mn on 30 November. Last week the curfew that was in place from 12 midnight to 4 AM was lifted with immediate effect resulting in no remaining restrictions on people’s hours of movement. In addition, indoor gatherings are now restricted to 1,000 people (previously 750), outdoor gatherings to 2,000, no more than 50% of capacity of an indoor venue to be used and establishments selling alcohol with a licence to operate beyond 11 PM will revert to their full licence conditions.

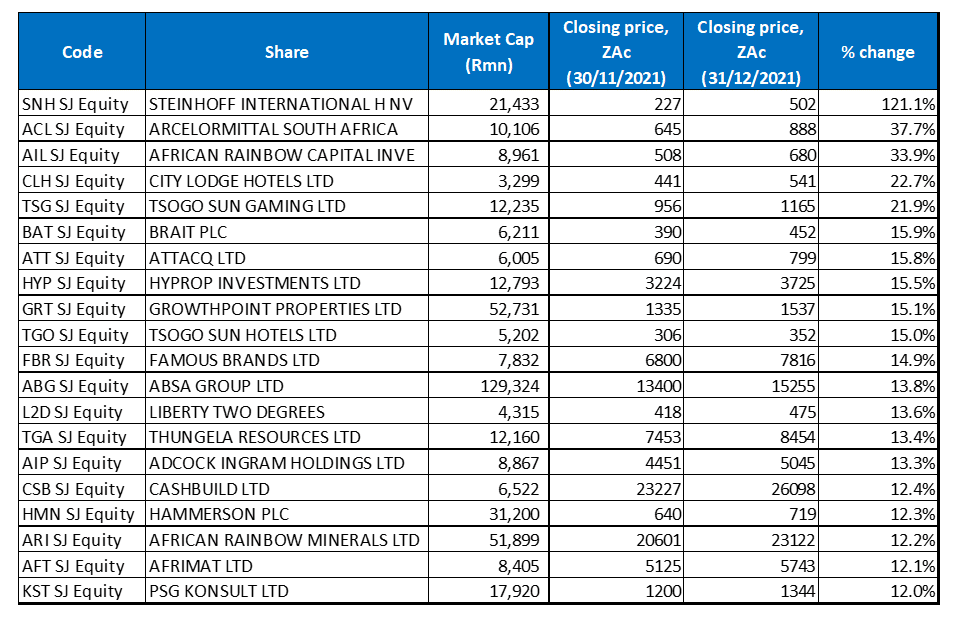

Figure 1: December 2021’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Steinhoff was by far December’s best-performing share, with its share price soaring 121.2% MoM after the company announced that it had reached an agreement with two major detractors of its R25bn litigation settlement proposal – the former owners of Tekkie Town and Trevo Capital. This clears another hurdle in Steinhoff’s plans to enter a multi-billion-rand financial settlement with investors following its 2017 share price plunge due to accounting fraud. In both cases, the unexpected settlements followed court rulings against Steinhoff, which had effectively halted, and had the potential to delay for years, a global settlement agreed to between impacted parties and the company. On 24 January, the Western Cape High Court will hear discussions to allow a major settlement, and the new Tekkie Town and Trevo settlements will only be effective if the court approves it. Steinhoff has said that, if approved, it can immediately begin paying earnings to thousands of shareholders as part of a major settlement agreement.

Coming in second, ArcelorMittal SA (Amsa) recorded a MoM gain of 37.7% in December and was followed in third place by African Rainbow Capital Investments (ARC), with a 33.9% MoM share price rise. ARC Investments announced in December that Tyme (in which it is the majority shareholder), including TymeBank SA and Tyme Global, had completed its Series B capital raise with the introduction of two new shareholders. Capital raised amounted to c. US$70mn and will see China’s Tencent, and the UK development finance institution, CDC Group becoming shareholders. According to Tyme, the investment will enable it to use its digital infrastructure “to accelerate the rollout of financial services …” to TymeBank’s historic mass-market customer base. The two investors’ capital and expertise will be used to strengthen Tyme’s ability to manage risk and will support its expansion into emerging markets.”

ARC Investments was followed by hospitality companies, City Lodge Hotels (+22.7% MoM) and Tsogo Sun Gaming (+21.9% MoM) as the prospect of normalising leisure travel returned. On 30 December, the government lifted the curfew that has been in place since the start of the pandemic, allowing big gatherings and, with the curfew lifted, bars, restaurants, etc. could now go back to their normal licensed operating hours, meaning that alcohol can be sold all night. This helped Tsogo Sun Gaming’s share price as casinos were initially one of the hardest-hit sectors in early 2020 and prior to the curfews, casinos could operate all night long.

In December, investment firm Brait (+15.9% MoM), a major investor in Premier Foods and Virgin Active in SA, announced that it had raised R3bn through a convertible bond offer to refinance its debt. Brait, also a stakeholder in glass manufacturer Consol, said in November that it had entered into a sale agreement with glass and metal supplier, Ardagh, which intends to acquire 100% of Consol (R10.1bn) and its operations in SA, Nigeria, Ethiopia, and Kenya.

Brait was followed by three property companies, Attacq Ltd, Hyprop Investments, and Growthpoint Properties, which recorded share price gains of 15.8%, 15.5%, and 15.1% MoM, respectively. This was on the back of better-than-expected market updates from Hyprop and Attacq, while Growthpoint Properties Australia (GOZ) also released a positive trading update which fed through to Growthpoint.

Rounding out December’s 10 best-performing shares was Tsogo Sun Hotels with its share price rising by 15.0% MoM.

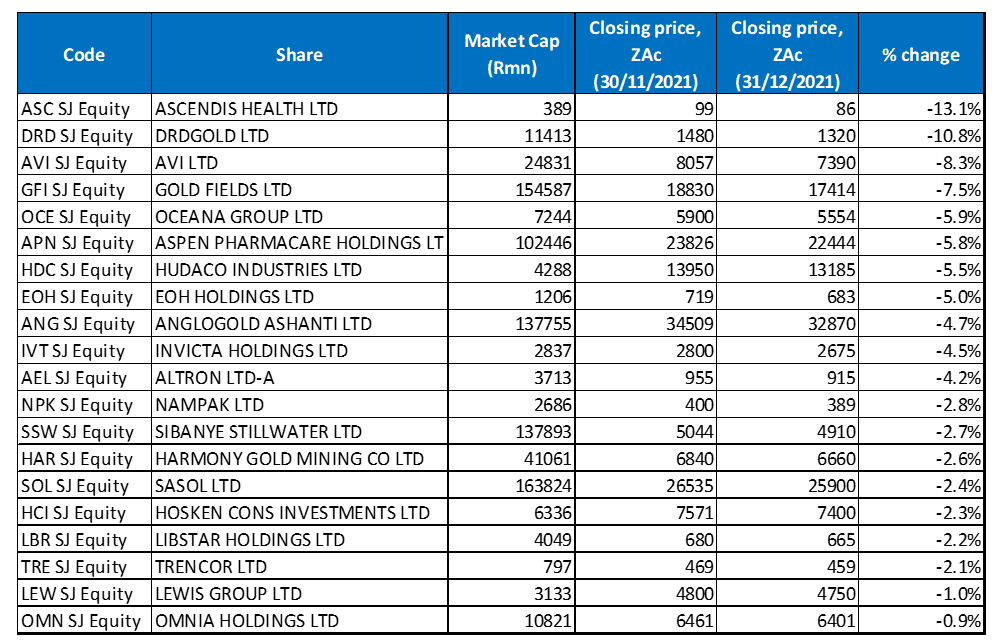

Figure 2: December 2021’s 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Debt-laden Ascendis Health (-13.1% MoM) was December’s worst-performing share. In mid-December, the company postponed its annual general meeting (AGM) but a court battle resulted in a court order that the AGM goes ahead. Business Day reported that 16 minutes before the AGM, Ascendis warned the market that lenders had said they could demand immediate repayment should the board be changed without their approval. On 22 December, lenders pulled the plug on the beleaguered firm after a board shake-up at the AGM, giving Ascendis a week to provide answers on how the debt they have called in is to be repaid. Just before Christmas, Ascendis announced that Andrew Marshall had been appointed as the CEO (he had previously served as its Chairman from May 2019 to December 2021 and as acting CEO from May to October 2019). Finally, last week, Ascendis said that it will be seeking new terms with a consortium led by investment group Apex Partners and incorporating a “leading BEE health and beauty group”, which have acquired the company’s debt, giving it more time to deal with its debt problems.

In the second spot, DRDGold was down 10.8% MoM, followed by AVI Ltd, down 8.3% MoM, in third place. The gold price has been under pressure this year as it was caught between how fast, and in which direction, US inflation was going and what the US Fed is doing to contain it. The lower gold price (-3.6% YoY) has weighed on the major local gold producers with DRDGold as well as Gold Fields (-7.5% MoM) and AngloGold Ashanti (-4.7% MoM) recording MoM declines.

Oceana Group (-5.9% MoM) released a disappointing voluntary FY21 trading statement, showing that it expected its headline EPS to be between ZAc597.0 and ZAc553.0 – this is 5.0%-12.0% lower vs the ZAc628.4 the company reported in FY20.

Oceana was followed by pharmaceutical Group, Aspen Pharmacare which recorded a 5.8% MoM decline, while Hudaco Industries was down 5.5% MoM. EOH Holdings (-5.0% MoM) and Invicta Holdings (-4.5% MoM) rounded out December’s worst-performing shares.

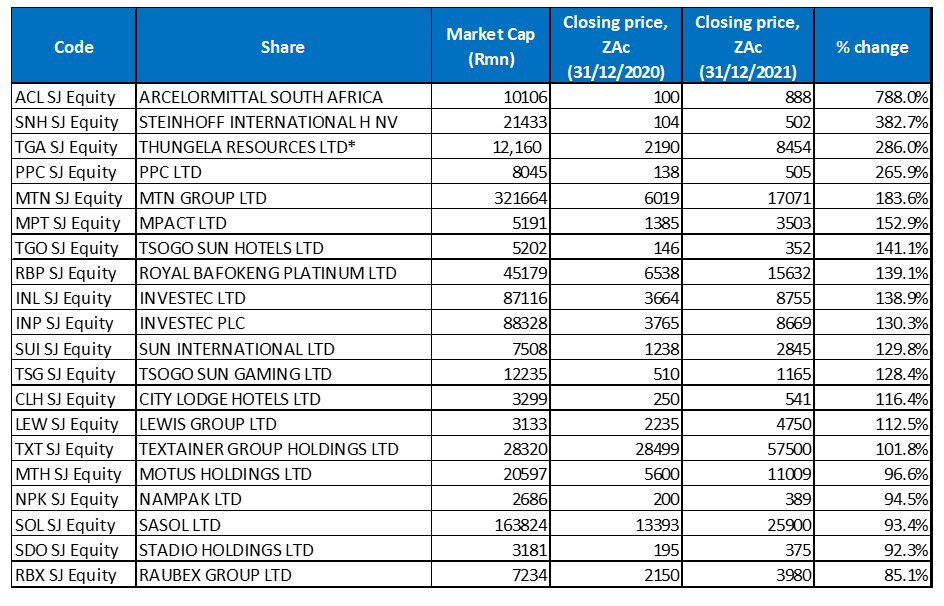

Figure 3: The 20 best-performing shares of 2021

Source: Anchor, Bloomberg. *Note Thungela Resources listed on the JSE on 7 June 2021.

Eighteen out of November’s top-20, YTD best-performing shares were unchanged from 2021’s best performers, with City Lodge Hotels (+116.4% YoY) and Raubex (+85.1% YoY) replacing Aspen Pharmacare and Richemont among the top-20 in December.

Amsa saw an unprecedented change in fortunes in 2021 and, with a YoY gain of 788.0%, the company has emerged as by far the best-performing share on the JSE, as it reaped the benefits of a commodity boom thanks to the faster-than-expected recovery in the automobile, construction, and infrastructure sectors.

Following its impressive performance in December (discussed earlier), Steinhoff (+382.7% YoY) emerged as 2021’s second best-performing share, with coal miner, Thungela (+286% YoY) in the third spot, driven higher by surging coal prices because of the Northern Hemisphere energy crunch.

It was followed by PPC (+265.9% YoY) in fourth place, bumping MTN (+183.6% YoY) to the fifth spot. MTN had a banner year in 2021 with investors seemingly pleased by the Group’s growth strategy, management’s focus on reducing debt, and opportunities in growth areas such as fintech.

MTN was followed by SA’s largest paper and plastics packaging and recycling business, MPact (+152.9% YoY), Tsogo Sun Hotels (+141.1% YoY), and Royal Bafokeng Platinum (RBPlat: +139.1% YoY). Last month, Impala Platinum (Implats) increased its shareholding in RBPlat to 35.23%, with Business Day reporting that this has upped the ante in Implats’ ongoing play with rival Northam for stakes in the company. Implats has made an offer to buy the whole of RBPlat and Northam has made an expression of interest, which could result in a potential offer for the whole of RBPlat.

Rounding out 2021’s best performing shares were Investec Ltd (+138.9% YoY), and Investec Plc (+130.3% YoY).

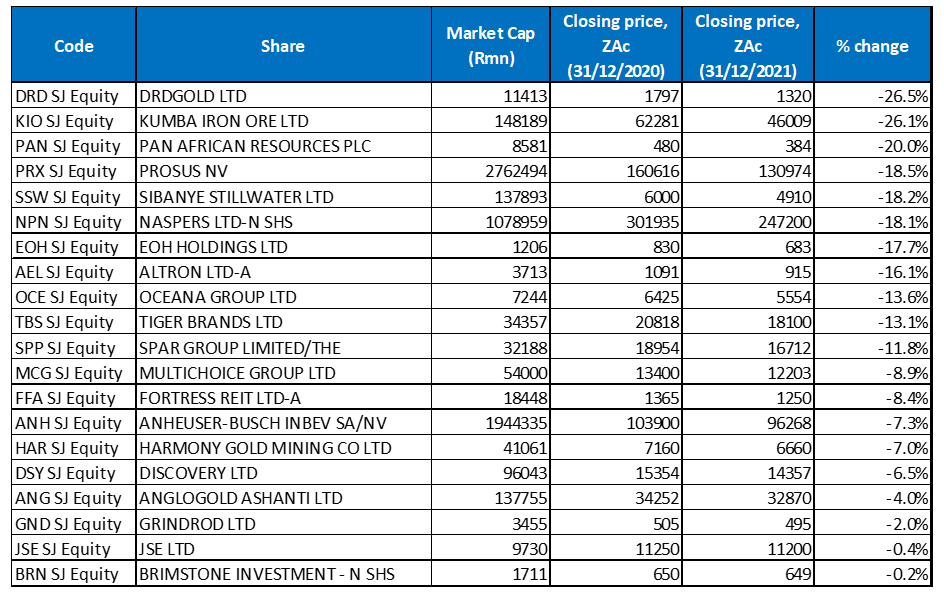

Figure 4: The 20 worst-performing shares of 2021

Source: Anchor, Bloomberg

Looking at last year’s worst performers, 18 of the 20 worst-performing shares for the year to end November again featured among the 20 worst performers for the year to end December. Newcomers in the category were AngloGold Ashanti (-4.0% YoY), and JSE Ltd (-0.4% YoY), which bumped African Rainbow Minerals and Reinet out of the year’s worst-performers list.

Gold tailings retreatment specialist, DRDGold (-26.5% YoY) pushed Kumba Iron Ore (-27.2% YoY) from the top spot and took the title of worst-performing share for 2021. It was followed by Kumba (coming in second) and Pan African Resources (-16.1% YoY) in third place.

Prosus and Naspers recorded YoY declines of 18.5% and 18.1%, respectively, as the companies were negatively impacted by uncertainty brought about by China’s regulatory crackdown on tech firms, including Tencent (their biggest underlying investment, which was down 12.0% YoY in rand terms), spooking investors.

Naspers N was followed by EOH Holdings (-17.7% YoY), Altron -A- (-16.1% YoY), Oceana Group (-13.6% YoY), and Tiger Brands (-13.1% YoY).