After March’s epic global markets meltdown, investors seemed to shrug off ongoing lockdowns as most major markets worldwide recorded an impressive bounce back in April, pushed along by a wave of stimulus packages unveiled by central banks. However, while US equity markets recorded impressive monthly gains in April, they ended their best month in decades slightly downbeat on Thursday (30 April) as spending and unemployment data released on the day showed new evidence of the COVID-19 pandemic’s reach. The inept handling of the crisis by the Trump administration (reported US deaths have increased from 9 in March to 67,682 by 3 May) has now also seen the US become the epicentre of the outbreak. Nevertheless, share prices have rebounded sharply since the US market bottomed on 23 March, the day the US Federal Reserve (Fed) signaled that it would do whatever is necessary to save an economy ravaged by the pandemic.

Looking at the major US indices, the Dow Jones ended April 11.1% higher MoM (-14.7% YTD) – its largest one-month percentage gain since 1987. Meanwhile, the S&P 500 jumped by 12.7% (-9.9% YTD), while the tech-heavy Nasdaq rocketed 15.4% MoM (-0.9% YTD) – its best performance since June 2000, according to CNN. The FAANG companies (Facebook, Amazon, Apple, Netflix, and Alphabet [formerly Google]) were once again among the best performers, as the online economy proved resilient in the face of movement restrictions.

On the economic data front, despite only a few weeks of 1Q20 seeing an impact from movement restrictions, the damage done was enough to push economic indicators to show record declines. Initial 1Q20 GDP data indicated that the US economy had contracted by 4.8% QoQ, ending the longest expansion in its history and, according to CNBC, the first negative reading since 1Q14. Personal spending on services dropped 10.2% QoQ – the biggest fall on record as the food services and accommodation sub-category fell by 30% QoQ. US employment continued to implode as 20mn US workers filed initial unemployment claims in April (in addition to the 10mn initial claims filed in March).

The UK’s FTSE 100 rebounded by 4.0% in April (-21.8% YTD), while European markets also recorded positive performances. After double-digit declines in March, Germany’s Dax gained 9.3% (-18.0% YTD) in April, while France’s CAC rose by 4.0% MoM (-23.5% YTD). As widely expected, the European Central Bank (ECB) on Thursday kept interest rates unchanged and did not alter the size of its EUR750bn pandemic emergency purchase programme (PEPP). The ECB did however say that it stood ready to adjust the size or composition of the PEPP if necessary. CNN reports that Europe’s economy suffered its deepest contraction on record in 1Q20, with preliminary data showing that European Union (EU) GDP shrank by 3.5% QoQ and by 2.7% YoY.

In Asia, China’s Shanghai Composite Index was up 4.0% MoM (-6.2% YTD), while Hong Kong’s Hang Seng gained 4.4% MoM (-12.6% YTD). However, factory output across several Asian countries fell to record lows in April, signaling a deeper contraction in the world’s manufacturing nerve centre. Purchasing managers indices (PMIs) across Southeast Asia slumped further below 50, which separates contraction and expansion, to post their weakest readings since the series began, according to IHS Markit data. China PMI data showed the official manufacturing PMI slipping to 50.8 from 52 a month earlier, while the Caixin gauge, which focuses more on smaller export-orientated firms, returned to contraction territory. China’s 1Q20 GDP shrank by 6.8% YoY – the first quarterly decline since 1992, when official quarterly GDP reports started. Meanwhile, Japanese stocks also recorded good advances with the Nikkei rising by 6.7% MoM (-14.6% YTD).

On the commodity front, iron ore prices have held up reasonably well throughout the current crisis at above the $80/tonne level but prices ended April down c. 4.7% MoM at $83.84/tonne as the impact of closed steel furnaces and improving supply gradually start weighing on prices. The platinum price bottomed around 23 March and was up 7.1% in April, closing the month at $776.75/oz. This, as South Africa (SA), which accounts for c. 70% of global primary platinum supply, went into lockdown, creating a short-term supply reduction. The shutdown of automotive production around the world in response to the COVID-19 outbreak has hit demand for palladium, which was down a further 15.3% MoM in April. Meanwhile, oil shook off major disruptions in the derivatives markets and the prospect of storage space running out to end the month 11.1% higher. This was with some help from a reunited OPEC+, which was able to finally agree on some supply cuts. YTD, oil is still down a massive 61.7%.

In SA, the JSE recorded a phenomenal turnaround as equities posted impressive gains from March’s share price lows. The FTSE JSE All Share Index (ALSI) gained 13.1% MoM (-11.8% YTD), buoyed by MoM share price gains among market-cap heavyweights and various resources counters. All ten of the biggest companies on the JSE posted gains – Anglo American Platinum (Amplats; +29.5%), Glencore (+24.8%), British American Tobacco (BAT: +18.3% MoM), BHP Group (+14.8% MoM), Naspers (+13.5%), Prosus (+11.5%), Anglo American (+8.2%) Anheuser Busch InBev (+5.7%), and FirstRand (+0.5%). With a monthly gain of 22.6% (-9.2% YTD), the Resi-10 by far outperformed the other indices as the bulk of the heavy lifting was done by resource shares. Gold, considered a safe-haven asset, has been a big winner in April (up c. 7%). The yellow metal is benefiting from the uncertainties clouding the global economy that COVID-19 has brought about and a move by central banks to expand balance sheets to support economies, companies and individuals. The Indi-25 ended the month 9.6% higher (+2.3% YTD), while banking and financial counters, which were hard hit in March, gained ground and the Fini-15 closed April 8.8% higher (-34.9% YTD).

Despite limited foreign selling in local equity and bond markets and strong global risk appetite, the rand breached the R19/$1 level several times in April before ending the month c. 3.7% weaker at R18.81/$1. YTD, the local currency is down c. 32% vs the greenback.

In local economic data, annual consumer price inflation (CPI) dipped in March following sustained increases since November 2019, coming in at 4.1% vs February’s 4.6% print. MoM, inflation rose by 0.3%. The main contributors to the increase were housing and utilities (+4.8% YoY), and miscellaneous goods and services (+6.4% YoY). March’s trade balance showed a surplus of R24.3bn from a revised R13.7bn in February. Exports were up 8.5% MoM at R118.5bn, while imports fell by 1.3% YoY to R94.2bn. The South African Reserve Bank’s (SARB) Monetary Policy Committee delivered a further 1% interest rate cut in April, following its 1% rate cut in March, bringing SA’s official interest rate to a record low of 4.25%.

In a mid-April speech, Finance Minister Tito Mboweni said that the COVID-19 pandemic is expected to push SA’s economy into a deep recession this year. He added that Treasury will have to revise the national budget across the board to ensure that the Department of Health has the necessary resources to respond to the outbreak. News24 reported that Treasury has also been in talks with foreign lenders, including the World Bank, the New Development Bank and the African Development Bank on possible loan facilities for COVID-19 support. While Treasury has introduced tax relief measures, Mboweni indicated that a downturn in tax revenue was also expected due to the reduced economic activity. SA began to gradually lift its strict coronavirus lockdown measures on 1 May with the introduction of Level-4 lockdown regulations, which allow some industries to reopen after five weeks of restrictions. Up to 3 May, SA recorded a total number of confirmed COVID-19 cases of 6,738 with deaths having risen to 131.

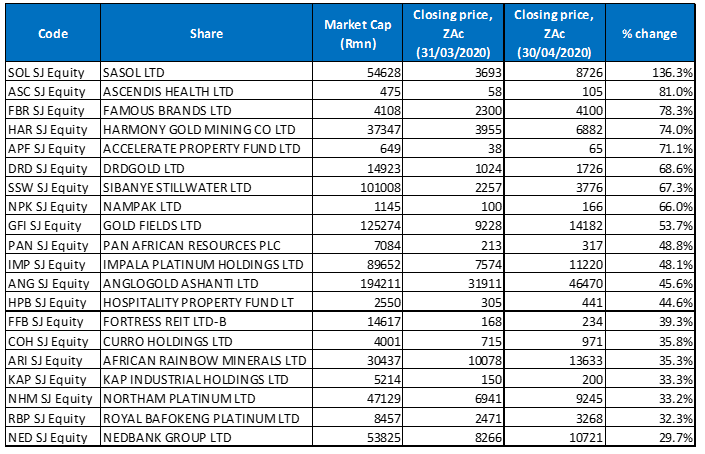

Figure 1: The 20 best-performing shares in April 2020, MoM

Source: Anchor, Bloomberg.

With gold miners up over 50% in aggregate last month, platinum shares jumping by c. 38% MoM and the oil price gaining 11.1% MoM, 11 out of April’s 20 best-performing shares came from the resources sector. Sasol’s share price had plummeted 80.1% in March as oil prices dropped to historic lows. This was due to unprecedented oil demand destruction on the back of COVID-19 movement restrictions and a boost in global oil supply as producers (particularly Russia and Saudi Arabia) flooded the market in a tussle to gain market share. However, the embattled integrated energy and chemicals firm emerged as April’s best performer with its share price jumping by 136.3% MoM (albeit from a low base). We highlight however that the share price remains 71.2% below where it started this year (see Figure 4 below).

Sasol last month released its 3Q20 production update in which the Group announced a range of measures to protect its balance sheet against the COVID-19 pandemic and record-low oil prices. Among these were a 20% cut to the salaries of its executive committee and senior leadership, and for middle and junior managers a cut of between 10% and 15%. It noted that these measures were “… necessary to help protect the company’s balance sheet and liquidity …” until at least the end of FY21. Sasol’s CEO will also donate 33% of his salary to the Solidarity Fund for three months, followed by a 20% salary cut for the next five months. The company now expects a FY20 loss of up to $100mn from its Lake Charles Chemicals Project (LCCP) due to weak oil prices. Its LCCP project has been a major financial drain for Sasol as development costs rose to c $13bn – almost double its initial budgeted projections.

Ascendis Health (+81.0% MoM) was April’s second-best performing share. The Ascendis share price initially leapt in early April after it announced that its drug chloroquine had been approved by the US Food and Drug Administration (FDA) for the limited treatment in an emergency situation of patients who were severely ill as a result of COVID-19 (we note that it is not advertised as a cure for the disease). Chloroquine has historically been used for the treatment and prevention of malaria and is manufactured by the Group’s subsidiary, Remedica. Later in the month, Ascendis also announced the conclusion of a sale between Ascendis Health International and Dutch firm, Atlas Invest B.V., which is part of the BioTech USA Group, a leading global sports nutrition company for the disposal of Ascendis’ Scitec business unit in its Consumer Health segment, for EUR5.0mn.

In third spot, Famous Brands rose 78.3% MoM. In early April, the company said that it will no longer fund its loss-making Gourmet Burger Kitchen (GBK) restaurants in the UK. Famous Brands acquired GBK for GBP120mn (c. R2.8bn) in 2016 in a move it explained at the time as intended to further its goal to diversify its earnings and expand its geographical footprint.

Famous Brands was followed by Harmony Gold (+74.0% MoM), Accelerate Property Fund (+71.1% MoM) and DRD Gold (+68.6% MoM), which re-mines gold-laden dump or tailings material and is controlled by Sibanye. As the global economy takes a battering from the COVID-19 pandemic, investors have been hurrying to the safety of gold resulting in a stronger gold price. This, together with the weakening local currency resulted in the rand gold price breaching the R1mn/kg level last month which, in turn, buoyed gold counters such as Harmony, DRD Gold, Sibanye Stillwater (+67.3% MoM) and Gold Fields (+53.7%).

Nampak rallied 66.0% MoM in April, also from a low base, after its share price dropped by 69.7% in March – we note the share is still down 75.7% YTD (see Figure 4). In early April, the packaging Group said that it had received R1.5bn in proceeds from the sale of its glass business on schedule, having recently relaxed debt covenants with lenders partially due to the risk of a delay in payment.

Finally, Pan African Resources, which recorded a 48.8% MoM jump in its share price, was also buoyed by the stronger gold price. The firm, which mines in Mpumalanga, closed at a YTD share price high of R3.48 on 28 April.

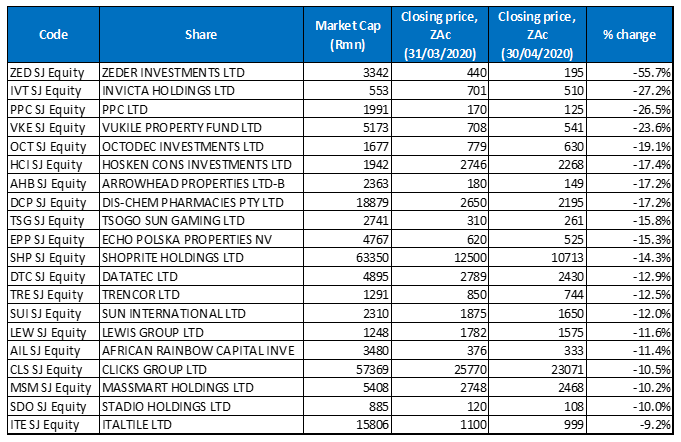

Figure 2: The 20 worst-performing shares in April 2020, MoM

Source: Anchor, Bloomberg.

Agribusiness, Zeder Investments (-55.7% MoM) was April’s worst-performing share by quite a margin. Zeder reported FY20 results last month which showed that its revenue had decreased to R7.49bn from R7.64bn posted in FY19, while diluted HEPS fell to ZAc7.10. Agrivision Africa, Zeder’s joint venture in Zambia, where it grows, mills and sells maize directly to consumers via its own operations, recorded a 51% YoY destruction in value. At one point the business was valued at c. R700mn but it is now valued at around R242mn. For several years, Zeder has indicated that it wants to sell this asset, but this has not happened. On 23 March, Zeder disposed of its largest investment, Pioneer Foods for a total consideration of R6.4bn.

Investment holding and management company, Invicta was in second spot with a MoM share price decline of 27.2%. It was followed by PPC Ltd, which was down 26.5% MoM. Last week, PPC announced the appointment of a permanent CFO and said that its businesses have generally been operationally constrained in their respective jurisdictions during April. Locally, the company said that only PPC Lime sold small quantities to customers deemed by the authorities as essential providers. Overall, SA sales volumes for April are expected to be c. 95.0% lower YoY, due to the stringent lockdown measures imposed by government.

The dire local economic outlook had already impacted property share prices hard when COVID-19 struck, but the sector is now in crisis as the lockdown forces retailers into a situation where they may be unable to pay rentals, adding further pressure to an already-struggling locally listed property sector. Some tenants (especially in the retail sector) earned little or no turnover during the lockdown, and we have no doubt they will want to renegotiate rentals with landlords, while other smaller tenants might go bankrupt. In addition, property companies may adjust (some have already) their capital retention policies — which could impact dividend payments. It was therefore no surprise that local property counters such as Vukile (-23.6% MoM), a retail centre owner in SA and Spain, and Octodec (-19.1% MoM), were quite high among the list of worst-performing shares. In early April, Vukile announced that even after considering the impact of the COVID-19 pandemic in Southern Africa and Spain, its FY20 distributable EPS was expected to remain within the guidance of 3.0%-5.0% YoY growth. However, to maintain maximum operational and financial flexibility, it withdrew its FY20 DPS guidance. In its 1H20 results, Octodec stated that its revenue increased to R1.0bn from R0.98bn posted in 1H19 and its diluted EPS fell by 83.5% YoY to ZAc13.0. The firm also did not pay a dividend, saying that it will reassess its position on this at year-end.

Hosken Consolidated Investments (HCI), whose primary investee companies are in manufacturing, hotels and casinos, which for the most part have completely closed due to the lockdown, fell 17.4% MoM. HCI’s CEO also said because its investee companies are in those sectors they will likely not reopen when the lockdown is lifted (it was moved to stage 4 on 1 May) and will probably have to operate under this cloud for most of 2020, with the exception of manufacturing. Fin24 writes that, to make matters worse, as an investment holding company that spends money to acquire new ventures, HCI’s balance sheet is highly leveraged.

Meanwhile, Arrowhead Properties and Dis-Chem Pharmacies both recorded MoM losses of 17.2%. Last month, Arrowhead said that the potential impact of COVID-19 on the business remains uncertain and as at 20 April (the date of the announcement), more than 65.0% of its April 2020 total billings has been collected. It noted that the Board believed that, “given the current unprecedented circumstances and prevailing uncertainty”, it is important that Arrowhead retain as much capital as possible to protect its balance sheet and bolster liquidity. Accordingly, it resolved to defer a decision on the payment of an 1H20 interim dividend, until the release of its FY20 results (on, or about, 25 November). In April, SA’s competition watchdog charged Dis-Chem, the second-biggest pharmaceutical products retailer, with excessive pricing of sought-after face masks, making it the first high-profile company to have to answer COVID-19-related price gouging allegations. Dis-Chem has denied the allegations.

Tsogo Sun Gaming (-15.8% MoM), in which HCI has a stake, had to close its hotels, convention centres and casinos during the lockdown. In an update to shareholders, Tsogo Sun said reduced trading volumes since 19 March and the lockdown, “ … would have a negative impact on its FY20 results although it still expects to deliver a solid set of results regardless of this setback.” Prior to 15 March, Tsogo had been on course to deliver c. 4% YoY revenue and EBITDA, long-term incentives and exceptional items growth, with the second half performing better than the first. However, the firm said that from 19 March its position “deteriorated significantly”, with sites operating at limited capacity due to the regulatory restrictions.

Rounding out April’s 10 worst-performing shares was Echo Polska Properties (EPP). Despite its share price rallying c. 10% on Thursday (30 April), when EPP said that Poland had lifted restrictions on all shopping malls and retail centres which will start operating from 4 May, EPP still recorded a 15.3% MoM share price drop. EPP is the largest owner of retail real-estate assets in Poland, with a portfolio of 32 properties having a total leasable area of more than 1mn square metres.

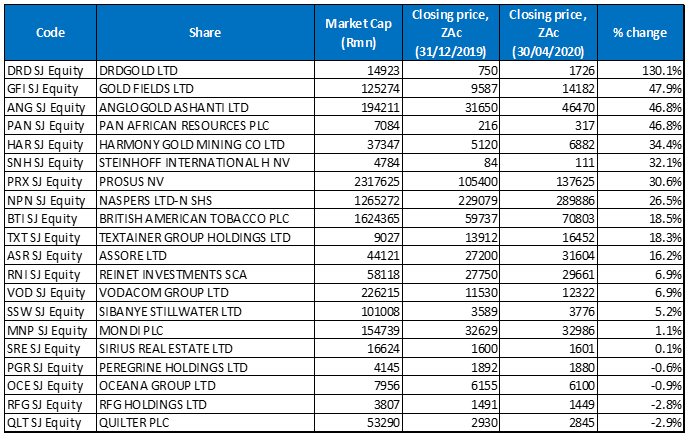

Figure 3: Top-20 YTD performers (to end April 2020)

Source: Anchor, Bloomberg

Fourteen of March’s best-performing shares YTD remained among the 20 best performers for the year to end April. Harmony, Sibanye Stillwater, Sirius Real Estate, Peregrine, Oceana and Quilter were April’s new entrants in the top-20, bumping Dis-Chem, Clicks, Shoprite, Pick ’n Pay, Trencor and Zeder from the list. Food retailers and pharmacies had a tough April after missing the initial JSE sell-off in March.

DRD Gold remained the YTD best-performing share with a share price gain of 130.1%. It was followed by Gold Fields (+47.9% YTD) in second place, as a robust gold price and the counter’s impressive performance in April saw it rocket higher in the rankings. Two other gold counters took third spot – AngloGold Ashanti and Pan African Resources, which also produces platinum, both recorded a 46.8% YTD gain. These shares pushed Steinhoff (+32.1% YTD), Prosus (+30.6% YTD) and Naspers (+26.5% YTD) from second, third and fourth positions in March to the sixth, seventh and eighth spots in April. Pan African Resources was followed by a new top-10 YTD entrant Harmony (+34.4% and discussed earlier), with BAT (+18.5% YTD) and Textainer (+18.3% YTD) rounding out the top-10 YTD performers.

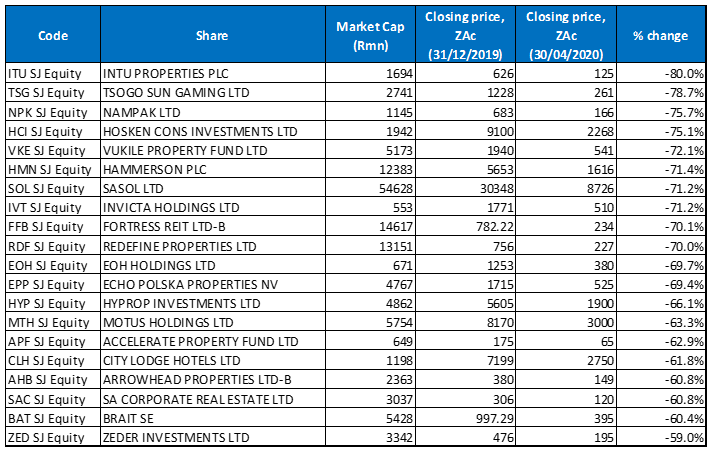

Figure 4: Bottom-20 YTD performers (to end April 2020)

Source: Anchor, Bloomberg

As mentioned earlier the past few months have seen the value of even the highest-quality property companies fall. The steep share price declines of counters such as Redefine, Vukile, Attacq, Hyprop etc. follow the already sharp declines experienced across the sector last year. With most property companies likely to cut or postpone dividend payments due to the COVID-19 lockdown, property shares will remain under pressure, with mall owners being hardest hit because of the rental (and operating cost) discounts that are likely to be given to large retail tenants due to the April lockdown. We note that income statements in the sector are going to be under pressure for as long as the crisis lasts, and for retail centres even longer, as these seem most exposed to behavioural changes in the aftermath of COVID-19. The negotiations between the Property Industry Group and regulators are critical, with a relaxation of REIT status rules as they relate to tax breaks on income retained being the main discussion point. This would need buy-in from both the JSE (listing rules) and SARS/National Treasury (tax legislation). At this point there is, however, no timeframe on when a conclusion will be reached.

The above-mentioned are just some of the reasons why property shares continue to account for most of the worst-performing shares YTD. Looking at the year to end-April’s worst performers, apart from Invicta Holdings (-71.2%), Arrowhead Properties (-60.8%) and Zeder (-59.0%), which replaced Famous Brands, Kap Industrial and Attacq, the remainder were unchanged from the year to end-March rankings. However, with Sasol’s share price gaining 136.3% in April, the counter moved up from March’s worst-performing share to the seventh-worst performing share in April (down 71.2% YTD). This resulted in Intu Properties (-80.0% YTD) grabbing the worst-performer spot, followed by Tsogo Sun (-78.7% YTD) and Nampak (-75.7% YTD) in second and third positions, respectively.

HCI (-75.1% YTD), Vukile (-72.1% YTD) and Hammerson Plc (-71.4% YTD) followed. With Invicta, Fortress-B (-70.1% YTD) and Redefine Properties (-70.0% YTD) rounding out the ten-worst performing shares. Fortress announced in March that it had changed its dividend policy to counter local economic headwinds and said that it plans to exit non-core assets and reinvest the proceeds into high-quality logistics parks. A growing number of property groups say that retaining cash will help them survive the difficult conditions that are likely to continue for the short term.