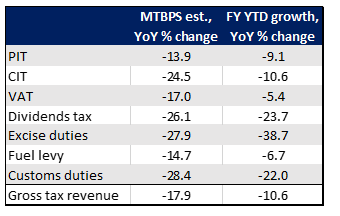

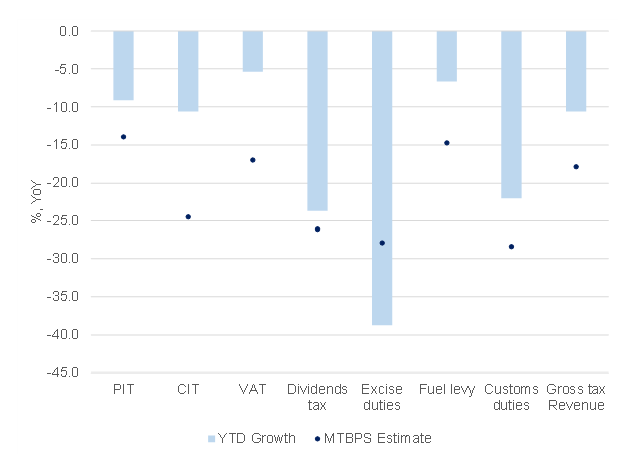

National Treasury (NT) recently published December’s monthly budget data, which continued to show an improvement in tax collections. Since October 2020, cumulative tax revenue collections have performed better than expected, relative to NT’s Medium Term Budget Policy Statement (MTBPS) expectations. YTD (i.e., April to December 2020), collections point to a 10.6% YoY decline in total tax revenue for FY20/21, compared to the MTBPS’ forecast for total tax revenue to decline by 17.9% YoY. The better-than-expected performance was broad-based and largely driven by the major tax categories (personal income tax [PIT], company income tax [CIT], and net VAT) – barring excise duties.

The strong CIT performance has been propelled by rising commodity prices (which have boosted profits of mining companies), and a surge in exports during the 2H20. CIT proceeds were the key line to watch as December is an important month for these receipts. Interestingly, CIT receipts rose 15% YoY in December, a surprisingly (but most welcome) strong outcome, especially given the magnitude of the hit to economic activity last year due to the COVID-19 induced lockdowns.

Considering the PIT collections, an interesting trend to note (as outlined in Statistics South Africa’s [SA’s] 3Q20 unemployment report), is that employees with higher levels of education have been less impacted by the COVID-19-driven unemployment and salary cuts, compared to those with lower levels of education. This has therefore cushioned the impact on PIT collections as employees with higher levels of education tend to earn more and therefore have a higher tax burden.

The net VAT performance (domestic VAT in particular) has likely been supported by the Temporary Employee/Employer Relief Scheme (TERS) payments, the government’s extended social grants programmes, and the current low interest rate environment. Together, these factors have supported consumption by remaining resilient. The significant weakness witnessed in excise duties comes as no surprise to us, especially given the number of restrictions with which the alcohol and tobacco industries have had to contend.

Figure 1: Tax revenue growth running ahead of NT’s forecasts

Source: National Treasury, Anchor

Figure 2: Tax revenue YTD vs MTBPS’ estimates

Source: National Treasury, Anchor

On the expenditure side, the YTD main budget expenditure is also tracking in-line with NT’s expected 6.9% YoY increase for FY20/21. A major source of concern, for some time now, from the expenditure side is the public wage bill. However, recent developments regarding public sector wage negotiations indicate that government and labour are willing to reach a middle ground. Still, this remains a fluid situation, and the eventual outcome is yet to be determined.

Other key issues to consider regarding the tabling of the upcoming national budget (scheduled for Wednesday, 24 February) include the funding of the COVID-19 vaccine drive (estimated to cost c. R20.6bn); the potential for increased/extended special social grants as unemployment and poverty continue to increase; and the ongoing financial challenges faced by the smaller, less frequently discussed, State-Owned Enterprises (SOEs) including the Land Bank, Denel, the SABC, and the Road Accident Fund (RAF). This is of course not discounting the ever-present gargantuan problem that is Eskom. Furthermore, it is not yet clear as to what the new, smaller and ‘rebranded’ SAA will look like. The recovery of the SA Revenue Service’s (SARS’) institutional strength to improve tax collection remains critical. Lastly, adding to all of the above, is the increasing conditionality and external oversight due to SA’s recent loans from key international lenders such as the IMF, the World Bank, and the African Development Bank.

Overall, despite the improvement in the near-term fiscal outlook, issues of debt sustainability continue to linger as the primary balance is projected to remain in a deficit, while the interest rate on government debt is expected to remain higher than nominal GDP – implying that the debt-to-GDP trajectory will continue to rise. As a result, increasing debt service costs are adding further pressure to an already strained fiscus. Therefore, a degree of caution is still warranted although the positives stemming from the better-than-expected revenue collection will assist in mitigating the many downward risks still present.