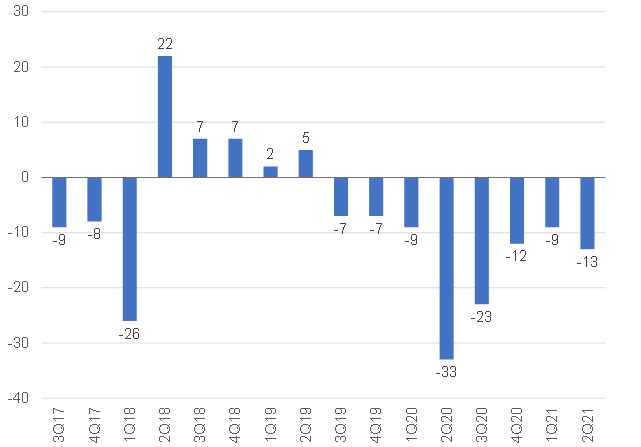

Data from the FNB/Bureau for Economic Research (BER) Consumer Confidence Index (CCI), released on Monday (28 June), showed that the FNB/BER CCI backtracked to -13 in 2Q21, after recovering from -12 (in 4Q20) to -9 index points during 1Q21. This latest reading remains well below the average CCI reading (of +2 since 1994), thus indicating very depressed consumer confidence levels, albeit less negative compared to the extraordinarily pessimistic readings of -33 and -23 recorded during 2Q20 and 3Q20, respectively.

Figure 1: The FNB/BER Consumer Confidence Index

Source: FNB/BER, Anchor

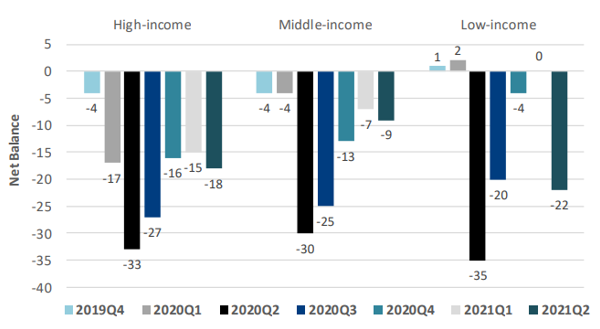

A breakdown of the CCI per household income group shows profoundly diverging results for the various income groups in South Africa (SA), and reiterates that it is the low-income groups that continue to feel the most strain. From an income group perspective, the decline in the overall CCI can largely be attributed to a major deterioration in the confidence levels of low-income households (earning less than R2,500/month), with the low-income confidence index plunging from zero to -22 index points during 2Q21. Essentially, low-income households now have little faith about their income prospects – they no longer expect their household finances to improve over the next year.

In contrast, high- and particularly middle-income confidence levels saw far smaller declines during 2Q21, and affluent consumers are now much less pessimistic compared to low-income households. Most high-income consumers expect the financial position of their households to be unchanged over the next 12 months.

Figure 2: Consumer confidence by income group

Source: FNB/BER