Executive summary:

- The US stock market has consistently outperformed other regions over the last few years.

- Much of the outperformance has been driven by a handful of tech heavyweights, and those sectors are now looking expensive on forecast earnings relative to their own history.

- Investors have started to ask whether it is time to look to companies listed outside the US, particularly with concerns around how unprecedented stimulus and a tricky US Presidential Election might impact the US economy.

- Many of the most interesting US sectors earn less than half of their revenue in the US, so US listings are not necessarily synonymous with US economic exposure.

- European stocks earn only c. 40% of their revenue in Europe – domicile of listing is not necessarily a good proxy for economic exposure.

- Stocks listed in the US represent more than 40% of the total global equity market cap (triple the size of all European stock exchanges combined and more than double the combined market cap of stocks listed in Hong Kong and China), so it is certainly the biggest pond to fish for interesting stock ideas.

- Companies in the US and China seem to be intent on maintaining their leadership of innovation in new products and services, with roughly half of global research and development (R&D) spending happening in those two countries.

- Rather than focussing on the listing domicile of stocks, we think it makes more sense to ensure that we construct a portfolio of stocks that earn a globally diversified revenue stream. We also tend to focus predominantly on identifying those companies that are best placed to grow their earnings in the countries in which they operate.

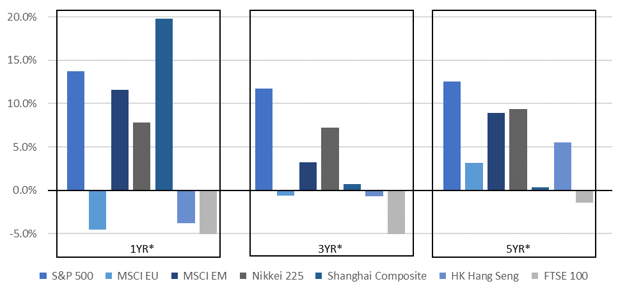

Over the last few years, we have seen US markets consistently outperform most other stock markets:

Figure 1: US Equities have consistently outperformed over the last few years

*Annualised total return in US dollar

Source: Bloomberg, Anchor

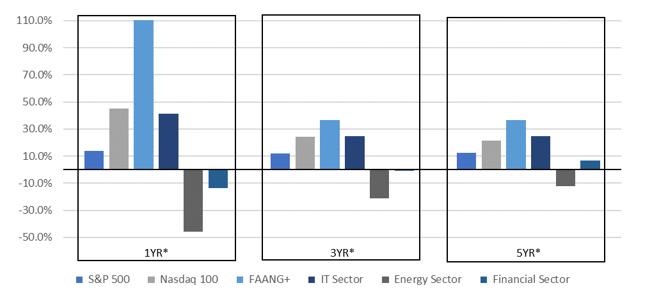

US markets have been dragged along by a few high-flying tech stocks. The New York Stock Exchange (NYSE) created an index consisting of 10 of the most prominent US-listed tech stocks (Facebook, Amazon, Alphabet, Netflix, Apple, Tesla, Alibaba, Twitter, Nvidia, and Baidu) – the NYSE FANG+ Index, which has more than doubled over the past year. This is in stark contrast to other sectors, like financials and energy, which are down by 10% and 43%, respectively, over the same period.

Figure 2: Tech stocks have been the primary driver of US stock market outperformance

*Annualised total return in US dollar

Source: Bloomberg, Anchor

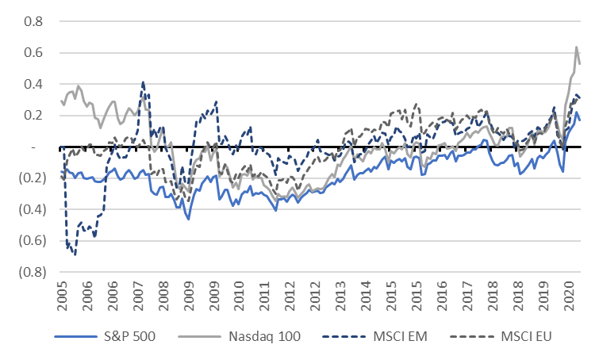

This concentrated rally in the US stock market has had many investors questioning whether it is time to look to other stock exchanges, particularly with the prospect of a messy US Presidential Election coming up and some concerns about how unprecedented fiscal and monetary stimulus might play out for the US economy.

This rally in US tech stocks has left the Nasdaq 100 Index (with a large concentration of tech shares) looking considerably more expensive than many other markets based on expectations for earnings two-years out (i.e. when the COVID-19 impact on earnings has hopefully waned).

Figure 3: US tech stocks are looking most expensive relative to their 15Y average rating

Source: Bloomberg, Anchor

In this note, we consider:

- How much of the US stock market is exposed to the US economy?

- Whether other stock markets present more interesting opportunities for investors.

How much of the US stock market is exposed to the US economy?

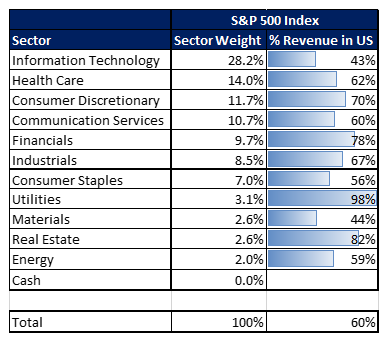

The market cap of a stock is typically a function of the value investors place on the company’s earnings (or more precisely its expected future earnings), so the best way to attribute the value of the US stock market to various geographies would be to apportion each company’s market cap according to its earnings in each region. Unfortunately, companies are under no obligation to report their geographic earnings split and almost none do, so that calculation is essentially impossible. As a very rough proxy, FactSet produces a monthly report on the geographic revenue split of the largest US-listed stocks as represented by the S&P 500 Index as most companies provide some sort of transparency to their geographic revenue split, albeit not a very granular one. Based on the most recent FactSet report, only 60% of US stock market revenue is generated in the US:

Figure 4: US large-cap stocks generate about 60% of their revenue in the US

Source: FactSet, Anchor

So, if investors are worried about the US economy, it is not a given that those US-listed stocks in which they are invested are at risk. Many US-listed companies earn less than half of their revenue in the US, particularly companies outside of some of the sectors with high domestic exposure, like financials, utilities, and real estate.

Do other regional stock markets provide more interesting opportunities?

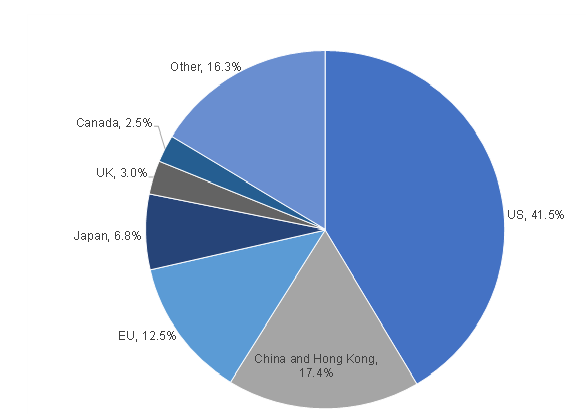

Stocks listed in the US represent more than 40% of total global equities’ market cap, so in terms of the broadest opportunity set, US-listed stocks represent comfortably the biggest selection, more than triple the size of all the European stock exchanges combined and more than double the combined market cap of stocks listed in Hong Kong and China. US stock market regulations also provide investors with the additional benefit of high-quality reporting and transparency standards with more frequent disclosure than many other global exchanges.

Figure 5: The geographic split of global stocks’ market cap by domicile of exchange listing

Source: Bloomberg, Anchor

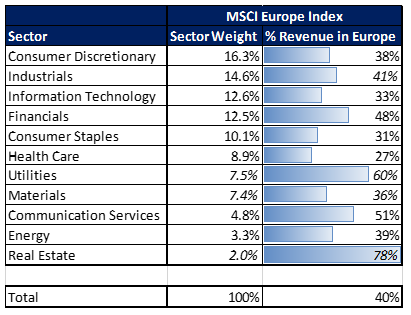

For those investors concerned about their exposure to the US economy, it is not clear that the European exchanges provide a significantly cleaner exposure to the European economy. UBS’ analysis of the geographic split of revenue for the c. 320 companies in the MSCI Europe Index suggests that European-listed companies generate only 40% of their revenue in Europe.

Figure 6: European-listed companies generate less than half of their revenue in Europe

Source: UBS, Anchor

The Asian exchanges present an interesting alternative to the US and Europe. Japan’s stock exchange has about 15% exposure to automobile and consumer electronics companies, which generate much of their revenue outside of Japan. However, the Japanese stock exchange also hosts a large selection of financial and real estate companies that generate all of their revenue in Japan. Unfortunately, the Japanese economy has not seen economic growth for decades, so for investors shifting cash from the US around economic growth concerns, Japan is not the obvious beneficiary.

China and Hong Kong represent perhaps the most interesting alternative to the US, with stocks representing around 11% of the total global market cap listed on mainland exchanges and another 7% of total global market cap coming from stocks listed in Hong Kong, many of which are companies with the bulk of their revenue being generated in mainland China. Investing in Chinese listed stocks is not without its challenges. This is especially so in terms of transparency and restrictions that Chinese authorities have placed on the ability of foreign investors to purchase Chinese-listed stocks and obtain local currency for the settlement of those purchase, although we note that those restrictions are becoming less onerous as Chinese authorities increasingly look to attract foreign capital.

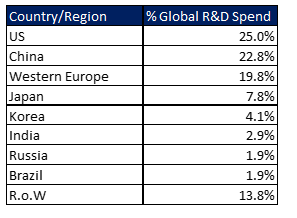

In terms of valuations, if R&D spending is correlated to the ability of companies to keep producing the most innovative products and services, it would seem that the US and China are certainly aiming to continue to lead that race. Almost half of total global R&D spending is happening in those two countries according to UNESCO’s latest data (from 2017).

Figure 7: US and China dominate global R&D spending

Source: Anchor, UNESCO

Conclusion

Investors should not be too obsessed with the country where stocks are listed and should instead focus more on where these companies earn their profits (or, more importantly, where they are likely to earn profits in the future). Ideally, investors should construct a portfolio of stocks with a globally diversified earnings stream.

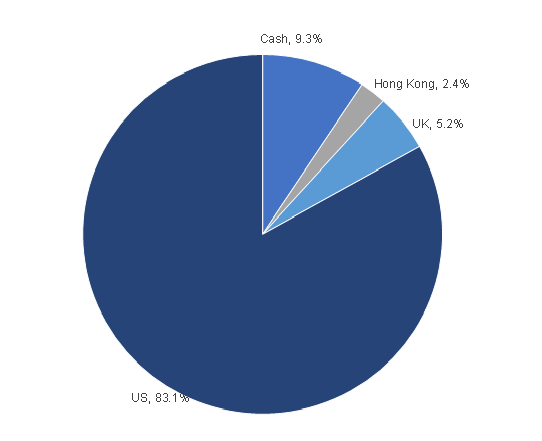

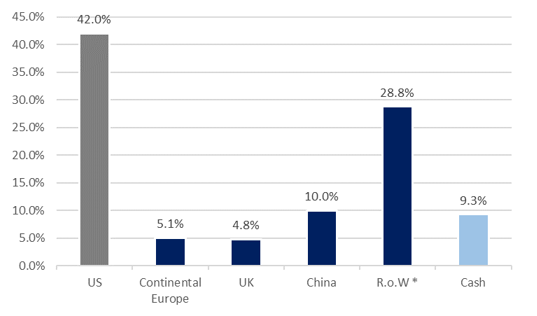

Anchor’s model offshore equity portfolio (High Street Equity) has more than 80% of its capital invested in US-listed stocks.

Figure 8: Anchor’s offshore model equity portfolio is more than 80% invested in US-listed stocks

Source: Anchor

Despite the heavy concentration in US-listed stocks, we have been able to construct a portfolio that earns less than half of its revenue in the US. Our focus has been on ensuring that we are not overly leveraged to any single geographic region but, more importantly, that we source those earnings via companies that are best placed to deliver superior earnings growth in those regions in which they operate.

Figure 9: Anchor’s offshore model equity portfolio is invested in companies that earn globally diversified revenue streams

*R.o.W. includes all countries outside of the US, where companies do not provide a more granular breakdown.

Source: Anchor, Bloomberg