“I’ve learned that life is like a roll of toilet paper. The closer it gets to the end, the faster it goes”

Andy Rooney

This year end takes on particular significance as it marks the end of the decade. Does that matter particularly from an investment perspective? In reality, no it doesn’t. However, it is probably in our nature to use these points in the calendar to reflect on what has passed, as well as to re-evaluate our plans for the future.

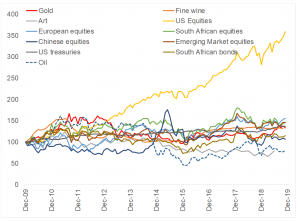

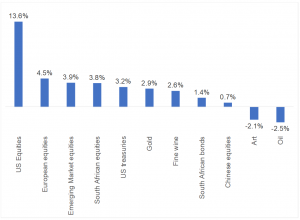

With that in mind, we thought it would be interesting to look back at the past decade and see how investment choices you might have made would have turned out. In Figure 1 and 2 below, we show the total returns, in US dollars, for a selection of asset classes (including some unusual ones for the more adventurous out there!).

Figure 1: Asset total returns over the past 10 years (US dollar)

Source: Bloomberg, Anchor

Figure 2: Compound 10-year total return (US dollar)

Source: Bloomberg, Anchor

A few points to ponder:

- There are numerous articles being written at the moment pointing out that we are experiencing one of the longest periods of economic expansion (or a bull market) in history. The charts above reveal that, from a market performance point of view at least, this is very much a US phenomenon. Outside of US equities, returns have been decidedly less bull-like!

- As for the US market, 10 years ago, much of the discussion in the business media bemoaned the US’ “lost decade” following the prior market peak in mid-2000. A decade on, those that listened to them and threw in the towel will be kicking themselves.

- South African (SA) equities possibly performed better than you might have thought over the past 10 years, relative to the rest at least! This was thanks to a strong start to the decade – in the past 5-years the SA equity market has returned just 1% p.a. Then, of course, there is the outsized impact of the largest stock in the local index – Naspers. Its compound annual US dollar return of 19% over the past decade concealed considerable pain elsewhere among SA equities.

- Although gold has enjoyed a resurgence recently, the fearmongers who predicted that de-basing of currencies through quantitative easing would lead to a rush to the security of gold must be licking their wounds (for now!).

- Those investing on the assumption that strong economic growth would translate into investment returns 10 years ago would no doubt have backed China. The US/China trade war hasn’t done the Chinese market any favours recently, but China’s equity market performance provides a sobering lesson to those assuming equity indices always mirror the underlying economy.

- The fears a decade ago that the world was approaching “peak oil” from a supply perspective failed to deliver the price spike that might have been expected to accompany this prediction. We likely have shale oil to thank for that. For the sake of the planet, let us hope that “peak oil” now refers to demand and that it is behind us!

- As for the adventurous types that sought returns in unusual places, the last decade did not treat them well – we hope the wine brought them some solace, while the art gave them joy as it hung on their walls. Their investment returns certainly didn’t!