The so-called October effect, a perceived market anomaly which postulates that shares usually decline during October (as happened with the 1929 stock market crash, Black Monday in 1987, 2002’s bursting of the Internet bubble and the 2008 global financial crisis, where the bear market started on 9 October) was fortunately not at play this past month, with most global equity markets closing in the green. Nevertheless, it was still a bumpy ride and markets have been up and down due to trade war uncertainty all month, especially after reports on Thursday (31 October) indicated that Chinese officials doubted whether a trade deal would get done. As widely expected, the Federal Reserve (Fed) cut its benchmark interest rates on Wednesday (30 October) for the third time this year. However, Fed chair Jerome Powell hinted that the Fed’s market-stimulating rate cuts won’t happen again unless the economic outlook worsens. While the Fed acknowledged challenges facing the global economy, it said that the US was still doing well in comparison.

In terms of the three major US indices, the tech-heavy Nasdaq gained the most in October (+3.7% MoM; +25.0% YTD), cheered by better-than-expected earnings from Facebook and Apple. The S&P 500 recorded a 2.0% MoM gain (+21.2% YTD), hitting a new record on Wednesday, while the Dow Jones Industrial Average posted a marginal 0.5% MoM advance (+15.9% YTD).

US economic data showed that the Institute of Supply Management’s Chicago Business Barometer came in at its lowest level since December 2015. It was also its second-straight reading below 50 (which signifies contraction, while above 50 shows expansion). The Commerce Department said that GDP growth slowed to a modest 1.9% in 3Q19, although this number still surpassed expectations of even weaker growth (consensus estimates were for a 1.6% print). Manufacturing output, as measured by the Fed, shrank over two straight quarters this year, effectively showing it is in a recession. Reuters reports that a separate, more widely followed index drawn from purchasing managers showed September’s contraction in manufacturing was the steepest since June 2009, hampered by a strike at General Motors and as trade tensions continue to weigh on US exports.

For the second month in a row, major European equity markets closed in the black. Germany’s DAX gained 3.5% MoM (+21.9% YTD), while France’s CAC advanced 0.9% MoM (+21.1% YTD). Central banks in the European Union (and Japan) kept rates at ultra-low levels, although economic growth in the region has been sluggish with the latest data showing that 3Q19 growth in the 19-nation single currency bloc came in at only 0.2% as global trade wars weigh on sentiment. The eurozone’s annual growth rate continued its 2019 path of a steady decline – from 1.3% in 1Q19 to 1.2% in 2Q and 1.1% in the latest three months (3Q19).

The UK’s FTSE 100 lost 2.2% MoM (+7.7% YTD), coming under pressure from results-driven declines in the likes of Shell, the index’s most valuable company, while Brexit fears also dragged the UK market lower. Over the past fortnight or so, UK equities have been volatile with major Brexit developments happening, including Prime Minister Boris Johnson striking a new deal with the EU as UK lawmakers forced his hand into asking for another Brexit extension. The UK will now also be going to the polls on 12 December, after MPs backed Johnson’s call for an election following months of Brexit deadlock.

Asian markets closed October higher, with China’s Hang Seng gaining 3.1% (+4.1% YTD), while the Shanghai Composite advanced 0.8% MoM (+17.4% YTD). The Caixin/Markit manufacturing PMI, a private factory activity survey, showed China’s October manufacturing activity expanded more than expected, coming in at 51.7. However, earlier last week, the more closely watched official October PMI data (which polls a large proportion of big businesses and state-owned enterprises) indicated that key manufacturing activity in China shrank for the sixth straight month, dropping to a worse-than-expected 49.3 from September’s 49.8 as the sector continues to suffer under a slowing domestic economy and the long-running trade war. Meanwhile, Japan’s Nikkei jumped 5.4% MoM (+14.6% YTD) and the yen appreciated after the Bank of Japan’s decision to keep policy rates unchanged.

On the commodity front, the price of Brent crude oil closed October c. 1.0% down (+12.0% YTD) with US crude inventories, which came in higher than market expectations, weighing on the price. Following a 3.1% MoM drop in September, the gold price recorded a turnaround, rising 2.8% MoM (+18.0% YTD) as the yellow metal’s safe-haven appeal was again boosted by uncertainty surrounding the latest US-China trade negotiations. Benchmark iron ore prices dropped c. 3.6% MoM, while the platinum price was relatively unchanged. The price of palladium (which together with platinum, rhodium and three other metals forms part of the platinum group metals [PGM] basket) hit an all-time high last month. The rand strengthened slightly (+0.2% MoM) against the dollar but is down 5.3% vs the greenback YTD.

The SA market staged quite a turnaround, closing green across the board in October after three consecutive months of declines. The FTSE JSE All Share Index rose 2.9% MoM (+7.0% YTD), with the Resi-10 rocketing 7.1% MoM (+13.5% YTD) as market-cap heavyweights such as Anglo American Platinum (Amplats), AngloGold Ashanti, Anglo American, Impala Platinum (Implats) and Sasol, recorded MoM share price gains of 23.5%, 16.3%, 9.9%, 9.0% and 8.4%, respectively. The Fini-15 jumped 2.8% MoM (-3.2% YTD) with Sanlam, Capitec, FirstRand and RMB Holdings recording MoM share price increases of 6.7%, 6.6%, 5.8% and 5.0%, respectively. The Indi-25 remained under pressure, but eked out a 0.2% MoM rise (+9.6% YTD) despite index heavyweights such as Anheuser-Busch InBev (AB InBev; -15.3%) and Naspers (-6.5%) posting significant MoM losses.

On the political front, news around the ruling party’s shenanigans were, for once, overshadowed by media reports around the official opposition – the Democratic Alliance (DA). As former leader Helen Zille returned to politics and was elected DA Federal Council Chair, there was talk of two factions battling it out in the party with then DA Leader Mmusi Maimane telling EWN that there were colleagues in the DA who “ … wanted to reclaim what he referred to as “the old DA”.” Zille’s election saw resignations from Johannesburg Mayor Herman Mashaba and Maimane, with Federal Chairperson Athol Trollip following suit. Meanwhile, President Cyril Ramaphosa led a local delegation to the first Russia-Africa Summit, held in Sochi earlier last month, while Public Enterprises Minister Pravin Gordhan unveiled government’s Special Paper on Eskom, which encompassed plans to reform the struggling state power utility. Eskom which supplies c. 95% of SA’s power, is considered to be the biggest risk to the local economy and is in debt to the tune of R450bn ($31bn). The paper sets out a roadmap for Eskom in a reformed electricity supply industry. Finally, this past week, Finance Minister Tito Mboweni gave us a depressing Medium Term Budget Policy Statement (MTBPS), which painted a rather bleak picture of SA’s finances and was widely criticised as not going far enough to address structural issues in the economy.

Local economic data showed that September consumer price inflation (CPI) was slightly down at 4.1% YoY (vs 4.3% in August), with Stats SA saying that the main contributors to the annual inflation rate were food and non-alcoholic beverages (+3.9% YoY), housing and utilities (+4.8% YoY), and miscellaneous goods and services (+5.7% YoY). The latest retail sales numbers showed a 1.1% YoY rise for August vs July’s 2.0% YoY gain, while the September trade surplus widened to R5.2bn (vs a revised R4.5bn in August) as the value of oil imports decreased. Other data showed that SA’s unemployment rate worsened to 29.1% – its highest level in more than 11 years.

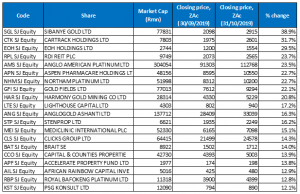

Top-20 October 2019 MoM performers

Source: Bloomberg, Anchor

October’s best-performing shares were again a mix of gold, industrial, financial and even property counters. Gold mining shares, conspicuously absent in September following their impressive performances over the previous few months, rallied in October as the price of bullion jumped nearly 3% for the month. Among the top-10 shares, Sibanye Gold (+38.9%), was by far the best performer. The gold miner, in its 3Q19 operating update released last week, said that the period saw a pleasing recovery in the Group’s operating and financial performance, following a difficult eighteen-month period. Group adjusted earnings before interest tax, depreciation and amortisation (EBITDA) stood at R5.50bn – a 243% YoY rise vs the R1.60bn generated in 3Q18. The other big takeaway from the operating update was that net debt/EBITDA declined from 2.5x at 1H19 (30 June 2019) to 1.7x at 3Q19 (30 September 2019). Sibanye also guided for the potential to reinstate dividends in the second half of 2020.

In second spot, fleet management and car-tracking firm, Cartrack’s share price shot up 31.7% MoM after the company said it had achieved robust growth of 20%-plus YoY, largely due to a growing demand for telematics services both globally and in SA. The firm delivered impressive growth in its interim results, showing that it had reached 1mn subscribers for the first time and grew headline earnings per share (EPS) by 28% YoY. Subscription revenue climbed 26% YoY to R897mn, while total revenue came in at R938mn, and cash generated from operations were up an impressive 70% YoY to R446mn. Regions outside SA now account for 27% of Group revenue,

In third position, EOH Holdings jumped 29.5% (albeit from a low base – its share price is down 49.6% YTD), after the company said it would offload more assets to reduce its high debt burden of R3.2bn. EOH has been mired in controversy following a fraud scandal involving its employees and the public sector. However, CEO Stephen van Coller took the helm in September 2018 and has drawn up a recovery plan for the business which includes selling assets and improving corporate governance standards. In October, EOH blacklisted 50 companies from doing business with it after an investigation into previous corrupt dealings, and van Coller said the firm would structure its operations into three units and sell assets that do not fit within the revised set up. The company had already sold 15 assets generating c. R750mn.

UK focused property fund, RDI Reit (+23.7% MoM) last month urged investors to be patient after it spent the past year exiting the UK retail industry and other weaker assets and reinvesting into sectors producing better returns. The firm declared a GBp10 (R1.88) FY19 dividend – down 3.5% YoY. Group revenue fell 1.6% YoY to GBP93.5mn, while headline earnings slowed 3.8% YoY to GBp8.2/share.

RDI was followed by Amplats, Aspen Pharmacare and Northam Platinum with MoM gains of 23.5% and 22.7% (both Aspen and Northam). Despite reporting disappointing PGM production of 1,141,200 ounces for the quarter to end-September – in line with the prior year, Amplats’ share price is up 110% YTD, due in large part to a rally in palladium prices. Aspen shares rose despite the company announcing last month that it has written down the value of heartburn medication, Zantac, which it mainly sells in Australia, after it was recalled due to possible cancer risks. Northam announced last week that it will buy the PGMs contained in Maroelabult, currently owned by Barplats, for R20mn. Miningmx writes that Northam has said that Group saleable annual production is seen doubling over the next five years to over 900,000 ounces, while saleable rhodium production is expected to double to over 70,000 ounces p.a. over the same period.

Rounding out the top-10 performers for the month were Gold Fields (+22.1% MoM), Harmony (20.8% MoM) and Lighthouse Capital (+17.2% MoM). In its FY19 annual report, Harmony, which operates mines in SA and Hidden Valley in Papua New Guinea, said the Group’s gold output had increased 17% YoY to 1.44mn ounces. According to the company, underground grade recovery improved by 2% for the seventh consecutive year in 2019 to 5.59 grammes/ tonne. Finally, property Group, Lighthouse Capital said last month that it was in advanced stages of negotiations regarding a potential significant direct retail property acquisition in Iberia, as it expands further into Western Europe. Lighthouse was previously part of the Resilient stable of companies.

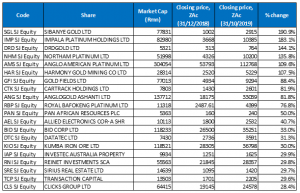

Bottom-20 shares: October 2019 MoM performance

Source: Bloomberg, Anchor

ArcelorMittal was October’s worst-performing share, declining by 17.8% MoM. It was followed by Nampak (-15.4% MoM) and AB InBev (-15.3%). Nampak last month sold its glass business for c. R1.5bn. The company has previously said that selling the glass business would enable it to focus on its metals business, which generates more than 60% of its trading profit and proceeds from the sale would be used to reduce debt. AB InBev’s share price sunk after the world’s largest brewer missed 3Q19 revenue and profit targets. In an October trading update the company said that revenue came in at $13.2bn, below analysts’ expectations of $13.4bn. It also reported flat EBITDA for the quarter, while the market was expecting a 3% YoY rise. Underlying EPS fell to $0.94 in 3Q19 from $1.11 in 3Q18. For 9M19, underlying earnings were down more than 5% YoY. AB InBev said that “Solid growth from markets such as Mexico, SA and Colombia was more than offset by declines in China and the US, both primarily driven by shipment phasing impacts.”

Murray & Roberts (M&R; -15.0% MoM) slumped following a failed takeover bid by Germany-based Aton Group. Aton, which owns 44% of M&R, let its offer to acquire the rest of the construction Group’s shares lapse after the Competition Commission ruled the bid illegal (further hearings had been scheduled at the Competition Tribunal for December 2019 and January 2020). At the time M&R said it valued the shares at R20-R22/share – well above the R17 that Aton offered.

Arrowhead Properties -B-, Lewis Group and health and wellness firm, Ascendis Health recorded MoM declines of 14.4%, 11.6% and 11.3%. Ascendis finally released its twice-delayed FY19 results last week, which showed that it had swung into a normalised loss after tax of R459mn vs a profit of R93mn previously. Revenue advanced 1.0% YoY to R5.6bn, while normalised operating profit stood at R58.0mn. The firm is urgently pursuing the sale of its crown jewel – Cyprus-based pharmaceutical firm Remedica (it said negotiations were at an advanced stage), after suffering write-downs that are more than twice its market cap.

Sun International (-11.0% MoM), building materials retailer, Cashbuild (-10.9% MoM) and ADvTECH (-10.0% MoM) rounded out the 10 worst-performing shares for October. Last month, Cashbuild said its 14 new stores, opened since July 2018, had outperformed its existing store base, helping Group revenue rise 2% YoY in 1Q20. These 14 new stores saw a 3% rise in transactions during the period, while existing stores recorded a 2% drop, the Group said in an operational update. Revenue rose 2.0% YoY. Cashbuild, together with other retailers, are feeling the effects of a cash-strapped SA consumer on their bottom line. Finally, private schooling and tertiary education firm, ADvTECH closed October down, after a 12.7% share price rise in September.

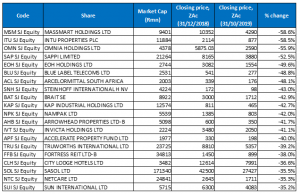

Top-20: YTD best-performing shares

Source: Bloomberg, Anchor

While September was a poor month for resource counters, their fortunes turned around again in October and, together with their impressive gains over the course of 2019, these shares continued to account for most of the twenty best-performing stocks YTD (to end October) and for nine out of the top-10 performers. After four months at the number one spot, platinum miner Impala was ousted from that position by Sibanye Gold (+190.9% YTD), following Sibanye’s impressive October run (discussed earlier). Impala (+183.1% YTD) moved to second position, followed by DRDGold (+144.1% YTD) in third spot. In September, DRDGold said that it had paid its investors without interruption for 12 years – the FY19 dividend was ZAc20/share, four times the interim dividend declared in FY18.

DRDGold was followed by Northam Platinum (+135.8% YTD), Amplats (+109.6% YTD), Harmony (+107.5% YTD), and Gold Fields (+88.4% YTD), which all rose up the ranks following their strong performances in October. After rocketing 31.7% last month, Cartrack (+81.9% YTD) jumped from 11th position to 8th spot among the YTD best-performing stocks.

AngloGold Ashanti, and Royal Bafokeng Platinum, which gained 81.8% and 76.8% YTD, rounded out the ten best-performing shares YTD. In mid-October, Royal Bafokeng announced it had secured a R2.1bn deal to deliver gold to mining financier Triple Flag, the proceeds of which will be used to settle the costs of its recent acquisition of 33% of the Bafokeng Rasimone Platinum Mine JV. Royal Bafokeng will deliver 70% of its gold production to Triple Flag until 261,000 ounces are delivered, and 42% thereafter. in turn, Triple Flag will pay 5% of the spot gold price per ounce. Gold is a byproduct of PGM production at Royal Bafokeng’s mining operations, accounting for c. 3% of its revenue.

Bottom-20: YTD worst-performing shares

Source: Bloomberg, Anchor

October’s YTD worst-performing shares were relatively unchanged from the September line-up. Rebosis, Delta, Aspen Pharmacare, Mr Price Group, Shoprite and Afrocentric Investment Corp. fell out of the list of 20 worst-performing shares YTD, while Nampak (-42.0% YTD), Arrowhead Properties (-41.7% YTD), Fortress Reit -B- (-38.0% YTD), City Lodge (-36.6% YTD), Netcare (-35.3% YTD) and Sun International (-35.2% YTD) recorded steep enough October share price drops to place these counters among the YTD 20 worst-performing stocks.

Among the bottom-twenty shares, Massmart was the worst performer, with its price now having plummeted 58.6% YTD. SA’s lacklustre economy, high unemployment and a difficult macro-economic environment has impacted most retailers, with Massmart especially hard hit as it reported 1H19 results in August which showed its first loss in c. two decades. Massmart was followed by Intu Properties, which is down 58.5% YTD, while chemicals and fertiliser manufacturer, Omnia is in third spot – down 55.9% YTD.

Sappi, EOH (discussed earlier), Blue Label Telecoms and ArcelorMittal are down 52.5%, 49.6%, 48.8% and 48.1% in the year to end October. Blue Label continued to be impacted by its 45% stake in mobile operator, Cell C. After several weeks of delay, Blue Label posted results at the end of September, showing a FY19 earnings decline, including a 3% YoY drop in Group revenue to R25.9bn as losses of R8bn incurred by Cell C, amounted to R3.6bn for Blue Label directly. As a result, Blue Label recorded a headline loss of ZAc312.49/share. When it acquired a stake in Cell C in August 2017, its share price was at c. R16.50 but since then it has plummeted to the current R2.77/share.

Steinhoff International (-43.0% YTD), Brait SE (-42.9% YTD) and Kap Industrial Holdings (-42.7% YTD) accounted for the remainder of the ten worst-performing shares YTD. Brait’s value and prospects were destroyed by the acquisition of UK-retailer New Look, which is effectively valued at zero in the Brait share price and has dragged the company into the doldrums. Early last month, Christo Wiese appointed Paul Roelofse, the former head of RMB’s global corporate finance business, to Brait’s board.