November proved to be choppy for global equity markets (MSCI World +0.3% MoM/+20.6% YTD) as concerns about stretched AI valuations weighed on investors, resulting in an especially turbulent month for US equities. Still, US markets did rally sharply in the final week of November (albeit not enough to end in the green) as expectations firmed that the US Federal Reserve (Fed) would cut rates by another 0.25 bps at its December meeting. This came after several top Fed officials backed a third straight reduction, mostly citing a weakening US labour market despite elevated inflation, and as the softer-than-expected reads on consumer confidence, retail sales, and producer price inflation collectively swung market expectations back toward another Fed rate cut.

Among the major US indices, the S&P 500 and Nasdaq last week soared higher by 3.7% and 4.9%, respectively, while the Dow advanced 3.2%. Nevertheless, MoM, the S&P 500 (+0.2% MoM/+17.8% YTD) and the Dow (+0.3% MoM/+12.2% YTD) closed relatively flat, while the Nasdaq was down 1.5% (+21.0% YTD), breaking its seven-month winning streak.

After a blackout during the 43 days of the government shutdown, US economic data releases last month included September wholesale inflation, which rose 0.3%, maintaining the annual level at 2.7%. Retail sales rose 0.2%, but after factoring in the 0.3% increase in prices for that month, spending was down 0.1%. November’s consumer confidence fell to its lowest level since April as Americans expressed concern about what the future holds for their jobs, cost of living and the US economy. The release of October inflation, as measured by the Consumer Price Index (CPI), was delayed. Previously scheduled for 7 November, the Bureau of Labor Statistics said the shutdown made it impossible to “retroactively collect” certain parts of the survey data. This means that October CPI will only be released on 10 December, with November inflation following on 18 December and the closely watched non-farm payrolls figures due in mid-December- all after the Fed rates announcement, leaving policymakers with limited visibility.

European markets were also muted in November, with France’s CAC closing flat (+10.1% YTD) and Germany’s DAX slipping 0.5% MoM (+19.7% YTD). Eurozone GDP grew by a higher-than-expected 0.2% in 3Q25 (it rose 0.1% in 2Q25), while the region’s trade surplus soared in September on the back of healthy exports to the US.

UK equity markets stalled in November, with the FTSE 100 ending the month unchanged (+18.9% YTD) and breaking its four-month positive streak. UK October inflation eased to 3.6% YoY vs the 3.8% print recorded in each of the previous three months. Core inflation rose by 3.4%, down from 3.5% in September. The UK’s 3Q25 GDP data showed that the country’s economy barely expanded, growing by only 0.1% and slowing from the 0.3% growth recorded in 2Q25.

China’s equity markets remained under pressure as weak domestic demand continued to be a drag on the economy, and momentum slowed in many of its economic indicators. The most notable was a 1.7% YoY drop in fixed-asset investment (from January to October), a bigger decline than expected. Infrastructure investment retreated by 0.1% in 10M25, while growth in manufacturing investment dropped to just 2.7%. Growth also slowed in industrial output and retail sales in October. On equity markets, the Shanghai Composite ended the month 1.7% lower (+16.0% YTD), while Hong Kong’s Hang Seng Index dipped by 0.2% MoM (+28.9% YTD). November’s official manufacturing PMI edged higher but remained in contraction territory for an eighth consecutive month, printing at 49.2 vs October’s 49.0. Non-manufacturing PMI, which includes services and construction, declined to 49.5 in November from 50.1 in the prior month. The 50-point mark separates expansion from contraction.

Following Japan’s equity market rally in October, the benchmark Nikkei closed 4.1% MoM lower in November (+26.0% YTD). Economic data showed October headline inflation edging up to 3.0% YoY vs September’s 2.9% print, marking the highest level since July and remaining above the Bank of Japan’s (BoJ) 2% target for a 43rd straight month. So-called “core-core” inflation, excluding the prices of fresh food and energy, crept up to 3.1% from September’s 3.0% print.

Among commodities, Brent crude (-2.9% MoM/-15.3% YTD) ended the month lower at US$63.20/bbl. Gold gained 5.9% MoM (+61.5% YTD), as expectations of another US rate cut in December boosted demand for the yellow metal and geopolitical risk remained elevated. The gold price has also been buoyed by buying from China and central banks around the world. Platinum group metals (PGMs) were stronger: platinum jumped 6.0% MoM (+84.1% YTD), while palladium (+1.1% MoM/+59.4% YTD) recorded good gains and rhodium (-2.7% MoM/+74.3% YTD) retreated. Iron ore hit four-month lows, falling by 0.4% MoM (+5.9% YTD) amid concerns over demand in its top consumer, China, and rising portside ore inventories.

The JSE extended its winning streak, recording its ninth consecutive monthly advance with the FTSE JSE All Share Index (ALSI) up 1.6% in November (+31.9% YTD) and breaching the 115,000-point level for the first time in mid-November. Positive sentiment towards SA Inc., the rand strengthening to trade below R17/US$1 for the first time in more than two years, and soaring commodities prices, which boosted the precious metals counters on the JSE, helped buoy the local bourse. SA also received an unexpected boost as S&P Global Ratings upgraded the country’s foreign-currency sovereign rating to BB from BB-, while maintaining a positive outlook. After declining in October, commodity-linked shares were back with a vengeance (Resi-10 +10.2% MoM/+125.7% YTD), followed closely by SA-listed property (+7.1% MoM/+23.8% YTD). Financial counters also recorded a positive performance in November with the Fini-15 up 2.1% (+12.6% YTD). Industrials, especially SA Inc. counters, were the laggards with the Indi-25 down 5.4% MoM (+15.0% YTD). The rand strengthened by 1.3% (+9.2% YTD) against a weaker US dollar.

In domestic economic data, October headline inflation advanced by a lower-than-expected 3.6% YoY, from 3.4% in September. Core inflation printed at a softer 3.1% YoY, down from September’s 3.2%. Against this backdrop, and in line with expectations, the South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) opted to lower the policy rate by 25 bps to 6.75%. The prime lending rate now stands at 10.25%. Earlier in the month, SA’s 2025 Medium Term Budget Policy Statement (MTBPS) was well-received, contributing to improved local asset sentiment.

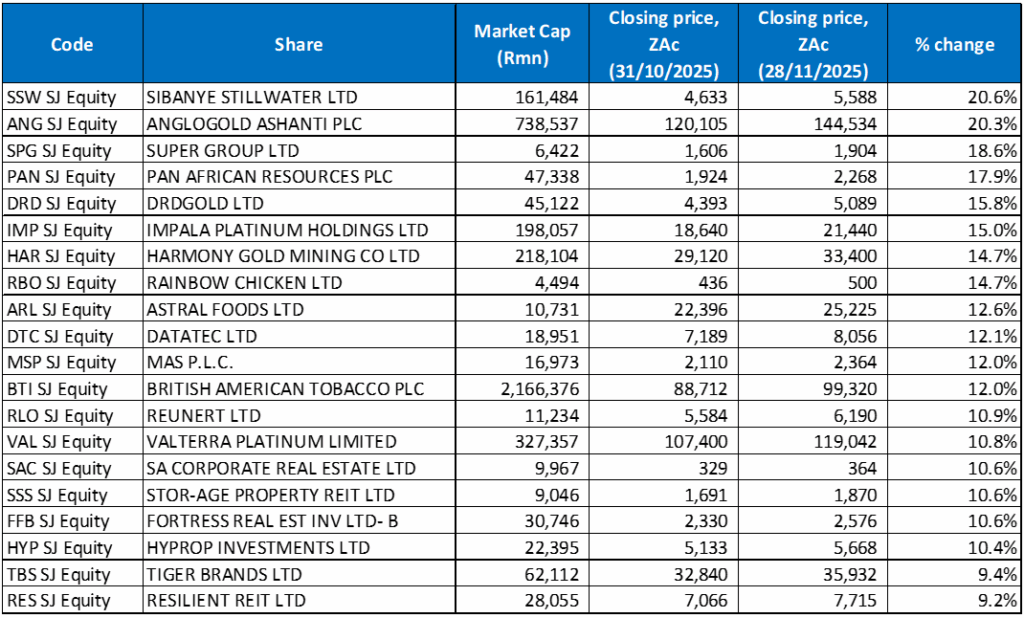

Figure 1: November 2025’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Precious metals miners were back behind the wheel on the JSE in November, with gold and platinum miners driving returns as seven out of the twenty best-performing shares came from the materials sector, while six of the top-20 were SA-listed property counters.

Sibanye Stillwater (+20.6% MoM/+273.0% YTD) was November’s best performer, delivering a strong 3Q25 financial performance, with its earnings boosted by higher commodity prices and greater operational stability after the restructuring it had undertaken over the past two years. CEO Richard Stewart said the stable operating performance from all Group operations underpinned a robust financial performance, which, combined with higher commodity prices, resulted in a 198% increase in adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) to R9.9bn for the quarter. Sibanye said that all operations were stable or improving and remain on track to meet FY25 guidance. Its SA PGM operations recorded a 213.0% EBITDA increase to R5.0bn, supported by higher basket prices, while local gold operations posted a 177.0% EBITDA rise to R3.7bn. US PGM operations delivered US$33.0mn in EBITDA, while two renewable energy projects went live, generating 99GWh and saving R45mn in energy costs.

AngloGold Ashanti (+20.3% MoM) benefitted from a combination of high gold prices, operational outperformance, improved cash flow and balance sheet strength, as well as renewed investor confidence. AngloGold has recorded a marked increase in gold output — helped by contributions from new or expanded mines (including the recently acquired Sukari mine in Egypt). In addition, the company has achieved substantial improvements in its free cash flow and profitability (on the back of higher output and relatively controlled costs), even against rising global inflation. As a result, its balance sheet has strengthened considerably, with net cash conversion improving and debt levels falling.

Logistics and mobility company Super Group (October’s top-performing share) gained another 18.6% in November. Its strong rebound has been driven, in part, by improved investor sentiment on the back of signs that the company is turning a corner after it upgraded its revenue guidance. In April, Super Group unlocked R7.47bn in capital by disposing of its 53.6% interest in SG Fleet Group. It used part of the proceeds to reduce its debt and paid a special dividend of R16.30/share in June. The restructuring has strengthened its balance sheet and sharpened the Group’s focus on its logistics and mobility operations in Africa, Europe, and the UK.

Super Group was followed by Pan African Resources, DRDGold, and Impala Platinum (Implats) with MoM gains of 17.9%, 15.9%, and 15.0%, thanks to rallying gold and platinum prices. Last month, Pan African Resources said that it plans to build an R2.8bn facility that will process leftover gold mine waste in Soweto. The facility is expected to process 600,000 tonnes per month of residual material left over from Soweto’s historic gold mines, churning out between 30,000 and 35,000oz of gold p.a. for 15 years. The company reported record FY25 earnings in September, driven by rising gold prices and increased production from new projects. In October, DRDGold’s share price dropped 8.7% after reaching a 23-year high earlier in the month, but the share price rebounded in November, ending the month above the R50/share level. Implats also carved out good gains after a decline in October as platinum prices rallied 6% in November.

Other notable performers were Harmony Gold and Rainbow Chicken Ltd – both up 14.7% in November. Harmony delivered a solid operational performance for the company’s 1Q26, registering a 53% increase in net cash to R17.1bn (US$989mn) from R11.1bn (US$628mn) as at 30 June 2025. Cash and available undrawn facilities rose 27% to R26.6bn over the same period. Harmony also said it will proceed with its Australian Eva Copper project and laid out plans to bring the asset online three years after it joined the Group’s portfolio. The miner expects a combined 100,000 tonnes of copper p.a. from Australia once Eva is fully commissioned.

Astral (+12.6% MoM) ended its FY25 with a solid cash position of R1bn. The poultry producer reported an operating profit of R1.24bn, despite having experienced pressure on its earnings in 1H25, marking a 10.9% YoY increase, compared with an operating profit of R1.12bn in FY24. Headline EPS rose 14% YoY to R21.93. In comparison, revenue jumped 10.4% YoY to R22.6bn, supported by increased broiler slaughter volumes and sales in its Poultry division, as well as a recovery in selling price realisations in 2H25, following selling price deflation in 1H25.

Rounding out the top-10 performing shares was Datatec, which gained 12.1% in November (+61.5% YTD). It has been an excellent year for the business. Despite coming off a strong FY25, Datatec delivered a robust set of 1H26 results. Revenue grew 11.7% YoY, while substantial operating leverage drove a 43% increase in underlying earnings. Net debt halved from the prior year, and an interim dividend of R1.75/share was declared, underscoring solid cash generation and balance sheet strength. Growth was broad-based, with all three of its divisions achieving double-digit profit growth, including a notable recovery from the previously underperforming Logicalis LATAM segment. The company’s shift toward higher-margin, recurring software and services, and away from once-off hardware sales, has materially improved its product mix.

Figure 2: November 2025’s 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Montauk Renewables (-23.7%), which specialises in the management, recovery and conversion of biogas into renewable natural gas (RNG), was November’s weakest performer. The company has had a difficult 2025 (-65.4% YTD), navigating a challenging market environment as Renewable Identification Number (RIN) pricing pressures significantly impacted its financial performance. Last month, Montauk released 3Q25 results, which showed its revenue decreasing by 31% YoY to US$45.3mn, while net income stood at US$5.2mn (US$0.04/share), a decrease of 69.5% YoY. This drop in profitability was primarily attributed to lower RIN pricing, which decreased by 31.4% YoY.

Blu Label Unlimited (formerly Blue Label Telecoms) was the second-worst performer with a MoM share price decline of 20.3%. After a good run this year (the share is up 69.0% YTD), Blu Label’s share price declined by 2.9% in September, primarily due to investor concerns around its decision not to declare a dividend and complexities surrounding the planned listing of its subsidiary, Cell C. However, in October, the share rose 3.3% before retreating again last month. After a 19.6% gain in October, mid-tier mining and materials Group, Afrimat, declined last month, taking third place with an 18.3% MoM drop in November.

Tech heavyweights Naspers (-12.3% MoM) and Prosus (-11.2% MoM) weakened. Both these shares have had a phenomenal 2025, with Naspers up 28.2% YTD (on a total return basis) while Prosus has gained 41.9% YTD. However, some profit-taking, a slowing pace of share buybacks, and especially deteriorating global market sentiment towards technology and AI counters in November weighed on their performance, with their largest holding, Chinese tech firm Tencent, also recording a 3.0% decline.

Prosus was followed by asset management company Ninety One Limited, retailer The Foschini Group (TFG) and Life Healthcare, which recorded MoM declines of 9.6%, 9.3% and 9.0%. Ninety One reported results for the six months ended 30 September 2025, which showed that revenue rose to GBP356.90mn from GBP343.00mn reported in FY24, while diluted EPS increased 14.1% YoY to GBP8.90. TFG’s share price fell by c. 5.3% on 7 November (it has been under significant pressure this year and is down 50.3% YTD) after it reported weak trading conditions that saw its interim dividend lowered by 18.8% YoY to ZAc130/share. The lower dividend was despite the Group managing to increase its revenue by 12.2% YoY to R31.4bn, supported by the inclusion of White Stuff in the UK and growth in its TFG Africa segment. However, HEPS decreased by 21.3% YoY to ZAc292.6.

Shares of the SA private hospital Group, Life Healthcare, tumbled after Life reported a drop in its earnings following the sale of one of its businesses to the pharmaceutical Group, Lantheus. Life Healthcare said its revenue increased by 6.4% YoY, on a like-for-like basis and excluding assets sold in FY25, to R21.3bn. However, despite the revenue growth, healthcare services revenue declined by 7.5% YoY following the loss of two government contracts during 2H24. Life Healthcare also concluded the disposal of Life Molecular Imaging (LMI) during the year, generating upfront proceeds of R6.3bn. The deal will entitle Life to potential future earnouts of up to US$400mn linked to future commercial and regulatory milestones. LMI was sold to the British subsidiary of the US-based pharmaceutical group, Lantheus. Through the deal, Life retains the rights to M2 milestone and regulatory payments, as well as to manufacture, commercialise and distribute LMI products in Africa. Following the sale, Life delivered a special dividend of R2.35/share in September. However, its HEPS were materially affected by the R2.9bn fair value adjustment to the Piramal liability, which reduced earnings from continuing operations. When Life Healthcare acquired LMI, it had a profit-sharing deal with Piramal Enterprises, and, as per the sale of LMI to Lantheus, proceeds went to Piramal.

Rounding out November’s ten worst-performing shares were MTN Group and Ninety One Plc with MoM declines of 8.7% and 8.6%, respectively. MTN has had a strong run this year and is up 71.6% YTD. In October, the share price jumped 19.3% MoM on the back of a strong turnaround in its Nigerian operations, and the decline last month was likely due to some profit-taking. MTN did release a 3Q25 update on 17 November, which showed a strong, broad-based performance across its 16 markets, led by MTN Nigeria and MTN Ghana. Group service revenue rose by 25.9%, supported by data revenue (+40.3% YoY), fintech revenue (+35.7% YoY) and voice revenue (+10.0% YoY). Group EBITDA increased by 41.1% YoY with margin expanding to 45.0%, driven by a strong topline performance and cost efficiencies.