It was another wretched and tumultuous month for world markets (MSCI World -9.3% MoM/-25.1% YTD), with market participants worried about a possible global recession as major central banks continued to implement outsized interest rate hikes in the hopes of pushing down the high inflation that has swept the globe. Geopolitical risks (Russia’s ongoing war in Ukraine and the increasing tension between Russia and much of Europe), Europe’s energy crisis, and China’s COVID-19 lockdowns added to the negative sentiment.

US markets fared relatively well earlier in September until the mid-month release of US August consumer price index (CPI) data triggered the biggest market sell-off since 2020. The print came in above expectations across the board and was largely driven by an acceleration in core inflation. Then, last week, US equities posted their best day since early August on 28 September as investors snapped up bargains and US Treasury yields dropped sharply after the Bank of England (BOE) unveiled a bond-buying programme to avert a crash in UK bonds. Unfortunately, this respite did not last long, and we saw global markets drop again into month-end. The US blue-chip S&P 500 declined by 9.3% (-5.3% in 3Q22/-24.8% YTD) in September, its worst monthly performance since March 2020, when COVID-19 crashed world markets and the index’s third losing quarter in a row. The Dow closed the month 8.8% lower (-6.7% in 3Q22/-20.9% YTD), while the tech-heavy Nasdaq fell by 10.5% MoM (-4.1% in 3Q22/-32.4% YTD).

In US economic data, CPI unexpectedly rose in August, driven by increasing rental and food prices. Consensus economists’ forecasts were expecting August headline CPI to ease to 8.1% YoY vs 8.5% YoY in July in a growing sign that inflation may have peaked at 9.1% in June. Instead, headline CPI came in at 8.3% YoY for August. Core CPI, which excludes volatile food and energy prices, came in higher than expected at 6.3% YoY as rents and healthcare costs showed little signs of slowing. CPI increased by 0.1% MoM, but when stripping out food and energy advanced by 0.6% (double what was expected) from July. Shelter, food, and medical care were the most significant contributors to price growth. The most concerning component of US inflation is core services inflation which looked to be flattening in July but reaccelerated in August, with shelter (42% of the core CPI basket) and medical care (9% of the core CPI basket) prices accelerating from already elevated levels. The US Federal Reserve’s (Fed’s) preferred inflation gauge, core personal consumption expenditure (PCE), which strips out the volatile food and energy categories, climbed 4.9% YoY in August vs a revised 4.7% YoY increase in July. US consumer spending, which accounts for more than two-thirds of US economic activity, increased by 0.4% last month.

At its 21 September meeting, the Fed hiked rates by 0.75 bpts – the third consecutive 0.75-bpt rate increase. Cumulatively, the market now anticipates a 1.5% rise in the federal funds rate over the next two meetings, followed by an easing off trajectory.

In Germany, the DAX ended the month 5.6% lower (-5.2% in 3Q22/-23.7% YTD), while France’s CAC Index, closed September 5.9% in the red (-2.7% in 3Q22/-19.4% YTD). In economic data, eurozone headline inflation reached a new record high of 9.1% YoY in August vs July’s 8.9% print. The jump was mainly driven by high energy prices (+40.8% YoY). September core inflation, excluding the food and energy categories, rose 4.8% YoY vs August’s 4.3% YoY. Europe’s continuing high inflation is strengthening the likelihood of the European Central Bank (ECB) announcing another hefty 75-bpt rate hike at its October meeting. Last month, the ECB hiked interest rates by 75 bpts (in line with expectations), pushing it into positive territory for the first time in a decade. The region’s biggest economy, Germany, recorded unprecedented double-digit inflation levels, coming in at 10.8% YoY in September vs a revised 7.9% YoY print in August, while France’s inflation rate decreased to 6.2% YoY in September vs 6.5% YoY in August. In the Netherlands, inflation shot up 17.1% YoY – the highest since World War II and a significant jump from August’s already high 12% print. Meanwhile, Europe’s GDP grew 4.1% YoY in 2Q22, coming in above market expectations, while Eurostat data show that the eurozone July unemployment rate remained at a record low of 6.6%.

In the UK, the blue-chip FTSE-100 Index closed September 5.4% lower (-3.8% in 3Q22/-6.6% YTD). On the political front, following Boris Johnson’s resignation, Liz Truss became UK prime minister. A controversial UK government plan to cut taxes saw bond markets in turmoil last week on worries that it could worsen inflation (bond markets calmed somewhat after the BOE pledged to buy however many UK government bonds needed to bring yields down). UK August headline inflation eased into the single digits coming in at 9.9% YoY vs July’s 40-year high of 10.1% YoY, on lower petrol prices.

Lockdowns in several of China’s large cities tightened COVID-19 control measures, and an embattled real estate sector weighed on Chinese markets. Hong Kong’s Hang Seng Index posted a 13.7% MoM loss (-21.2% in 3Q22/-26.4% YTD), while the Shanghai Composite Index fell 5.6% MoM (-11.0% in 3Q22/-16.9% YTD). On the economic data front, China’s official manufacturing purchasing managers index (PMI) unexpectedly expanded to 50.1 in September compared with August’s 49.4 print. The official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, fell to 50.6 in September from August’s 52.6 print (the 50-point mark separates expansion from contraction). Chinese retail sales beat expectations, rising 5.4% YoY in August vs July 2.7% YoY increase, as strong vehicle sales (+15.9% YoY) led the way on the back of government tax cuts and subsidies.

In Japan, the benchmark Nikkei dropped 7.7% MoM in September (-1.7% in 3Q22/-9.9% YTD). On the economic front, Japan’s economy grew by an annualised 3.5% in 2Q22, revised upwards from an initial estimated 2.2% growth. Private consumption, which accounts for more than 50% of its GDP, grew 1.2%, also revised higher from an initial estimate of a 1.1% increase.

Among commodity prices, Brent crude oil dropped for a third month (-8.8% MoM/-23.4% in 3Q22/+13.1% YTD) to end September at c. US$87.96/bbl, as a strong US dollar weighed on prices. Meanwhile, the price of iron ore rose 0.2% MoM (-13.2% in 3Q22/-16.3% YTD) as the world’s top steel producer, China, ramped up output. China’s steel mills have also been replenishing iron ore stock ahead of that country’s week-long National Day holidays, which started on 1 October. The gold price recorded its sixth consecutive MoM decline (-2.9% MoM/-8.1% in 3Q22/-9.2% YTD) on the back of a rampant US dollar and as hawkish Fed comments continue to point to an aggressive interest rate path, denting gold’s appeal. The price of platinum rose 1.8% MoM (-3.6% in 3Q22/+10.8% YTD), while palladium jumped 3.7% MoM (+11.7% in 3Q22/+13.7% YTD).

The JSE followed international markets lower, with Eskom implementing a record-long stretch of loadshedding for most of September not helping matters. South Africa’s (SA’s) FTSE JSE All Share Index closed September 5.2% in the red (-3.8% in 3Q22/-13.5% YTD), while the FTSE JSE Capped SWIX declined by 3.8% MoM (-7.0% YTD). The resources sector held up relatively well considering the significant losses recorded in other sectors on the local bourse (Resi-10 down 0.1% MoM/-5.5% in 3Q22/-15.1% YTD). The SA Listed Property Index was one of the worst-performing indices falling by 7.7% MoM (-5.2% in 3Q22/-20.0% YTD). It was followed by the Indi-25 (-7.3% MoM/-2.5% in 3Q22/-18.9% YTD) and the Fini-15, which declined by 7.2% MoM (-6.1% in 3Q22/-6.8% YTD). Highlighting the best-performing shares on the JSE by market cap, BHP Group, the largest company on the exchange, was up 4.0% MoM. It was followed by Glencore (+6.6% MoM), Anglo American Platinum (Amplats; +7.5% MoM), and Gold Fields (+6.35 MoM). Prosus, the second biggest JSE-listed company, declined by 10.9% MoM, with Naspers also down (-6.7% MoM). The rand continued its retreat against a rampaging US dollar, weakening by a further 5.3% MoM against the greenback (-11.1% in 3Q22/-13.5% YTD).

In terms of local economic data, annual August headline inflation eased slightly, coming in at 7.6% vs July’s 7.8% print. While the major driver of the lower CPI print was fuel inflation, as was broadly anticipated, August core CPI inflation also came in much softer than expected at 4.4% YoY – down from July’s 4.6%. The downside surprise in core inflation partly owed to a modestly smaller increase in public transport costs than initially forecast, amid the sharp mid-year rise in taxi fares (surveyed outside their regular quarterly schedule). Car prices also increased slightly less than expected. Following two consecutive quarters of growth, 2Q22 GDP decreased 0.7% QoQ seasonally adjusted, printing marginally better than expectations. YoY, GDP increased by only 0.2%. While SA had a solid start to the year with GDP growth of 1.9% QoQ seasonally adjusted in 1Q22, flood damage in KwaZulu-Natal (KZN) and extensive bouts of loadshedding have weighed on activity across different parts of the economy during the quarter. The weakness was broad-based, with most sectors contracting QoQ in 2Q22. However, the weakness was most pronounced in the goods-producing economic sector, with significant negative contributors to growth recorded in manufacturing, agriculture, trade, and mining. It is important to remember that Eskom implemented electricity outages for over half of the days in 2Q22, adding to the record blackouts in the financial year through March that hobbled local economic output. July retail sales climbed 8.6% YoY, compared to a revised drop of 2.3% YoY in June.

At its 22 September meeting, the SA Reserve Bank’s (SARB’s) Monetary Policy Committee (MPC) hiked interest rates by 75 bpts, taking the repo rate to 6.25%. Neither the 2Q22 GDP contraction nor the easing of inflation in August influenced the MPC’s planned interest rate normalisation meaningfully. Whilst we still expect inflation to trend lower and second-round inflation to remain relatively subdued, as it stands, there are enough indicators of stronger price pressure to keep the SARB hawkish, especially given its resolve to avoid underestimating the pervasiveness of inflation, such as several other central banks have done including the Fed. July mining production dropped for a sixth consecutive month as power outages hindered industrial activities.

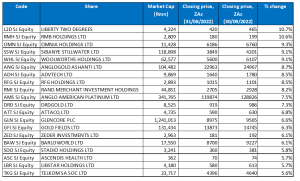

Figure 1: September 2022’s 20 best-performing shares, % change

Source: Anchor, Bloomberg

Real estate investment trust (REIT) Group, Liberty Two Degrees, a highly illiquid counter with limited free float as Liberty owns a large stake in the business, was September’s best-performing share – rising by 10.7% MoM. It was followed by RMB Holdings (+10.6% MoM) in the second spot with a 10.6% MoM share price gain. The Group’s NAV is mostly cash; in September, RMB announced that it would distribute this cash. Because the share was trading at such a large discount (to essentially cash), when the announcement was made regarding the distribution, the discount to NAV started narrowing, and the share price rose. Diversified chemicals Group, Omnia Holdings (+9.3% MoM) rounded out the top 3 performers for September.

Omnia was followed by Sibanye Stillwater, Woolworths, and AngloGold Ashanti, with MoM gains of 9.1%, 9.1%, and 8.7%. Last month, Woolworths posted FY22 results, which showed that its revenue increased to R82.26bn, compared with R80.94bn reported in FY21, while diluted EPS fell 11.0% YoY to ZAc381.4. The results were disappointing mainly due to a poor 1H22 performance because of civil unrest locally (in July 2021), which negatively impacted the SA segments of the business, while in Australia, lockdown restrictions weighed on its stores as 70% of David Jones and Country Road stores were unable to trade for a few months in 1H22 due to government-implemented restrictions because of the Omicron variant. A key disappointment from the results came from Woolworths Food, as revenues only rose 4.2% YoY, while its competitors (such as Shoprite and Pick ‘n Pay) grew revenues in the double digits. Woolworths managed to repatriate R1bn of capital from David Jones and said it would use this to reduce its SA debt. It plans to bring back a further R500mn by the end of December 2022. This is in stark contrast to the situation just a few years ago, when Woolworths was using money from its SA operations to funnel into David Jones.

Meanwhile, AngloGold Ashanti said last month that it would buy properties in Nevada (adjacent to its interest there) containing c. 914,000 ounces in mineral resources. It has agreed to pay US$150mn to purchase Coeur Mining subsidiary Coeur Sterling, which owns the properties. AngloGold has also agreed to pay Coeur an extra US$50mn if further exploration results in a mineral resource greater than 3.5mn ounces.

ADvTECH’s (+8.5% MoM) interim results (1H22) to end-June saw its revenue rising by 18% YoY to R3.38bn, with the benefits of controlling costs from a centralised structure aiding margin growth and Headline EPS increasing 22% YoY to ZAc68. ADvTECH recorded good growth in its domestic segment, which recorded an operating profit rise of 16% YoY, but the star performers were its African school assets, where profits rose 70% YoY.

Rounding out the ten best-performing shares for September were canned food products company RFG Holdings, Rand Merchant Investment Holdings and Amplats, with MoM gains of 8.5%, 8.2% and 7.5%. In its trading update for the 11 months ended August 2022, RFG stated that its total revenue increased by 21.2% YoY after the Group reported growth of 20.9% YoY in 1H22. The company said that revenue growth was driven by ongoing strong international demand for its canned fruit and fruit puree products and a resilient performance in the regional segment against the background of the deteriorating consumer spending environment. RFG will release its FY22 results on 23 November. Last month, Amplats revised its guidance due to a delay to the Polokwane smelter rebuild and the resultant work-in-progress inventory build. The delivery of replacement materials will result in a two-month delay in the completion of the project, and as a result, there will be a build-up in work-in-progress inventory in 2022 and a short-term timing impact on refined PGM production. It revised its refined production in 2022 to between 3.70mn and 3.90mn PGM ounces.

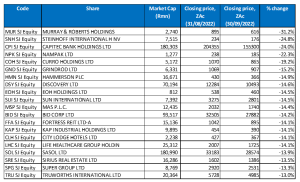

Figure 2: September 2022’s worst-performing shares, % change

Source: Bloomberg, Anchor

The JSE saw broad-based losses in September, with mining counters emerging as the better performers in what can only be described as a dire month. Amongst the worst-performing shares were real estate, industrial and financial counters. Engineering and mining contracting company Murray & Roberts was the worst-performing share on the JSE for September – declining by 31.2% MoM. Murray & Roberts released FY22 results early last month, and while these results were good compared to the FY21 results, they still fell short of market expectations. As a result, the share price has underperformed. Revenue increased to R29.9bn, compared with R21.9bn posted in FY21, while diluted EPS stood at ZAc61, compared with ZAc18 recorded in the previous year. Multiple headwinds impacted the results, including COVID-19 restrictions in Australia and the US, leading to project delays. As a result of these project delays, there were delays in revenue recognition. Management has guided that they expect some delayed revenue recognition for the affected projects to fall into FY23.

Steinhoff International was in second place with a 24.8% MoM share price drop. On 30 August, Steinhoff released a nine-month trading update to the end of June, showing that it had raised revenue by 12% YoY to EUR7.7bn. Steinhoff also said that it is facing challenges in restructuring its EUR10bn corporate debt, which is owed to various investor classes with different rights and obligations. The company noted that the situation had been worsened by the current global economic environment that has driven up rates and seen rising fears of an economic downturn.

Capitec Bank was September’s third worst-performing share, dropping by 24.0% MoM. Capitec’s share price tumbled c. 13% from 28 to 30 September after the market took a dim view of the company’s interim dividend and Capitec’s CEO highlighted concerns about global and domestic economic uncertainty. For 1H22, Capitec’s lending, investment, and insurance income rose to R11.38bn from R9.53bn posted in the corresponding period of 2021, while its diluted EPS increased 19.0% YoY to R40.25. Headline earnings, a profit measure that strips out one-off items, rose 17% YoY to R4.7bn in the six months to end-August 2022. Although Capitec managed to increase its interim dividend by 16.7% YoY to ZAc1,400 (almost doubling the pre-pandemic interim dividend of ZAc755 declared in August 2019), the share price still slumped as the dividend was lower than the market had expected.

Paper and plastics packaging group Nampak was down 22.3% MoM. Nampak’s share price fell to its lowest level in nine months on 30 September (down 13.2% to close at ZAc185) after the company said that a capital raise and asset sale were high on its list of options to pay off its R5bn debt. Nampak has been struggling with options to address its capital and funding structure and service its R5bn debt. Last week, it also announced an extension of the maturity date for its revolving credit and term loan facilities.

Nampak was followed by Curro, Grindrod Ltd, and Hammerson Plc, which recorded MoM share price declines of 19.2%, 15.2%, and 14.9%, respectively. The initial announcement in March and the eventual unbundling of Curro majority shareholder PSG Group (it owned 64% of Curro) in early September have weighed on the Curro share price. Similarly, Remgro’s decision to unbundle its 25.8% stake in logistics Group Grindrod has seen the share price come under pressure. Remgro will distribute its entire shareholding in Grindrod by way of distribution in specie to Remgro shareholders as an unbundling transaction.

Meanwhile, Discovery’s (-14.6% MoM) shares slumped after the Group maintained its no-dividend policy for ordinary shareholders, even after its earnings topped pre-pandemic levels led by a strong performance from its SA operations. Discovery’s FY22 results showed that its insurance premium revenue advanced 5.1% YoY to R58.8bn, while diluted EPS stood at ZAc817.8 compared with the ZAc475.4 recorded in FY21. The board opted not to declare an ordinary final dividend for the year to end June 2022 due to uncertainty about the future effects of COVID-19 and an increasingly worrying global economic backdrop. The last time Discovery declared a dividend was the ZAc101/share interim dividend it announced in February 2020, just before the COVID-19-induced lockdowns in SA. Meanwhile,

Information technology services company EOH and Sun International (both down14.5% MoM) rounded out September’s ten worst-performing shares. In its full-year (FY22) trading update, EOH revealed that it generated an operating profit of between R250.0mn and R310.0mn from continuing and discontinued operations, vs the R147.0mn recorded in FY21. The company said it expects a loss per share between ZAc10.0 and ZAc20.0, lower than the ZAc166.0 recorded in the previous period. It also forecasts its headline loss per share to be between ZAc18.0 and ZAc26.0, higher vs the ZAc22.0 posted in the previous period. Following a good run in August, when Sun International gained 18.0% MoM, after releasing 1H22 results that showed its earnings increasing significantly, the counter retreated again, ending September in the red.

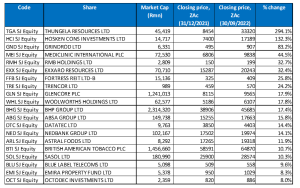

Figure 3: Top-20 September 2022, YTD

Source: Anchor, Bloomberg

Sixteen out of September’s top-20 YTD best-performing shares also featured among the top-20 performers for the year to end August, with Woolworths Holdings (+17.8% YTD), BHP Group (+17.4% YTD), Datatec (+14.4% YTD), and Emira Property Fund (+8.3% YTD) replacing Pick n Pay Stores, Sun International, Bidvest and Shoprite.

Coal miner Thungela Resources (+294.1% YTD) remained in the top spot for the eighth month as its share price gained a further 1.6% in September. In August, Thungela reported fantastic 1H22 results, buoyed by soaring coal prices which have reached record highs following Russia’s invasion of Ukraine. The resultant sanctions on Russia, a major European gas supplier, have seen increased gas to coal switching. Thungela posted a 1H22 profit of R9.6bn vs an R351mn profit in the same period of 2021, and its cash soared by 70% YoY to R14.8bn. The coal miner also declared an R60/share dividend – a payout of R8.2bn, or c. 92% of adjusted operating free cash flow. Thungela’s YTD total return (which includes the dividend) now stands at 405.2%.

Hosken Consolidated Investments (HCI;+132.3% YTD) remained in second place for a third consecutive month, despite the HCI share price losing 6.3% MoM in September. HCI was again followed by Grindrod (+83.2% YTD), which remained in the third spot for a fifth month despite the share price falling 15.2% MoM in September.

Healthcare Group, Mediclinic also remained the fourth best-performing share YTD – its share price lost 0.4% in September, and it is now up 44.5% YTD amid a takeover offer by a consortium led by Remgro’s Johann Rupert. In August, Mediclinic said it had agreed to the latest in a series of offers from the consortium valuing the hospital operator at GBP3.7bn (c. US$4.5bn). Remgro, already Mediclinic’s majority shareholder with a 44.6% stake, is partnering with MSC Mediterranean Shipping Company SA to pay GBp504/share for the shares in Mediclinic it does not already own.

Mediclinic was followed by RMB Holdings (discussed earlier), Exxaro Resources, and Fortress REIT -B- with YTD gains of 32.7%, 32.4% and 25.8%, respectively.

Rounding out the YTD 10 best-performing shares were Trencor, diversified miner Glencore Plc, and Woolworths, with YTD gains of 24.2%, 17.9% and 17.8%, respectively. Last month, Glencore said it will buy gold miner Newmont’s 18.75% shareholding in Argentina’s Minera Agua Rica Alumbrera (MARA) Project. After the completion of the transaction, Glencore will own 43.75% of MARA. Glencore will pay Newmont US$124.9mn on closing and a US$30mn deferred payment when commercial production starts, subject to an interest charge of 6% p.a.

Figure 4: Bottom-20 September 2022, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, 16 of the 20 shares for the year to end-September were also among the 20 worst performers for the year to end-August. EOH Holdings (-32.7% YTD), City Lodge Hotels (-32.2% YTD), Curro Holdings (-30.5% YTD), and Equites Property Fund (-30.0% YTD) were the newcomers last month, replacing Amplats, DRD Gold, AngloGold Ashanti and Attacq.

For a sixth month running, Steinhoff (-64.9% YTD) was the worst-performing share YTD after recording a further 24.8% MoM decline in September. PPC (-54.9% YTD) was bumped from the second position to third by Murray & Roberts (-56.8% YTD). PPC’s share price tumbled by 10.6% in September after it released a disappointing operational update for the five months ended 31 August 2022, in which it said that without a significant increase in infrastructure investments, local cement demand was expected to remain subdued. PPC revealed that its revenues, excluding Zimbabwe, increased 9.0% YoY, driven by robust demand in Rwanda but cement sales volumes in SA and Botswana decreased by 1.0% compared with the previous year. Cement sales volumes in Zimbabwe also declined by 7.0% YoY.

Sirius Real Estate, Nampak, ArcelorMittal SA, and Hammerson Plc recorded YTD declines of 54.3%, 52.4%, 50.0% and 49.1%, respectively.

Coronation Fund Managers, Quilter Plc, and Capital & Counties Properties rounded out the ten worst-performing shares with YTD losses of 42.8%, 41.7%, and 41.3%.