Major global markets (MSCI World -2.3% MoM; +16.6% YTD) recorded declines in August (traditionally a weak month for markets) as worries about the health of the global economy, especially China, and the US Federal Reserve’s (Fed) keeping interest rates higher for longer than expected weighed on sentiment. In the Fed’s July meeting summary, Fed members said they still see “upside risks” to inflation, which could lead to more interest rate hikes. Economic data out of China continued to disappoint, with the world’s second-largest economy reporting much weaker-than-expected July retail sales growth in August, while industrial production data rose less than expected, and manufacturing activity fell for a sixth straight month in August. In addition, investor worries intensified over a real estate crisis, as Chinese real estate giant Evergrande filed for US bankruptcy protection. At the same time, the heavily indebted property development Group Country Garden Holdings’ shares fell to a record low, and it was removed from Hong Kong’s Hang Seng Index. A slowdown in China’s economy spells trouble for world markets, considering the number of global companies relying on China as a revenue source.

In US economic data, July headline inflation, as measured by the Consumer Price Index (CPI), increased by 3.2% YoY after slowing sharply to 3.0% YoY in June. July core CPI, excluding the erratic food and energy components, rose 4.7% YoY vs 4.8% YoY in June. MoM headline inflation rose 0.2% (June’s data were also 0.2% higher). July retail sales advanced 0.7% MoM (better than expected), while June retail sales data were revised upward (to 0.3% MoM). Retail sales increased 3.2% YoY in July. July core personal consumption expenditure (PCE), excluding food and energy and the Fed’s preferred inflation gauge, rose 4.2% YoY and 0.2% MoM (in line with expectations) vs 4.1% in June.

Among the major Wall Street indices, the tech-heavy Nasdaq Composite Index recorded its worst monthly performance of 2023 – down 2.2% MoM (+34.1% YTD). The blue-chip S&P 500 slipped 1.8% MoM(+17.4% YTD), while the Dow Jones declined by 2.4% MoM but is up 4.8% YTD.

In Europe, Germany’s DAX ended August 3.0% down (+14.5% YTD), while France’s CAC Index closed 2.4% in the red (+13.0% YTD). In economic data, inflation in the eurozone was steady at 5.3% in August, while core inflation (excluding food and fuel) eased to 5.3% vs 5.5% in July, raising hopes that the European Central Bank (ECB) will hold interest rates steady when it meets this month. Germany’s headline inflation came in at 6.1% YoY in August vs July’s 6.2% print but slowed less than expected. The core inflation rate, excluding volatile items such as food and energy, was 5.5% in August, unchanged from July. France’s inflation slowed to 4.3% YoY in July from June’s 4.5% print, while core inflation fell from 5.7% YoY in June to 5.0% in July.

The UK’s blue-chip FTSE-100 closed 3.4% in the red in August (-0.2% YTD). July UK inflation cooled to a 15-month low of 6.8% YoY (down from June’s 7.9% YoY print) off lower energy prices. July core inflation, excluding the volatile food and energy items, was unchanged at 6.9%.

MoM, Chinese markets recorded losses with foreign funds exiting equity markets as the slump in manufacturing activity persisted, and the property sector’s debt woes continued hurting sentiment. Hong Kong’s Hang Seng Index lost 8.5% in August (-7.1% YTD), its first MoM drop since May and its biggest since February, while the Shanghai Composite Index retreated by 5.2% (+1.0% YTD). China’s official Manufacturing Purchasing Managers Index (PMI) rose to 49.7 in August vs July’s 49.3 print but remained in contraction territory for a fifth consecutive month. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, slowed to 51 in August from 51.5 in July. The 50-point mark separates expansion from contraction.

Japan’s equity market performance disappointed, with the benchmark Nikkei declining by 1.7% (+25.0%YTD) in August after two consecutive positive MoM performances. Core CPI (excluding the volatile fresh food category but including energy costs) rose 3.1% YoY in July, down from a 3.3% rise in June. The latest data remained above the Bank of Japan’s 2% target for the 16th consecutive month.

In commodities, Brent crude oil recorded a third consecutive MoM gain (+1.5% MoM/+1.1% YTD) as tighter crude supplies overshadowed worries around China’s economic malaise and the impact on global energy demand. Iron ore prices fell 1.2% MoM and are down 1.6% YTD. Meanwhile, the gold price declined by 1.2% MoM (+6.4% YTD). The platinum price rose 1.9% MoM (-9.4% YTD), while palladium ended the month 5.1% lower (-31.9% YTD). Natural gas prices rose by 5.1% MoM (-38.1% YTD), while thermal coal prices jumped 12.7% MoM (-36.1% YTD).

South Africa’s (SA’s) FTSE JSE All Share Index declined by 5.1% in August (+2.6% YTD), while the FTSE JSE Capped SWIX retreated by 4.8% MoM (+2.8% YTD). The SA Listed Property Index managed to eke out a 0.8% gain for the month (-4.7% YTD) while resources, industrials and financials all ended in the red, with the Resi-10 down 10.3% MoM (-18.6% YTD), the Indi-25 losing 5.1% MoM (+14.6% YTD) and the Fini-15 retreating by 2.0% MoM (+9.4% YTD). Highlighting the performances of the biggest JSE-listed shares by market cap, the largest company on the exchange, BHP Group, disappointed as resources counters came under pressure, falling by 1.4% MoM. Prosus, the second-biggest listed company, dropped 7.3% MoM, Naspers lost 8.5% MoM and Richemont declined 6.7% MoM. However, Anheuser Busch InBev, the third-largest company on the JSE, jumped 5.5% MoM, with British American Tobacco up 4.9% MoM. After two consecutive months of gains, the rand fell by 5.8% against the greenback in August (-10.5% YTD),

In economic data, SA’s July headline CPI slowed for a fourth consecutive month, easing by more than expected to 4.7% YoY (the lowest reading since July 2021) vs June’s 5.4%, as fuel prices continued to decline. The annual rate for fuel was down 16.8% YoY in July, which dragged the transport category down into negative territory for the first time since January 2021. Significantly, food and non-alcoholic beverages, one of the key upward drivers of inflation over the previous few months, has dropped back down to single digits, printing at 9.9% YoY for July vs June’s 11% YoY print. Core inflation (excluding the volatile food and energy categories) reached a 10-month low of 4.7% YoY in July vs 5% YoY in June. June retail sales data (released in August) fell again, declining by 0.9% YoY, following a revised 1.6% YoY drop in May. YTD, every month has seen a decline in retail sales data.

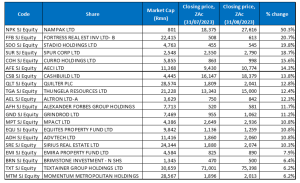

Figure 1: August 2023 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Packaging Group, Nampak was last month’s best-performing counter, with its share price gaining 50.3% MoM, albeit from a low base. In mid-August, Nampak said favourable terms with lenders had been agreed on, and a rights issue of up to R1bn is planned. It added that the finance restructuring meant the Group was now well placed to hold a rights issue. Nampak has been hamstrung by R5.4bn in debt following its ill-fated excursion into the rest of Africa. At the end of August, it announced that it had received JSE approval to proceed with the R1bn rights offer, bringing it closer to a major overhaul of the business that will shift the focus to its core metals business and selling non-core assets. The offer, comprising the new Nampak shares at R175 each, will open on 11 September, with the company saying shareholders will be entitled to 2.20902 rights shares for each ordinary share held on the recorded date.

Real estate investment trust (REIT), Fortress Real Estate Investments Ltd -B- shares was August’s second best-performing counter. The Group has seen the value of its direct property portfolio grow to R30bn since it was listed in October 2009 due to its disposals of non-core and older assets. In its FY23 results (for the period ended 30 June 2023), Fortress announced that total revenue increased to R3.79bn from R3.45bn posted in FY22, while its diluted EPS stood at ZAc279.51, compared with ZAc70.07 recorded in the previous year. The company also said vacancies were at a historic low of 3.7%.

In third place, private higher education Group Stadio (+19.8% MoM) recorded a surge in its 1H23 profit among rising student enrolments, with its results showing that profit grew 21% YoY to R126.6mn and headline EPS rose by 22% YoY to ZAc13.5. Revenue increased by 16% YoY to R618mn, while core HEPS, which excludes non-recurring items, increased 20% YoY to ZAc13.6.

Stadio was followed by Spur Corporation Ltd., Curro Holdings, and AECI with MoM gains of 18.7%, 15.6% and 14.3%. Despite the pressure on consumer spending, Spur delivered resilient FY23 results in August, reporting a revenue jump of 27.4% YoY to R3.05bn, while its diluted EPS stood at ZAc258.86, up 80% YoY compared with the ZAc143.80 recorded in FY22. Independent schools and education services Group, Curro reported strong 1H23 results showing that revenue rose by 16% YoY to R2.4bn from R2.1bn reported in 1H23, while HEPS stood at ZAc34.6 – up 26% YoY.

Building materials retailer Cashbuild (+13.8% MoM) reported disappointing FY23 results, which showed that its revenue decreased by 4% YoY to R10.65bn, compared with the R11.15bn posted in FY22. Diluted EPS fell 78.2% YoY to ZAc455.6. However, Cashbuild operations director Shane Thoresson said in an interview that although the company’s overall revenue had declined, it was able to lift revenue from its new stores. He added that the Group was well positioned for growth when the environment it operates in improves. YTD, Cashbuild’s share price is down 2.8%.

Rounding out the top ten were Quilter Plc (+12.8% MoM), Thungela Resources (+12.4% MoM), and Altron Ltd -A- shares (+12.3% MoM). UK-based Quilter, Old Mutual’s former wealth management business, reported a substantial improvement in its 1H23 adjusted profit (+25% YoY) and healthy fund inflows. Meanwhile, Thungela, the star performer on the JSE in 2022, reported 1H23 results, which showed sales of R14,359mn compared to R26,176mn a year ago. Profit of R3bn plummeted from the R9.6bn reported in the same period last year, following the significant decrease from the previous year’s record thermal coal prices. In 2022, coal prices were buoyed by an energy crisis in Europe following Russia’s invasion of Ukraine. However, seaborne coal prices fell sharply this year as European buying slowed due to record coal and gas stock levels coming out of a milder winter. HEPS fell to R22.46 from R67.23 in 1H22. Last week, Thungela also announced it will officially take control of an Australian thermal coal mine from 1 September after the necessary conditions for the deal (first announced in February) were met. Through a new company, Sungela, Thungela will acquire an 85% interest in the Ensham coal mine in Queensland, Australia, at R4.1bn. It said the move was part of its strategy of pursuing geographic diversification.

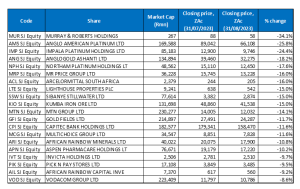

Figure 2: August 2023 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

August was a poor month for commodity counters, with more than half of last month’s worst-performing shares coming from the sector. This is as the economic slowdown in China, the world’s largest commodity consumer, weighed on SA’s mining sector, which is already struggling with an inefficient and unreliable rail system that has curtailed exports.

Specialist engineering Group Murray & Roberts was the worst-performing share in August, declining by 34.1%. Last week, the company flagged an earnings plunge of more than 100% for the year to end-June (FY23), saying it expected to swing into a basic headline loss per share of as much as ZAc76, hit by the loss of its Australian subsidiaries Clough and RUC Cementation Mining Contractors, which it has restated as discontinued operations. This saw its share price plunge 12% on 28 August. It posted FY23 results on 30 August, which showed that revenue from continuing operations advanced 42.3% YoY to R12.46bn, while it reported a diluted continuing headline loss per share of ZAc71 from a loss of ZAc47 in FY22.

Platinum counters were a prominent feature among August’s worst-performing shares, with Anglo American Platinum (Amplats) in second place after recording a 25.8% MoM decline. Amplats was followed by Impala Platinum (Implats) in third spot and Northam Platinum in fifth place, with MoM declines of 24.4% and 17.6%, respectively. Platinum group metals (PGM) prices have come under pressure this year, with palladium down 31.9% YTD, platinum 9.4% lower YTD and rhodium 66.5% in the red YTD. In addition, PGM prices came off aggressively in August, as PGMs and the broader resources sector were hit by China’s (SA’s largest trading partner) economic malaise, which is likely to have serious consequences for commodities demand, including PGMs.

AngloGold Ashanti was August’s third worst-performing share, declining by 18.2% MoM. In its 1H23 results, released last month, the gold miner reported a revenue advance of 1.4% YoY to US$2.19bn, while diluted EPS stood at USc10.0 compared with USc71.0 recorded in the corresponding period of 2022. AngloGold also cut its interim dividend after profit plunged (its attributable profit fell by more than four-fifths YoY to US$40mn [c. R741mn]) as higher metal prices were more than offset by rising costs and further impairments at its Brazil portfolio.

Both Mr Price Group and Arcelor Mittal SA lost 16.0% MoM, while Lighthouse Properties, Sibanye Stillwater and Kumba Iron Ore (Kumba) were all down 15.0%. Mining company Sibanye, in its 1H23 results, reported that revenue declined by 13.9% YoY to R60.57bn, while diluted EPS stood at ZAc262.0, compared with ZAc424.0 recorded in the corresponding period of 2022. A global growth slowdown has seen commodity demand decline, leading to lower prices. Finally, SA’s largest producer and exporter of iron ore, Kumba’s share price continued to feel the pressure of lower iron ore prices (it was down 1.1% in August and 1.6% YTD) on the back of declining demand from China as steel demand dropped due to the country’s struggling property market.

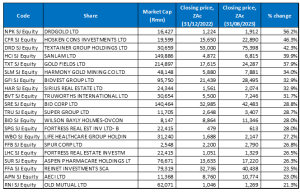

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

Sixteen out of July’s top-20 YTD best-performing shares were again among the top-20 best performers for the year to the end of August. Sirius Real Estate, Fortress Real Estate Investments -B-, Spur and AECI were the new entrants among the best YTD performers, bumping Richemont, Discovery, Naspers -N- and PPC from the list.

For a third month running, the top-performing share was gold miner DRDGold, with a YTD gain of 56.2%. In August, the gold producer reported a 14% YoY jump in its FY23 profit to R1.3bn as it benefited from the higher rand gold price despite producing and selling less gold. Its HEPS rose 13% YoY to R1.48 – the mid-range of its guidance of R1.40-R1.54 provided in an earlier trading statement. DRDGold said gold production was down 8% YoY to 5,282kg. It declared a final dividend of ZAc65/share, bringing the total payout to ZAc85/share for the year – up 41.7% YoY.

Following a tough August for commodity counters, Hosken Consolidated Investments (HCI; +46.3% YTD) bumped Gold Fields (+37.9% YTD) from its second position to the fifth spot. Textainer (+42.3%) took HCI’s third spot after recording a 6.2% MoM gain in August.

Sanlam, Gold Fields and Harmony Gold followed Textainer with YTD gains of 39.9%, 37.9% and 34.0%. Sanlam’s share price was up 3.6% in August after the insurer said in a 1H23 trading update that it expected its half-year profit to almost double. Sanlam also forecast HEPS to be between ZAc331.0 and ZAc347.0 vs ZAc155.0 recorded in 1H22. Sanlam said all clusters and lines of the business performed well during the review period.

Harmony was followed by Bidvest (+32.9% YTD), Sirius Real Estate (+32.9% YTD), Truworths (+31.7% YTD) and international food services Group, Bidcorp (+28.8% YTD). Clothing retailer Truworths reported FY23 results last week, indicating that its revenue rose to R21.99bn, compared with R19.34bn posted in the previous year, while its diluted EPS was up 11.7% YoY to ZAc876.4. Finally, in its FY23 results, Bidcorp said profit increased by 41.5% YoY to R6.95bn, while its HEPS rose by 35.4% YoY to ZAc2,082.9. Revenue soared 33.4% YoY to R196.3bn. The company said it had delivered a record performance in an environment where management teams were able to maximise the trading opportunities created by resurgent demand across the broader food-service market and higher inflation.

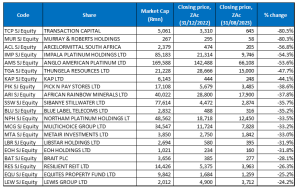

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, sixteen of the twenty shares for the year to end of July again featured among the twenty worst-performers for the year to the end of August. The new entrants were Northam (-33.5% YTD), Brait (-28.1% YTD), Resilient REIT (-26.3% YTD), and Lewis Group (-24.2% YTD).

Investment holding company Transaction Capital was again the worst-performing share YTD, with a 80.5% drop after the share lost a further 4.7% in August. Once again, Transaction Capital was followed by Murray & Roberts (-80.3% YTD) in second spot, with ArcelorMittal SA (-56.8% YTD) taking third spot and bumping thermal coal miner Thungela (discussed earlier) into sixth position.

ArcelorMittal was followed by Implats, Amplats, Thungela and KAP Ltd, which recorded YTD share price declines of 54.3%, 53.6%, 47.7% and 44.1%, respectively. Last month, KAP, a diversified group of industrial, chemical and logistics businesses, reported worse-than-expected FY23 results, which saw its share price drop by 8.2% in August. Citing a tough economic environment, high debt levels and its commitment to capital projects, KAP said that Group revenue rose 6% YoY to R29.6bn as price increases offset raw material cost increases. However, EBITDA fell 11% YoY to R3.9bn, with operating profit dropping 19% YoY to R2.4bn. This saw HEPS coming in significantly lower (-43% YoY) at ZAc42.7. KAP has attributed this to “the decline in operating profit before capital items and a 59% increase in net finance costs relating mainly to higher interest rates …”.

Finally, Pick N Pay Stores (-38.6%), African Rainbow Minerals (ARM; -37.8%), and Sibanye Stillwater (-35.7%) rounded out the ten worst-performers YTD. In its FY23 trading update, ARM said that it expects its HEPS to decline to between ZAc4,225.0 and ZAc4,745.0 vs the ZAc5,787.0 recorded in FY22.