The Foschini Group (TFG, which own Foschini, Markhams, Totalsports and Fabiani) released a good set of numbers in its FY20 results on 18 June, with a slight beat vs consensus, surprising us on the upside. This is especially positive when considering how resilient the business was in an extremely difficult macro operating environment even before COVID-19. Since these numbers are to the end of March 2020, we note that it reflects very little of the COVID-19 lockdown experience. HEPS was down 1.1% YoY vs consensus analyst estimates, which expected a 5%-10% YoY decline in earnings. Revenue rose by 3.6% YoY to R38.5bn, broadly in line with expectations. The gross margin print surprised us by remaining more resilient than we had expected at 52.7% vs 53.6% in FY19. The Group generated free cash flow (FCF) of R2.3bn – equal to 92.2% of net profit after tax, which is extremely pleasing as TFG’s FCF generation was of real concern for us. As broadly expected, no dividend was announced. Management also gave very little colour on a net debt level after March and, as it stands currently it is R8.4bn – marginally higher vs the 1H20 level. The big news coming out of the FY20 results release is TFG’s proposed rights offer of up to R3.95bn, which we discuss below.

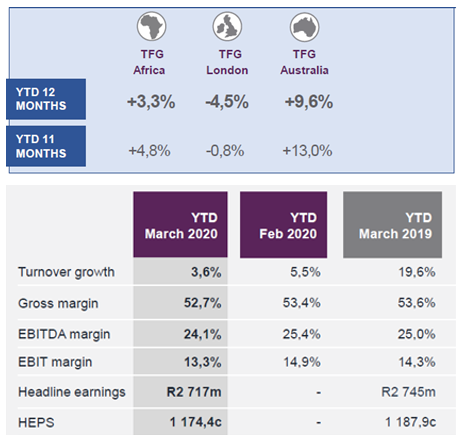

TFG recorded quite a resilient operating performance for the 11 months to end February, maintaining or improving margins with stronger-than-expected turnover growth. This was despite a very poor performance all round by the Group’s UK divisions, where TFG continues to struggle. This also highlighted the firm’s strong position in South Africa (SA) and Australia. However, the strong local performance unfortunately unravelled quickly in March as lockdown measures hit the company, with the pandemic accentuating its struggles as malls saw a pronounced decline in foot traffic, impacting the sales of most major retailers that were already under pressure from a sluggish economy. Figure 1 below, highlights the extent to which March 2020 negatively impacted the Group’s businesses globally.

Figure 1: Impact of March 2020 global lockdowns on The Foschini Group

Source: Company data

TFG’s reaction to the lockdown measures has been to batten down the hatches and CEO Anthony Thunström, spoke about all the cost saving initiatives that the company was embarking on including 1) negotiating extended payment terms with suppliers; 2) trying to cancel, or delay, merchandise orders; 3) squeezing landlords in all their jurisdictions; and 4) cutting any non-essential capex. TFG is targeting R6bn of total savings including R1bn in operating expenditure (that is c. 6% of its total operating expenditure!). In addition, 62% of all expansionary capex has been paused, delayed, deferred, or cancelled.

TFG believes that its key competitive advantage going forward will be its strong online presence (TFG’s website is the most visited website among the major SA retailers, according to the company) and the flexibility in its supply chain, due to its focus on local manufacturing. The company said it is doubling down on these efforts. TFG expects online sales to equate to 10% of total revenue by 2025 vs 1.6% in FY20.

Unfortunately, TFG gave very limited guidance on how its businesses have been trading post-lockdown. SA trading started on a robust footing in May but has fallen in June. Meanwhile, Australia started below expectations following the lockdown, but is slowly gaining momentum. However, the UK is struggling. The focus of TFG’s UK business is workwear or occasion wear and the current stay-at-home environment is mostly benefitting casual wear retailers. We highlight our concern regarding the fact that TFG gave no indication at its results presentation around what has happened to its credit book since the 31 March. While the FY20 results surprised on the upside, we have little confidence in TFG’s FY21 and FY22 results.

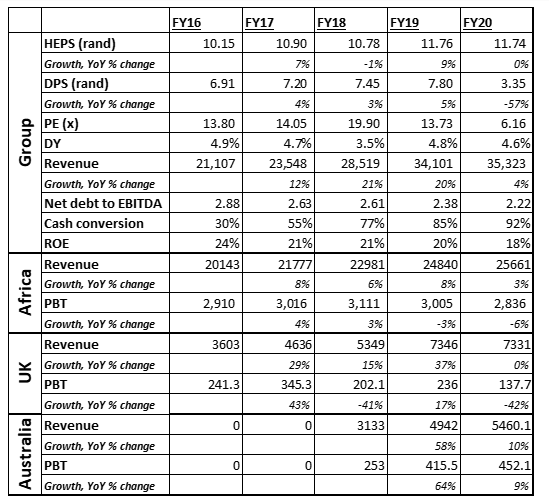

Figure 2: TFG financials by operating segment, Rmn (unless otherwise indicated)

Source: Company data, Anchor

Importantly, TFG announced its intention to do a fully underwritten rights-offer of R3.95bn at the back end of July, subject to shareholder approval on 16 July (we struggle to see this not being passed as it is already fully underwritten). This rights offer equates to c. 23% of the Group’s current market cap. The proceeds will be used to reduce debt in order to insulate its balance sheet against future COVID-19 related shocks and to allow TFG to continue to invest in its current businesses and take advantage of any opportunities that may arise.

While we have great admiration for the performance of TFG pre-lockdown, after the lockdown and the COVID-19 pandemic we do not believe that we need to have exposure to the SA discretionary spending sector, with the exception perhaps of Mr Price. In comparison to TFG, Mr Price has a much stronger balance sheet and is also raising equity to be nimbler. In addition, Mr Price is much more on the frontfoot vs TFG and other peers. TFG will first have to cut costs and rationalise before embarking on any expansionary opportunities, while Mr Price is basically debt free and cash flush. Nevertheless, while both these businesses will face uncertain times over the next 18 months or so, we believe that they will also likely come out of it stronger than any of their peers.