Global equity markets, especially the US, struggled in February (MSCI World -0.7%) as economic uncertainties mounted, and risk-off sentiment prevailed, with investors anxious about the potential negative economic impact of the Trump administration’s policies. The latest US consumer confidence data recorded its biggest drop since August 2021, while a jump in jobless claims also subdued sentiment. Since taking office in January, Trump has proposed a flurry of tariffs and other market-moving policy changes. Following initial confusion regarding timing, he said last week that tariffs would go ahead on 4 March. This weighed on US equities as the Trump tariff offensive and mounting global geopolitical and economic uncertainty around looming trade wars threatened to trigger a worldwide wave of inflation. Higher-for-longer interest rates were also front of mind, as inflation concerns delayed the US Federal Reserve’s (Fed) urgency to ease rates. Testifying before Congress, Fed Chair Jerome Powell reiterated that there would be no rush to cut rates again and said the US economy remains strong but acknowledged that uncertainty around future policies remains.

The three major US averages recorded monthly losses, with the S&P 500 down 1.4% (+1.2% YTD) and the Dow falling by 1.6% (+3.0% YTD). The tech-heavy Nasdaq was the worst performer for the month – ending 4% lower (-2.4% YTD). January headline inflation, as measured by the Consumer Price Index (CPI), came in at 3.0% YoY – higher than expected across the board and signalling renewed price pressures. Core CPI, which excludes food and energy, rose 3.3% YoY. January core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, printed at 2.6% YoY, down from December’s upwardly revised 2.9%.

While European equities were also under pressure after Trump said he would impose 25% tariffs on the EU, major European markets managed to end February with a tenth straight week of gains, outperforming the US. Germany’s DAX gained an impressive 3.8% (+13.3% YTD), while France’s CAC closed 2.0% higher MoM (+9.9% YTD). January eurozone headline inflation rose for a fourth straight month, printing at 2.5% YoY vs December’s 2.4%, while core inflation remained at 2.7% for a fifth consecutive month. Germany held elections, with Friedrich Merz set to become the next chancellor as his opposition centre-right Christian Democratic Union (CDU) and its sister party won 28.6% of the vote. Following the election results, Merz warned that Europe should seek ‘independence’ from the US, as Trump continues to upend Europe and US relations in favour of Russia.

The UK market also ended strong, with the FTSE 100 gaining 1.6% (+7.8% YTD). January UK inflation unexpectedly shot up to 3.0% (the fastest rate since March 2024) from 2.5% in December. Core inflation also rose – printing at 3.7% in January from 3.2% in December.

China’s equity markets whipsawed for most of February as the Trump administration took aim at China with a series of moves involving investment, trade and other issues that have raised the risk that relations between the two countries would worsen. However, equity markets rebounded as China’s government stepped up rescue efforts, including President Xi Jinping’s meeting with many of the country’s top private sector leaders, which many welcomed as a sign that the private sector is key to reviving China’s economy. Hong Kong’s Hang Seng rose 13.4% (+14.4% YTD), while the Shanghai Composite rose 2.2% (-0.9% YTD). February’s official manufacturing PMI beat expectations, expanding to 50.2 vs January’s 49.1. The non-manufacturing PMI, which includes services and construction, climbed to 50.4 from 50.2 in the prior month.

Japan’s benchmark Nikkei recorded its biggest monthly decline in c. two years in February (-6.1% MoM/ -6.9% YTD), led by a sell-off in chip-related companies and concerns over tariffs. January core inflation rose 3.2% YoY, surpassing expectations and reinforcing concerns about persistent price pressures. Including fresh food, overall inflation printed at 4.0%, the highest since June 2023. 4Q24 GDP grew 0.7% QoQ, accelerating from an upwardly revised 0.4% expansion in 3Q24 and beating market expectations of 0.3%, marking the third consecutive quarterly growth print.

In commodities, Brent crude fell 4.7% MoM (-2.0% YTD) as weak economic data from the US and Germany fed fears of slowing demand. Gold (+2.1% MoM/+8.9% YTD) hit another all-time high on 20 February of US$2,955/oz before cooling slightly to close at US$2,937/oz on 21 February as escalating global trade tensions, heightened US tariff threats and the wars in Gaza and Ukraine fuel gold’s safe-haven demand. Among platinum group metals (PGMs), platinum lost 3.4% MoM (+4.6% YTD), palladium plummeted 9.3% MoM (+1.0% YoY), and rhodium gained 1.6% MoM (+3.3% YoY).

In South Africa (SA), the FTSE JSE All Share Index retreated 0.02% last month (+2.2% YTD) despite reaching several all-time highs in February (including closing at 8,9061.67 on 18 February). The Capped SWIX ended 0.4% lower for the month (+2.2% YTD). In stark contrast to January, precious metals miners were the biggest underperformers, with industrials (Indi-25 +3.4% MoM/+4.3% YTD) doing most of the heavy lifting, while the Resi-10 was down 6.2% MoM (+10.6% YTD). Financials rose (Fini-15 +0.8% MoM/-1.9% YTD), and property shares declined (SA Listed Property Index -0.3% MoM/-2.6% YTD). The rand weakened by 0.1% against the US dollar (+0.8% YTD).

SA January headline inflation rose slightly to 3.2% vs 3.0% in December, while core inflation eased for a fourth consecutive month to 3.5% YoY vs 3.6% in December (this is the first release since Stats SA updated its consumer price basket). The unprecedented, last-minute postponement of the Budget (set for 19 February) caught many by surprise. At the heart of the dispute within the Government of National Unity (GNU) is a proposed two-percentage-point VAT increase intended to fund additional spending on social grants and the public sector. The Budget is now set for 12 March.

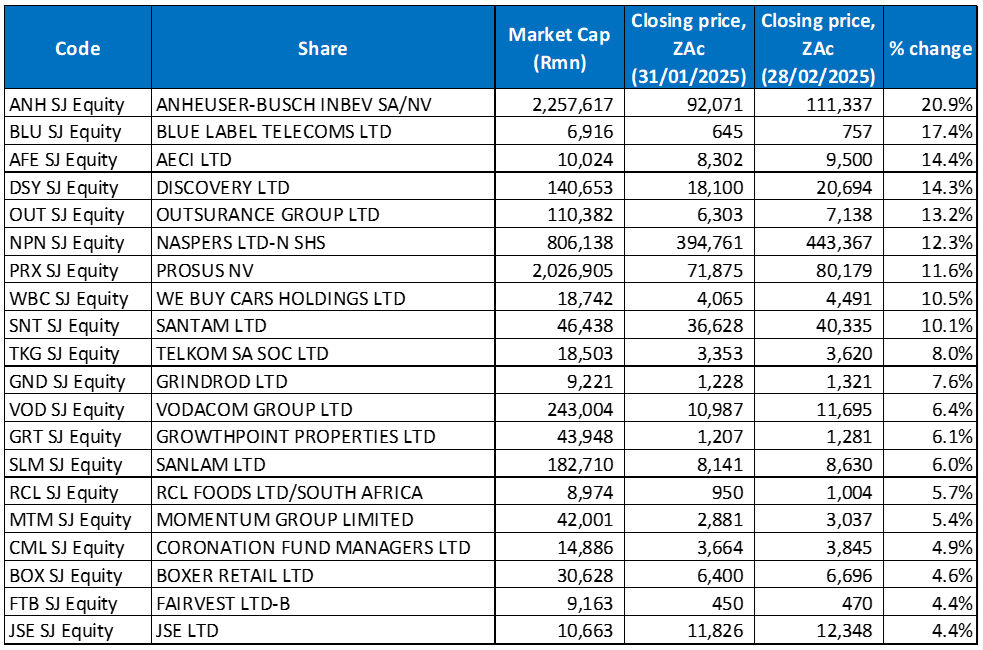

Figure 1: February 2025’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

In February, the JSE’s standout performer was global brewer Anheuser-Busch InBev (AB InBev), with a MoM gain of 20.9% after delivering robust results, which showed a strong margin improvement in the key South America region and better-than-expected cash generation, which will aid in unwinding its elevated leverage. FY24 underlying EPS came in at US$3.53 (+15% YoY), beating the consensus forecast of US$3.34, driven by robust profit growth and favourable financial adjustments. A strengthened balance sheet allowed it to announce a higher-than-anticipated dividend of EUR1/share.

AB InBev was followed by Blue Label Telecoms (+17.4% MoM) in second spot. Blue Label reported interim headline EPS of ZAc46.01 for the six months ended November from ZAc45.91 in the same period of the prior year. Revenue declined 4% YoY to R7.24bn. Still, Blue Label noted that as only the gross profit earned on “PINless top-ups”, prepaid electricity, ticketing and universal vouchers is recognised as revenue, on imputing the gross revenue generated from these sources, the effective revenue growth equated to R3.5bn (+8% YoY), resulting in a total revenue of R47.4bn compared with R43.8bn in the prior year. Blue Label, Cell C’s largest shareholder, also said it is confident that the mobile operator has turned its business around after languishing for years under a mountain of debt and uncompetitive structure.

Chemicals company AECI reported FY24 results last week, with challenging market conditions in SA and declining ammonia prices (due to weak natural gas prices) weighing on its results. Group revenue fell 4.0% YoY to R33.60bn, while it reported a diluted loss per share of ZAc266.0, compared with an EPS of ZAc1,092.0 in FY23. However, the Group said it is looking to double the profitability of its core businesses by 2026 and secure a global market position of third in mining by 2030. This, combined with a narrative that the bottom is in and that things will improve from here, seemed to get market approval as the share price soared by 14.4% MoM.

Insurers Discovery and Outsurance recorded MoM gains of 14.3% and 13.2%, respectively. Discovery’s trading update said that profits are expected to rise by 25%-30% YoY, well ahead of analyst expectations for 15% YoY growth. The Group attributed this to a strong operating performance across its businesses, including Discovery SA and Vitality.

The Naspers (+12.3% MoM) and Prosus (+11.6% MoM) complex was another standout performer despite announcing that they would purchase the food-delivery group Just Eat, which the market was unhappy about. Nevertheless, an otherwise stellar performance from their most significant underlying investment, Chinese tech conglomerate Tencent (+19% MoM), boosted their respective share prices. Tencent rallied following the Chinese president’s meeting with China’s private sector leaders to revive the country’s economy.

WeBuyCars, Santam and Telkom rounded out the ten best-performing shares with MoM gains of 10.5%, 10.1%, and 8.0%, respectively. Telkom reported quarterly earnings reflecting growing demand for data-led services as it experiences improved operational efficiencies across its businesses. Group revenue for the quarter ended December was up 0.9% YoY at R10.99bn, driven by higher prepaid recharges, mobile data revenue growth of 10.8% and ongoing migrations to fibre-related services with fixed-data revenue growing 4.7%, and information technology services revenue increasing by 3.2%. Meanwhile, Santam reported higher FY24 earnings as the various underwriting measures it implemented in response to the difficult global operating and risk environments improved profitability. Group insurance revenue for the year to end December was 21% YoY higher at R52.3bn, while HEPS jumped 51% YoY to R34.77.

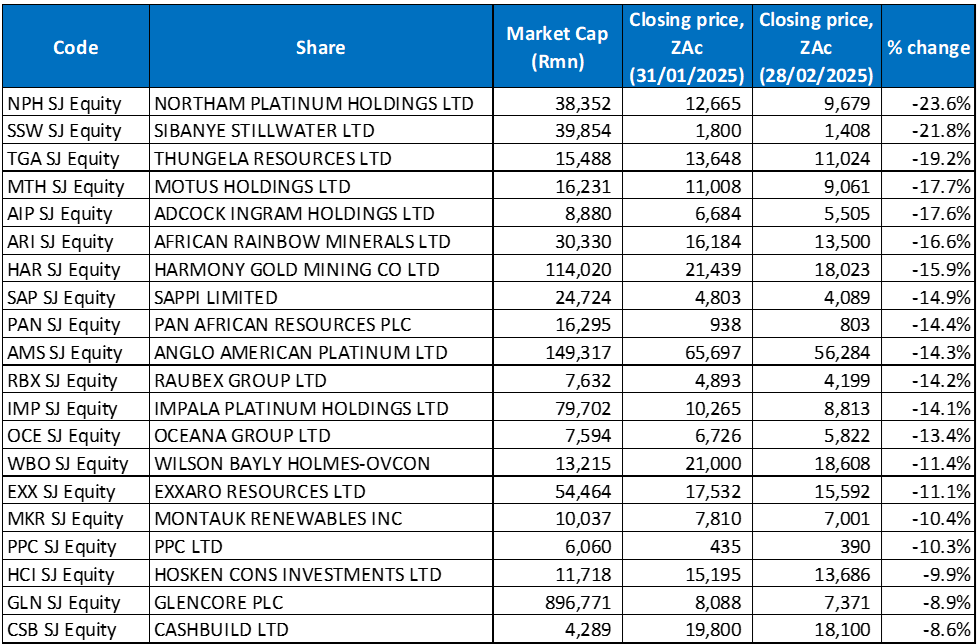

Figure 2: February 2025’s 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

While commodities companies performed well in January, the opposite was true last month, and most of February’s worst-performing shares were materials counters. Northam Platinum was the overall worst performer, with a MoM decline of 23.6%. In its 1H25 results, Northam warned that its sustainability continued to be threatened by its dependence on the national grid, with supply disruptions and above-inflation electricity tariff hikes likely to persist this year. Its revenues declined by 3.1% YoY to R14.5bn, resulting in a 55% YoY decrease in operating profit and a 45% drop in earnings before interest, tax, depreciation and amortisation (EBITDA). Mining cost inflation and persistently low PGM prices also weighed on its balance sheet.

Gold and PGM company Sibanye Stillwater (-21.8% MoM) was the second-worst performer despite narrowing its FY24 losses. However, it opted not to pay dividends, with adjusted EBITDA from its SA gold operations surpassing that from its PGM activities in SA. Revenue decreased to R112.1bn from R113.7bn posted in the previous year, while its diluted loss per share fell 80.7% YoY to ZAc258.0.

Sibanye was followed by Thungela Resources (-19.2% MoM). The JSE- and London-listed coal producer warned last week of a sharp fall in its earnings for FY24 as several headwinds persist, including weaker coal prices, logistical constraints, and reduced global demand. Thungela now expects HEPS of R24-R26.50, a drop from R34.97 in 2023.

Motus Holdings, Adcock Ingram, African Rainbow Minerals, and Harmony Gold recorded MoM losses of 17.7%, 17.6%, 16.6%, and 15.9%, respectively. Vehicle sales and automotive services giant Motus’ shares plunged on 27 February as the market showed disappointment with its 1H results. Motus reported a 2% YoY decline in revenue to R56.2bn, with operating profit consequently dropping 4% YoY to just over R2.5bn. However, HEPS grew by 3% YoY to ZAc681. Meanwhile, pharmaceutical group Adcock also reported lower profits at the interim stage, with the Group’s operational and financial performance affected by sector-specific factors. Its revenue decreased 0.6% YoY to R4.7bn due to a slowdown in its independent and pharmaceutical wholesale channels. HEPS declined by 9.4% YoY to ZAc265.5.

In its latest trading and operational update, Harmony expects HEPS to be between ZAc1,188.0 and ZAc1,361.0, higher than the ZAc956.0 recorded in the prior year. Despite favourable conditions, Harmony has faced challenges that have partially offset its earnings growth, including above-inflation increases in labour and electricity costs, higher taxation due to increased taxable income and royalty taxes driven by higher revenue and profitability.

Sappi (-14.9% MoM), Pan African Resources (-14.4% MoM), and Anglo American Platinum (Amplats; -14.3% MoM) rounded out February’s worst-performing shares. Sappi released 1Q25 results, which showed that its sales rose to US$1.36bn from US$1.27bn, while its diluted EPS stood at USc12.0 vs a loss per share of USc23.0 in 1Q24. The company said despite continued challenging global macroeconomic conditions and weak paper markets, it delivered adjusted EBITDA of US$203mn, above expectations and last year. However, its net debt rose 16% YoY because of higher capex. External pressures (a slowdown in China, weaker European markets and uncertainties around tariffs) and the planned work at its Somerset Mill PM2 that will see it shut for an expected 70 days could result in weaker 2Q25 results.

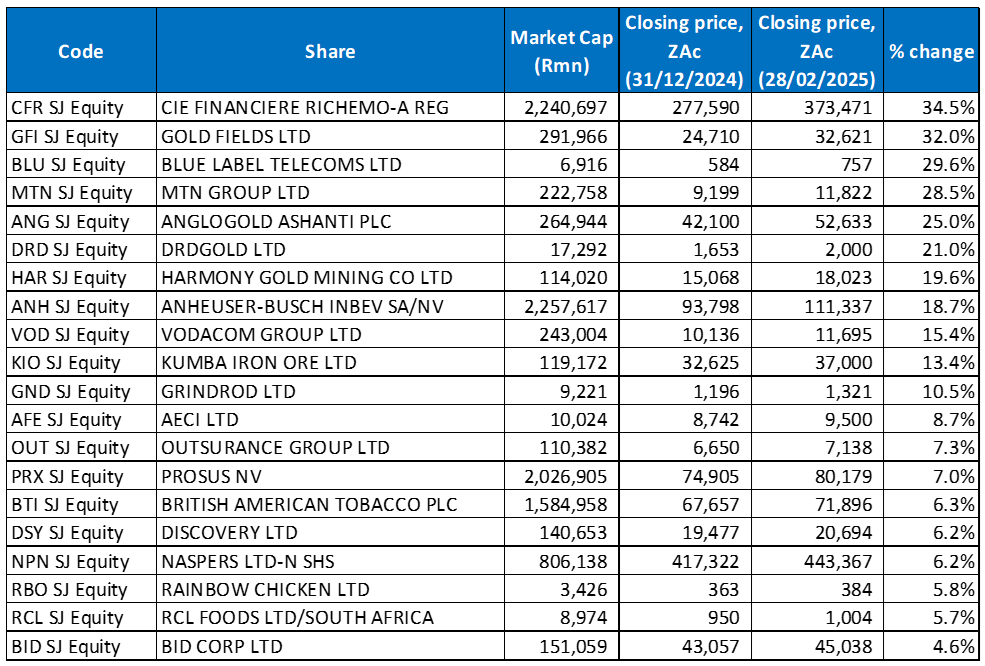

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

YTD’s best-performing shares overlapped with those of February and several precious metals miners, whose prices had soared in January, remained among the YTD best performers despite their poor performances in February. In January, the gold price gained 6.6%, while platinum and palladium prices jumped by 8.3% and 11.4% MoM, respectively, and rhodium rose 1.6%. Gold’s gains came as concerns over US tariff threats and the Trump administration’s unpredictability regarding trade and foreign policy are buoying demand for the safe-haven asset.

YTD, Richemont (+34.5%) has performed well, outperforming its global luxury peers, particularly its jewellery segment, which recorded good growth (despite a slowdown in China). In January, the Group reported robust sales for the holiday and festive season quarter, with investors pushing its market cap above R2trn for the first time. For the three months, Richemont reported a 10% YoY rise in sales at constant exchange rates, with double-digit growth in all regions except Asia Pacific. The Americas and Europe were standout markets, with sales growing 22% and 19% YoY, respectively, driven by strong local and tourist demand. Japan, the Middle East and Africa also performed well, posting gains of 19% and 20%, respectively.

Gold Fields (+32.0% YTD) was in second spot, buoyed by its 30.8% share price gain in January (it was also one of a few commodities shares that recorded gains in February [+1.0%]). It was followed by Blue Label Telecoms (discussed earlier), which is up 29.6% YTD.

A 20.2% surge in MTN’s share price in January (on the back of reports that it can now increase its tariffs in Nigeria after a long-standing battle with the country’s regulator about pricing) and a 2.8% gain in February has resulted in a 28.5% share price surge YTD. MTN was followed by AngloGold Ashanti, DRDGold, and Harmony Gold, with YTD gains of 25.0%, 21.0%, and 19.6%.

ABI InBev (discussed earlier), Vodacom Group and Kumba Iron Ore rounded out the YTD best-performing shares with gains of 18.7%, 15.4%, and 13.4%, respectively. Vodacom (+6% MoM) released quarterly results in February, which showed some growth in the domestic market and waning FX headwinds in its African regions.

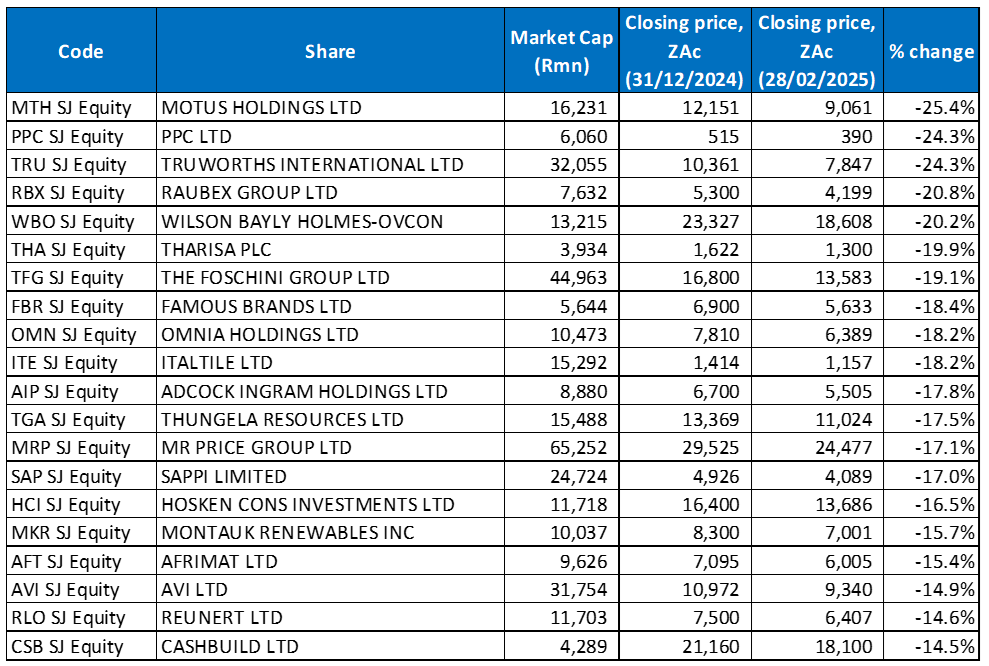

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

After a strong 2024 performance, SA Inc., or domestically focused shares, struggled in January, with some of these companies having dropped by such a large percentage that they remained among the YTD worst performers to the end of February. The clothing retailers were among the hardest hit counters in January, with Truworths, Mr Price and The Foschini Group all featuring prominently among the YTD losers.

Motus’ share price losses this year saw it emerge as the worst-performing share YTD with a decline of 25.4%. It was followed in second and third place by PPC Ltd and Truworths International, with both shares down 24.3% YTD. In a disappointing business update and voluntary trading statement for the 26 weeks ended 29 December 2024, Truworths said that Group retail sales advanced by just 2.4% to R12.5bn, while online sales continued to show good growth, increasing 38% and contributing 5.8% to Truworths Africa’s retail sales (this segment was a drag on performance with an overall decline of 1.1% YoY). Its Office UK business posted growth of 11.3% in pound terms and 9.9% in rand for the period. Truworths now expects HEPS to be 4%-8% lower YoY.

Truworths was followed by Raubex, Wilson Bayley Holmes Ovcon (WBHO), Tharisa Plc, and The Foschini Group, with YTD declines of 20.8%, 20.2%, 19.9%, and 19.1%. Mining and metals Group, Tharisa Plc, dropped by a further 4.4% last month, following its 16.2% January decline after it released a poor 1Q25 production update, which showed lower production for its first quarter as operations were negatively impacted by drilling equipment availability. Foschini built on January’s double-digit decline with a further 4.4% drop last month.

Famous Brands (-18.4% YTD), Omnia Holdings, and Italtile (both down 18.2% YTD) rounded out the ten worst-performing shares.