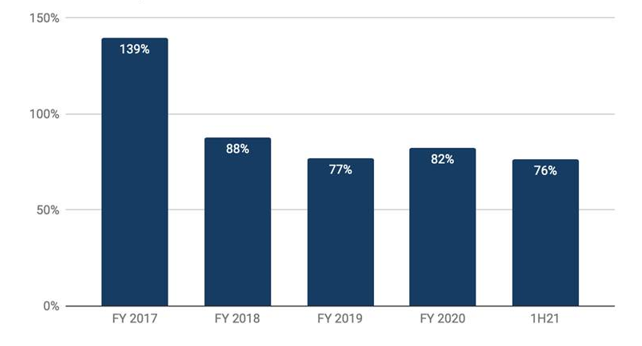

Exxaro reported results for the six months ended 30 June 2021 on 12 August 2021. The diversified coal, energy, and ferrous resources firm announced a significantly higher interim dividend, as iron ore prices buoyed its 1H21 income inflows. Exxaro’s dividend policy is to pass through100% of the dividend it receives from its c. 21% stake in the Sishen Iron Ore Company (SIOC) and to pay 28% to 40% of adjusted group earnings. The 1H21 dividend was also boosted by proceeds from the sale of Exxaro’s Tronox stake, which was used to fund an R7.79/share special dividend and an R1.5bn (R6.00/share) buyback. Since 2017, Exxaro has consistently returned a high proportion (generally > 75%) of earnings generated to shareholders.

The total Group revenue rose by 8% YoY to R51.1bn on the back of higher coal revenue and the inclusion of renewable energy revenue from Cennergi (the company’s diversified independent power producer [IPP]). Earnings doubled YoY, driven by iron ore, while net operating profit rose 29% YoY to R5.2bn.

Earnings from Exxaro’s stake in the SIOC nearly tripled over the period under review and now represent c. two-thirds of pre-tax income for Exxaro. The remainder is largely coal and here net operating profit was flat YoY. While coal production and sales were 12% and 10% lower YoY, respectively, a c. 47% jump in the average benchmark export price of coal, positively offset the impact of the COVID-19 pandemic and the Transnet Freight Rail challenges which the company experienced.

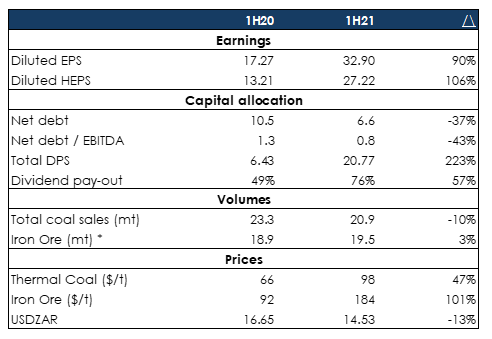

Figure 1: Exxaro 1H21 results overview, in Rbn except per share

Source: Anchor, Bloomberg

Exxaro is paying 29%-40%* of Group adjusted earnings.

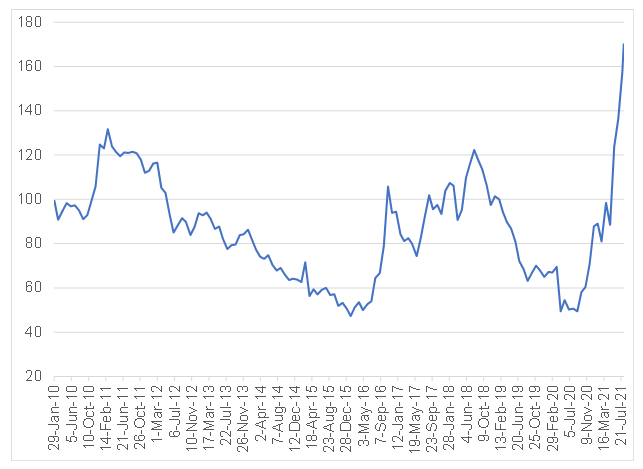

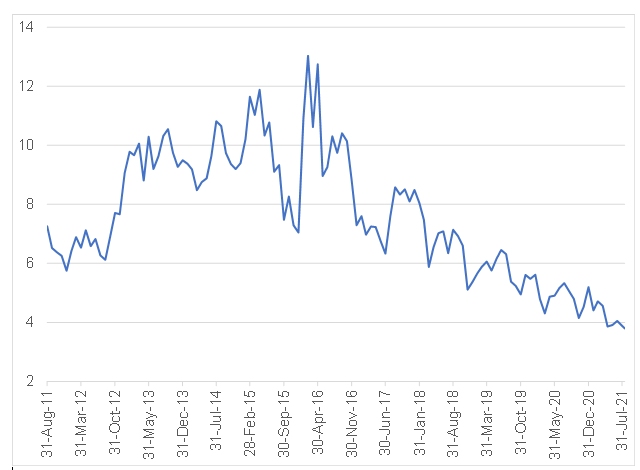

Export thermal coal prices have been incredibly strong recently and in Figure 2 we highlight prices since 2010.

Figure 2: Export thermal coal prices, US$/tonne

Source: Anchor, Bloomberg

Exxaro had a few interesting comments on the coal market, which we highlight below:

- The company said that the Atlantic Basin supply was very tight at the moment – this is the first time in a long time that Exxaro has made this comment since the Atlantic Basin has generally historically been oversupplied.

- A hot summer in Europe is helping demand.

- There has been low output from renewables and gas prices are rising from last year and 2019’s lows and are now at quite expensive levels.

- There has also been quite a bit of switching back from gas to coal.

- Historically, there have been record stock levels in Europe (in cities such as Amsterdam, Rotterdam, and Antwerp), but these inventory levels are currently at very low levels (c. 4mt).

- China’s ban on Australian coal has resulted in China being very short on coal and Chinese domestic supply was also reduced by China due to safety concerns.

- There are other regional supply issues (in Russia, Indonesia etc.) and, as a result, China has been a very strong buyer of South African (SA) coal.

- YTD, however, China’s coal imports are down 21% YoY.

- Exxaro’s medium-term view on coal remains that demand in Europe will continue to decline by c. 3% p.a., but the company said that this does not change its long-term view on coal at all.

- The fact that there are so many variables, makes it difficult to forecast but Exxaro sees a case for strong pricing for the remainder of the year.

Exxaro is not hugely exposed to export thermal coal prices (iron ore and long-term coal contracts are the majority of its business).

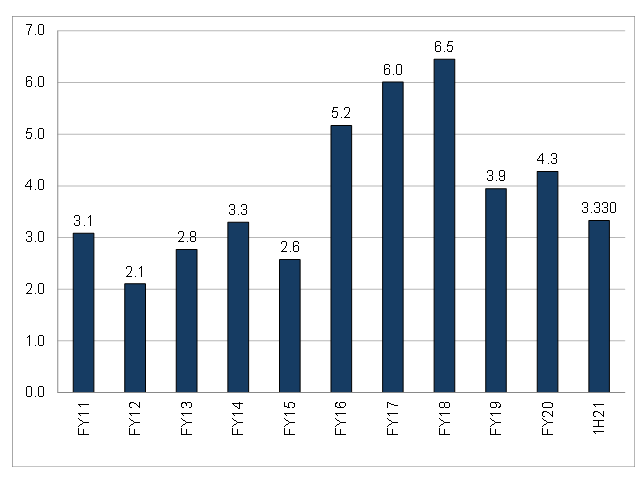

Figure 3: Exxaro coal net operating profit (Rbn)

Source: Anchor, company reports

Figure 4: Exxaro dividend payout ratio

Source: Anchor, company reports

Figure 5: Exxaro consensus 12-month forward P/E history (now 3.8x)

Source: Anchor, Bloomberg

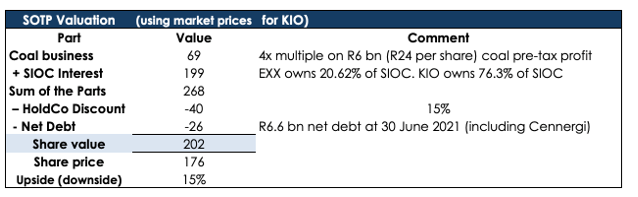

Figure 6: Exxaro 1H21 SoTP valuation

Source: Anchor, Bloomberg

Exxaro is currently trading at a 3.8x forward P/E multiple. The multiple has consistently contracted for some time as earnings growth has been strong since 2017. We value Exxaro on a sum-of-the-parts (SoTP) basis at R202/share, with about 75% of that value coming from iron ore and the remainder coming from coal (see Figure 6). That suggests an 11% upside to current share price levels. Therefore we believe that Exxaro is quite fairly priced at present.