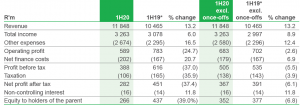

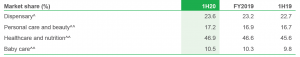

Dis-Chem reported 1H20 results on Thursday (7 November), which showed a 39% YoY drop in interim profit to R282mn as the company was impacted by strike-related costs (including extra security) and lower volumes ordered from suppliers. Headline earnings per share (HEPS) fell to ZAc31 in 1H20 – down c. 39% YoY from a restated ZAc50.7/share in 1H19. Revenue for the period under review rose to R11.85bn from R10.5bn in the year-ago period. Dis-Chem included the strike-related costs under “other expenses” as R2.7bn (+16.5% YoY). We note though that a change in the Group’s bonus policy relating to thirteenth cheques also contributed to this increase as Dis-Chem had previously expensed the full bonus amount when paid in December of each year. Dis-Chem declared an interim dividend of ZAc12.8 for the six-month period vs ZAc20.7 during the 2018 interim period.

This set of numbers saw many one-off adjustments to its earnings with the numbers negatively impacted by:

- The aforementioned extended strike action from November 2018 to March 2019 over workers’ wage demands, which had already seen Dis-Chem miss its earnings expectations for FY19 (it has a February year-end);

- IFRS16 adjustments;

- the loss of volume rebates because of attempts to bring down the company’s inventory days; and

- the abovementioned accounting changes to bonus payments as Disc-Chem now accrues bonusses through the year rather than expensing it in the month in which it is paid.

The company did attempt to adjust for these one-off impacts. However, its adjustments account for the IFRS16, strike-related costs and bonus accruals, but the firm could not normalise for volume rebates. The normalisation of these rebates is the contentious issue and the key variable on whether investors should view these numbers in a positive or a negative light.

Dis-Chem reported an earnings drop of 39% YoY, but according to the company’s normalised numbers earnings were down 6.8% YoY. We note that revenue growth was still relatively strong at 13.2% YoY, although it was nevertheless slightly weaker than the market’s expectation of 14% YoY growth. Meanwhile, retail revenue growth came in at 11.8% YoY, with like-for-like (LfL) growth of 5.4% and price inflation of 2.3%.

Figure 1: Dis-Chem Group 1H20 financial summary

Source: Dis-Chem

*Increase in net finance cost due to: i) the increase in the term loan; ii) financing of additional stock ahead of the strike and; iii) IFRS16.

*Growth in minorities as a result of good performance of the firm’s oncology business.

The big disappointment for us came in the gross profit (GP) margin, where the loss of volume rebates caused the GP margin to contract by 184bps.

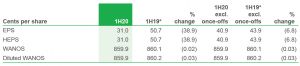

Figure 2: Dis-Chem Group total income

Source: Dis-Chem.

Low growth in purchases from suppliers impacted growth rebates and fee-for-service income, negatively impacting the total income margin.

The majority of the impact was in the retail segment.

Despite successful improvement of additional trade term income and the maintenance of transactional gross margin, the Group total income margin declined.

Expense growth was on the high side and came in at 11.2% (ignoring one-off items) but was, encouragingly, slightly lower than revenue growth. The high expense growth is expected since Dis-Chem continues to roll out new stores. On a normalised basis, the company earned ZAc41/share vs the ZAc31 reported. It thus looks very unlikely that Dis-Chem will earn more than ZAc90/share even on a normalised basis for the full year.

Figure 3: Dis-Chem Group EPS and HEPS

Source: Dis-Chem

Dis-Chem continues to take market share in all the areas in which it competes, highlighting the quality of the business and the strength of the brand. Importantly, the performance of those brands it acquired from Ascendis are exceeding management’s expectations.

Figure 4: Dis-Chem Group core category market shares

Source: Dis-Chem

^Scheduled 0-6 medicines including oncology ^^Nielsen

The Group continues to gain market share in all of its core categories despite a tough trading environment.

Dis-Chem has 54.6% of the vitamins and supplements market share (internally generated, exclusive brand, Biogen, is the largest vitamins and supplement brand in SA).

Positive growth of the brands acquired in the previous year after reformulation, rebranding or repositioning (Evox, SSN, Supashape, Muscle Junkie).

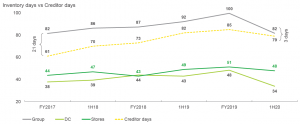

The loss of volume rebates was due to a focus on reducing the Group’s inventory days which led to reduced volumes ordered from manufacturers. The benefit of this should be better cash flow. However, thus far, we have only seen the negative side of this particular coin since Dis-Chem has not materially improved its cash flow, while the loss of rebates caused the GP margin to decline significantly. We believe that the next set of numbers will be critical for this management team. If they do not show an improvement in the GP margin and in cash flows, then there is likely to be significant questions from the market and from investors.

Figure 5: Dis-Chem Group improvement in net working capital

Source: Dis-Chem

The outlook statement was cautious. Dis-Chem believes that the consumer will remain constrained but said it is well positioned and embarking on a number of initiatives to enhance growth. Looking ahead, the company said that it will introduce the following:

- Telemedicine (or the provision of healthcare over a distance using information technology) into its clinics.

- Conclude a franchise agreement to rebrand all airport pharmacies to Dis-Chem pharmacies.

- Add 20 new stores for FY20.

- It has also concluded a deal to take ownership of pharmacies in Mediclinic hospitals.

- The majority of the rationalisation of inventory levels have been completed.

- ROIC and cost containment will remain a key focus area going forward.

The firm also said it expects the consumer to remain constrained due to the current difficult and challenging economic environment, with inflation between 2% and 3%.

Conclusion

We believe that Dis-Chem is a high-quality (albeit expensive at current levels) business, but the next set of results (FY20) will be the most important set of numbers for the current management team. If we do not see a recovery in GP margins and improved cash flows, investors will likely start to ask some real questions. In our view, investors buying at current levels are making some significant assumptions on the reversion of GP margins, but we are slightly less optimistic at the moment and would be sellers at current levels.

Despite the drop in its earnings, the Dis-Chem share price rose c. 5% on Thursday to close at R25.25.