The January Barometer Stock Market Effect is a market strategy which looks at how the S&P 500 performs in the first month of any given year. It postulates that the index’s performance in January will determine its performance for the rest of the year – ‘so goes January, goes the year’. While the S&P 500 rose last month, which is usually a good sign for the year, it was a volatile four weeks, especially over the last few days of January. First, Chinese artificial intelligence (AI) firm DeepSeek caused disruption after it announced a low-cost, open-source large language model, which challenged the established US tech giants (with traders on US equity markets’ first instinct being to sell). No sooner had concerns around the release of DeepSeek abated, and US President Donald Trump’s unpredictability came to the fore as he implemented sweeping tariffs against US allies and enemies alike, spooking markets further. Earnings reports and upcoming US Federal Reserve (Fed) rate decisions added to the volatility, with inflation concerns also in focus. Nevertheless, despite the volatility, global markets (MSCI World +3.6% MoM) recorded a strong start to 2025, with most major global markets beginning the year on a positive note.

The three major US averages posted monthly gains, with the S&P 500 rising 2.7% and the tech-heavy Nasdaq advancing by 1.6% (despite the mega-cap tech shares coming under pressure). The Dow outperformed, soaring by 4.7% MoM. In US economic data, December headline inflation, as measured by the Consumer Price Index (CPI), rose 2.9% YoY, while core CPI, excluding the erratic food and energy components, was up 3.2% YoY. MoM, headline inflation advanced 0.4% while core inflation rose 0.2%. December core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, printed at 2.8% YoY – meeting expectations and unchanged from the previous month. MoM, core PCE rose by 0.2% in December – also unchanged. As widely expected, the Fed held rates steady on 29 January, with Fed Chair Jerome Powell saying there would be no rush to cut rates again.

European equity markets outperformed their US counterparts in January, with Germany’s DAX gaining an impressive 9.2%, while France’s CAC closed 7.7% MoM higher despite Trump’s tariff threats weighing on European markets. According to Bank of America, January recorded the most significant rotation from US stocks into eurozone equities in c. ten years, as investors piled into European defensive and growth stocks (including banks, pharmaceuticals and luxury retailers). December eurozone headline inflation rose for a third straight month, printing at 2.4% YoY vs November’s 2.2%, while core inflation held at 2.7% for a fourth consecutive month. In January, the European Central Bank (ECB) cut rates for the fifth time since June 2024 (again by 25 bpts), taking its benchmark rate to 2.75%.

The UK’s FTSE 100 index closed at a record high on 31 January, taking its returns to 6.1% – its best monthly performance since November 2022. December UK inflation unexpectedly declined to 2.5% from 2.6% in November, while core inflation printed at 3.2% in December, down from 3.5% in November.

China’s equity markets closed mixed in January, with Hong Kong’s Hang Seng rising 0.8%, while the Shanghai Composite fell 3.0%. December inflation declined further to 0.1% YoY vs 0.2% in November, with core inflation nudging slightly higher to 0.4% (from November’s 0.3% gain). Following three consecutive months above the 50-point mark (separating expansion from contraction), January’s manufacturing PMI came in lower at 49.1 vs December’s 50.1. The official non-manufacturing PMI, tracking business sentiment in services and construction, fell to 50.2 vs 52.2 in the prior month. We note, though, that January manufacturing PMI does tend to be softer as migrant workers return to their hometowns ahead of the Chinese New Year, which starts on 29 January.

Japan’s benchmark Nikkei ended January 0.8% lower. At its January meeting, the Bank of Japan (BoJ) raised its key interest rate to c. 0.5% from 0.25%. The BoJ said inflation was holding at a “desirable target level” as recent data showed inflation hovering at about the central bank’s 2% target level.

In South Africa (SA), after three consecutive months of declines, the JSE bounced back, starting 2025 on a positive note, with the FTSE JSE All Share Index ending January 2.2% higher, while the Capped SWIX rose 2.6% MoM. Precious metals miners were the outperformers by far, doing most of the heavy lifting for the local bourse. In contrast to December, commodity prices, especially gold and palladium, soared in January, pushing the Resi-10 c. 18% higher MoM. Industrials, as measured by the Indi-25, gained 0.9% MoM, despite JSE heavyweights Naspers and Prosus (down 5.4% and 4.1% MoM, respectively) being caught in the crosshairs of geopolitics as the US added their largest underlying investment, Chinese tech conglomerate Tencent (-5% MoM in rand) to its blacklist of Chinese firms. Financials and property shares were amongst the biggest losers, as the Fini-15 and the SA Listed Property Index declined by 2.7% and 2.3% MoM, respectively. The rand strengthened by 1.0% against the US dollar.

SA December headline inflation rose slightly to 3.0% vs 2.9% in November, while core inflation declined for the third consecutive month, easing to 3.6% YoY from 3.7% in November. The decline in inflation was broad-based, with most subcategories continuing to show downward pressure. The latest inflation data, now settled at the lower end of the SA Reserve Bank’s (SARB) target range and well below the SARB Monetary Policy Committee’s (MPC) preferred target of 4.5%, saw the MPC cut the repo rate by 25 bps at its meeting on 30 January).

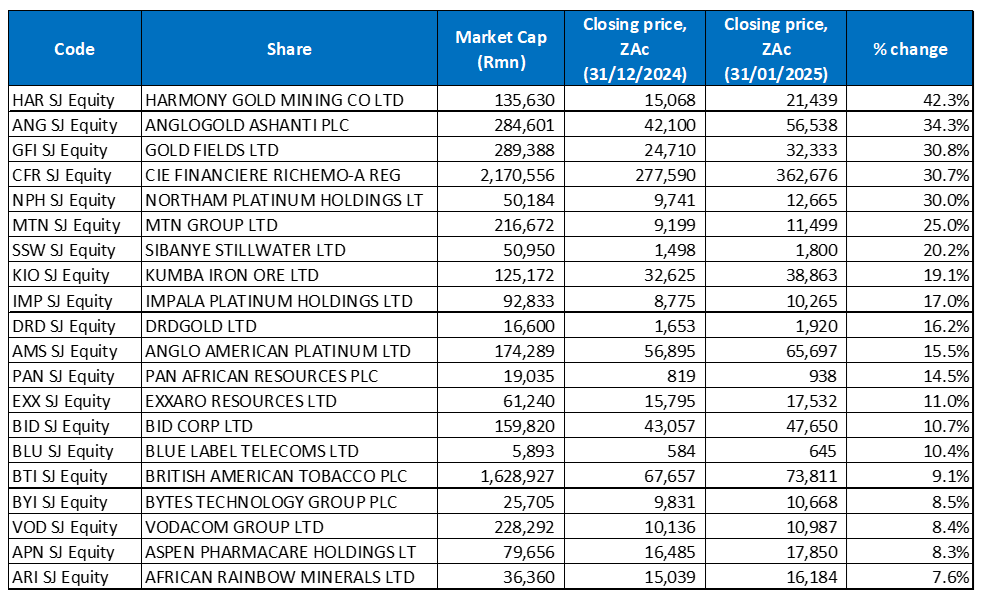

Figure 1: January 2025’s 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Precious metals miners soared in January as the gold price gained 6.6% MoM, while platinum and palladium prices jumped by 8.3% and 11.4% MoM, respectively. Rhodium rose 1.6% MoM. The gold price enjoyed a strong rally last month, hitting record highs and reviving its uptrend after encountering some weakness in November and December 2024. Gold’s gains come as concerns over US tariff threats and the Trump administration’s unpredictability around trade and foreign policy buoy demand for the safe-haven asset.

Gold’s performance, in turn, boosted local mining sector stocks, especially the gold miners, which accounted for the top three best-performing shares in January. Harmony Gold was January’s top performer, with an impressive 42.3% MoM gain, as record bullion prices buoyed the gold miners. In November, Harmony announced the appointment of Beyers Nel as its CEO, effective 1 January 2025. Strategically, Harmony is also expanding its global footprint by planning to advance new copper projects in Australia (the Eva copper project) and Papua New Guinea (the Walfi Golpu gold-copper joint venture, which it owns with Newmont Corp). Media reports have also suggested that Harmony is considering the acquisition of the Ravenswood Gold Mine in Queensland for US$2bn, which will further enhance its Australian operations. AngloGold Ashanti was in second place with a MoM gain of 34.3%, followed by Gold Fields in third spot with a share price gain of 30.8%.

Richemont (+30.7% MoM) posted strong 3Q25 (for the three months to end December 2024) sales (+10% YoY) in January, with the share price soaring c. 14% on 16 January following the release of the results. The EUR6.2bn (c. R120bn) sales of the Group’s branded luxury jewellery and accessories reflected double-digit growth in the Americas, Europe, Middle East & Africa, and Japan. The results also seemed to raise investor hopes that the high-end luxury goods sector is recovering from the slump induced by weak demand from China (sales declined by 7% in Asia Pacific, led by an 18% decline in the combined regions of mainland China, Hong Kong and Macau).

Northam Platinum, MTN Group and Sibanye Stillwater rose by 30.0%, 25.0%, and 20.2% MoM, respectively. In its 1H25 production update, Northam reported a 3.7% YoY rise in equivalent refined platinum group metal (PGM) output to 451,213 ounces. In addition, the miner said that its chrome production was 7.5% higher YoY, coming in at c. 716,622 tonnes. MTN’s share price surged by c. 11% on 15 January on the back of press reports that it can now increase its tariffs in Nigeria after a long-standing battle with that country’s regulator about pricing. Last year, MTN said that higher inflation and interest rates weighed on consumers’ spending power and had impacted the company’s business activity. In addition, the naira depreciated by a significant 41% against the US dollar in 2024 (Central Bank of Nigeria data).

A 4.7% MoM uptick in iron ore prices boosted Kumba in January as its share price rose by 19.1%, albeit from a very low base. The higher iron ore price has been underpinned by optimism around China’s policy stimulus measures, which many investors hope will stabilise that country’s construction and property sectors, thus enabling a recovery in the demand for iron ore.

Impala Platinum (Implats) and DRDGold rounded out January’s top-ten performers with MoM gains of 17.0% and 16.2%, respectively. In January, Implats signed a power purchase agreement (PPA) with Discovery Green to power its SA refineries with wheeled renewable energy over the next five years (starting in 2026). The move accelerates Implats’ decarbonisation efforts while simultaneously hedging against rising prices and possible future loadshedding from Eskom.

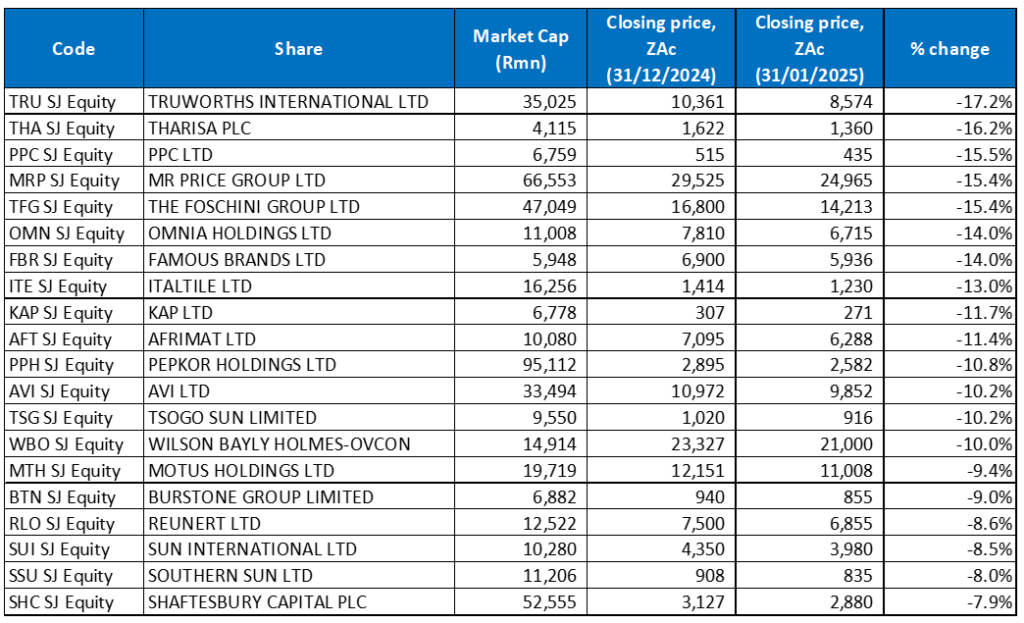

Figure 2: January 2025’s 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

After a strong 2024, SA Inc., or domestically focused shares, struggled in January. The clothing retailers were among the hardest hit counters, with Truworths, Mr Price and The Foschini Group all featuring prominently among the losers (these counters had gained 39.4%, 88.3% and 51.4%, respectively, last year).

Truworths International was January’s worst-performing share, with a MoM decline of 17.2%. In a disappointing business update and voluntary trading statement for the 26 weeks ended 29 December 2024, Truworths said that Group retail sales advanced by just 2.4% to R12.5bn, while online sales continued to show good growth, increasing 38% and contributing 5.8% to Truworths Africa’s retail sales (this segment was a drag on performance with an overall decline of 1.1% YoY). Its Office UK business posted growth of 11.3% in pound terms and 9.9% in rand for the period. Truworths said it now expects headline earnings per share (HEPS) to be 4%-8% lower YoY (at ZAc472-ZAc492).

In second place, the mining and metals Group, Tharisa Plc, released a poor 1Q25 production update, which showed lower production for its first quarter as operations were negatively impacted by drilling equipment availability. Tharisa said that its PGM production declined to 29,900oz from 35,700oz in 1Q24, while its chrome production fell to 374,400 tonnes vs 462,800 tonnes recorded in 1Q24. For FY25, it expects production to be between 140,000oz-160,000oz of PGMs and 1.65mn tonnes to 1.8mn tonnes of chrome concentrates.

Last month, PPC (-15.5% MoM) announced that it had signed a strategic cooperation agreement with Sinoma for the construction of a new R3.0bn state-of-the-art integrated cement plant, which will provide an “enhanced value proposition” to existing and new customers across the Western, Eastern and Northern Cape regions. In effect, PPC is adding capacity to an already overcrowded market that is also facing the threat of cheap imports.

Mr Price, The Foschini Group (both down 15.4% MoM), and diversified chemicals Group Omnia Holdings (-14.0%) followed PPC. Mr Price sold off despite reporting double-digit sales growth in a trading update it released in January. The clothing retailer said sales reached double-digit growth in the 13 weeks to 31 December 2024 and that it had now gained market share for six consecutive months, with stronger sales in December (which is traditionally a strong month for retailers due to the festive season holidays). Group retail sales rose 12.8% in December, while Mr Price Apparel and all its acquired businesses recorded double-digit growth for the month.

Meanwhile, in its 3Q25 trading update, The Foschini Group said that its Group sales rose by 8.4% YoY while online sales surged by 47.2% YoY, driven by its Bash e-commerce platform. TFG Africa sales advanced by 5.3% YoY because of improved trading over Black Friday and the 2024 Christmas period. Moreover, TFG London sales increased 46.5% YoY following its acquisition of White Stuff, effective 25 October 2024.

After recording double-digit gains in 2024, Famous Brands, Italtile, and Kap Ltd were down 14.0%, 13.0% and 11.7%, respectively, in January.

Mid-tier mining and materials company Afrimat Ltd (-11.4% MoM) finally concluded its integration of Lafarge in January (the much-delayed Competition Commission approval of Afrimat’s acquisition of Lafarge resulted in the latter being in worse shape by the time Afrimat finally got its hands on it). Over the past year, Afrimat has shown resilience despite feeling the effects of a declining iron ore price, a stronger rand, continued limitations on the export rail line (Transnet), large industrial customers reducing offtake because of economic and unforeseeable circumstances, and losses in its cement business. The company’s share price has also been under pressure following ArcelorMittal SA’s (AMSA) announcement last month that it will shut its loss-making long steel operations in Newcastle and Vereeniging. The closures will result in an estimated loss of 3,500 direct and contractor jobs in provinces across Gauteng, Mpumalanga and KwaZulu-Natal and iron ore suppliers such as Afrimat.