Curro reported disappointing FY19 results, which showed that recurring headline earnings per share (EPS) were down 15% YoY to ZAc51. The key stats we were looking for were student and turnover growth numbers for 2019 and 2020 – in 2019, student numbers grew 12% YoY to 57,597, boosting turnover by 18% YoY. However, Curro said that despite the number of learners increasing 12% YoY to 57,597 in 2019, an increase in bad debts and “economic pressure” in certain schools had eaten into its profits.

The 15% YoY decline in recurring HEPS was, on the face of it, disappointing especially considering the kind of J-curve model that we all anticipated this company was on. However, our conclusion from the results presentation is that the business model, while by no means immune to the economic challenges South Africa (SA) is facing, is holding up well. Although we think that FY20 may also not be a great year from an earnings growth perspective as capex (guided to be R1bn) looks like it is still running ahead of cash generation after interest costs (c. R600mn-R650mn), gearing is rising. In FY21, gearing should start to roll over and, from that point, earnings growth should be extremely strong. However, we note that it’s hard to know how far down the Curro share price goes on the back of this result. Nevertheless, in our view the company’s business model is working fine and it remains a share to put in the bottom drawer and “hold fast”. What is likely to hang over the share in the short term is that investors are going to want to see evidence that gearing has indeed rolled over, rather than relying on management promises about the future – while debt continues to rise, in these uncertain times, expect this risk to be an overhang.

The numbers:

- Revenue growth was 18% YoY.

- The growth in learners stood at 12% YoY and Curro managed to push through an average fee increase of 8%. We note that the reason this doesn’t neatly align with revenue growth is that the student growth is skewed to the lower-fee models.

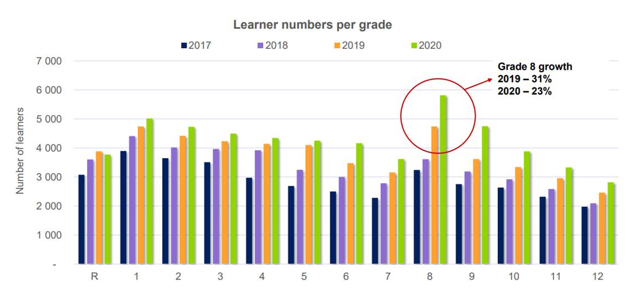

- Regarding Figure 1 below, we highlight that the big intake years are grade 1 and grade 8. 40% of Curro schools still do not go all the way to grade 12, as Curro is adding this capacity to new schools as the first intake moves up through the school. One of the areas where Curro is seeing some economic impact is that the demand in Grade 1 is proving to be slightly soft – parents are opting to send their kids to government schools for junior school, but the demand for English-medium private senior schools is very strong.

Figure 1: Learners per grade

Source: Curro

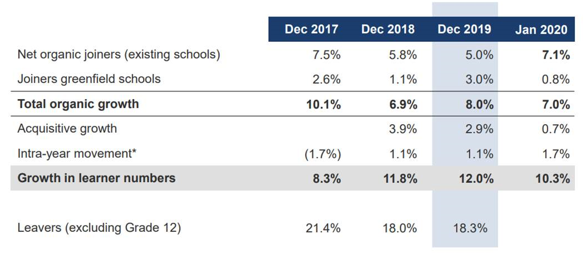

- Curro is continuing to see healthy demand, with growth in 2020 looking solid. As noted above though, this growth is coming predominantly at the lower-fee end (Curro Academy – fees R1,900-R2,900/month) vs higher fee Curro and Curro Select fees of R4,600/month.

- We also highlight the fact that this growth is achieved net of high turnover rates – in 2019, 18.3% of children left, excluding those that leave naturally at the end of Grade 12. Although this is a consequence of financial difficulties and people relocating to areas where there is no Curro school or emigrating, there are other behavioral quirks that Curro is seeing: (1) because it’s not compulsory to send your child to pre-school, Curro sees a fairly high incidence of people pulling their children out for the last couple of months of the year; and (2) particularly Afrikaans families are pulling their children out after Grade R and sending them to Afrikaans-medium primary schools and then sending them to English-medium Curro senior schools

Figure 2: Learner numbers

Source: Curro

- EBITDA grew by 13% YoY: Curro said that it would typically target 1%-2% margin expansion, so the fact that we saw margin contraction was disappointing. The message appears to be that the widening margin trend should resume in the year ahead. However, points made about these results were as follows:

- Where previously the numbers of students allowed for Curro to have teachers covering multiple grades, a very strong grade-8 intake has required it to split responsibilities and make a step change in its teacher compliment.

- Higher levels of bad debt. In 2019, Curro tried out a new initiative where it entered into financial arrangements with some of the parents that were in arrears, reasoning that it was better to keep students in school and try to recover fees. It allowed 1,800 children back whose parents were in arrears. By December 2019, 500 students’ fees had not been paid and these students were expelled. The resultant higher bad debts (it provides 15% on arrears where the child is still at the school vs 90% where the child has left the school) pushed the charge from 0.8% of revenue in FY18 to 1.7% in FY19. Curro has done the same with 1,300 children this year, which should imply there isn’t any deterioration in charge-off percentage assuming this behaviour remains the same.

- Greater fee discounting is required as a result of SA’s economic challenges. Curro said that nine higher-fee campuses (out of 70 in total) were particularly hard hit with pressure on fees. However, Curro has taken remedial action to enhance its offering and seek efficiencies. Curro believes that it’s on top of this now.

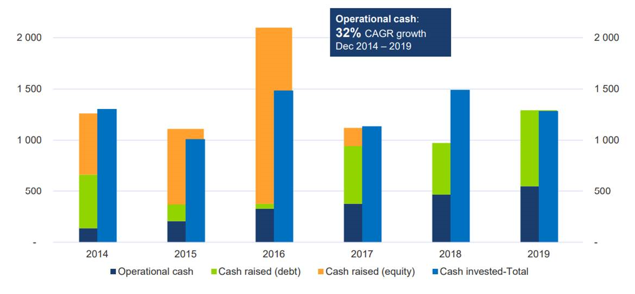

- In terms of capex, Curro spent R1.3bn in 2019 and is guiding towards spending a further R1bn in 2020. This R1bn budget includes R250mn deferred from 2019. Curro says that the reason for deferring capex was related to some uncertainty around the level of demand it was anticipating rather than covenant issues. Figure 3 below shows how Curro has been funding its capex to date. Although Curro does have some land on which it could start new greenfield projects, its plan (after years of rapid growth) is to concentrate only on brownfield expansion. If it wasn’t for the deferral of capex from FY19, we would be looking at spend coming in at R750mn in FY20 and R700mn or below in FY21.

Figure 3: Capital investment

Source: Curro

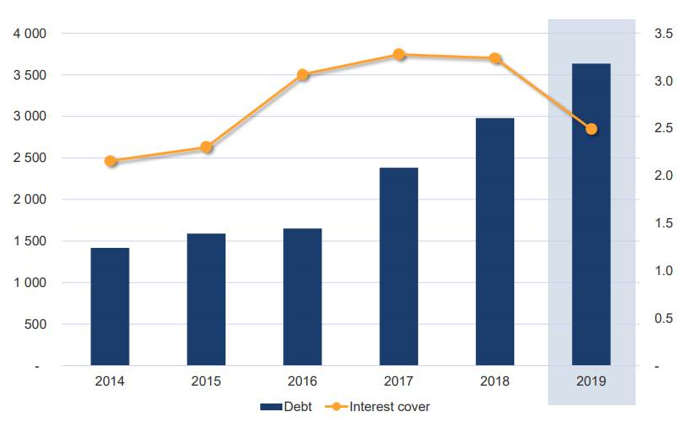

- Curro has largely been reliant on debt to finance capex over the last few years. Guidance is that this will roll over and start to decline in the next 12-24 months. It has a debt covenant (interest cover) of 1.75x.

Figure 4: Curro debt and interest cover

Source: Curro

- Management was very firm that there are no plans to raise further equity.

- Curro is paying a dividend (20% of HEPS) of ZAc10.2/share – down 15% YoY (from ZAc12.0 in FY18).