Independent education provider, Curro Holdings reported 1H19 results on 14 August, which showed a 19% YoY increase in revenue to R1.48bn. However, recurring headline EPS disappointed, rising by only 7% YoY from ZAc34.8 to ZAc37.1 (here we note that Curro’s theoretical earnings without the drag of investment in new campuses would have seen HEPS rising by 20% YoY and that was what the market had expected). Recurring headline earnings for the period rose 7% YoY from R143mn to R153mn. Earnings before interest, taxation, depreciation and amortisation (EBITDA) rose 21% YoY to R415mn vs a restated R342mn in 1H18. Curro restated its 1H18 results to align these with the new accounting standards. No interim dividend was paid.

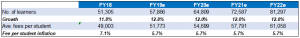

The number of schools continued to grow into grade 12, with strong momentum in grade 8 students (seemingly a key entry point) joining Curro schools – the 2019 grade 8 student intake alone jumped 31% YoY. In terms of learner numbers, a breakdown shows organic growth (net joiners at existing schools) of 5.0% YoY, while total student growth stood at 8.0% YoY.

Bad debts as a percentage of revenue were flat YoY at 0.8%. Net finance costs rocketed 49% YoY to R109mn, due to long-term, interest-bearing debt increasing from R2.3bn to R3.2bn and the impact of IFRS 16, while the interest cover ratio rose from 45% to 58%. Curro also refinanced R850mn of debt due for repayment in 2020, with a five-year bullet repayment loan which is now only due in 2024. Curro is also pushing ahead with its expansion plans by investing R223mn in the establishment of four new campuses (five schools). The 2019 estimated cost of expansion and replacement of assets is R1bn, but CEO Andries Greyling described it as a “necessary undertaking for us as a business and for our learners who will be the beneficiaries of our enhanced facilities …”

According to Curro, these results were buoyed by rising learner numbers – up 13% YoY, from 50,691 to 57,173, as well as new businesses (17 campuses were opened over the past 18 months) and 40% of campuses are growing into high schools. Curro is now focusing on increasing its capacity and new greenfields projects have been reduced. Its aim is also to improve operational efficiencies in the form of student retention and capacity utilisation. Curro noted that its balance sheet was well-geared to fund capital expenditure in 2019 and beyond.

Conclusion:

The Curro share price came under significant pressure after it released a trading statement on 6 August (the share price was down c. 13% on the day) warning of muted first-half earnings growth of c. 10% YoY – the market was expecting 20% YoY growth. However, after the results were reported, the share price recovered – up 11.8% from the results release (14 August) to Thursday’s (5 September’s) close. We note that the lower-than-expected earnings growth was a function of operating expenditure that grew in tandem with revenue (far less operating leverage came through), and a material step-up in net finance charges. This was not a top-line disappointment! The accelerated opex growth, and higher finance charges, were due to its investment in new schools.

The top-line performance of the business was incredibly strong, with net student growth running at 12.8% YoY and weighted school fee inflation of 5.7% YoY. This flies in the face of the negative narrative that has developed around Curro, and the assertion that affordability and emigration are derailing the Group’s growth prospects

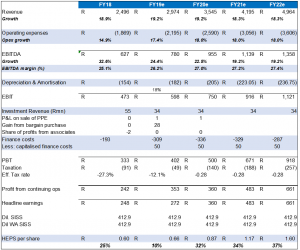

The business is now at an interesting stage, where we expect operating leverage to drive meaningful earnings growth over the next 3 years. Should the business continue to grow the student count at 12% p.a., with a similar rate of school fee inflation to this year, the resultant 19% revenue growth p.a. should drive earnings growth at > 30% p.a.

By 2022, Curro will have around 81,000 students (more or less the current built capacity) and should earn ZAc160/share – rendering the current share price quite reasonable given the growth prospects going forward.

Figure 1: Curro student growth and fee inflation :

Source: Company data, Anchor

Following our discussions with management, we would expect the income statement to develop as follows:

Figure 2: Curro income statement:

Source: Company data, Anchor