It is a daunting task to write about the COVID-19 pandemic. According to the Financial Times, as at 4 June 2020 some 23,000 academic papers have been produced on the subject, of which 18,300 were published by academic journals and 4,700 were on preprint servers (these are online archives with scholarly papers that have not been peer reviewed). And that is just in the academic community! If we look at the wider sample of financial journalism, we are inundated by COVID-19 information. It is thus difficult to add value on this topic.

In this article, we take a slightly different approach by looking at how we, the consumer, have reacted to COVID-19 and the subsequent economic lockdowns that various governments have enforced thus far. We will draw from our interactions with various industry experts and company management teams in an attempt to identify interesting behavioural changes with a specific focus on changes in shopping patterns and general consumer behaviour.

According to behavioural science research (Richard Shotton’s The Choice Factory: 25 behavioural biases that influence what we buy), major life events disrupt historical behaviour, with an individual up to 75% more likely to try something new (such as a new brand) following such an event and 21% of consumers expected to stick to that new brand or behaviour. What is significant about this specific event is that it is worldwide – the global population as a whole has in some way been impacted by the pandemic. New behaviours will emerge, which will have significant implications for your investment portfolio.

The lockdowns

The COVID-19 pandemic caused governments across the world to take the extraordinary step of locking down their economies and restricting the movements of their citizens. The durations of the various lockdown measures differed by country, but the impact was very similar across the board – people were stranded in their homes for an extended period of time, only going out for emergencies. Governments have slowly started lifting restrictions, but people are still encouraged or forced to enact social distancing and to focus on improving their general hygiene. Needless to say, this pandemic has forced people to change their habits, to experience new technologies and, potentially, to develop new habits.

How did consumers buy?

A key trend that emerged during the various lockdown stages locally is the adoption of online shopping in SA. Before the lockdowns were enforced, SA consumers seemed to have reservations about online shopping, with many questioning the reliability of delivery or ease of returning items. However, trapped in their homes and/or reluctant to leave their homes due to safety concerns, local consumers were forced to try out this “new” technology. While increased online sales were a global phenomenon, with e-tailing giants such as Amazon reporting very robust sales numbers, compared with the rest of the world, SA has in the past been slow to take-up online shopping. But SA now also recorded a surge in online retailing, with Mr Price reporting a 90.1% increase in online sales since the initial hard lockdown started on 27 March. We also found it interesting that, according to Mr Price, the basket size of the average Mr Price online shopper is 50% larger than the basket size of the average shopper in a physical Mr Price store.

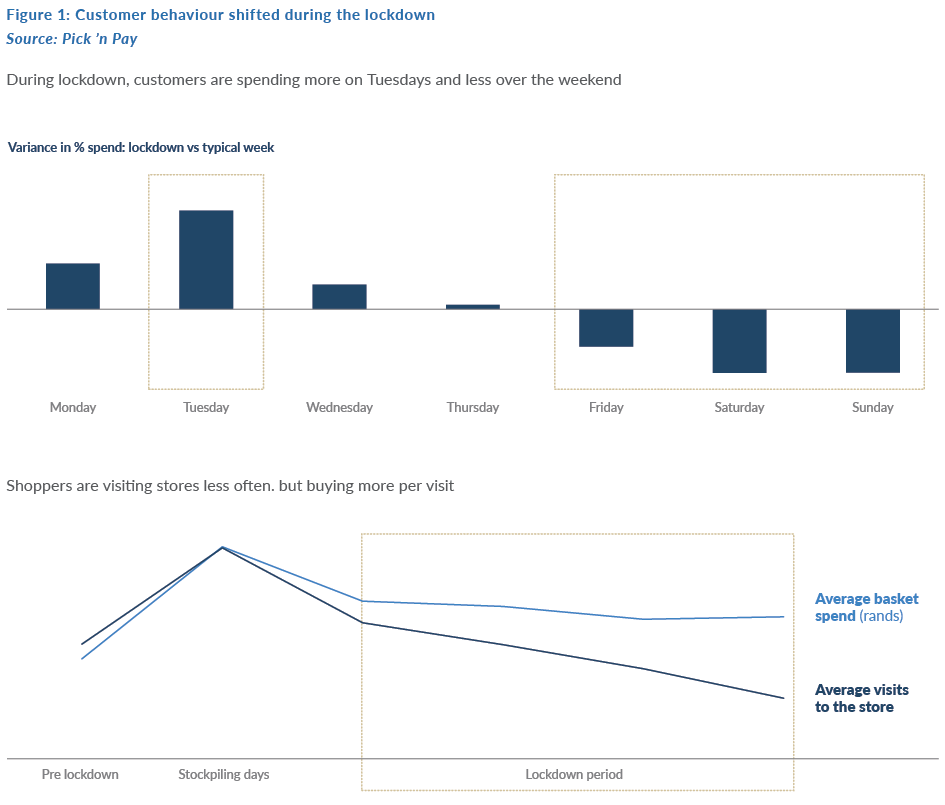

Which brings us to another trend; over the past few years many local retailers reported consumers increasing the frequency of their store visits but buying smaller basket sizes. This trend reversed significantly during the lockdown. With people feeling uncomfortable going to shopping malls and wearing masks this is probably a natural reaction. Spar, for example, reported that the basket size of its customers doubled across all formats, while Pick ’n Pay highlighted that its average customer shopping bill was 30% higher than before the lockdown. It will be very interesting to see whether this will reverse again once the pandemic subsides.

According to Pick ’n Pay, its data shows that during the lockdown South Africans preferred going to a store on a Tuesday. This is probably another proof of Dr John Forbes Nash Jr’s game theory, so well-illustrated in the movie A Beautiful Mind. With everybody second guessing one another on when nobody will likely go to the grocery store, everyone ended up going at the same inconvenient time. We, humans, are so predictable.

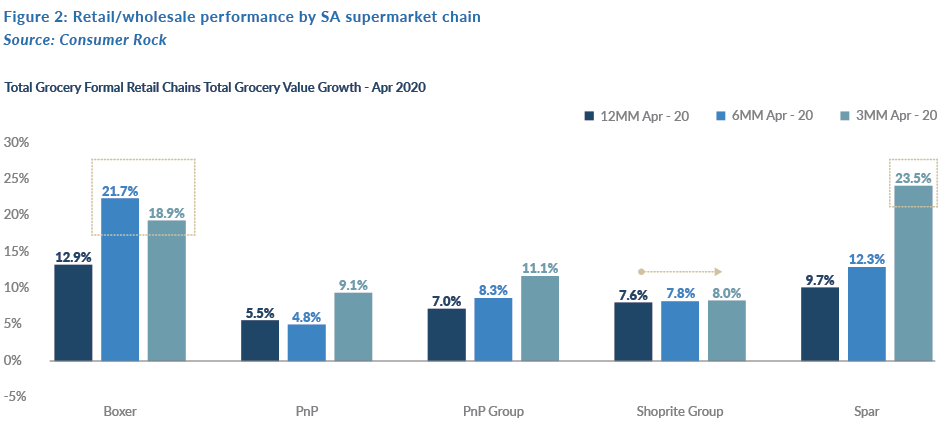

During the lockdowns, convenience is also very important to consumers. The prospect of traversing potentially crowded areas, such as large shopping centres, is a real deterrent to many. According to consultancy firm, Consumer Rock and market research company, Ask’d, Spar and Boxer stores outperformed significantly during April’s hard lockdown. They attribute this to several factors including good value from Boxer and quality fresh products from Spar. However, the one factor both have in common is that their stores are conveniently located near taxi ranks or in the suburbs. This trend was further reinforced by Mr Price, which noted that its micro-, small- and medium-stores as well as its standalone Kids stores, experienced significant growth, while its super regional centre stores lagged.

What did consumers buy?

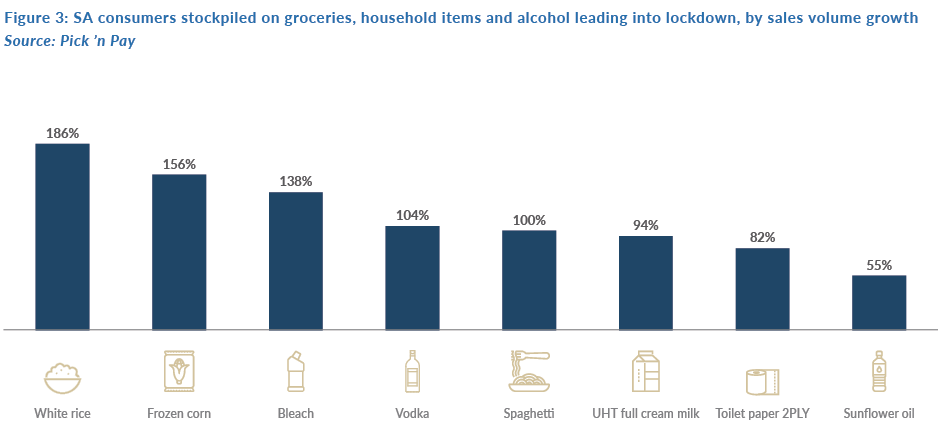

We found it very interesting to hear from companies around the world how people adjusted to homebound living. Trends differed slightly by country, as the severity and duration of the lockdowns varied but, in general, consumers worldwide reacted in a very similar manner. Fearmongering and uncertainty around when stores would reopen caused a mad rush to stockpile as SA moved closer to the initiation of the lockdowns. Essentials, toilet paper and alcohol were high on the priority lists as consumers braced for uncertain times ahead.

However, after that initial surge, consumers shifted their priorities to comfort, entertainment and staying busy. In SA, entertaining and educating children in the home was the top priority. Pick ’n Pay reported that its stores experienced a surge in demand for paint, brushes and playdough. The onerous lockdown regulations locally meant that it was difficult to assess trends here during that period, but in other countries some very interesting trends emerged.

The social nature of humans was difficult to suppress. With pubs and bars closed, cocktail hour had to take place at home. British supermarket group, Waitrose & Partners reported that in the UK, a quarter of those who consume alcohol drank more during the lockdown, and one-fifth took part in virtual drinking with friends – apparently, it was all about the “quarantini”, which was trending on Instagram. As people seek to create their own bar experience, cocktail glasses, shakers, and other drink accessories sold fast. Amara, an online retailer in the UK which specialises in luxury interior goods, reported that its barware sales from January to May increased by 3,430% YoY.

Home decor, storage and DIY also featured prominently as people were confined to their homes. Indoor plants had already experienced an increase in demand due to another Instagram trend, but it really kicked into high gear during the lockdown. Amara reported that sales of its indoor planters jumped 79% YoY from January to May. Candles and home fragrances were also very popular as people tried to relax and create a sanctuary at home. Amara recorded a 127% YoY increase in scented candles, while John Lewis posted a 43% YoY increase in the sale of candleholders.

Spending a significant amount of time at home, with some extra time to boot, saw people attempt to restore order to their lives with many investing in home storage. John Lewis recorded an increase of 74% YoY in home storage sales. Home improvement was also a key winner as people fixated on every nook and cranny of their homes. Recently, US paint supplier, Sherwin Williams said that its consumer-brands division will see earnings well above its original guidance and US home improvement and building product supplier, Masco, halved its 2Q20 YoY sales decline forecasts due to better-than-expected revenue trends.

Entertainment was key to staying sane during lockdown. Streaming giant, Netflix announced that it had to reduce the quality of its streaming service in Europe and Africa to be able to service the high demand for its product as new subscribers surged. On the home front, MultiChoice recorded subscriber growth thanks to the lockdown. Gaming also benefited from the lockdown with Google reporting growth of twenty times in search interest for “online games to play with friends” between February and March 2020.

Since the lifting of the hard lockdown in SA, we have seen some interesting habits develop which may remain a feature for some time. A focus on health and wellness as well as home cooking has become prominent. Food retailers have reported a surge in demand for healthy foods such as avocado, citrus, and fresh produce in general. Spar’s Natural product range recorded a c. 55% growth rate over the past few months. General hygiene and preventative products including wipes, hand soaps, sanitisers and vitamins remain in high demand, while many consumers also turned to traditional remedies to safeguard against diseases including ginger, garlic, and lemons.

At the other end of the spectrum we also saw some interesting shifts. The wearing of facemasks is having a negative impact on the cosmetics market, with sales of make-up under pressure. The Foschini Group reported, as can be expected, that its workwear and occasion wear categories are struggling in all the jurisdictions in which it operates. Big-ticket, highly discretionary purchases have also been severely impacted. Vehicle sales numbers across the globe continue to show very poor demand.

How are consumers feeling about spending?

The global lockdown measures have had serious financial implications for businesses and consumers. Although governments and central banks have tried to minimise the impact as much as possible, with fiscal stimulus and extremely low interest rates, consumers and businesses are still very weary of an uncertain future. Many companies have announced drastic cuts in expenditure with salaries being cut, people being retrenched, and new projects being put on hold or cancelled.

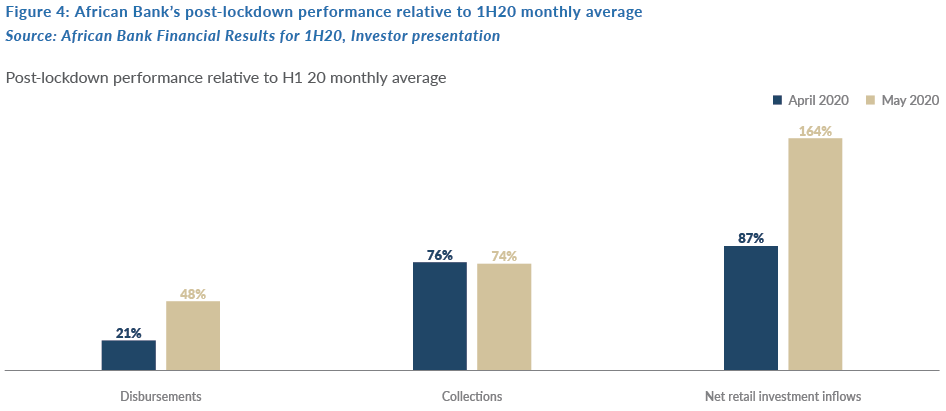

In this environment, consumers are feeling extremely vulnerable. Many are reluctant to take on unnecessary new debt and they are saving as much as they can while they can. In African Bank’s results presentation, the firm highlighted this trend indicating that the bank’s loan disbursements have been less than 50% relative

to the average before the lockdown, while retail investment inflows were much higher than before. Mr Price reported that consumers preferred to pay for new purchases with cash rather than credit, with cash sales growing by 16.7% and credit sales declining by 9.4% since 1 May. Of course, the lower use of credit may also be due to credit providers pulling back supply in the face of growing uncertainty. It will be interesting to see how this trend develops.

The financial constraints which the average SA consumer is experiencing is also palpable in the outperformance of value offerings. Private label offerings from all local food retailers have outperformed their respective categories. This trend is now so entrenched that even Tiger Brands, which has been unwilling to manufacture for the private label market, publicly announced that it will be looking for private label manufacturing opportunities. In the more discretionary items, value has outperformed, with sales trends post-lockdown for Pep Stores, Ackermans and Mr Price showing a greater improvement than their more fashionable and upmarket peers.

Will the world be materially different post this pandemic?

It will be interesting to see how many of the trends highlighted above are sustained as the world recovers from this pandemic. Our view is that the new “lockdown-enforced” trends, such as partying at home and not spending on cosmetics, will be short lived. Humans are inherently social animals and, once we believe it is safe to go out and socialise, we will revert to our old habits. This view was reinforced by the BidCorp management team, which said that globally its Group sales performance exceeded expectations after governments started lifting harsh lockdown measures around the world.

Nevertheless, some trends may be here to stay. This is especially true for those trends that were already being witnessed before the lockdowns and have now just accelerated as consumers had to adapt. Working from home, or at least more-flexible working hours, may remain. Many corporates will be far more willing to consider these new working arrangements. The clearest example of this was Twitter’s announcement that it will no longer require any of its employees to work from an office. People are going to spend more time in their homes, which may continue to assist DIY and home décor sales trends. Consumer willingness to try new brands will also probably remain intact. This will put severe pressure on price premiums for branded goods and the fast-moving consumer goods (FMCG) market will have to adapt rapidly to this. And then the acceptance of using the internet for meetings, shopping and a variety of other needs will accelerate as more and more people are forced to embrace technology. This may fundamentally change how companies think about their workforce, where they work, how they work and how many employees are needed.

When working to form the United Nations after World War 2, Winston Churchill famously said “Never let a good crisis go to waste”. Currently, we are facing a serious crisis in COVID-19 but from every crisis new opportunities emerge. It is our goal to identify these opportunities, be open to embrace them and then to take full advantage of them on behalf of investors.