The Competition Commission’s (CompCom’s) final report on data prices entitled, Data Services Market Inquiry was released on Monday (2 December). Among the conclusions reached by CompCom was that mobile data is too expensive in South Africa (SA) and that pricing practices discriminated against the poor (the cost per megabyte [MB] for smaller bundles is higher than that for larger bundles). Remedies it is proposing include data price reductions of 30%-50% within the next two months, all sub-500MB bundles to have the same cost per MB, and that mobile operators should provide a daily free “lifeline package” of data to all prepaid users. Failure to comply would result in mobile operators facing prosecution. In our view, the findings have far-reaching implications, not only for the mobile telcos sector itself, but also for what the ruling says about the ideological direction of government regulators towards ever greater meddling in private sector commercial dynamics generally.

Since the publication several years ago of the Information and Communication Technologies (ICT) White Paper, which laid out the proposed new policy framework for the sector, we are seeing a clear intent from SA’s telcos regulators to be far more interventionist regarding price regulation. Meanwhile, government’s determination to press ahead with the Wholesale Open Access Network (WOAN), despite no precedent for such a project being successfully implemented anywhere else in the world, threatens to unnecessarily make SA the global guinea pig to test out this idea. Sadly, the history of telcos as state-owned monopolies means that governments tend to see the services they provide as a social right. This history and perception may explain the tendency to make demands that trample on normal commercial principles in a way that would appear totally unacceptable elsewhere.

Once governments cross the line and start dictating pricing for services, resulting in commercial returns on capital being undermined, the incentive to invest will disappear and the result will be a rapid degradation of services – provision of electricity in Nigeria is an excellent example of how destroying commercial incentives through price regulation ends. While it may not be perfect, the development of SA’s mobile telecommunications sector is one of the country’s success stories of the past 20-years – “don’t try to fix what isn’t broken” comes to mind

Below, we highlight the implications of the CompCom’s proposal:

- Perhaps the first point to make is that mobile data is (in our opinion at least!) not as much of a commodity as people think, and thus how well prices travel across borders is highly questionable. Data may be cheaper in some other markets, but what is the quality of that data service (is it 2G, 3G or 4G?) and how available is it once you move outside of the main urban areas? Is it relevant to compare SA’s data prices to a small developed market such as the UK, where operators have to provide a network that covers an area equivalent in size to KZN (or somewhere around that size!) and subscribers fairly quickly migrate to the latest technology from a mobile device perspective, which makes much more efficient use of spectrum, whereas in SA, mobile operators are still having to support inefficient legacy 2G technology.

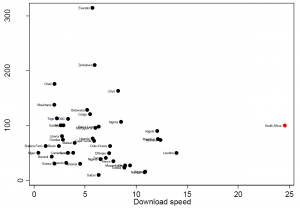

- Interestingly, the Independent Communications Authority of South Africa (ICASA) published its Discussion Document on the Market Inquiry into Mobile Broadband Services in South Africa last Friday (29 November). We have reproduced one of the charts from ICASA’s report in Figure 1 below, as well as a quote from the report. Once one moves beyond the simplistic one-dimensional CompCom price analysis, it is not surprising that ICASA comes to a very different conclusion.

Figure 1: Africa: Price for a 1GB bundle ($), 1Q19 vs download speed (2017)

Source: Discussion Document on The Market Inquiry Into Mobile Broadband Services

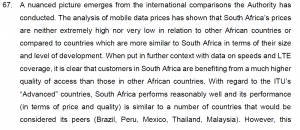

Figure 2: Excerpt from ICASA discussion document on mobile broadband services inquiry

Source: Discussion Document on The Market Inquiry Into Mobile Broadband Services

- Then comes the matter of spectrum. CompCom appears to play down the relevance of spectrum in pricing of data. Aside from advancements in technology which find clever ways of squeezing more juice out of the whole system, the two levers that can be pulled to provide more capacity are: (1) allocating the mobile operators more spectrum; or (2) the operators densifying their networks and making the cells smaller. As you are probably aware from a number of recent articles that have been written on this subject, SA is one of the few countries in the world that has not issued any new spectrum for 4G. We won’t go into the many failings of the regulatory process that lie behind this sad state of affairs, but the result is that mobile operators have had to compensate for lack of spectrum by spending more on network to meet demand. Thus, regulatory failures have materially contributed to the fact that the cost of production of 1MB of data is higher than it should be.

- A further point to consider here is what the impact will be on the market if Vodacom and MTN were to comply with the CompCom’s demand that they lower pre-paid data pricing by 30%-50%. Rather than improve the state of competition in the market, we think this would be disastrous for the smaller operators. Cell C, which is already teetering on the brink, would see this as the final nail in the coffin – the last thing the smaller players can afford would be a cut in price of this magnitude. So much for improving competition!

- It seems that the CompCom is now looking for the mobile operators to respond to its findings and engage with it. There’s obviously a problem that its two-month deadline falls squarely over the Christmas holiday period. While we cannot say for certain whether this is deliberate, it’s certainly not helpful! Should the CompCom decide to “prosecute”, what this means practically is that it believes there is a prima facie case that is worth pursuing. This would then be referred to the Competition Tribunal for further investigation. It is likely that this will drag on for years and it is very probable that the telcos will strongly contest it, particularly given that there are already conflicting views among regulators on whether SA’s data pricing is out of line. In fact, MTN has already said as much in its initial response to CompCom’s report – “we respectfully disagree with the analysis and recommendations contained in the summary report and, as we study the full report, will continue to engage constructively and vigorously defend against overboard and intrusive recommendations”. By the time the issue is resolved, one would think that the new spectrum will have been released and pricing will be looking significantly different to when the CompCom did its analysis. Importantly, we are not seeing any suggestion that the telcos have colluded or broken the law, so we are not talking about fines being handed down. Rather, it concerns market remedies for what the CompCom sees as a market failure.

- Another factor to consider is the practicality of doing what the CompCom is demanding. Given that this seems to be directed at the smaller data bundles in the prepaid space, one needs to appreciate that this is a segment of the market that has a relatively fixed amount of income to spend on data/communications every month (you could say that price elasticity is close to 100% – you halve the price and data consumed nearly doubles). The question here is whether the operators have the capacity on their networks to cope with this demand for data? We saw this graphically demonstrated in Nigeria around 2012 where a price war, combined with lack of investment, led to MTN’s network running out of capacity. In a sense then, if the mobile operators were to make these cuts, the impact on their bottom line may be more dependent on whether they have network capacity to cope with the resultant surge in data consumption rather than on demand itself.

- How material is SA pre-paid data for MTN and Vodacom? We estimate that it is about 4.5% and 11% of MTN and Vodacom’s service revenue, respectively. It is important to keep in mind that if the operators were to make the cuts demanded of them (and that’s a big “if”!), this revenue would not disappear for the reason given above. It is very likely that there would be a short-term dip in revenue as it would take consumer behaviour a bit of time to adjust to the drop in the price, but ultimately consumers would likely return to similar spend and consume more data.

- A further factor to consider is that the CompCom’s demands here will be very damaging to government’s plans to auction new spectrum. If we are entering a future in which SA is going to begin engaging in retail price regulation of telecommunication services, we expect that this will significantly reduce the amount that telcos will be willing to spend on new spectrum.

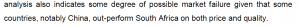

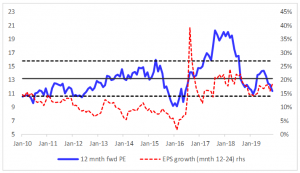

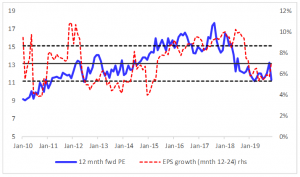

In conclusion, we see this as a very ill-considered move by the CompCom and we expect that there will be significant pushback with the chances of these demands being enacted as being quite low. However, it is yet another sentiment-negative blow for the sector and reinforces our view that this is a sector that is no more than a trading opportunity from time to time due to heavy-handed regulatory treatment across many markets in which they operate, which undermines our confidence in their ability to deliver sustainable growth. That said, the fall in share prices has pushed them to a level that presents just such an opportunity. Having been close to ZAc13500/share just a few weeks ago, Vodacom (11.4x 12-month forward PE; 7.3% prospective dividend yield) is now back at the bottom of its trading range of the past 18 months and has a strong dividend underpin at these levels. MTN (11.3x 12-month forward PE; 6.4% prospective dividend yield), at below ZAc9,000/share is also looking very interesting, with several potential positive catalysts over the next year or so (specifically around the disposal of non-core assets and cutting its gearing). We would, however, avoid Telkom, even after its share price drop. As pointed out above, its competitiveness in mobile would be seriously undermined if these price cuts were made by MTN/Vodacom.

MTN 12-month forward PE vs. consensus earnings growth

Source: Bloomberg

Vodacom 12-month forward PE vs. consensus earnings growth

Source: Bloomberg