Clicks reported good FY20 results on 22 October, despite incurring R44mn in COVID-related costs for personal protective equipment (PPEs), store hygiene, deep cleaning costs, etc. In addition, what Clicks may have lost in terms of the usual winter surge in demand for curative (pharmacy) products, due to a nearly non-existent flu season, were more than made up for by robust sales in preventative products (vitamins, supplements etc.). Group turnover rose 9.6% YoY to R34.4bn, with retail, health, and beauty sales up 8.4% YoY, while its medicine distribution unit, United Pharmaceutical Distributors’ (UPD’s) turnover jumped 11.2% YoY. The company’s online sales rocketed by 361% in 2H20, off a relatively low base with management saying that the business was now seeing the benefits of its e-commerce investments over the past four years.

During the period under review, Clicks opened 39 stores. It now has a retail footprint of 743 stores across South Africa (SA) as well as the largest retail pharmacy chain in the country with over 580 in-store pharmacies. Clicks’ UPD unit is also SA’s leading full-range national pharmaceutical wholesaler. The Group operating margin improved from 8.1% to 8%. Diluted HEPS grew by 13.7%. HEPS has recorded a CAGR of 12.3% since 2010, with maximum growth of 18.5% (in 2011) and minimum growth of 8.4% (in 2013). This highlights the remarkably consistent performance that Clicks has generated during a very tumultuous economic decade in SA. Clicks now has a net cash balance of R2.2bn, with return on equity (ROE) of 37.8% vs 37.0% in FY19. Clicks declared a solid full year dividend of ZAc450. This dividend is up 1% from the FY19 full-year dividend of R4.45. Clicks also decided to reduce its payout ratio to 60%, which is slightly disappointing considering the Group’s very resilient business model and strong balance sheet.

Positives

- Cost containment: The firm recorded strong operational gearing due to continued cost rationalisation.

- Acceleration in product approvals at the SA Health Products Regulatory Authority. YTD, 163 products have been approved vs 152 in FY19. Clicks’ Unicorn brand is expected to drive private label further in its dispensaries and Clicks is targeting a 15% SA private label market share in its dispensaries.

- Clicks has a great contract with government, distributing c. 1mn medicine parcels on behalf of the Department of Health. Around 50% of these recipients are also Clicks ClubCard members and there is an average spend of R60 in front shop by these medicine recipients.

- Clicks’ UPD unit is also exceeding expectations, gaining further market share during the various stages of lockdown in its delivery to hospitals. In addition, it is also still benefitting from Clicks’ store expansion.

Negatives

- There was a slowdown in sales in the last three weeks of FY20 and management are blaming 2019’s severe flu season vs almost no flu season in 2020, likely due to the wearing of masks and other safety protocols by individuals to protect against COVID-19. However, we note that it could also indicate that much of the growth during lockdown was due to stockpiling.

- Investment in IT: SA retailers have a terrible track record in implementing new enterprise resource planning (ERP) systems. However, Clicks management believe that the business will achieve RoICs in excess of 20%, through a reduction in inventory.

- Clicks is also investing in delivery services, which we see as a defensive move rather than being offensive. It is lower margin, but most independent pharmacies already provide this service.

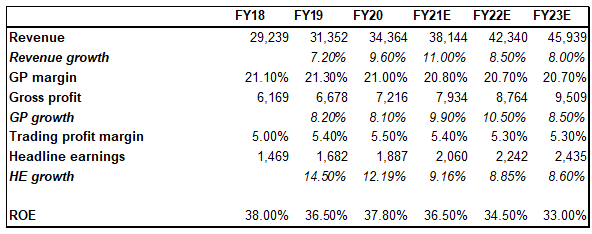

Figure 1: Clicks forecasts, Rmn unless otherwise indicated

Source: Anchor

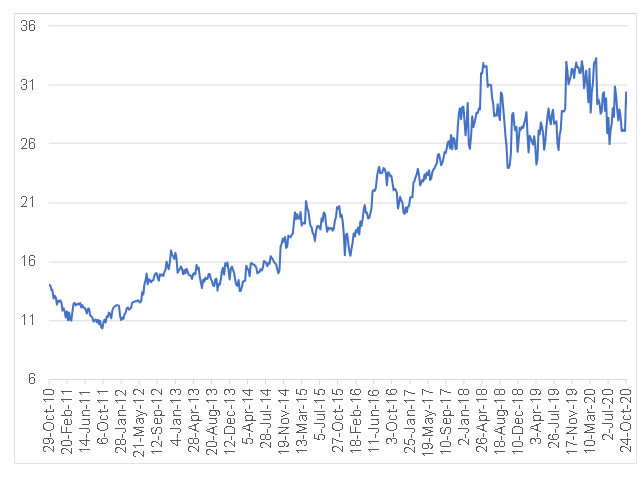

Figure 2: BEst P/E ratio (blended 24 months)

Source: Anchor, Bloomberg

Conclusion

Clicks reported better-than-expected results in a difficult operating environment and the company said that, while it expects consumer spending to remain constrained in the year ahead, it has adapted well to trading in an economic downturn. Clicks is a high-quality business with a resilient business model and extremely capable management. However, the current valuation is very demanding, with the share price trading at a 12-month forward PE ratio of 29.4x. We also believe that Clicks’ growth profile is going to slow as its store expansion starts to move into more rural or more saturated markets. This may cause trading densities to reduce. Clicks does still generate significant operating cash and may start to distribute this cash pile to investors in the future. However, in our view there are other investment opportunities that provide a better risk-reward profile on the SA market.