Historically a strong month for equities, November lived up to its reputation, recording a broad bull rally in global markets. China, however, was the glaring exception as its troubled real estate sector and ongoing concerns around its slowing economy weighed on investor sentiment. MoM, the MSCI World soared 9.4% (+18.6% YTD) as investors seemed to increasingly believe that the US Federal Reserve (Fed) would keep interest rates on hold or even start cutting rates next year following several positive inflation data prints. In addition, US ten-year Treasury yields drifted lower, dropping to 4.3% by month-end on the back of cooling inflation data after rising above 5% in October. At its 1 November meeting, the Fed kept rates unchanged, but Fed Chair Jerome Powell said it was watching the economic data closely and keeping its options open for further rate increases.

In US economic data, October headline inflation, as measured by the Consumer Price Index (CPI), rose 3.2% YoY, coming in below market expectations. October core CPI, excluding the erratic food and energy components, also edged lower to 4.0% YoY vs 4.1% YoY in September. MoM headline inflation was flat in October at 0.4%. October US retail sales fell (-0.1% MoM) for the first time in seven months, while September retail sales were revised higher to a 0.9% increase vs the previously reported 0.7% MoM rise. YoY, retail sales slowed to 2.5% in October vs September’s upwardly revised 4.1%. October core personal consumption expenditure (PCE), excluding food and energy, the Fed’s preferred inflation gauge, slowed to 3.5% YoY (in line with expectations) compared to 3.8% YoY in September, giving the Fed more incentive to keep rates at current levels. MoM, October core PCE rose 0.2% vs 0.3% in September.

After posting three consecutive months of losses, US markets reversed course in November, with Big Tech counters leading the charge. The Dow (+8.8% MoM/+8.5% YTD) rallied to a new high for the year on 30 November, while the tech-heavy Nasdaq Composite and the blue-chip S&P 500 indices jumped 10.7% (+35.9% YTD) and 8.9% MoM (+19.0% YTD), respectively.

In Europe, Germany’s DAX gained 9.5% MoM (+16.5% YTD), while France’s CAC Index closed November 6.2% higher (+12.9% YTD). In economic data, October euro area inflation was lower at 2.9% (the lowest in 15 months) vs 4.3% YoY in September, while core inflation (excluding food and fuel) eased to 4.2% vs 5.5% YoY in September. Germany’s November inflation fell to its lowest level since June 2021 as energy prices dropped, coming in at 2.3% YoY vs October’s 3.0% print. The core inflation rate declined to 3.8% YoY vs 4.3% in October. France’s October inflation was 3.8% YoY, compared to September’s 4.9% YoY. According to Eurostat, EU and euro area GDP data were relatively stable QoQ for 3Q23. A flash estimate released in mid-November showed that the euro area’s GDP shrank by 0.1% in 3Q23 – the first contraction since 2020. The figure followed 0.2% QoQ growth in 2Q23.

The UK’s blue-chip FTSE-100 advanced by 1.8% in November and is up 0.03% YTD. Cheaper gas and electricity prices saw October UK inflation fall to 4.6% vs September’s 6.7% YoY print – the lowest YoY increase in two years. Core inflation remained elevated, coming in at 5.7% vs September’s 6.1% print.

China’s equity markets were the outlier in November’s stock market rally as investor concerns around that country’s economic recovery continued to weigh on sentiment. In addition, Hong Kong-listed China property share prices dropped last month after reports that authorities had launched a criminal probe into one of China’s biggest privately owned financial conglomerates – debt-laden Zhongzhi Enterprise Group. MoM, Chinese equity markets disappointed, with Hong Kong’s Hang Seng Index down 0.4% in November (-13.8% YTD), while the Shanghai Composite Index was up only 0.4% MoM (-1.9% YTD). China’s official November Manufacturing Purchasing Managers Index (PMI) slipped further into contraction territory, coming in at 49.4 vs October’s 49.5 print. The PMI has contracted for five consecutive months (since April), it expanded in September and then contracted again in October. The official non-manufacturing PMI, measuring business sentiment in the services and construction sectors, stood at 50.2 in November vs 50.6 in October. The 50-point mark separates expansion from contraction.

Japan’s benchmark Nikkei soared 8.5% MoM (+28.3% YTD). October core CPI (excluding the volatile fresh food category but including energy costs) accelerated slightly to 2.9% YoY vs September’s 2.8% print.

Among commodities, Brent crude was down for a second consecutive month (-5.2% MoM) and is now 3.6% in the red YTD. Iron ore prices rose 3.7% MoM and are up 10.3% YTD. The spot gold price remained above the psychological US$2,000 level, ending the month 2.6% higher (+11.6% YTD). The platinum price retreated by 0.8% MoM, while palladium plummeted by 10.2% MoM and rhodium gained 2.3%. Natural gas prices fell 21.6% MoM (-37.4% YTD), while thermal coal dropped by 10.7% MoM (-49.5% YTD).

South Africa’s (SA’s) FTSE JSE All Share Index soared 8.4% in November (+3.4% YTD), while the FTSE JSE Capped SWIX rocketed 8.3% MoM (+4.9% YTD). Industrial counters were among the best performers, with the Indi-25 gaining 10.4% MoM (+14.6% YTD), followed by the Fini-15 (+8.6% MoM/+9.3% YTD) and the SA Listed Property Index (+7.7% MoM/-6.2% YTD). The Resi-10 ended the month 5.9% higher (-17.7% YTD), boosted by gold mining counters. Highlighting the monthly performances of the biggest shares on the JSE by market cap, the largest company on the exchange, BHP Group, jumped 8.2% MoM, while the second-biggest share, Anheuser-Busch InBev, climbed 11.4% MoM. Prosus, SA’s third-biggest listed company, and Naspers both jumped by 19.4%. Other large-cap counters such as Richemont, British American Tobacco, Glencore and Anglo American Plc recorded share price increases of 6.1%, 7.7%, 8.2% and 7.3% MoM, respectively. The rand weakened 1.1% against the greenback in November and is down 9.6% YTD.

In economic data, SA’s October headline CPI surprised on the upside, coming in at 5.9% YoY vs 5.4% YoY in September. The main drivers of this acceleration were food and non-alcoholic beverages (NAB), housing and utilities, and transport costs. Core inflation (excluding the volatile food and energy categories) continued its downward trend for a seventh consecutive month, printing at 4.4% in October, just below the midpoint of the South African Reserve Bank’s (SARB) target range. Against this backdrop, as expected, the SARB looked through the first-round inflation impact of these supply-side shocks and kept the repo rate on hold at 8.25% at its last meeting for the year, with the prime rate remaining at 11.75%. Seasonally adjusted September retail sales (released in November) registered its first expansion of 2023, rising by 0.9% YoY.

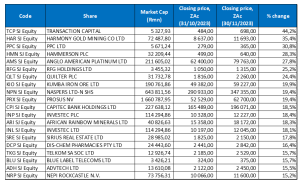

Figure 1: November 2023 20 best-performing shares, MoM % change

Source: Bloomberg, Anchor

Transaction Capital’s share price continued to recover in November, emerging as the month’s best-performing share, albeit from a low base. After gaining 15.2% in October, the share ended last month 44.2% higher, suggesting investor confidence in the management team to turn the ship around (YTD, however, it is still down 78.9%). Last month, Citi also upgraded Transaction Capital to a buy recommendation, helping boost market confidence in the company, which released a trading statement on 29 November, saying that it will report a headline loss of over R700mn in FY23 (the year to end September) vs a profit of R1.6bn in FY22. Headline earnings per share (HEPS), excluding one-off costs such as writedowns, are forecast to decline between ZAc92.5 and ZAc103.3 from ZAc224.4 in FY22. Transaction said that it had stopped financing new taxis – its SA Taxi business is still being restructured, and it is now only financing second-hand taxis. The company’s second-hand car dealer, WeBuyCars, is now the biggest part of its business, and while it recorded a weak 1H23, 2H23 beat expectations.

Harmony Gold Mining took the second spot with a MoM share price gain of 35.4%. The gold miner’s share price jumped after it reported strong quarterly sales and production. Harmony’s operating free cash flow soared by 278% YoY to R3.24bn (from R857mn), driven by higher recovered grades at Mponeng, Moab Khotsong and Hidden Valley. It also recorded a 17% YoY rise in gold production for its 1Q24, with gold revenue jumping 33% YoY to R14.8bn. The average gold price received rose 18% YoY to R1,127,208/kg. The gold price (+11.6% YTD) has been buoyant this year, especially over the past two months, on the back of global geopolitical tensions, led by the conflict in Gaza, and robust central bank buying of the yellow metal amid high inflation and a sluggish recovery in China’s economy.

Cement maker PPC Ltd (+30.8% MoM) was November’s third best-performing share, with its share price rising initially after the company released a trading update earlier in November and following the release of good 1H23 results. PPC’s 1H23 revenue increased to R6.17bn, vs the R5.10bn posted in 1H22, while diluted EPS stood at ZAc24, compared with a loss per share of ZAc30 recorded in the corresponding period of the previous year. At its results presentation, outgoing CEO Roland van Wijnen said “The period under review reflects an encouraging recovery for the PPC group, albeit off a low base. A key driver is that profitability shows improvement across our core Southern African markets, despite the weak macro environment and decline in cement volumes in SA,”.

PPC was followed by Hammerson Plc, Anglo American Platinum (Amplats) and RFG Holdings, which recorded MoM gains of 28.3%, 27.8% and 25.2%, respectively. Food brands Group, RFG released its FY23 results (for the period ended 1 October 2023) in November, which showed that its revenue advanced by 9% YoY to R7.89bn (from R7.26bn), while EPS rose by 35.4% YoY to ZAc185.9. The company increased its dividend to ZAc62. RFG was followed by Quilter and Kumba Iron ore with MoM share price gains of 24.4% and 19.9%, respectively.

The Naspers/Prosus complex rounded out November’s top-10 best-performing shares, with both counters rising by 9.4% MoM. In its 1H24 results, Naspers revealed that its revenue advanced by 9.0% YoY to US$3.0bn, while diluted EPS increased to USc736 from USc477 posted in 1H23. Meanwhile, Prosus said its consolidated Group revenue from continuing operations rose by 13% YoY to US$2.6bn in 1H24, compared to the US$2.3bn reported in 1H23. Core 1H24 headline earnings jumped 118% YoY to US$2.0bn on the back of improved profitability in its stable of e-commerce investments. Profit after tax, including the equity accounted share from Tencent (in which it has a c. 25% stake), gains on the sale of Tencent shares and some write-offs in the value of other investments, increased 34% YoY to US$3.4bn.

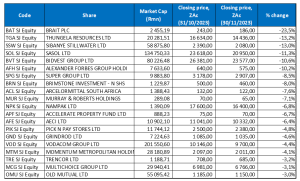

Figure 2: November 2023 20 worst-performing shares, MoM % change

Source: Bloomberg, Anchor

Brait Plc (-23.5% MoM) was November’s worst-performing share. In its 1H23 results, the investment holding company indicated that its investment valuation gain stood at R186.0mn compared to a loss of R280.0mn posted in 1H22. Its basic and diluted EPS stood at ZAc1.0, compared to a loss per share of ZAc32.0 recorded in 1H22. Brait’s interim results showed that the company’s net asset value (NAV) fell 3.1% to R6.84 at the half-year stage, compared with R7.06 at the end of the previous financial year. The Group’s international health and wellness brand, Virgin Active, recorded a robust performance despite losing some members in SA, its largest market, and membership remaining below pre-pandemic levels.

Last year’s darling Thungela Resources was November’s second-worst-performing share, with a 13.2% MoM decline as the price of thermal coal has plummeted c. 50% YTD. Rounding out the bottom three was diversified miner Sibanye Stillwater, down 13.0% MoM as PGM prices, used mainly by auto manufacturers to curb emissions, remain under pressure. PGM prices have declined significantly over the past year amid concerns over global economic growth – the palladium price has plunged by 43% YTD, mainly impacted by weak demand in China, while platinum is down 13.5% YTD, and rhodium has lost 63.7% YTD. In November, Sibanye announced plans to restructure its SA PGM operations, targeting four loss-making shafts. The move could potentially result in the loss of over 4,000 jobs.

Sibanye was followed by Sasol (-11.3% MoM), which announced the appointment of Simon Baloyi as the President and Chief Executive Officer (CEO) and executive director, effective 1 April 2024. He succeeds Fleetwood Grobler. Meanwhile, Bidvest Group’s (-10.6% MoM) share price slumped c. 10% on 28 November – its most significant one-day drop in c. 15 years after it released a disappointing four-month voluntary trading update (to 31 October 2023), which showed that the company’s performance was muted during the period under review. Group revenue growth slowed as activity, coming off a high base, was diluted by diminishing durable consumer spending, volume reduction in some sectors and increased price competitiveness. At the same time, good cost management could not neutralise the pressure on its gross margin. CEO Mpumi Madisa said that while the expected slowdown was previously communicated to the market, the actual volume and margin drop, particularly in the consumer-facing activities, was greater than anticipated. The Group’s Automotive segment result was also significantly weaker as volumes declined and gross margins contracted.

Financial Services Group Alexander Forbes, logistics firm Super Group, investment holding company Brimstone Investments, and steel producer ArcelorMittal SA (AMSA) accounted for November’s remaining worst performers, recording MoM declines of 10.2%, 8.5%, 8.0% and 7.6%, respectively. Last week, AMSA said it may close its long-products business, which could result in 3,500 direct and contractor jobs being lost at its Newcastle and Vereeniging operations. It blamed structural issues beyond its control, including a 20% drop in demand over the past seven years on the back of persistent low economic growth, project delays, rising transport and logistics costs compounded by rail-service disruptions and the prevailing scrap advantage over iron-ore, precipitated by a preferential pricing system for scrap, a 20% export duty, and the recently imposed ban on scrap exports, which had given electric arc furnaces an “artificial” competitive advantage over integrated mills beneficiating iron-ore. AMSA’s CEO said that the decision was reached after “all possible options” were exhausted and was being pursued to place the rest of the business on a “sustainable financial footing”.

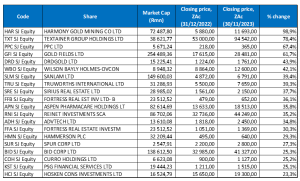

Figure 3: Top-20 best-performing shares, YTD

Source: Anchor, Bloomberg

Thirteen out of October’s top-20 YTD best-performing shares again featured among the top-20 best performers for the year to the end of November. Following good performances last month, Hammerson Plc (+28.3% MoM), Sirius Real Estate (+17.8% MoM), ADvTECH (+15.5% MoM), Reinet Investments (+14.3% MoM), Curro Holdings (+11.0% MoM), PSG Financial Services (+4.8% MoM) and Bid Corp Ltd (+4.5% MoM) were the new entrants, bumping AECI, Bidvest, Momentum Metropolitan Holdings, Alexander Forbes, Trencor, Super Group and Liberty Two Degrees from the list.

November’s share price run by Harmony (+98.9% YTD; discussed earlier) saw it bump Textainer (+78.4% YTD) from the number-one spot to number two, while PPC’s c. 31% MoM gain (discussed earlier) saw it move to third position. Impressive gains from the other gold counters in November saw Gold Fields moving into fourth position with a YTD gain of 61.7%. Gold Fields was followed by the gold tailings retreatment Group, DRDGold (+43.9% YTD), and Wilson Bayly Holmes Ovcon (WBHO; +42.1% YTD) in fifth place. Gold Fields said in November that it expected to meet its projected 2023 bullion production despite shortages of critical skills and other persistent challenges with the operating environment in SA and Australia, including above-inflation cost surges. It said its FY23 production guidance was “unchanged despite operational challenges” in its third quarter period to September 2023.

Sanlam (+39.4% YTD) moved to seventh place, followed by retailer Truworths (+39.3% YTD), with Sirius Real Estate and Fortress Real Estate -B- shares rounding out the top-ten performers with YTD gains of 37.7% and 36.1%. In its operational update for the nine months ended 30 September, Sanlam revealed that net operating earnings increased by 35.0% YoY, while the Group’s new business volumes increased by 13% YoY. Life insurance new business volumes are 8.0% YoY higher on a present value of new business premiums (PVNBP) basis.

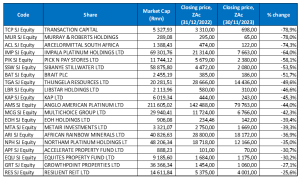

Figure 4: Bottom-20 worst-performing shares, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, nineteen of the twenty shares for the year to the end of October were unchanged from the twenty worst-performers to the end of November. Following its 15.7% MoM share price gain in November, Blue Label Telecoms dropped out of the bottom 20, with Accelerate Property Fund filling its spot.

Despite its share price soaring in November (discussed earlier), investment holding company Transaction Capital remained the worst-performing share YTD, with a 78.9% drop. Once again, it was followed by Murray & Roberts (M&R; -78.0% YTD) in second place (M&R recorded a further 7.1% share price loss in November), while ArcelorMittal (-74.3% YTD) remained in the third spot.

Impala Platinum (Implats), retailer Pick n Pay, and Sibanye Stillwater followed with YTD declines of 64.0%, 58.1% and 53.5%. Platinum counters continue to be in a rout this year as PGM prices have plummeted, and China’s economic growth has remained sluggish, resulting in lower demand from the world’s second-largest economy. Implats has also started offering voluntary job cuts to workers in SA to cut costs amid the PGM price rout.

Brait Plc (-51.7), Thungela Resources (-49.6%), Libstar Holdings (-46.6%), and KAP (-45.3%) rounded out the ten worst-performing shares YTD.