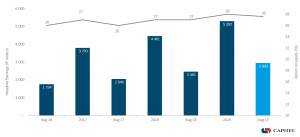

Capitec reported 1H20 results on Thursday (26 September), with very strong HEPS growth in an extremely lacklustre macro environment. The bank’s profit rose by 20% YoY to R2.9bn, with its ROE remaining at a somewhat-elevated 28% as non-interest revenue continued to contribute a greater percentage of Group revenue (currently at 36.6%). Following a meeting with CFO Andre Du Plessis, we provide our thoughts on these results below.

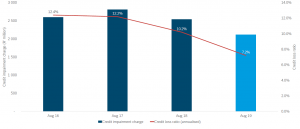

Figure 1: Key performance indicators – HEPS up 20% YoY

Source: Capitec 1H20 results presentation

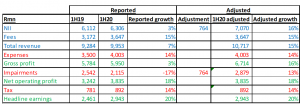

Our initial reaction to these results was disappointment. The major reason for this is because, on the reported IFRS numbers, Capitec’s revenue grew by only 7% YoY and the main driver of earnings came from impairments which were 17% lower YoY! However, following our meeting with Andre, we realised that this was due to changes in the reporting standard. We are not going to go through the technicalities of why this change is happening but suffice to say that IFRS9 forces Capitec to net a significant amount from its net interest income (NII) and the impairment line. This causes NII and impairments to be lower than under previous accounting standards. If we adjust for this, the growth numbers look far more robust and the quality of these results is no longer questionable, with NII growing 16% YoY (in-line with Capitec’s 17% YoY book growth) and the impairment charge increasing 13% YoY (which highlights an increase, albeit lower than book growth given the higher quality of the bank’s customer base). We note that the IFRS adjustments have no impact on net operating profit.

Figure 2: Capitec results reported and adjusted for IFRS

Source: Capitec, Anchor.

Capitec also continued to secure new clients aggressively in the period under review, with the bank acquiring an average of 200,000 clients per month since January 2019 vs a 100,000/month in 2018. Capitec now has 12.6mn active client accounts across its deposit, credit and transactional facilities. The Capitec Funeral Plan is exceeding management expectations and the firm is writing 100,000 policies a month. Capitec has issued 1mn policies since the funeral plan’s inception in April 2018. The funeral plan is very competitively priced and Capitec is fast gaining market share.

The bank’s retail deposit growth continues to be exceptional, with retail deposits growing by 23% YoY to R81bn. In our view, this is a critical measure of the brand perception of Capitec in SA – it is one thing to borrow money from a bank, but something completely different to deposit your savings in said bank. The high percentage of retail deposits de-risk Capitec from an ABIL-type scenario, where corporates started withdrawing their deposits very quickly after questions emerged around the robustness of ABIL’s balance sheet.

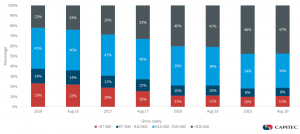

Capitec has been actively trying to move into the higher-income earning segment of the SA market and the bank has been doing this quite successfully. The launch of a credit card has been a key enabler, which is also gaining significant traction. Currently, 11% of loans granted are to individuals earning R7,500 or less per month (the income level where debt forgiveness kicks in). However, on the value of loans this is a much lower percentage.

Figure 3: Credit term loans – focus on higher income market (loans granted)

Source: Capitec 1H20 results presentation

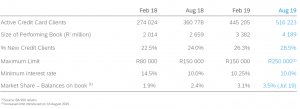

Figure 4: Credit – Credit card book

Source: Capitec 1H20 results presentation.

Total loan growth was c. 17%, which is quite strong vs the bank’s recent history. This was predominantly on the back of higher-value loans to lower-risk customers. The bank is quite happy with the current quality of its book and the opportunities available out there for further growth. Capitec’s impairment charge was reduced to 7.2% in the period under review. We highlight that this is very low for the business as Capitec usually targets a 10% impairment charge. However, according to Andre the changes in IFRS9 will cause the bank to now settle at between 7% and 7.5%, which will be the equivalent of Capitec’s old 10% target.

Figure 5: Credit book – loan book breakdown, Rmn

Source: Capitec 1H20 results presentation.

Figure 6: Credit book – Improved arrears performance (with some help from IFRS)

Source: Capitec 1H20 results presentation.

Conclusion:

Capitec reported another set of very strong numbers, with HEPS growing 20% YoY (the middle of the company’s guided range) and driven by more customer acquisitions and loan book growth. The IFRS changes made this slightly murky though (as discussed earlier). Capitec is seeing a number of growth opportunities – its credit card continues to gain traction and acceptance in the market, while the Group’s funeral insurance is exceeding even Capitec’s own expectations and management are very excited to finalise the Mercantile Bank acquisition. The share price is currently on the expensive side, trading on a Price to Book of 6.8x and a forward P/E of 20.7x! However, we continue to believe that this is a solid and well-run operation. So, while we may not be buyers at current price levels, we will always look for weakness (similar to what we saw in July when the share price was down c. 6% MoM) to accumulate and hold for the long term. This remains a structural growth story, in our view!