It was another tumultuous and volatile month for US and global markets in May (MSCI World +0.1% MoM, -12.8% YTD), with some of the most extreme swings in recent memory as nearly all asset classes saw significant selling in the first half of the month, bounced back and rallied last week as investors bought in the dip, before ending the month on a downbeat note. Ultimately, sentiment was weighed down by worries about a possible US recession, rising interest rates, the ongoing Russian offensive against Ukraine, and soaring inflation with the c. 58% YTD jump in oil prices being a big contributor to the very high inflation globally. China’s strict zero-COVID policies also weighed on sentiment for most of the month although Beijing announced this week that these strict lockdown policies would be systematically lifted.

US indices’ losses for the month were capped after a strong rally the week of 23 May, with the blue-chip S&P 500 gauge and the Dow ending the month very little changed (S&P +0.04% MoM: -13.3% YTD and the Dow +0.01% MoM and -9.2% YTD). After recording its worst monthly performance since October 2008 (during the global financial crisis) in April, the tech-heavy Nasdaq lost another 2.1% MoM in May, bringing its YTD loss to 22.8%.

On the US economic data front, April inflation (released in May) decelerated slightly although it remained close to 40-year highs, coming in at 8.3% YoY vs 8.5% in March. Excluding the volatile food and energy prices categories, April’s core CPI rose 6.2% YoY vs March’s 6.5% print. MoM, inflation was up 0.3% – significantly below March’s 1.2% increase. Consumer spending, accounting for over two-thirds of US economic activity, grew 0.9% YoY in April, and the core personal consumption expenditures (PCE) price index, the US Federal Reserve’s (Fed’s) preferred inflation gauge, rose 4.9% YoY. Headline PCE advanced by 0.2% MoM vs March’s 0.9% rise – its smallest gain since November 2020. The Fed, in minutes from its 3-4 May policy meeting, called inflation a serious concern and highlighted, as expected, that most participants backed two 50-bpt rate hikes at the June and July meetings, as it attempts to curb inflation without causing a recession. We note though that the Fed did leave room for a pause in rate hikes if the US economy weakens.

In Germany, Europe’s largest economy, the DAX closed the month 2.1% higher (-9.4% YTD), while the eurozone’s second-biggest economy, France’s CAC Index ended May 1.0% in the red (-9.6% YTD). In economic data, May eurozone inflation data reached a much higher-than-expected 8.1% YoY vs April’s 7.4% print. This was the eleventh consecutive rise in inflation for the region and the highest since records began in 1997 as the fallout from Russia’s invasion of Ukraine sent energy and commodity prices soaring and added to global supply chain issues. Germany’s seasonally adjusted final gross domestic product (GDP) registered a QoQ rise of 0.2% in 1Q22, compared with a drop of 0.3% in 4Q21. France’s May inflation rate also continued to rise – hitting a new record of 5.8% YoY vs April’s revised 5.4% print, while Germany’s preliminary inflation rate for May hit a fresh record reaching 7.9% YoY vs 7.4% YoY in April.

The UK’s blue-chip FTSE-100 surprised on the upside for a second month, closing May 0.8% higher (+3.0% YTD). In economic data. April UK inflation, released last month, hit a 40-year high of 9% YoY (up from 7% in March) on the back of soaring gas and electricity costs.

In China, Shanghai and Beijing announced the easing of lockdown restrictions (after c. three months) this week amid a drop in COVID-19 cases. Fears about the impact of that country’s zero-COVID strategy on its economy and the disruption of global supply chains had weighed on markets for most of the month due to Beijing’s unprecedented lockdown measures to curb the spread of the pandemic. There was a late-month rally in Chinese stocks after the government announced restrictions would be eased and Hong Kong’s Hang Seng Index posted a MoM gain of 1.5% (-8.5% YTD), while the Shanghai Composite Index rose by 4.6% MoM (-12.5%YTD). In economic data, following two months of contraction, China’s official manufacturing purchasing managers index (PMI) advanced to 49.6 in May– up from 47.4 in April. The official non-manufacturing PMI, which measures business sentiment in the services and construction sectors, advanced to 47.8 in May – up from 41.9 in April (the 50-point mark separates expansion from contraction). China’s central bank said in May that it would step up support for the country’s slowing economy, while closely watching domestic inflation and monitoring policy adjustments by developed nations. Elsewhere, Japan’s benchmark Nikkei rose 1.6% in May but is down 5.3% YTD.

The Brent crude oil price rose above US$120/bbl on Monday (30 May), ending the month at US$122.40/bbl (+12.3% MoM/+57.9% YTD). This is on the back of a tight market due to rising gasoline consumption during the US summer and an EU embargo on most Russian oil imports to take effect by the end of the year. Iron ore continued to slump (-0.2% MoM/+16.9% YTD) amid stagnant demand from China and that country’s continued economic woes. Chinese downstream demand remained muted in May as investors worried that China’s economy would contract in 2Q22 amid the COVID-19-fuelled lockdowns and supply-chain disruptions. The gold price was also lower in May (-3.1% MoM/+0.4% YTD) although a weakening US dollar saw bullion notching up a second straight weekly rise on Friday (27 May), supported by somewhat of a moderation in market expectations for the Fed’s monetary policy for next year. The yellow metal has been struggling over recent months due to the Fed’s aggressive and hawkish campaign. Platinum rose 3.1% MoM (+0.01% YTD), while palladium plummeted 14.0% MoM (+5.1% YTD), negatively impacted by falling auto output due to supply chain constraints. Russia’s war on Ukraine has resulted in challenges for the auto industry with some German car manufacturers halting production in March due to a shortage of wiring harnesses made in Ukraine, while China’s stringent lockdown measures saw the closure of some vehicle assembly plants which added to consumer demand for vehicles.

The JSE ended May basically unchanged, as South Africa’s (SA’s) FTSE JSE All Share Index closed the month 0.5% lower (-2.2% YTD), while the FTSE JSE Capped SWIX rose slightly (+0.5% MoM; +3.1% YTD). The Fini-15 outperformed in May, rising 4.2% MoM (+14.8% YTD), as banks and insurance companies were amongst May’s best-performing stocks after their poor performances in April. The Resi-10 ended the month slightly lower (-0.3% MoM; +8.4% YTD), while the SA Listed Property Index also declined slightly (-0.3% MoM; -4.8% YTD). The Indi-25 (-2.4% MoM; -18.0% YTD) was the month’s biggest loser as industrial counters retreated. Highlighting May’s best-performing shares by market cap, Anglo American soared 6.8%, Naspers jumped 6.6%, FirstRand rose 5.7%, Glencore gained 4.9%, Prosus advanced by 4.3% MoM, British American Tobacco moved 3.9% higher, and BHP Group, the largest company on the JSE by market cap, gained 3.6% MoM. After dropping by 8.1% against a strong greenback in April, the rand clawed back c. 1.0% in May (+1.9% YTD).

On the local economic data front, April’s annual headline inflation, as measured by the consumer price index (CPI), was unchanged from March at 5.9% YoY. Stats SA said the key drivers were, once again, food and non-alcoholic beverages, housing, and utilities as well as transport – all the usual suspects that have been driving prices of late. Interestingly, April core CPI printed slightly higher at 3.9% YoY (vs 3.8% in March) as headline pressures slowly trickle down through to the stickier, entrenched categories. Nonetheless, core inflation remains contained – signalling domestic inflationary pressures are muted. March SA retail sales rose 1.30% YoY, less than forecast and compared to a YoY drop of 0.90% in February. The latest Quarterly Labour Force Survey (QLFS), released on 31 May, showed that SA’s unemployment rate declined slightly (for the first time in seven quarters as the manufacturing and mining industries added jobs to meet the demand for commodities) in 1Q22 to 34.5% from 35.3% in 4Q21. There were 7.9mn unemployed people in the country in 1Q22, with 370,000 jobs gained QoQ.

As expected, and largely already priced in by the market, the South African Reserve Bank’s (SARB’s) Monetary Policy Committee (MPC) broke precedence and hiked rates by 50 bpts on 19 May, as opposed to the 25-bpt increments that we have seen thus far in the current rate-hiking cycle. Standard &Poor’s (S&P) upgraded SA’s credit rating outlook to positive from stable, noting that recent favourable terms of trade have improved the external and fiscal trajectory, while the country’s “reasonably large net external asset position, flexible currency, and deep domestic capital markets provide strong buffers against shifts in external financing.”

Late May saw a second wave of flooding in KwaZulu-Natal (KZN) – just six weeks after parts of that province were hit by flooding in which over 400 people died and infrastructure (roads, bridges, water, and electricity), was destroyed. On the pandemic front, as at 31 May, Department of Health data show that 36.1mn vaccine doses have been administered (vs 34.9mn as at 30 April), while the total number of confirmed COVID-19 cases in SA since the start of the pandemic stood at 3.96mn vs 3.79mn on 30 April.

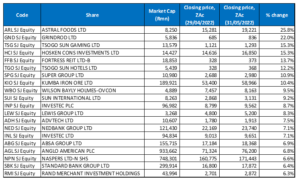

Figure 1: May 2022’s 20 best-performing shares, % change

Source: Bloomberg, Anchor

Astral Foods (+25.8% MoM) was the best-performing share in May, bumping Thungela Resources from the top spot that it had occupied for the prior three months running. The company’s share price surged after it reported a 138% YoY jump in 1H22 headline earnings per share (HEPS) to ZAc1,420 as capital investments to increase its processing and production translated to higher sales. The integrated poultry producer also reported a 26% YoY increase in revenue to R9.4bn and raised its interim dividend by 163% YoY to ZAc790. The company highlighted that poor municipal service delivery, loadshedding, and water supply disruptions negatively impacted its operations, adding an unnecessary cost burden to producing chicken in SA. Group CEO Chris Schutte said the strong growth was off a low base in a tough market and operational conditions. He added that market and trading conditions for the remainder of FY22 were expected to remain challenging as the high unemployment rate and constrained consumer disposable income worsen.

Grindrod Ltd, the diversified freight logistics Group, was May’s second best-performing share rising by 22.0% MoM, buoyed by the news that African Bank would buy 100% of Grindrod Bank in an R1.5bn deal to speed up African Bank’s entry into the business banking market. Grindrod Ltd CEO Andrew Waller said that the deal aligns with the company’s long-stated intent to separate its freight and banking services segments.

Tsogo Sun Gaming was May’s third best-performing share. Its share price rose by 15.3% MoM. The gaming Group said that it expected its FY22 HEPS to be between ZAc106.9 and ZAc113.5 vs ZAc3.1 reported in FY21. In 2019, Tsogo Sun unbundled its hotel business listing Tsogo Sun Gaming and Tsogo Sun Hotels separately on the JSE.

Tsogo Sun Gaming was followed by investment holding company, Hosken Consolidated Investments Ltd (HCI), Fortress REIT Ltd -B-, and Tsogo Sun Hotels with MoM gains of 15.3%, 13.7%, and 12.2%, respectively. HCI, which has interests in media, property, gaming, transport as well as oil and gas, reported FY22 results in May which showed that Group revenue rose 31% YoY to R10.7bn with core profit jumping by 62% YoY to R5bn. This as its core gaming (c. 10% of total revenue) and media (30% of total revenue) units recovered. However, the core profit number was still 25% down from FY20 (pre-pandemic) levels and the company withheld its dividend. In April, HCI’s share price also jumped following a report by a Norwegian oil, gas, and energy publication, that an offshore field in Namibia, in which HCI has a 10% stake, could be the world’s largest deep-sea oilfield. Meanwhile, resort Group, Tsogo Sun Hotels reported a c. 138% YoY rise in FY22 income to R2.71bn, while its diluted loss per share came in at ZAc10.6 vs the loss of ZAc72.7 posted in FY21. The company also announced that shareholders would vote on changing its name to Southern Sun Ltd (it will however retain its JSE share code).

Super Group (+10.9% MoM) reported good 1H22 results with HEPS rising 20% YoY (albeit from a low base) to ZAc191, while revenue was up 8.4% YoY to R21.6bn. The consulting and logistics company’s results included the four-month impact of its recent offshore acquisition, LeasePlan, and Super Group said that it saw strong sales performances from its SA supply chain and fleet businesses.

Rounding out the month’s top-ten performers were Kumba Iron Ore (+10.4% MoM), Wilson Bayly Holmes-Ovcon (WBHO; +9.5% MoM), and Sun International (+9.2% MoM). Last month, the City of Cape Town and three construction firms (WBHO, Stefanutti Stocks, and Aveng Africa) accused of collusion and bid-rigging for the Cape Town Stadium reached a settlement ending a R430mn High Court case for damages. The parties said in a statement that the settlement includes a R31.3mn payment by each contractor to the council.

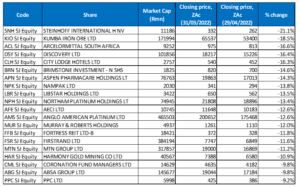

Figure 2: May 2022’s worst-performing shares, % change

Source: Bloomberg, Anchor

Gold miners featured prominently among May’s worst-performing shares with four out of the ten worst-performing counters coming from an industry that has been taking strain this year. This as the gold price ended the month 3.1% lower despite a brief respite for the yellow metal last week on the back of a weaker US dollar and some indications that the Fed’s tightening path might not be as aggressive as was initially feared. With a MoM decline of 29.7%, Gold Fields was May’s worst-performing share. The company’s share price plummeted by 19.9% on 31 May after the gold miner announced a plan to buy Canada’s Yamana Gold in a c. R103bn all-share deal. In a joint statement, the two companies said that Gold Fields will take full control of Yamana in a share exchange at the ratio of 0.6 Gold Fields shares for every Yamana share. The deal adds five producing mines to Gold Fields’ network as well as a pipeline of development projects and exploration properties. The concerns are that Gold Fields is paying a premium for Yamana and with the world entering a higher interest rate environment the timing of this deal is risky as it could see investors moving away from gold to higher-yield investments such as bonds.

Another gold miner, Harmony (-17.7% MoM) was the month’s second worst-performing share, weighed down by a lower gold price, input cost pressures, production challenges, and the announcement in early May that four miners had died in an infrastructure maintenance-related incident at its Kusasalethu mine in Gauteng.

In the third spot, AngloGold Ashanti (AngloGold) fell 16.7% in May. It released disappointing 1Q22 results early last month and although production for the Group during the period was flat, AngloGold said that it was on track to achieve full-year guidance and still expects to produce between 2.55mn and 2.8mn ounces of gold in 2022. Its total cash costs increased by US$1,041/oz (+4% YoY), driven by factors such as rising inflation across several input costs and increased royalties – due to the higher gold price received. Inflationary pressure was partly offset by operating improvements and an 8.0% increase in underground grades. EBITDA fell 2% YoY to US$438mn.

May saw more uncertainty for Ascendis Health (-16.5% MoM) as its shareholders voted in favour of appointing three new people to the company’s board including dissident shareholders, posing the risk (once again) that lenders will call in Ascendis’ debt facilities. The company has a c. R550mn debt pile which it has been paying interest on with more debt and its terms with lenders mean they can insist on immediate payment if changes to the board happen without their prior approval. Ascendis also issued a cautionary a few days later saying that it is in talks that may result in the refinancing of its R550mn debt pile.

DRD Gold, Life Healthcare, and Transaction Capital followed, with MoM losses of 16.4%, 14.5%, and 14.1%. Last month, DRD Gold said its production decreased by 3% QoQ for the three months ended 31 March (1Q22), primarily due to a 5% decrease in tonnage throughput. Gold sold during the quarter decreased by 6% QoQ, elevating cash operating costs in rand terms by 3%. In US dollar terms its cash operating costs were up 5% QoQ at US$1,237/kg, while cash operating costs per tonne of material processed increased by 9% in dollar terms to US$8.30/tonne. Life Healthcare, meanwhile, reported a 4.5% YoY rise in 1H22 Group revenue to R13.5bn, but its HEPS fell 12.7% YoY to ZAc41.4. We note that this figure was affected by the disposal of its Polish hospital business, Scanmed, which added ZAc6 to the prior year’s HEPS, as well as an end to short-term COVID-19 contracts provided by AMG to governments in the UK and Italy. Transaction Capital said in May that the closing of the Toyota plant in KZN, following the recent floods, will affect its minibus financing business which will likely see pressure on its earnings in the remainder of the current financial year.

Rounding out May’s worst performers were Barloworld (-13.9% MoM), Lighthouse Properties (-13.2% MoM) and Massmart Holdings (-11.5% MoM). Heavy equipment and motor dealership Group, Barloworld’s share price fell after it announced a R1bn write-down due mainly to the impairment of non-current assets in equipment because of the war in Ukraine. The company said 1H22 HEPS was ZAc756 vs ZAc362 in the prior period, driven by good performances from its Equipment Southern Africa, Equipment Eurasia, and Ingrain segments, as well as strong results from its car rental and leasing business. Revenue from continuing operations (of R18.4bn) was 13.6% higher YoY. Retailer Massmart saw its share price drop after it warned of weaker sales and growing supply-chain costs. In a trading update, Massmart reported a drop in sales (total Group sales fell 0.2% to R30.4bn in the 19 weeks to 8 May), saying it was battling the fallout of July 2021’s civil unrest and signs that local economic conditions were eroding customers’ disposable income. It added that soaring shipping costs during the pandemic amid global supply chain disruptions have made the cost of importing goods such as electronics more expensive.

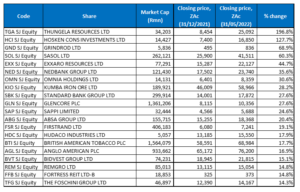

Figure 3: Top-20 May 2022, YTD

Source: Anchor, Bloomberg

Thirteen out of May’s top-20 YTD best-performing shares also featured among the top-20 performers for the year to end April, with ABSA (+20.4% YTD), FirstRand (+19.1% YTD), Hudaco (+17.9% YTD), Anglo American (+16.9% YTD), Remgro (+14.8% YTD), Fortress REIT Ltd -B- (+14.8% YTD), and The Foschini Group (+14.3% YTD), replacing Gold Fields, Invicta, KAP Industrial, Woolworths, Emira Property Fund, Sibanye Stillwater, and Afrimat.

Thungela Resources (+196.8% YTD) took the top spot for the fourth month in a row. The share price has been on a tear since Russia’s invasion of Ukraine supercharged the coal market, leaving power producers scrambling for supply and pushing coal prices to record levels. In March, Thungela also delivered stellar maiden results, with its FY21 headline EPS coming in at R66.57 vs a loss of R5.31 in FY20, while the company also posted a profit of R6.9bn vs a loss of R362mn in FY20.

HCI (+127.7% YTD, discussed earlier) was again in second place and was followed by Grindrod (+68.9% YTD, discussed earlier), which bumped Sasol (+60.3% YTD) from its third spot in the year to end-April to the fourth position. Sasol’s energy business is doing extremely well due to the high demand and the company’s operational risk has lowered as its capital expenditure has reduced significantly to c. R20bn. As a result, Sasol’s cash flow has improved substantially compared to the pressure the balance sheet faced two-three years ago.

In April, Exxaro (+44.7% YTD) said that it has received “numerous” requests from European countries wanting to sign supply contracts after the EU proposed sanctions on Russian coal following Russia’s invasion of Ukraine which has put European countries under immense pressure to diversify their coal supply. While Exxaro had the right quality of coal for that market, the company said that its current production has already been allocated and the struggling SA rail network meant that miners were unable to meet increased demand and export more coal.

Exxaro was followed by Nedbank (+35.6% YTD), Omnia Holdings (+30.6% YTD), and Kumba Iron Ore (+28.2% YTD).

Rounding out the YTD 10 best-performing shares was Standard Bank and Glencore – both with YTD gains of 27.6%. Glencore announced on 24 May that it had reached an agreement with authorities in the US, the UK, and Brazil to settle past corruption and bribery charges. Glencore has been facing bribery and corruption investigations in these jurisdictions for some time. It previously raised a US$1.5bn provision (the Group’s best estimate of the cost to resolve the investigations) in its FY21 results and said that it expected the investigations to be concluded this year.

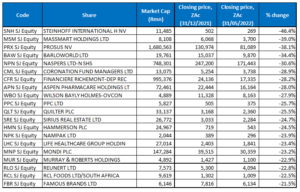

Figure 4: Bottom-20 May 2022, YTD

Source: Anchor, Bloomberg

Among the YTD worst-performing shares, 17 of the 20 for the year to end-May were also among the 20 worst performers for the year to end-April. Hammerson plc (-24.5% YTD), Life Healthcare (-23.4% YTD), and RCL Foods (-22.5% YTD) were the newcomers, replacing Super Group, EOH, and City Lodge.

Steinhoff (-46.4% YTD) was the worst-performing share YTD for the second month running although the share price posted a positive MoM gain of 2.7%. It was followed by Massmart (-39.0% YTD, discussed earlier) in second place and Prosus (-38.1% YTD) in the third position.

Prosus was followed by Barloworld (-34.4% YTD and discussed earlier), Naspers (-30.6% YTD), Coronation Fund Managers (-28.9% YTD), and Richemont (-28.2% YTD). Naspers’s SA-focused venture capital unit, Foundry, in May announced its second investment in a month with the backing of fintech start-up LifeCheq, further strengthening its portfolio in this segment. Foundry led a US$3.3mn (R53.0mn) series A funding round in the financial advisory company, investing R40.0mn, with the balance coming from existing investors. Richemont announced mixed FY22 results (to 31 March 2022) on 20 May, with revenue coming in above expectations while operating profit disappointed. The company said that operating profit lagged expectations as margins contracted despite stronger-than-expected top-line growth. On the day of the release (20 May), the Swiss-based luxury goods Group’s share price dropped c. 12.8% (its worst day in c. 22 years), after it warned it was facing a global environment that was the “most unsettled” the company has experienced for a number of years due to high inflation, COVID-19 lockdowns in China (due to Beijing’s zero-Covid strategy with c. 40% of its retail network closed), and the effects of the war in Ukraine.

Richemont was followed by Aspen Pharmacare (-28.0%), WBHO (-27.9%), and PPC (-25.7%). which rounded out the ten worst-performing shares YTD. Aspen said last month that it needed clear commitments within weeks from African governments for orders of its COVID-19 vaccine or it will recommit that production line to more in-demand anaesthetics. Aspen has been let down by the lack of interest in vaccine shots after starting production in March 2022 under licence from Johnson & Johnson.

If you have any questions or would like to discuss the subjects raised in this article with someone at Anchor please email us at info@anchorcapital.co.za.