Black Friday, which is taking place today (29 November), closely followed by Cyber Monday on 2 December, are two manic shopping days relatively new to the South African (SA) consumer. One version of events regarding the origin of Black Friday is that the day was named by Philadelphia police officers in the 1950s, when large crowds of tourists and shoppers would flood the city the day after Thanksgiving for the Army-Navy football game. For those police officers, not only did they not get the day off from work, they also had to work extra-long shifts to control the chaos in the streets and sporadic shoplifting. It took thirty years for the term to become common across the US to describe the post-Thanksgiving sale.

Takealot and Checkers were the first retailers to introduce Black Friday to local consumers back in 2014 and these two shopping days have since taken our country by storm. According to Black-Friday.Global, in 2018 the Black Friday shopping phenomenon saw a much faster growth rate in SA vs any other country, with a 9,900% jump in interest and a 1,952% rise in Black Friday sales when compared to any other day of the year. Meanwhile, SA price-comparison platform, PriceCheck, writes that in 2017 website traffic shot up from a daily average of 94,000 visits to 290,000 visits on Black Friday.

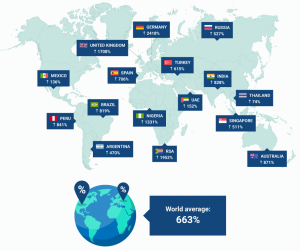

Figure 1: Sales increases on Black Friday by country vs other shopping days in the year, 2018

Source: Black-Friday.Global

In addition, Black Friday is quickly morphing into a Black November across the globe as more and more sales are held for longer than only one day. Locally, for example, ads for Black Friday deals started weeks ago with some of the big stores even announcing a week (or longer) of deals and every shop being more aggressive than the next in marketing their discounts. As we are all acutely aware, the SA consumer is under enormous pressure – the economy is in the doldrums, having just recently emerged from a technical recession, while problems such as low growth, high unemployment, load shedding, rampant corruption etc. are weighing on businesses and consumers alike. Stats SA’s latest retail sales statistics show that retail sales were subdued during the first nine months of 2019 (9M19), growing at only 1.3% in constant 2015 prices vs 9M18 and signaling that SA retailers are in for tough times ahead. Nevertheless, amid this depressed local economic environment, consumers are still likely to be searching for great deals come Black Friday and to spend money they don’t necessarily have on items they might not necessarily need at both e-commerce and brick-and-mortar retailers.

When retailers make a loss, their books are described as being “in the red”, whereas when they are profitable, they are described as being “in the black”. This is also an apt description for shops on the day, with Black Friday becoming almost as important as Christmas in retailers’ lives. According to Stats SA, historically the most important month of the year for retailers had been December, but in 2018 it was a tough month for local retail (sales volumes dropped by 1.4% YoY), after a much better November, when Black Friday buoyed sales to 2.9% YoY volume growth. Stats SA writes that the Black Friday effect “has been growing in strength in recent years, resulting in a partial shift of sales from December to November.” The benefit of this day to a local economy is not a new realisation, as far back as 1939 US President Franklin D Roosevelt moved the date of Thanksgiving one week earlier in the hope of boosting the US economy in a move now called “Franksgiving”.

We want to make sure that your bank balance also tends more towards black than red. We have written previously that financial behaviour tends to be more emotional than rational and that there are numerous behavioural biases impeding our ability to reason if we don’t understand them and make a conscious effort to work around them (see our article entitled Focus on the Facts dated 11 October 2019) We often act automatically or subconsciously, in response to our emotions rather than rationally and logically by thinking through our decisions. The irony of people storming to the shops the day after giving thanks for everything they have is an article for another day. Today we want to make sure that consumers better understand their cognitive fallacies and the context in which they make decisions on days such as Black Friday as we can only better ourselves by knowing ourselves and the behavioural economics at play during days such as Black Friday is particularly interesting.

Globally, and locally, marketers have created massive hype. The day is, arguably, a glorified sale which has been framed as a special event and once-a-year opportunity. The perception is created that consumers won’t have access to this kind of discount again soon. This is known as framing and ties in closely to scarcity and loss aversion. People fear that they might miss out because not only is it a limited day, often retailers mark the stock itself as limited in edition or availability which may not necessarily be true. This raises the perceived value of the product or service as we all know that scarcity and value are often inextricably linked. Looked at objectively, the discounts might not be that great and seasonal sales aren’t that rare.

Another behavioural phenomenon is that of herding. It is rooted in our evolution to find comfort in fitting in with crowds, and people easily become caught up in the euphoria or behaviour of those around them. Other examples of this kind of mob mentality is the Salem Witch Trials of the 1600s or the fanatical behaviour of sports fans when they are in large groups. The sunk cost fallacy is often also demonstrated in consumer behaviour on this day. A buyer might get up early to queue or load a shopping basket online and then, even if what they initially intended to buy is not available, they end up buying something else as they have already sunk the cost of time or effort spent. In addition to this, it might be painful to part with the first R100 but every additional R10 or R50 is easier to spend. The amount of pain experienced in parting with hard-earned money decreases with every additional increment. Also be aware of the halo effect. It is important to look at every deal in isolation as often people will see one great deal in a shop and assume that all the other sales are great deals as well.

Most importantly, always take cognisance of the fact that, a bargain or a great deal is only such if an individual can afford it! This is probably the most important mantra consumers should repeat to themselves as they get overwhelmed by the sheer number of Black Friday/Cyber Monday deals available. Retail management platform, Vend’s data show that in 2018, there was a significant YoY increase in consumers who made their Black Friday purchases using a credit card – 53% of sales were cash and 45% by credit card (vs 2017’s 58% of cash sales and 36% on credit). This is telling perhaps that, after a very difficult year for local consumers, many chose to take advantage of special offers on credit.

While Black Friday can be a day when consumers get great deals, it is also a day on which shoppers spend money on impulse buying due to marketers using consumers’ behavioural biases to their advantage. In addition to understanding your emotional self, there are some practical tips too. With SA consumers carrying vast amounts of debt, it is important to be smart about what you buy as to not get into further financial difficulty.

Below, we highlight some considerations that will hopefully stop shoppers from spending too much money or from spending money which they don’t necessarily have:

- Shopping only because of the discounts: Ask yourself whether you really need the item/s you are purchasing or if you are buying these items only because they have been heavily discounted? Be practical when shopping and don’t use the excuse that something is “such a great deal” to justify spending money that you might not have for an item which you may not necessarily need. If you have no budget available, rather avoid the temptation of going to stores or shopping online merely because items have been discounted. Remember that the day has been framed to appear scarce and to make you feel like you are losing out if you don’t participate.

- Buy essentials, not luxuries: Essentials are usually seen as grudge purchases (a product you buy out of necessity and not because you want to buy it), so if you don’t have money do not buy something you do not need. Having said that, if you are able to buy items you do need at a discount then take advantage of the day to your benefit.

- Set a budget for yourself: Know if something which is on special is indeed affordable to you and do not go over a price that you have deemed as being affordable. Avoid overspending by setting a budget and adhering to it. Be aware of the implications of spending money which you do not have. It is important to take into consideration the sunk cost and initial pain fallacy here. Only buy what you initially intended to purchase.

- Know what you plan to buy ahead of time: Following on from the point above, know exactly what you plan to buy and do not deviate from this list. This allows you to find the best deals for that specific item – avoid making impulse purchases that you will regret later unless your budget can accommodate such purchases. Be cognisant of the fact that you might be buying things because everyone around you is doing so. Make sure that you would behave the same way in isolation and that you are not just taking on the collective mood and actions of the herd, or mob!

- Compare prices: Research those items you are shopping to make certain you are indeed getting the best deal – just because it’s being advertised as a Black Friday discounted deal, doesn’t necessarily mean it’s the best price. Do your homework! While businesses bombard you with advertising to ensure that you spend the most money at their store/s, be aware of the practice which sees stores sometimes pass off not such great deals as huge discounts. Remember that because of the halo effect, the deal might not be that great. Make sure that you have a detailed list of the items that you need and their prices beforehand.

- Black Friday is closer to Christmas this year: 2019’s Black Friday event falls later in November than in the past. This will likely create a greater sense of urgency for consumers to also get their Christmas shopping done since you expect to find more bargains during the event. This might not necessarily be the case.

- Credit card purchases: Only make use of credit when it is necessary and do not use credit for basic living costs (fuel, groceries etc.) but rather, for example, use a credit card in the case of an unforeseen emergency. If you are spending using money you don’t have by doing all your shopping on a credit card, make sure that the on-sale item doesn’t end up costing you much more once interest is added to your credit card repayments. Also, if you do use a credit card pay it off each month to avoid having to pay high interest rates.

- Make use of credit card rewards: If you do shop with a credit card, then at least use a credit card which offers you rewards. That way a shopper gets free points which can be exchange for groceries, holidays etc.

- Online shopping: The internet is filled with websites that are either fake, fraudulent or a scam so be vigilant and cautious when shopping online. Select only trusted websites and look out for deals that are too good to be true, because those type of deals usually are!

- Understand a store’s return policies: If you do get caught up in the Black Friday shopping euphoria be sure that you understand the store where you are shopping’s return policies. Stores differ with some offering refunds and others only allowing exchanges. Know whether the item you purchase comes with a guarantee.

We hope that by highlighting some of the behavioural biases inherent in consumers this will create awareness and as such rational, rather than emotional, decision making. Do not live (and spend) beyond your means, this is especially so when a hyped sale event such as Black Friday takes place, where a person is more inclined to be easily swept up in the frenzy surrounding it.