Overview

Bidvest released FY20 results on 14 September and, as expected, the results were negatively impacted by the COVID-19 pandemic and the ensuing lockdown restrictions. However, Bidvest managed to allay fears of a rights issue after it managed to keep its net debt/EBITDA ratio at 2.1x – within its net debt/EBITDA covenant ratio of 3x. Net debt increased from R7.8bn to R19.2bn, due to the acquisition of UK hygiene firm, PHS for GBP495mn on 1 May 2020. Strong free cash flow generation resulted in Bidvest remaining within bank covenants despite the disproportionate amount of debt compared to EBITDA added and losses from trading in its fourth quarter (we note that the SA lockdown started on 26 March 2020 basically at the start of 2Q20 and Bidvest’s fourth quarter).

Balance sheet concerns and M&A

Bidvest is unlikely to make any major mergers and acquisition (M&A) deals in the near term, except for smaller bolt-on acquisitions. The Group is currently looking at one or two bolt-on acquisitions in the UK that will occur next year if the company decides to be more aggressive on acquisitions. We note that, according to Bidvest, bolt-on acquisitions that will be pursued will not cost more than c. R500mn each.

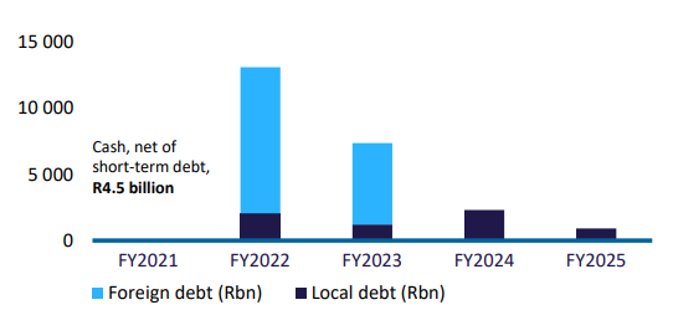

Bidvest management are confident that the need for a rights issue will not arise and they remain comfortable with the Group’s net debt/EBITDA ratio covenant of 3x. Bidvest has also strengthened its liquidity position by sourcing additional credit facilities worth R4.5bn from South African (SA) banks. In addition, management has put together a PHS British pound-denominated bridge facility plan worth R11bn (payable within the next 15 months), which will help pay-off debt from Bidvest’s PHS acquisition. Around R8.5bn against R11bn can be paid down in the very near term through R4bn in credit facilities from local banks, R2.5bn from offshore cash, the Mumbai International Airport (MIAL) proceeds of c. R1bn and free cash flow. This ultimately leaves R2.5bn remaining on the bridge and management said that they would be comfortable with the company paying down the remaining balance of R2.5bn on the bridge facility. Although management appear to have a solid plan on reducing debt, we expect balance sheet concerns for Bidvest to remain in the near term.

Figure 1: Bidvest debt maturity

Source: Bidvest

Group highlights

Bidvest’s revenue increased marginally by 0.6% YoY to R76.5bn, driven by Adcock’s consolidation into the Group, as well as two months revenue contribution from Bidvest’s new PHS acquisition in the UK. Trading profit (including COVID-related expenses) declined by 19.9%YoY. Net capital items of R2bn were significant with R1.1bn in impairments related directly to COVID-19 and the balance relating to R1.0bn of impairments as a result of lower forecast cash flows which were impacted by COVID-19, the expected slowdown in economic activity, as well as higher discount rates. Normalised HEPS from continuing operations declined by 22.9% YoY to ZAc1,028.3, while HEPS from continued operations decreased by 59.5% YoY to ZAc553.2. Basic EPS declined 95.6% YoY, from ZAc11,33.8 to ZAc49.8, due to impairments, business closures, disposals, and a reduction in the share prices of BVT’s associates. Net debt/EBITDA increased from 0.9x to 2.1x. No final dividend was declared due to the current uncertainty related to the pandemic. Therefore, the total FY20 dividend is ZAc282/share – a 53% YoY decline. BidAir Services and Bidvest Car Rental are to be divested, with Bidvest Car Rental disclosed as a discontinued operation.

Current CEO Lindsay Ralphs will retire on 30 September 2020 and the new CEO, Mpumi Madisa, will assume the role on 1 October 2020. Madisa has c. 15 years’ experience within Bidvest and has had good exposure in the Group’s international operations.

Performances of the various business units

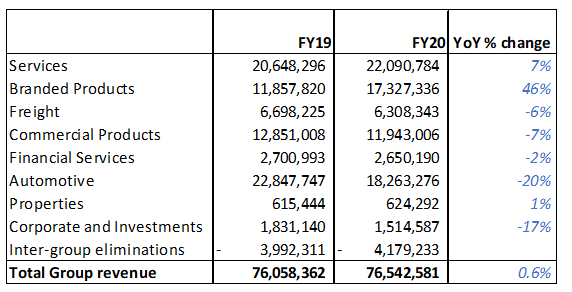

Figure 2: Bidvest revenue contribution by segment, R’000

Source: Anchor, Company data

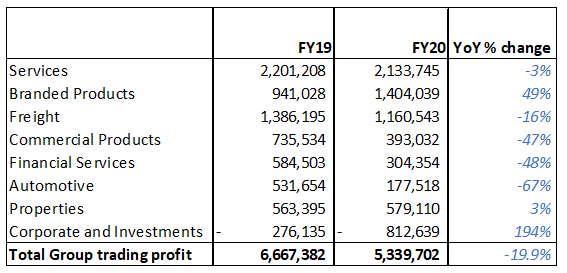

Figure 3: Bidvest trading profit contribution by segment, R’000

Source: Anchor, Company data

Below, we highlight the performances of Bidvest’s various business units in more detail:

Services (trading profit contribution 40%): Services revenue grew 7% YoY, but operating profit declined 3% YoY, SA’s profitability was negatively impacted by the travel and hospitality sectors struggling through the worst effects of COVID-19. The travel cluster within the services division recorded a loss, while Noonan had an excellent performance, as both PHS and Noonan are experiencing the benefits of people returning to work in the UK. The FM cluster, Protea Coin, UDS, BidTrack, Vericon, and BidAir Cargo achieved good results, while BidAir Lounges was on track for a record performance but this was offset by COVID-19 restrictions in the company’s fourth quarter (2Q20). BidAir Services was loss-making, and management have decided to divest the company. Management have also instituted extensive restructurings within the Bidvest travel cluster and are monitoring the future of remote working and its impact in regions in which the company operates.

Branded Products (trading profit contribution 26%). This segment now includes Adcock Ingram, Office, and Print divisions as well as other consumer businesses. Revenue increased 46% YoY and trading profit rose 49% YoY on the back of the Adcock inclusion. The result was driven by a solid performance from Adcock, while the rest of the businesses in the sector experienced the worst effects of the pandemic.

Freight (trading profit contribution of 22%): Revenue declined 6% YoY, while trading profit fell by 16% YoY due to the subdued local economy and lower volumes handled as a result of reduced global trading. The liquid petroleum gas (LPG) storage project is expected to be commissioned in September 2020 and will start contributing to this division in FY21. Management expect an economic recovery and a good maize crop to benefit this segment.

Commercial Products (trading profit contribution 7%). Revenue declined 7% YoY and trading profit plummeted by 47% YoY. All the businesses within this segment were severely impacted by the depressed trading conditions and severe lockdown restrictions. Management have indicated that commodity and product price increases, as well as product shortages, are becoming evident in the market and said that Bidvest was well positioned to take advantage of these shortages and an uptick in DIY demand.

Financial Services ( trading profit contribution 6%): Revenue retreated by 2% YoY and trading profit dropped 48% YoY as a significant decline in foreign exchange demand in the Group’s fourth quarter and fleet contracts rolling off, offset higher investment income within this division. Bidvest Bank’s non-interest revenue was negatively impacted by significant declines in forex and currency card revenue streams. New business and insurance policy sales were disrupted, while reduced employee headcounts affected Bidvest’s Wealth and Employee Benefits’ business. Bidvest Bank’s liquidity remains healthy and well capitalised.

Automotive (trading profit contribution 3%): Revenue fell 20% YoY and trading profit plummeted 67% YoY (excluding Bidvest Car Rental). The segment’s performance was decimated by the lockdown restrictions despite a good prior 9-month performance (before April 2020). Management indicated that recent new and used car sales, as well as workshop volumes, have been better when compared to pre-COVID levels in February. Still, it is possible that large-scale retrenchments across SA and constrained disposable income could disrupt and limit demand over the coming months.

Property (trading profit contribution 11%). Revenue was flat and trading profit increased slightly. This segment remains resilient.

Corporate & Investments (trading profit contribution -15%). A R400mn COVID-19 fund was established to assist the company’s employees that were on furlough. The MIAL investment was adjusted for foreign exchange movements since the previous reporting date and a lower offer was accepted for MIAL, due to the significant deterioration in the airport’s financial position.

Conclusion

Bidvest will be looking to take advantage of an improvement in the macro-economic environment and is also likely to benefit from market share growth as result of smaller companies going out of business. Management still expect a fragile operating environment for the next 4-5 months but are optimistic that the macro-environment will improve in FY21. Bidvest’s hygiene division stands to benefit from the synergistic effects of Steiner, Noonan, and its recent UK acquisition, PHS. In addition, Bidvest’s hygiene division will likely structurally benefit from the heightened awareness of out-of-home hygiene in the longer term. Overall, we like the structural growth drivers for Bidvest’s hygiene division and management’s increased focus on growing this segment. We believe that an improvement in the macro-environment, albeit a slower recovery, will result in a better performance from Bidvest’s other divisions. Post COVID-19 trends and Bidvest’s global expansion are encouraging, but elevated debt levels remain a concern.